Author: Musolsol.??? Source: X, @MMMusol

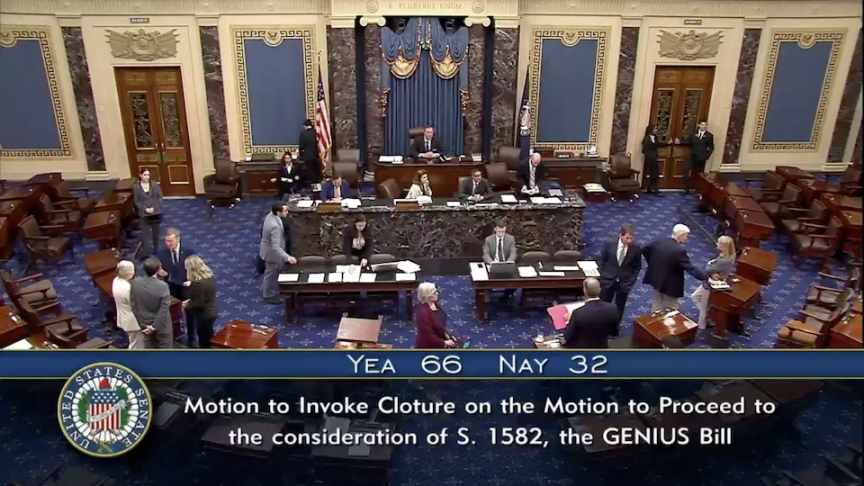

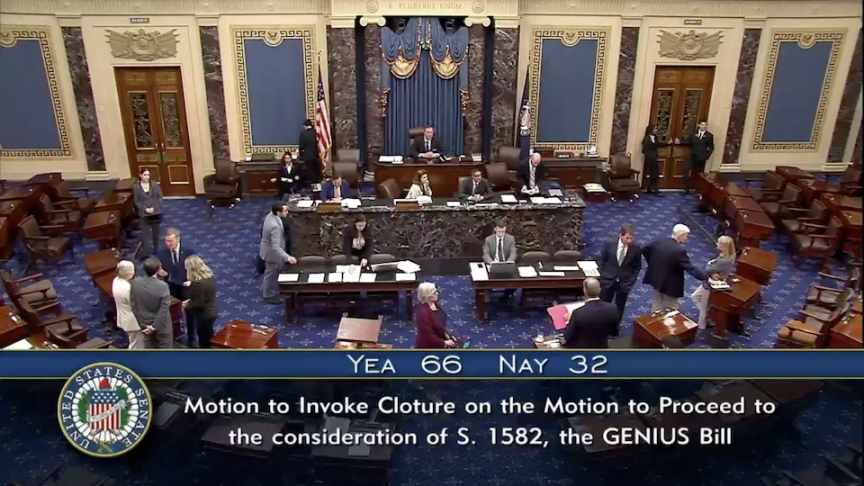

Just recently, the U.S. Senate passed the procedural motion of the GENIUS Act by 66 votes to 32, which means that stablecoins will enter the "practical stage" of federal legislation.

The U.S. Senate advanced the debate on the GENIUS Stablecoin Act by 66 votes to 32. Source: U.S. Senate

This may also be the first time for our generation to witness "on-chain issuance of U.S. dollars" entering the core of legislation; this may also be the first time for our generation to witness whether the two swords of Damocles, stablecoins and U.S. debt, will fall to pierce people's last utopia. Behind this, there will be a profound reconstruction of virtual currency, Web3 ecology and global payment pattern.

Pt.1. Coin of Damocles

Why is the Stablecoin Act so important?

Stablecoin, as the name suggests, is a cryptocurrency that is linked to assets such as the U.S. dollar and has a stable value. It is a "bridge" in the crypto market and is widely used in transactions, cross-border payments and decentralized finance (DeFi). In 2024, the global stablecoin market size has exceeded US$200 billion, of which the U.S. dollar stablecoin occupies a dominant position. However, due to the lack of a clear regulatory framework, the stablecoin industry has been wandering in a gray area, facing questions about money laundering, fraud and systemic risks.

The core goal of the GENIUS Act is to establish clear regulatory rules for stablecoin issuers, including:

Issuance requirements: Stablecoin issuers must obtain federal or state licenses and meet strict capital and reserve requirements.

