Deng Tong, Golden Finance

On July 30, 2025, the U.S. Securities and Exchange Commission (SEC) introduced a new set of listing standards for cryptocurrency exchange-traded products (ETPs), marking a key step in the institutionalization of digital assets. The regulations, set to take effect in September or October 2025, require that eligible cryptocurrencies must have at least six months of futures trading history on Coinbase's derivatives exchange.

What are the new listing standards for cryptocurrency exchange-traded products (ETPs)? What are their core elements? Who will be approved? What impact will they have on the crypto market?

I. Content of the New Standards

The proposal aims to allow commodity trust units to be issued by a variety of entities, including trusts, limited liability companies, or other similar entities, and recognize that these entities can hold a diversified portfolio of commodities, securities, cash, and cash equivalents.

Purpose of Change:To amend Rule 14.11(e)(4) to allow commodity trust units that meet the revised requirements to be generally listed and traded, or to be traded pursuant to unlisted trading privileges.

Expanded Scope of Issuance and Holding:Commodity trust units may be issued by a variety of entities, such as trusts and limited liability companies, and may hold a variety of assets (including a variety of commodity assets, securities, cash and cash equivalents), and are subject to the Exchange's equity securities trading rules.

New core definitions:

Commodity fund assets: refers to commodity futures, commodity options, and commodity transactions;

Cash equivalents: includes U.S. government securities, certificates of deposit, bank acceptances and other short-term instruments (maturity < 3 months);

Net asset value: the market value of trust assets minus expense liabilities, used for share creation and redemption pricing;

Intraday reference value: the reference value of trust shares estimated based on the current value of the underlying assets.

Listing Criteria:

The underlying commodity must meet at least one of the following criteria: trading on an ISG member market with exchange-accessible information, trading on a designated contract market for at least six months with a supervisory agreement in place, and listing of the relevant ETF (with exposure to the commodity of ≥40% of net asset value) on a national exchange.

General listing of leveraged or inverse series of shares is prohibited.

Information Disclosure Requirements:The trust must disclose holding details (such as ticker symbol, quantity, weight), daily net asset value, premium/discount data (table and line chart), liquidity policy, trading volume, and prospectus on its public website.

Liquidity Risk Management: If less than 85% of assets are available for redemption daily, a written policy (reviewed annually) must be in place, covering investment strategy, cash holdings, and the percentage and description of restricted assets.

Continuous Listing and Delisting Criteria: If there are fewer than 50 holders, less than 50,000 shares outstanding, less than $1 million in market capitalization, information dissemination interruptions, or net asset value not calculated daily, the exchange may suspend trading and initiate delisting.

Trading Suspension Mechanism: If there is a disruption in the dissemination of underlying asset values, the intraday reference value is not provided in a timely manner, or information disclosure is non-compliant, the exchange may suspend trading. If the net asset value is not disseminated simultaneously, it must be suspended until it is made public.

Information Segregation Requirements: Broker-dealers involved in index maintenance, the Index Advisory Committee, and entities associated with the trust must establish an information segregation mechanism to prevent the misuse of material non-public information.

II. Core of the New Standard

The core feature of the new standard is the approval of the physical creation and redemption process for ETPs. This enables investors and authorized participants to exchange a basket of underlying cryptocurrencies directly for ETP shares, eliminating the need for cash settlement and reducing intermediary costs. This change is expected to improve market efficiency and lower barriers to institutional participation.

The SEC pointed out on its official website: "The orders approved today are different from the recently approved spot Bitcoin and Ethereum ETPs, which were limited to creation and redemption in cash. Under today's approved orders, Bitcoin and Ethereum ETPs will be allowed to create and redeem shares in physical form, consistent with other commodity ETPs approved by the Commission."

SEC Chairman Paul S. Atkins said: "This is a new day for the SEC, and my top priority as Chairman is to develop a practical regulatory framework for the crypto asset market. I am pleased that the Commission has approved these orders, which will allow a range of crypto asset ETPs to be created and redeemed in physical form. Investors will benefit from these approvals because they will reduce the cost of these products and improve the efficiency."

Jamie Selway, Director of the SEC's Division of Trading and Markets, said: "The Commission's decision today is a positive development for the growing market for cryptocurrency ETPs. This is an important development for the market. Physical creation and redemption provides flexibility and cost savings for ETP issuers, authorized participants, and investors, thereby improving market efficiency.

Third, Who Will Be Approved?

