Source: Mikko

Long-term US and Japanese bonds performed poorly.

The reason is simple: The auction was bad, buyers went on strike, and the fiscal and monetary environment was unfavorable.

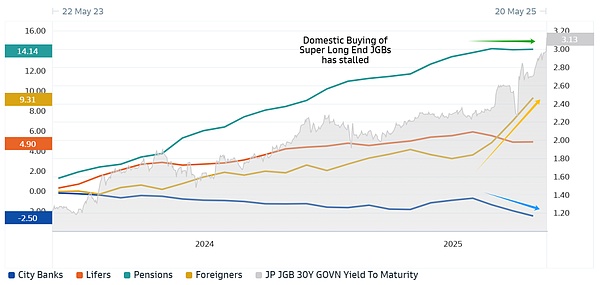

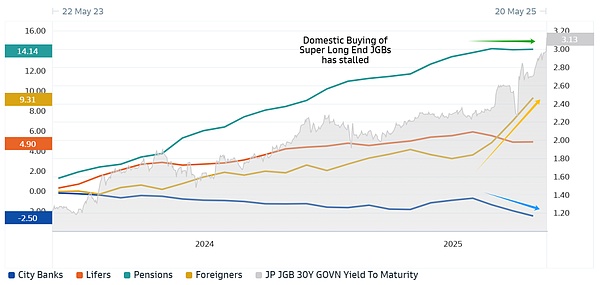

First, let's talk about Japanese bonds. Since April, the curve has steepened while long-term government bond yields have soared rapidly.

The demand for insurance funds has been relatively weak for three consecutive months, and the supply of ultra-long bonds is basically absorbed by foreign capital.

20-year poor bid-to-cover ratio:

Of course, there are also some monetary and fiscal factors:

After the tariff incident on April 2, the Bank of Japan turned dovish, and a major bank said that this shift led to the unwinding of previous bets on a flattening curve.

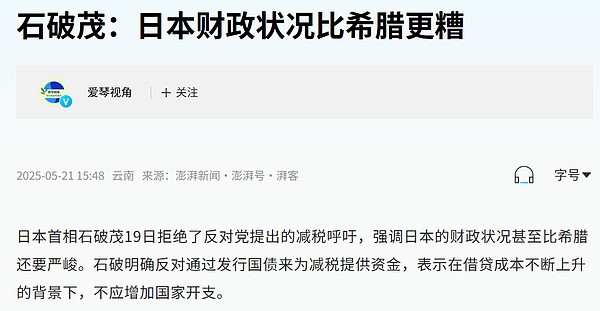

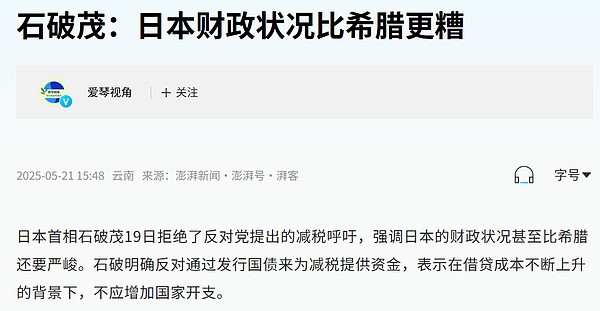

The fiscal situation is as shown in the figure below, which is similar to that of the United States. Under the premise of poor fiscal situation, the opposition party still proposed tax cuts.With the approaching Senate election in July, both the ruling party and the opposition party may strongly promise fiscal stimulus measures.

