Author: W3C DAO

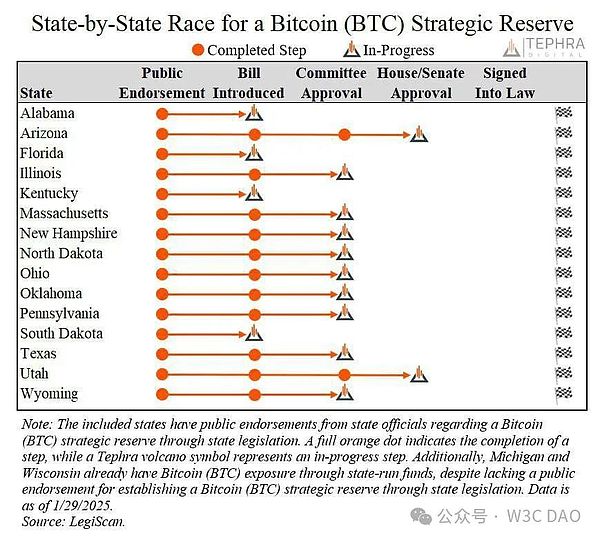

According to Bitcoin Magazine's post on the X platform, citing information from Eric Weiss, a board member of Core Scientific, a US-listed company, 15 states, including Alabama, Arizona, and Florida, have launched plans for strategic Bitcoin reserves. Arizona and Utah have already reached the stage of approval by both houses, and are only one step away from being approved into law.

Bitcoin Reserves

Previously, Tim Scott, chairman of the US Senate Banking Committee, appointed Wyoming Senator Cynthia Lummis as chair of the committee's newly established Digital Assets Committee. Lummis then issued a statement announcing that the new committee dedicated to digital assets will focus on two areas:

Adopt bipartisan digital asset legislation to promote responsible innovation and protect consumers, including legislation on market structure, stablecoins, and strategic bitcoin reserves;

Strong oversight of federal financial regulators to ensure that these institutions comply with the law, including ensuring that Operation Chokepoint 2.0 does not occur again.

Operation Chokepoint 2.0 is allegedly a collaborative action taken by U.S. federal government agencies to remove cryptocurrency companies from the traditional banking system, and no official documents have yet confirmed its existence.

Last July, Trump promised to list Bitcoin as a strategic reserve asset for the United States at the Bitcoin 2024 conference. Later, Lummis mentioned the legislation for the strategic reserve of Bitcoin again. She said: "Digital assets represent the future. If the United States hopes to continue to maintain its leading position in global financial innovation, Congress needs to urgently pass bipartisan legislation to establish a comprehensive legal framework for digital assets and strengthen the dollar through strategic Bitcoin reserves. ... I look forward to submitting bipartisan legislation to President Trump to ensure our financial future." The news of Lummis's appointment quickly detonated the cryptocurrency market. At that time, the intraday trading price of Bitcoin (BTC) against the US dollar once rose and turned up.

Rapid progress

The "Bitcoin Strategic Reserve" issue was actually proposed and discussed before the US presidential election. Senator Cynthia Lummis proposed the "US Bitcoin Strategic Reserve Act" (BITCOIN Act of 2024) as early as July 31, 2024. The bill proposed to purchase 200,000 bitcoins each year, reaching 1 million within five years.

Later, during the campaign, Trump promised to become the "cryptocurrency president" in a speech at the Bitcoin Conference of the crypto industry. The industry hopes that he will fulfill his promise to create a Bitcoin inventory through executive orders, ensure that the industry can obtain banking services, and create a cryptocurrency committee.

On December 17, 2024, the Bitcoin Policy Institute (BPI) (note that it is not an official organization, but a non-profit organization focusing on Bitcoin policy research, but it is still one of the important think tanks for decision makers on Bitcoin-related issues) released a draft executive order, trying to provide reference opinions for Trump's "Bitcoin Strategic Reserve" executive order framework. This draft clearly proposes: It is recommended that 1%-5% of Treasury assets be used to purchase Bitcoin to form a long-term reserve. Led by the Ministry of Finance and coordinated by the Federal Reserve, the reserve will be gradually established.

On December 19, 2024, Federal Reserve Chairman Powell (who is expected to continue to perform his duties after Trump takes office) expressed cautious views at a press conference. Powell said that the Federal Reserve has no intention of participating in any government plan to hoard Bitcoin. Such issues fall within the scope of Congress’s responsibilities, and the Federal Reserve has not sought to change existing laws to allow the holding of Bitcoin.

From the latest situation, although the Federal Reserve Chairman holds a conservative opinion, under favorable conditions such as Trump’s nomination of a crypto-friendly US Treasury Secretary and the “Presidential Executive Order” issued quickly after taking office, these will not affect the Trump team’s plan to continue to promote the inclusion of Bitcoin in the US strategic reserve.

Written in the end

Looking to the future, the concept of Bitcoin as a strategic reserve asset is gradually gaining more attention and support. As more states and countries begin to consider including Bitcoin in their reserve assets, the global financial system may undergo a profound transformation. Bitcoin's decentralized nature and limited supply make it a unique means of storing value, attracting the interest of governments and financial institutions. In the United States, with the advancement of the Bitcoin Strategic Reserve Act and the gradual implementation of relevant legislation, Bitcoin is expected to become part of the national strategic reserve. This will not only enhance Bitcoin's position in the global financial market, but also set an important example for other countries. In the future, we may see more countries follow the United States' practice and include Bitcoin in their national reserves, thereby promoting the further development of the global cryptocurrency market. In addition, with the improvement of digital asset legislation and the establishment of a regulatory framework, the cryptocurrency market will become more transparent and stable. This will help attract more investors to the market and promote innovation and technological progress. As an emerging financial instrument, Bitcoin's potential and influence will continue to expand and become an indispensable part of the global financial system. In short, the advancement of Bitcoin strategic reserves is not only a recognition of the cryptocurrency market, but also a positive exploration of future financial innovation. We look forward to the widespread application and development of Bitcoin around the world, which will bring more opportunities and challenges to the global economy.

Alex

Alex

Alex

Alex Catherine

Catherine Kikyo

Kikyo Weatherly

Weatherly Catherine

Catherine Anais

Anais Kikyo

Kikyo Weatherly

Weatherly Catherine

Catherine Weatherly

Weatherly