Anti-money laundering and security: Strengthen anti-money laundering (AML) and know your customer (KYC) measures to ensure that stablecoins are not used for illegal activities.

Consumer protection: Provide users with transparency and financial security to prevent tragedies similar to the TerraUSD crash in 2022.

Extraterritorial jurisdiction: Restrict foreign stablecoins from entering the US market and consolidate the "hegemony" of the US dollar in the crypto world.

This vote is not only about the standardization of the crypto industry, but is also seen as the United States' strategic layout in the global fintech competition. As US Treasury Secretary Bessant said: "The US dollar stablecoin will maintain the status of the US dollar as an international reserve currency."

The end result of the bill's passage: Who are the winners and who are the losers?

If the GENIUS Act is successfully passed, several areas will usher in huge changes:

Winners:

Stablecoin issuers: Tether (USDT), Circle (USDC) and other leading issuers will obtain legal status. Although the compliance cost is high, the market trust will be greatly improved.

Cryptocurrency exchanges: After clear supervision, platforms such as Coinbase and Kraken are expected to attract more institutional funds and drive a surge in trading volume.

Dollar hegemony: The bill restricts foreign stablecoins from entering the United States, and the US dollar stablecoin will further consolidate its global financial dominance. European Central Bank President Lagarde once warned: "Dollar stablecoins may threaten the monetary sovereignty of the euro."

Investors: The standardization of stablecoins will reduce market risks, attract more traditional capital into the crypto field, and push up asset prices.

Losers:

Non-compliant issuers: Small stablecoin projects that cannot meet regulatory requirements may be eliminated.

Foreign stablecoins: Stablecoins such as those pegged to the euro or the renminbi will be restricted in the US market.

Decentralized idealists: Strict KYC and AML requirements may weaken the anonymity of cryptocurrencies and cause community controversy.

What is behind the "freedom" of stablecoins?

"From fighting each other to death stampede, the higher you climb, the harder you fall."

Fighting each other - Why does Trump support the development of cryptocurrency?

The two main pain points of cryptocurrency at present are - how to exchange with legal currency & the fluctuations of various currencies are too large

Therefore, in order to solve the above two pain points and build a more complete cryptocurrency ecosystem, Tether issued a stable currency: USDT. Tether claims that after receiving one dollar from a customer, one USDT will be issued, and after the customer returns one USDT and gets one dollar back, one USDT will be destroyed.

If everything goes well, one USDT is equivalent to one dollar.

With the continuous development of cryptocurrency, many merchants now support cryptocurrency payments, such as buying pizza. If so, USDT is equivalent to "silver bills" and can replace real "gold and silver" to realize the function of currency circulation.

It seems impeccable, right?

Is there a bug? Yes.

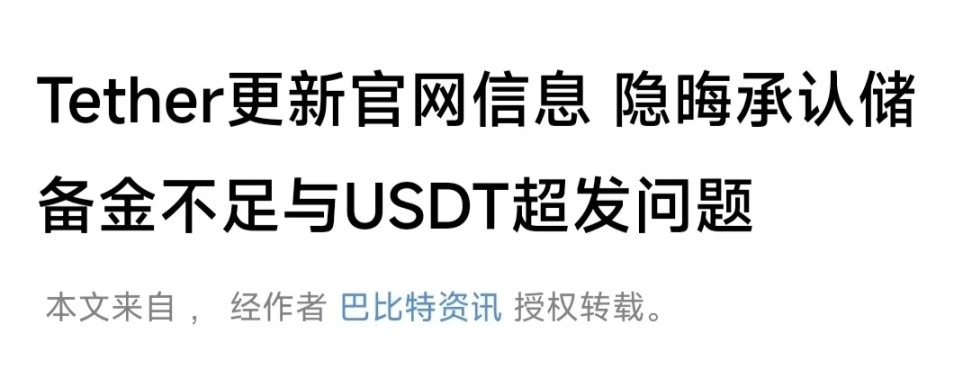

BUG 1: Will Tether over-issue? For example, there are only 10 million USD worth of assets (whether it is USD, US bonds or stocks), but 20 million USDTs were issued. Even in the era when banks issued silver bills, this kind of thing is impossible to avoid completely. Tether was once blacklisted by banks in the United States and Taiwan Province due to over-issuance.

