Shaw, Jinse Finance

On the evening of November 20th, the US September non-farm payroll data was released, showing better-than-expected job growth but a rise in the unemployment rate. The three major US stock indices opened sharply higher, but then plummeted during the session, staging an epic "high open, low close" scenario. Cryptocurrencies were affected by this, experiencing another rapid decline in the early hours of the morning, with a slight rebound in the morning. Bitcoin fell below $87,000, briefly touching $86,100, with a 24-hour drop exceeding 3%; Ethereum briefly fell below $2,800, touching $2,790, with a 24-hour drop exceeding 3.3%. Data shows that in the past 24 hours, $823 million in positions were liquidated across the entire network, including $695 million in long positions and $128 million in short positions.

US stocks and the crypto market have fallen again, triggering a sell-off in risk assets. What are the reasons for this? How should we interpret it? How can we predict the market trend at the end of the year?

I. Crypto Market Suffers Another Severe Blow, Panic Selling Continues

Cryptocurrencies experienced another rapid decline in the early hours of today, followed by a slight rebound this morning.

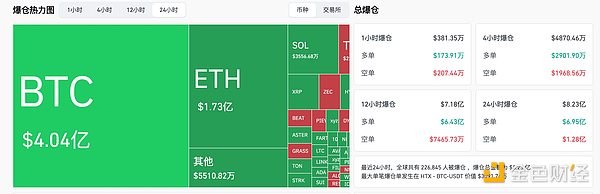

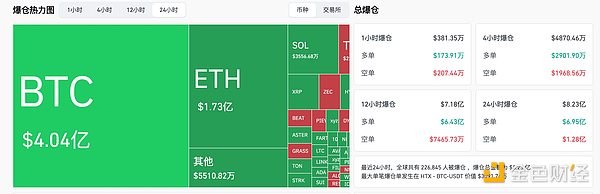

Bitcoin fell below $87,000 for the first time in seven months, briefly touching $86,100, with a 24-hour drop exceeding 3%. Ethereum briefly fell below $2,800, touching $2,790, with a 24-hour drop exceeding 3.3%. Other cryptocurrencies such as Solana and BNB also experienced significant declines. Coinglass data shows that in the past 24 hours, $823 million in positions were liquidated across the network, with over 226,000 people liquidated. This included $695 million in long positions, $128 million in short positions, $404 million in BTC liquidations, $173 million in ETH liquidations, and $35.5668 million in Solana liquidations. The sharp decline in the crypto market was influenced by the fluctuations in major assets such as the US stock market. The recent continuous decline triggered a sustained sell-off of risk assets, and market panic has not been effectively alleviated, amplifying even minor fluctuations.

II. US Stocks Experience Epic Plunge, Impacting Risk Assets

Following the release of the September non-farm payroll data last night, the three major US stock indexes opened sharply higher, with the S&P 500 rising 1.44% and the Nasdaq surging 2.18%. However, they quickly reversed course and fell sharply during the session, staging an epic "high open, low close." In the final minutes of trading, US stocks suffered a broad sell-off, with the S&P 500 closing down 1.56% and the Nasdaq plummeting 2.16%. Nvidia's better-than-expected earnings report, coupled with the "Goldilocks-esque" better-than-expected non-farm payroll data, should have been a double boost. However, the rapid decline in the crypto market and the interaction between the two markets triggered a continued sell-off in risk assets. Meanwhile, the market turned its attention to hawkish comments from Federal Reserve officials and concerns about private credit risk.

Some market analysts believe that when positive news fails to drive the market upward, it becomes a strong bearish signal, triggering large-scale profit-taking and technical selling in the US stock market. Third, non-farm payroll data exceeded expectations, but it's unlikely to benefit the market. Last night, the US September non-farm payroll data was released. The US added 119,000 jobs in September, more than double the expected 51,000. However, at the same time, the August job growth was revised down from an increase of 22,000 to a decrease of 4,000. The combined downward revision of July and August non-farm payrolls was 33,000, continuing the "continuous downward revision" pattern this year. The US September unemployment rate was 4.4%, higher than the expected and previous value of 4.3%, the highest since October 2021, mainly due to the rising unemployment rate among Black people. Following the data release, both US Treasury yields and the US dollar index declined. This report is the first economic health indicator released by the US Bureau of Labor Statistics since the record-breaking shutdown of the US federal government led to a halt in official data releases. Market analysts say the employment data sends contradictory signals: on the one hand, employment growth exceeded expectations, while on the other hand, the unemployment rate unexpectedly rose to a four-year high. The unexpectedly positive data will reinforce the stance of hawkish members of the Federal Open Market Committee. Fourth, expectations for a Fed rate cut have plummeted, and market concerns have intensified. Concerns about financial market stability, including the risk of a sharp decline in asset prices, are becoming a new theme in discussions among Fed officials regarding the timing and even the possibility of a rate cut. The release of the non-farm payroll data further reinforced the cautious stance of the Fed's "hawkish" governors. Fed official Hamak stated that the employment data looked mixed. The employment report was "slightly stable" but in line with expectations; for the US economy, high inflation remains a very real problem. Hamak also stated that interest rate cuts could prolong high inflation. Rate cuts could also encourage risk-taking in financial markets. Federal Reserve Governor Barr expressed concern about inflation remaining at 3%. He believes that monetary policy needs to be carefully formulated to balance risks, requiring support for the labor market but also aiming to restore inflation to 2%. Furthermore, Federal Reserve Governor Cook stated that given the "increased complexity and interconnectedness" of leveraged companies, officials should monitor how unexpected losses in private lending could spread to the broader U.S. financial system. She believes the expanding footprint and asset valuation levels of hedge funds in the U.S. Treasury market represent a potential vulnerability. According to CME's "FedWatch": the probability of the Fed cutting rates by 25 basis points in December is 39.6%, and the probability of keeping rates unchanged is 60.4%. The probability of the Fed cumulatively cutting rates by 25 basis points by January next year is 50.2%, the probability of keeping rates unchanged is 29.7%, and the probability of cumulative rate cuts of 50 basis points is 20.2%. Furthermore, Polymarket data shows that the probability of a 25 basis point rate cut by the Federal Reserve in December has fallen to 34%, while the probability of maintaining the current rate has risen to 64%. Several hawkish Fed governors have recently made frequent statements, continuously lowering market expectations for a December rate cut. The recently released September employment data also provides a basis for the Fed's more cautious policy-making.

