Author: Christopher Tepedino, CoinTelegraph; Compiler: Tao Zhu, Golden Finance

In an analysis of the $1.5 billion Bybit hack, two blockchain research institutions, Nansen and Chainalysis, revealed the Lazarus Group's money laundering strategy, which included exchanging illiquid assets for liquid assets, creating complex fund flows, and leaving certain wallets idle to reduce scrutiny.

According to Nansen, the typical Lazarus Group strategy is to first exchange illiquid assets for more fungible assets and therefore easier to transfer.After the Bybit hack, the perpetrators converted at least $200 million in staked tokens into Ether, which can be transferred more easily on the chain.

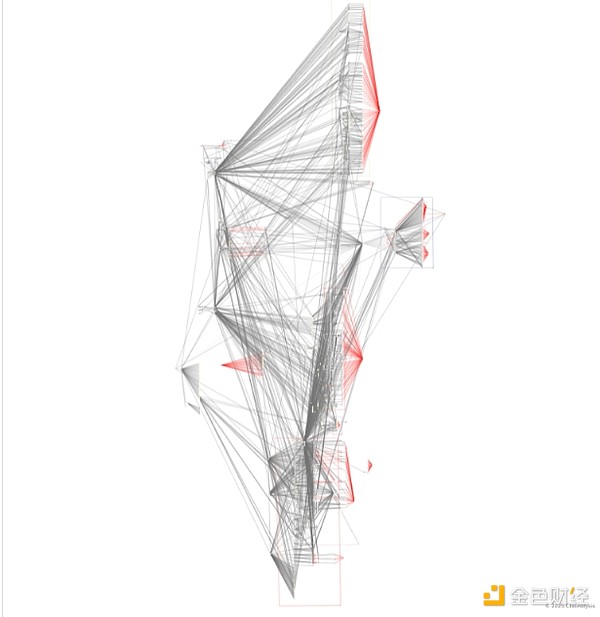

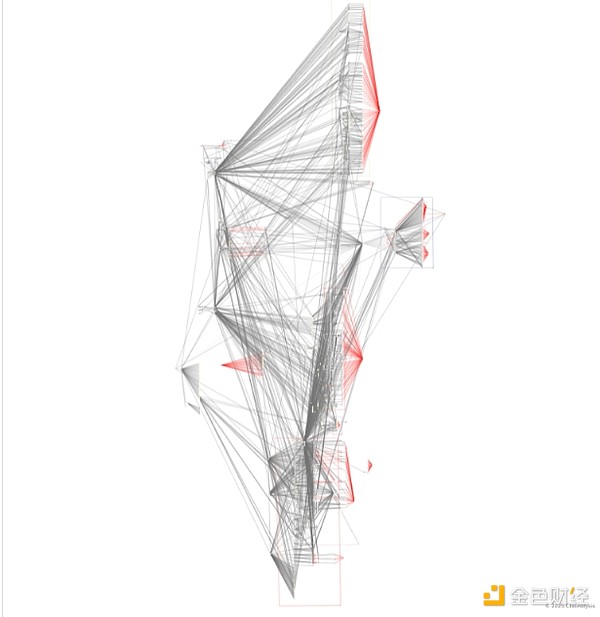

After converting illiquid assets into liquid assets, the money laundering process began. To create confusion, hackers used a maze of intermediate wallets to create a complex path designed to confuse trackers. According to Chainalysis, the funds were laundered through decentralized exchanges, cross-chain bridges, and even instant exchange services that do not require Know Your Customer (KYC) verification.

The complexity of Lazarus Group's money laundering behavior. Source: Chainalysis

Most of the ETH ended up being exchanged for stablecoins like Bitcoin and Dai. In some cases, blockchain analysts were able to track these movements in real time. This allowed certain organizations that run these decentralized protocols, such as Chainflip, to thwart the perpetrators’ attempts to launder the stolen funds.

Throughout the laundering process, the hackers kept splitting the stolen funds into smaller pools, sending them to more and more wallets. The first “transfer” split the funds from one wallet into 42 wallets. The second “transfer” split the funds from 42 wallets into thousands.

The money laundered by the Bybit hackers so far is only a portion of the $1.5 billion. The Lazarus Group has another strategy to avoid the high profile that comes with high-profile thefts: sit back and wait. Some wallets containing stolen funds (currently up to $900 million across all wallets) have been lying dormant as the group awaits the end of the scrutiny.

The nearly $1.5 billion hack is more than the group will make in all of 2024 — $1.3 billion in 47 attacks. The attack, the largest cryptocurrency heist ever, rallied the community behind Bybit and against the hackers. As the Lazarus Group faces increasing scrutiny, it continues to adapt to that intensity. As reported, its cyber warfare strategy remains one of the most lucrative and sophisticated in the world.

Weatherly

Weatherly