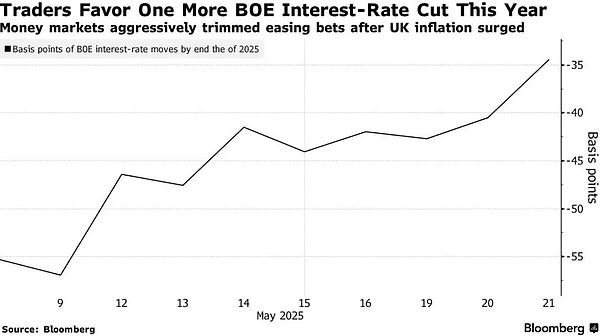

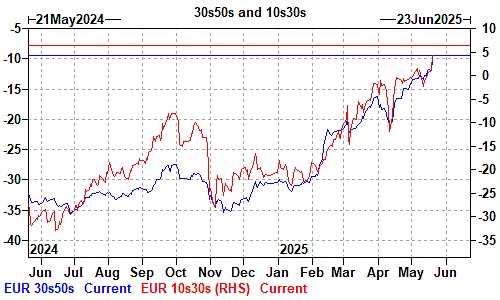

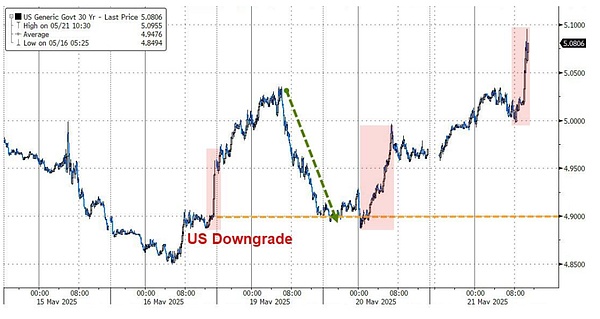

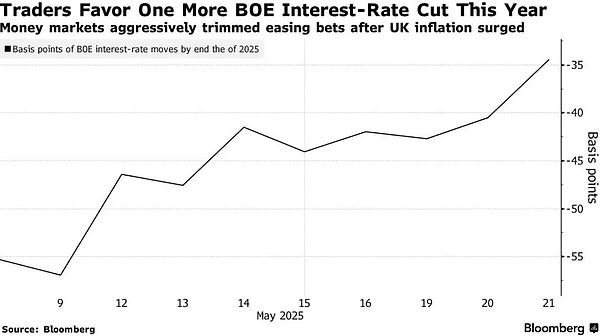

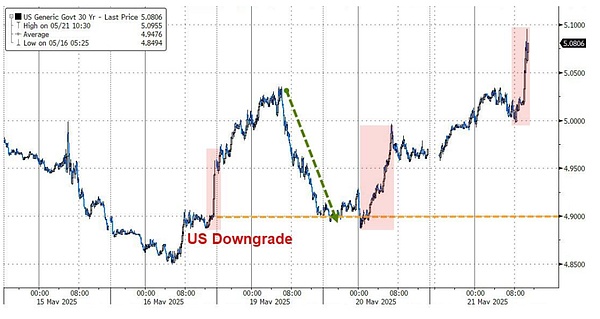

Of course, there are also some linkage effects from the global bond market, such as the cross-border linkage of US rating downgrade (everyone is also worried about Japan's rating) and 30-year British bond yields, Dutch pension reform and other issues.

UK inflation exceeded expectations, and the market's interest rate cut pricing subsided.

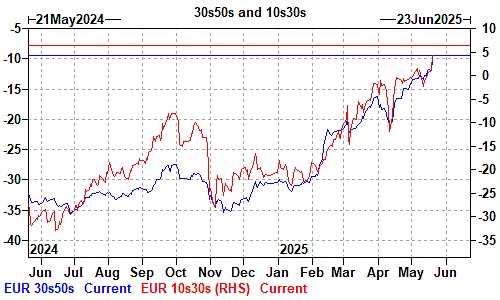

Dutch pension reform also drives steepening:

Let's look at US bonds:

The results of the 20-year US bond auction were not very good. The 30-year US bond yield broke through 5%, close to the previous high in the fourth quarter of 2023.

Conclusion:

The overall situation of the bond market in developed economies is not good, but there is no new story:

The overall fiscal spending narrative has led to the lingering shadow of the deficit, Japan: consumption tax, the United States: TCJA/debt limit/rating downgrade/DOGE loss of power, Europe: military spending narrative/Dutch pension reform/UK CPI

Monetary policy can do very little, because the economy is not good, so it is relaxed, and the long end falls; because inflation pressure is large and tight, and the expectation of interest rate cuts has subsided, the long end still falls

Buyers go on strike: US bonds are sold by foreign investors (counting the dollar's depreciation twice), Japanese bonds are sold by domestic investors and bought by foreign investors (the yen appreciates)

The conclusion is the same as last time, don't buy it yet.

Joy

Joy