If BUG1 is just a figment of the imagination, then BUG2 is a real loophole.

BUG 2: After Tether receives one dollar from a customer and issues one USDT, the dollar will not be locked in a safe, but will be used to buy other forms of assets, such as U.S. Treasury bonds. After receiving the dollar, the U.S. Treasury or other U.S. Treasury sellers in the secondary market will continue to circulate it.

In short, a dollar in the real world has never been withdrawn from circulation, and a USDT in the crypto world can also act as a "silver bill" to participate in the circulation of real-world currency.

The original $1 has become $2.

If the U.S. Treasury sells one dollar of U.S. Treasury bonds, it will use the one dollar received to continue to buy USDT, and Tether will continue to buy U.S. Treasury bonds... In the end, Tether holds an unlimited amount of U.S. Treasury bonds, and the U.S. Treasury holds an unlimited amount of USDT...

And all this, Tether and the U.S. Treasury, do not even have any illegal operations.

Death stampede - moral transgression

Any form of currency over-issuance is immoral.

Inflation comes from this.

But, we have to say, we have no way to deal with this.

If the U.S. credit is believed, it will not increase the national debt to 36 trillion.

If you are pessimistic enough, the situation shown in the above deduction will become a reality one day.

The so-called death stampede, one scenario is that the over-issuance of USDT leads to insufficient purchasing power, and holders run on Tether, forcing Tether to sell US bonds, which then triggers the collapse of US bonds that are already on the verge of bankruptcy.

Another scenario is that US bonds collapse first, and Tether's reserve assets depreciate sharply, triggering a run and depreciation of USDT.

Now that Trump is arguing with the Federal Reserve, if the Federal Reserve is stubborn to the end, it is not ruled out that Trump will bypass the Federal Reserve with cryptocurrency and use BUG2 to solve the urgent problem of US bonds.

Drinking poison to quench thirst.

Self-deception - the higher you climb, the harder you fall

Any form of currency over-issuance is immoral. It is not impossible for Tether to issue USDT, but either you have to completely withdraw it from the circulation of the real world after receiving a dollar, or your USDT cannot buy pizza and just circulate in the crypto market as if it is an online game.

In any case, one dollar is one dollar, and it should not become two dollars in any case. No matter how good the trick becomes, it is still a trick, a trick to deceive people. The higher you climb by magic, the harder you fall.

"We can't let corruption blind us to the broader reality: blockchain technology is here to stay. If U.S. lawmakers don't lead the way, other countries will take action - and not in a way that is consistent with our interests or democratic values."

