Author: TM Compiler: TechFlow

Good news: Another wave of enthusiasm is coming to the Solana chain!

We're finally getting the massive liquidity we've been dreaming of, and this time, it's bankers injecting funds into our "meme."

If you need a quick summary: @worldlibertyfi is providing TWAP (time-weighted average price) services for the ETH and SOL ecosystems. This alone is enough to foreshadow what's coming next.

First Look: A "Money Laundering" Scheme?

When I first heard about World Liberty, I honestly thought it was just an elaborate "money laundering operation" by the Trump family.

In theory, this logic seems to make sense:

Print billions of profits through the $TRUMP memecoin;

Launch a platform that provides liquidity services for traditional financial (TradFi) funds;

Transfer profits tax-free through this plan;

No supervision, no touch, perfect achievement.

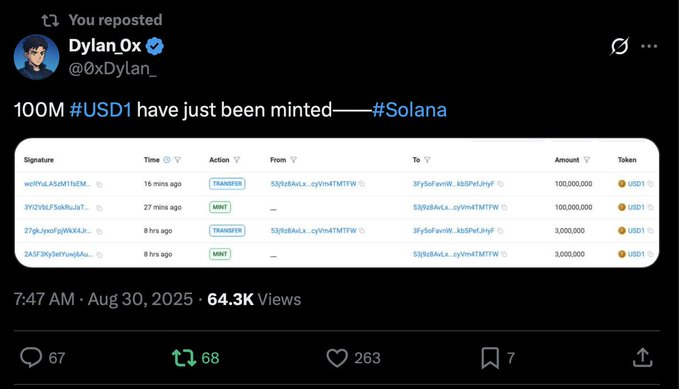

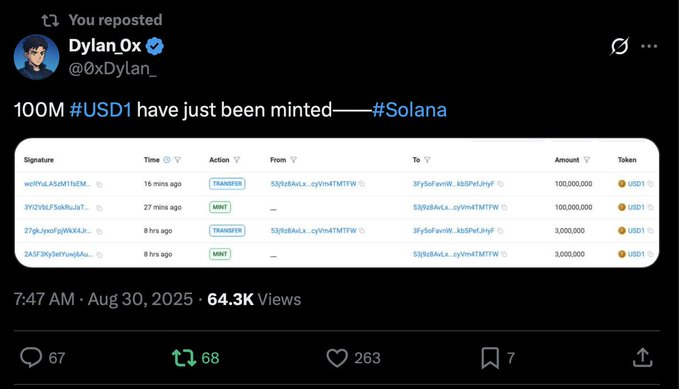

But at the time I overlooked a key point - I finally understand it today - the scale of World Liberty is much larger than this! HUUUUUGE Cryptocurrency Liquidity Machine World Liberty is positioning itself as a key liquidity provider in the on-chain ecosystem. Like it or not: Trump may be coming to the rescue of us "decentralization enthusiasts." We've been starving for liquidity, and now it's finally here. Sounds great, right? But here's the thing: whoever controls the flow of money in and out also controls the rules of the game. In the last cycle, centralized exchanges (CEXs) played this role. They served as the bridge between banks (the true liquidity providers and the source of fiat) and traders. But today, CEXs have become largely irrelevant. CZ and Brian foresaw this, which is why they began building their own on-chain layer. Meanwhile, World Liberty has minted hundreds of millions of dollars in the stablecoin USD1 as you read this.

"USD1 Wallet" Account Manager

The Problem with USD1

So far, exactly how these funds will be deployed remains a mystery.

Who will have access to these funds?

What are the criteria?

Does one simply need to be close to the Trump family? Or do they need to give them 10% of their company shares in exchange for funds?

No one knows for sure. But the key is this: they control the flow of liquidity across the entire crypto space. From now on, every emerging trend is directly tied to Trump's influence. Don't like Meme Meta? They'll fund ICM (on-chain capital markets) projects instead. Don't like ICM this month? Maybe AI next month. They can guide the direction of the entire cycle.

Married...with Children 2.0

The Hidden Concerns of Centralization

In the short term, we win: attention, buzz, and liquidity. Decentralization enthusiasts will revel in this feast.

But in the long term, who are the real winners?

Crypto natives, or the Wall Street bankers who support this game?

Ask yourself: How many people still hold onto the Bitcoin you once accumulated? Or did you already gamble it all away in the memecoin frenzy?

Don’t tell me you gambled all our money on those memecoins, Donny! (Deep Tide Note: Donny is Trump’s nickname.)

All my Bitcoin is gone.

Transparency, Control, and Punishment

We’re not the Wild West anymore.

We’ve traded freedom for liquidity and fun for privacy. Today, every transaction you make on Solana is visible forever. Right now, most people might be thinking, "I don't care, they can't touch me." But the truth is, they can, and they probably will. Groypers. At some point, you might be punished for the assets you traded, the tokens you held, or even the words you said in 2025. This is the bitter legacy of this game: we're priced out of the assets we once built; we lose ownership of the ecosystems we love; and worst of all, we give up our freedom in the spaces we live in.

We need Degenspartan back!

Here are my initial suggestions

Make as much money as you can while the window is still open.

But don’t forget: There is no free lunch. Liquidity is not free, and neither is Trump’s “endorsement.”

We are swimming in a pool of sharks, and those sharks don’t want the “little guy” to win.

What does the future hold? Which coin should I buy? The truth is, unless you have direct inside information from within Trump's circle, it's all speculation. They control the market right now. As Rothschild once said, "He who controls the money controls the world." My best guess is that as World Liberty begins TWAPing (time-weighted average price) into the ecosystem, other foundations will follow. Expect Chinese players and others to invest in more aggressive yields (higher annualized returns, more leverage). By late 2025 or early 2026, regulators will likely step in and lock things down—not to weaken World Liberty's power, but to consolidate it. By then, real-world startups and tech projects will begin deploying on-chain.

JinseFinance

JinseFinance