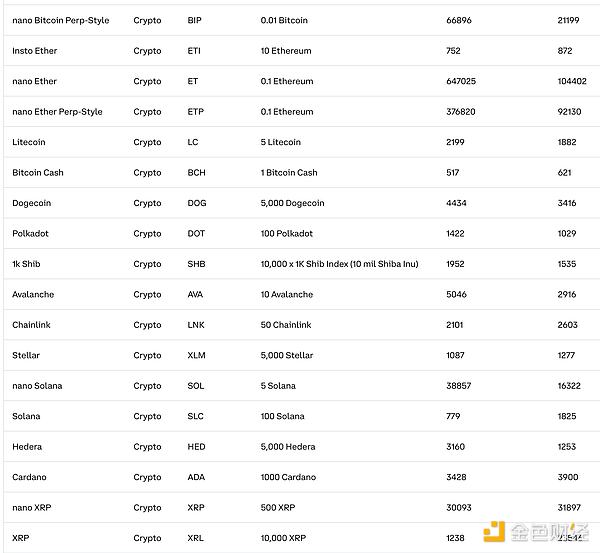

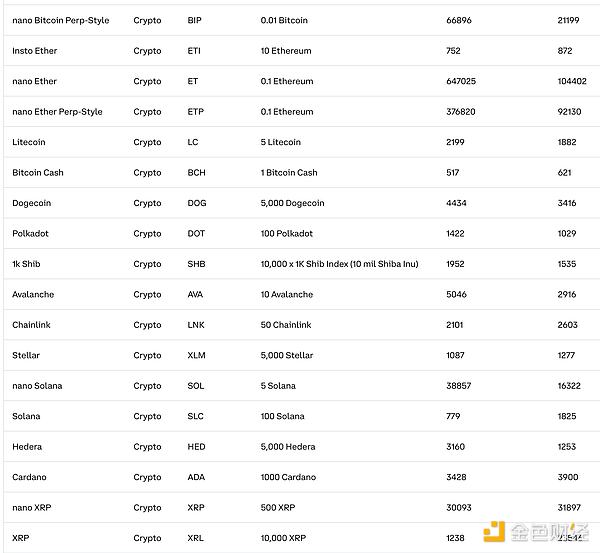

Any futures tracking currency that has been listed on the Coinbase Derivatives Exchange for more than six months will be approved (list below).

Fourth, What Happens Next?

First, the rule will require comment and review. The comment period will likely end 21 days after publication in the Federal Register (likely this week), meaning the rule will likely take effect in less than 60 days. Meanwhile, numerous ETP applications are awaiting approval, including Solana and XRP ETPs. The SEC could choose to take direct Rule 19b-4 action on these ETPs before the October 10th deadline for Solana and the slightly later deadline for XRP, or it could choose to process them under the Global Liquidity Solution (GLS). September 17th is circled as six months after the listing of SOL futures on the Chicago Mercantile Exchange (CME), although these futures were certified on Bitnomial and NADEX exchanges about a month earlier (so approval could come sooner if the Global Liquidity Solution (GLS) is already live or if the SEC independently takes action on Solana's 19b4 filing). XRP futures will launch slightly later, as they were launched after SOL futures. However, both SOL and XRP ETPs are highly likely to launch in early Q4. They will include physical transactions and, most likely, SOL staking. V. Impact on the Crypto Market The new standard is expected to strengthen regulatory harmonization between cryptocurrencies and traditional ETPs (such as those backed by gold or silver). This parity will help reduce arbitrage opportunities and improve price discovery for crypto assets. As the ETP market expands under clearer regulatory frameworks, investors can access products with greater transparency and lower counterparty risk than unregulated cryptocurrency exchanges. This shift in regulatory approach is consistent with the overall trend in the cryptocurrency market. Historical data shows that the approval of ETPs typically increases liquidity and trading volume, just as Bitcoin and Ethereum have gradually integrated into traditional finance. Industry stakeholders and analysts believe the SEC's move will drive significant growth in the ETP market. Experts from the Coincu research team stated that the new framework could spark interest from more institutional investors while standardizing best practices in trading and custody. Furthermore, the regulatory clarity brought about by the SEC's decision may foster more structured product development and promote broader adoption of crypto-based financial instruments. Notably, other market participants are also responding to the evolving landscape. The Chicago Board Options Exchange (Cboe), a major derivatives exchange operator, has submitted a proposed rule change to streamline the approval of cryptocurrency ETPs, further demonstrating the industry's maturation. Meanwhile, BlackRock has applied for a collateralized Ethereum spot ETP, a move that could further promote the integration of cryptocurrencies into the broader financial ecosystem. However, the SEC has also suspended some applications, including those involving XRP, highlighting the agency's cautious, case-by-case approach to review. The SEC's evolving approach to cryptocurrency ETPs reflects its balance between fostering innovation and maintaining market integrity. With clearer guidelines in place, digital assets will be integrated into the mainstream financial system in a more systematic and scalable manner.

Joy

Joy