Pt.2. The Damocles Debt

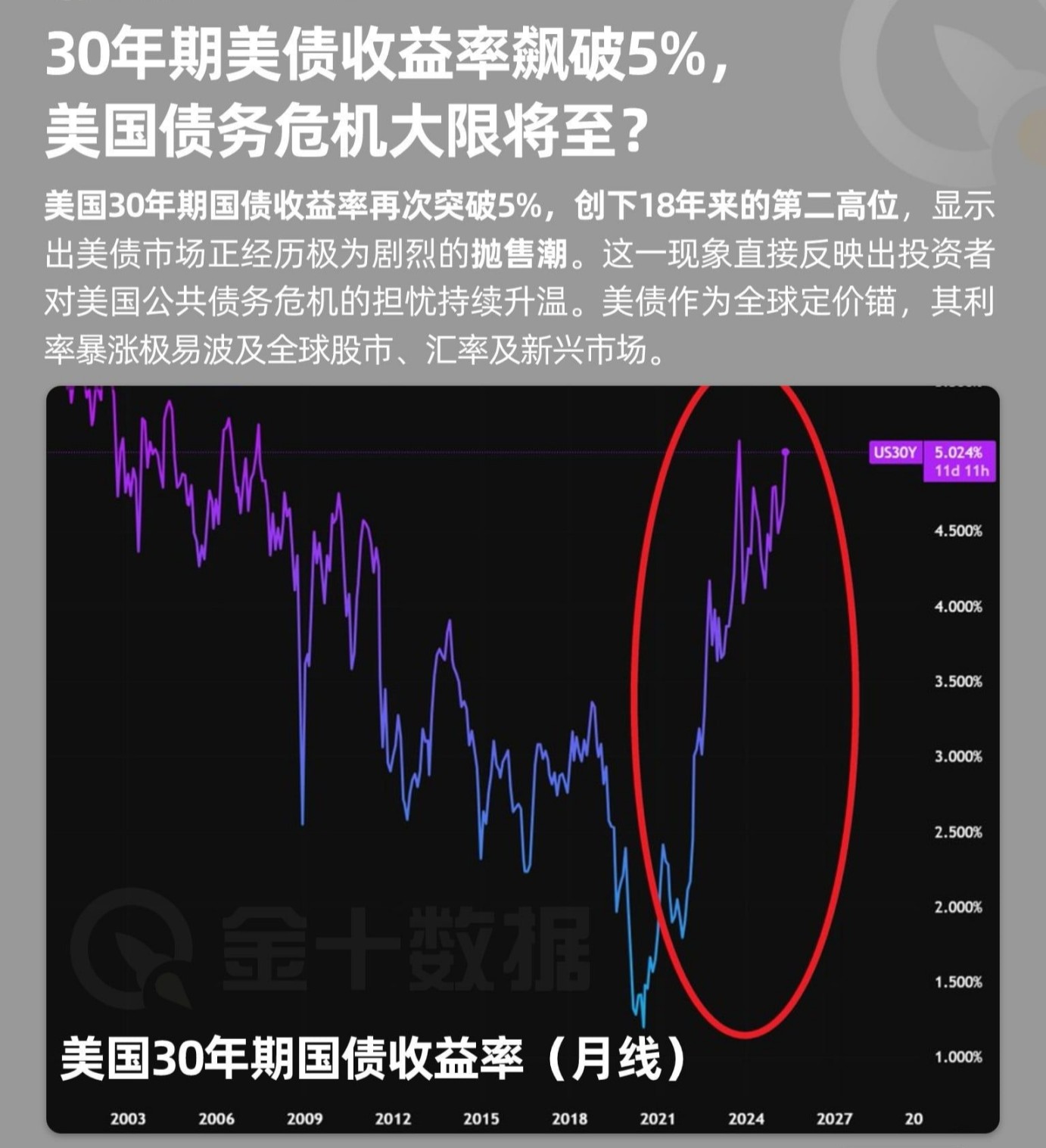

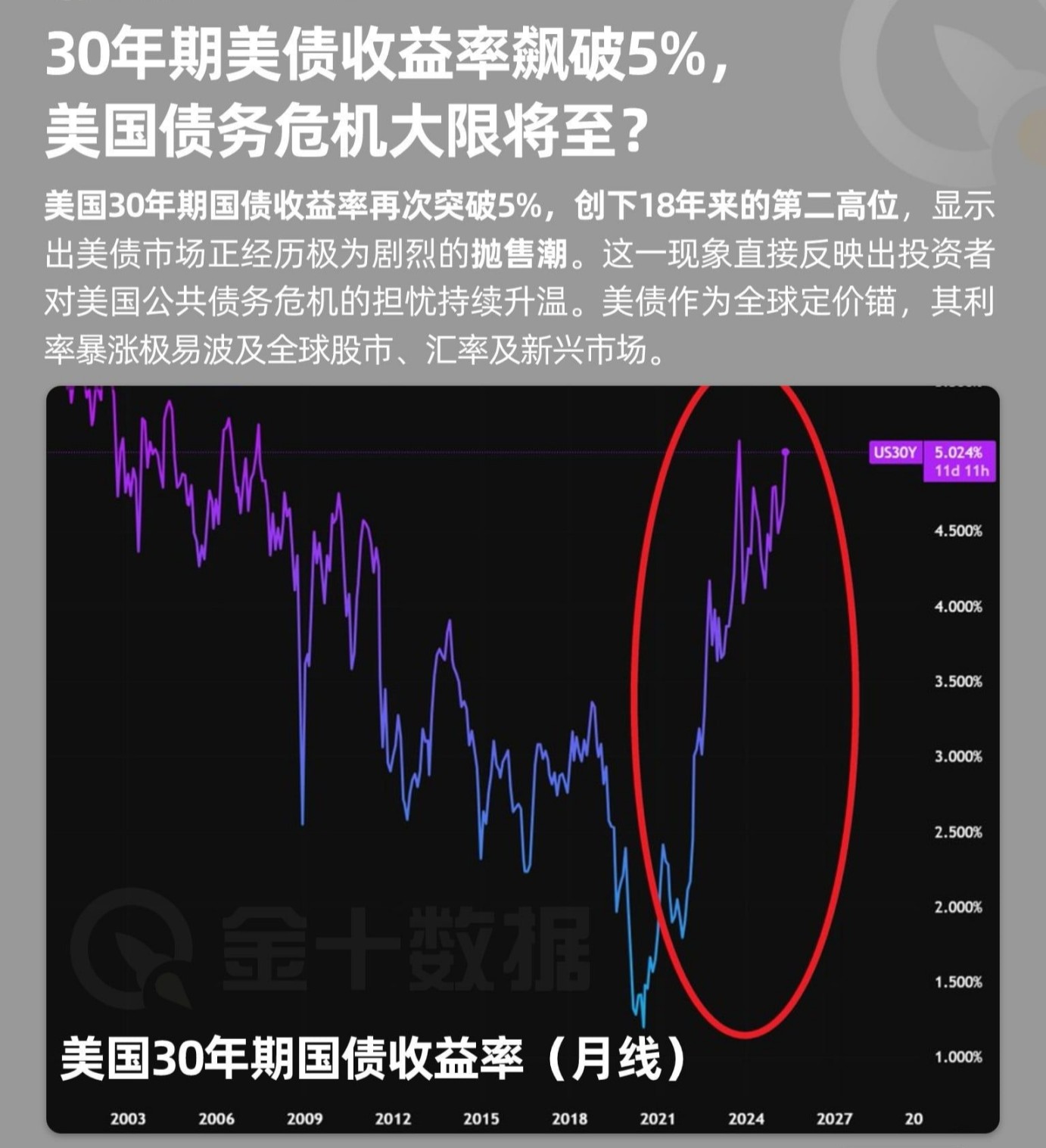

Source: Jinshi Data

In 2025, 2026 In the past two years, we all know that the United States has a huge amount of national debt due. This is the sword of Damocles hanging over the United States and Trump. Trump, at the age of 80, has maintained such a high intensity of work in the past 90 days, which is enough to give us a glimpse of the leopard.

Many historical events at the end of dynasties, people always rely on imagination to experience the scenes at that time, always wondering why there can't be a brave man from heaven, but now the United States is a living example, with a sense of déjà vu at the end of the dynasty, this feeling in short - no one can fill this hole.

At first, Trump hoped to lower the interest rate of national debt by creating an economic recession, that is, to save the bond market with a double kill of stocks and currencies, but the result unexpectedly turned into a triple kill of stocks, bonds and currencies.

So Trump found a reason to temporarily calm the storm and went back to think about how to deal with it. But this does not mean the storm is over. Trump really wants to make a fuss about tariffs to balance the income and expenditure. On the other hand, Trump does not want to decouple from China. Businessmen's ideas are simple and complex - the simplicity is that they will definitely not refuse to make money, and the complexity is that they want more in the distribution of benefits, but in the end they will end up in the same place.

Of course, time will solve everything.

Some people say that cryptocurrency can solve the US debt problem, and this statement is theoretically correct. We assume that countries use their own currencies to buy stablecoins, and the US dollar that supports stablecoins buys US bonds, which is roughly equivalent to countries buying US bonds. In addition, the bitcoins held by the US government will continue to appreciate and can bring in a lot of income. However, ideals are full, and reality is very skinny. Compared with the US scale of 40 trillion, the hundreds of billions of stablecoins are just a drop in the bucket, not to mention that the gap between the two is gradually widening. Even if BTC is all in all market value, it is only enough to pay for one year's interest on US debt, not to mention that the US government and enterprises hold only 5% of BTC.

In other words, even if you want to solve the US debt problem through the above two methods, it will take years of accumulation and waiting.

Therefore, the key to the problem is - how long can US debt last, or how long can the US dollar payment system last - the Bretton Woods system only lasted for 27 years before it collapsed, and the debt currency system since the collapse of the Bretton Woods system has lasted for 54 years. Regarding its cycle, we both hope that it survives and look forward to its rebirth.

Perhaps, decades later, when people look back on history, they will find that a new era may have begun from today.

"The bleak autumn wind is here again, and the world has changed."

Miyuki

Miyuki