V. Funds from ETFs and other instruments have not yet recovered significantly, resulting in insufficient liquidity

Farside Investors data shows that the US spot Bitcoin ETF has seen a cumulative net outflow of $1.099 billion this week, and the US spot Ethereum ETF has seen a cumulative net outflow of $433 million this week. In addition, BlackRock's Bitcoin ETF IBIT has seen net outflows for five consecutive days as of November 19th, totaling $1.43 billion. On November 18th (Tuesday), IBIT experienced a $523.15 million outflow, recording the largest single-day net outflow since its inception in January 2024.

The continued net outflow of ETF funds indicates that institutional funds, the main driver of the previous bull market, have failed to recover effectively, and the cryptocurrency market still lacks sufficient liquidity and momentum for a rebound.

VI. Market Analysis and Interpretation

Recently, Nvidia's better-than-expected earnings report, non-farm payroll data, and positive policy and regulatory fundamentals should have been favorable factors for the market. However, why has the asset sell-off continued and why has the panic failed to subside effectively? How can we predict the market trend at the end of the year? Let's take a look at the main market interpretations.

1. JPMorgan analysts stated that retail investors sold approximately $4 billion worth of spot Bitcoin and Ethereum ETFs in November, which is the main driver of the recent cryptocurrency market correction. At the same time, retail investors are buying equity ETFs, increasing their holdings by approximately $96 billion this month, indicating that the cryptocurrency sell-off is not part of a broader risk aversion sentiment.

2. A VanEck report states that Bitcoin has fallen 13% in the past 30 days under strong selling pressure. The selling activity was concentrated among mid-term holders, rather than the earliest wallet addresses. Long-term whales are still holding BTC, and the total amount of BTC held for over 5 years continues to grow. The net increase in BTC held for over 5 years since the last trading session was 278,000 Bitcoins compared to two years ago. The futures market has shown signs of complete consolidation, with funding rates and open interest both at oversold levels. 3. BitMine Chairman Tom Lee stated that the current weakness in the crypto market is highly similar to the crash on October 10th, when a stablecoin pricing error triggered the largest liquidation in history, washing out nearly 2 million accounts and instantly depleting liquidity. Lee pointed out that such deleveraging cycles typically last about 8 weeks, and we are currently in the 6th week, suggesting the market may be nearing the end of its correction. 4. CryptoQuant CEO Ki Young Ju released several Bitcoin realized cost distribution charts, stating that the current sell-off is mainly driven by short-term Bitcoin holders, while miners and long-term holders are relatively restrained.

5. Bitwise Chief Investment Officer Matt Hougan refuted market concerns about a potential bear market for Bitcoin. He stated that Bitcoin's value lies in its role as a digital wealth storage "service," independent of governments, banks, or other third parties. Hougan believes that despite the recent market correction, increasing institutional demand for this service supports Bitcoin's long-term trajectory.

6. Strategy Executive Chairman Michael Saylor stated that Bitcoin's volatility and growth have both decreased from 80 to 50. He said BTC could reach 1.5 times the S&P 500 in terms of volatility and performance.

7. Glassnode's observation article states that Bitcoin has fallen below the short-term holder cost benchmark and the negative one standard deviation range, putting pressure on recent buyers; the $95,000-$97,000 area is now a key resistance level, and a recovery in this range would be an initial signal of market structure repair. Spot demand remains weak: US spot ETF inflows are deep in negative territory, and traditional financial (TradFi) allocation institutions have not seen any new buying. Speculative leverage continues to be unwound, a trend reflected in the decline in futures open interest (OI), and in the top 500 assets by market capitalization, financing rates have fallen to cyclical lows.

12. Goldman Sachs' client briefing stated that the S&P 500's fall below a closely watched level has given the green light to trend-following hedge funds, which could sell nearly $40 billion worth of stocks in the coming week. The S&P 500 fell below 6725 points on Wednesday. Goldman Sachs' calculations show that after the price fell below this level, $39 billion worth of stocks could be sold globally in the following week. If stock prices continue to fall, the bank estimates that systemically trend-following hedge funds could sell up to approximately $65 billion worth of stocks.

Anais

Anais