Source: MiaoTou APP

U.S. bond yields fell, U.S. bond prices rebounded, are U.S. bonds safe?

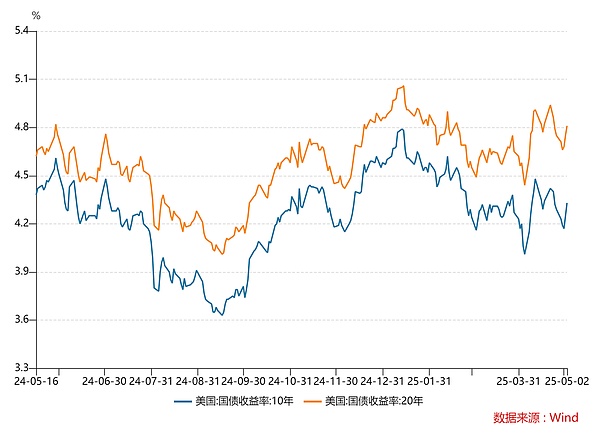

After the tariff policy was implemented, U.S. bond yields continued to rise. The 30-year U.S. Treasury bond yield once exceeded 5%, and the 10-year yield also reached 4.50%.

The rise in U.S. bond yields means the decline in U.S. bond prices. The two are inversely related, and the logic is very simple:

Suppose you buy a 1-year U.S. bond with a coupon rate of 5% and a face value of $100. You can cash it out for $105 at maturity. But if the stock market rises at this time, investors sell the original $100 US bonds, the supply in the market increases, and if the demand remains unchanged, the price of the US bonds in your hand will fall, for example, if it falls to $98, the corresponding yield will become 7.14% (7/98); vice versa. The key behind the rise and fall of bond prices is actually the change in supply and demand. When the market demand for treasury bonds increases sharply and there is a situation of supply exceeding demand, bond prices will rise and the yield to maturity will fall; conversely, when the market supply increases and supply exceeds demand, bond prices will fall and the yield to maturity will rise.

The rise in U.S. bond yields actually reflects that U.S. bonds are being sold off. In theory, U.S. bonds should be the safest "safe haven" amid global tariff uncertainty, rising risk aversion, and rising expectations of a Fed rate cut, but now they are being sold off.

One of the reasons is that the fund basis trading exploded, forcing them to close their positions and sell U.S. bonds in exchange for liquidity, which resulted in a price stampede.

Basis trading is actually arbitrage through the price difference between spot and futures Treasury bonds. Hedge funds play with high leverage. Once market fluctuations lead to losses, a wave of selling will be triggered, forming a vicious cycle of "selling-yield increase-selling again"; Another reason is that market confidence in the United States is weakening. Whether it is the worry that the escalation of the trade war will increase the risk of stagflation in the United States, or Trump's public pressure on Federal Reserve Chairman Powell to cut interest rates and even threaten to fire him, the Fed's independence crisis has weakened the market's confidence in US dollar assets.

However, the selling pressure on US bonds was soon alleviated. Since April 21, US bond yields have fallen, and US bond prices have also rebounded. Has the US bond alarm been lifted?

#01U.S. debt has Trump in its grip

According to conventional logic, rising U.S. debt yields(i.e. falling U.S. debt prices)usually mean rising U.S. interest rates or strong economic data, which in turn attracts global capital to flow into the United States and pushes up the U.S. dollar exchange rate. But this time the situation is very different - U.S. debt and the dollar actually fell simultaneously, and U.S. stocks were not "spared".

The collapse of U.S. stocks and the dollar may be exactly what Trump wantsto see

. After all, his core consideration has always been around consolidating political power, and his consistent approach is to "create a crisis first, then resolve it in a high-profile manner."

The plunge in US stocks just became a tool for him to play against the Federal Reserve. Once the market trades that the US economy is in recession and panic is rising, the Federal Reserve is forced to launch a large-scale interest rate cut. Then the economy recovers and the stock market picks up. Trump can take advantage of the situation to attribute the "credit" to his wise decision and pave the way for his 2026 mid-term elections.

As for the depreciation of the US dollar, it is also a two-birds-with-one-stone for Trump: on the one hand, it improves export competitiveness; on the other hand, it can also dilute the huge government debt, which can be said to be "suppression with calculations."

But the decline in US debt has put Trump under tremendous pressure. The yield on US debt in the market has risen, and the interest rate on newly issued US bonds also needs to be increased accordingly, otherwise investors are unwilling to buy. Once the interest rate on new treasury bonds increases, the payment pressure on the United States will also increase accordingly. In this way, the U.S. practice of "taking money from Peter to pay Paul" will only make the debt gap bigger and bigger, forming a vicious circle.

So after the sharp drop in U.S. debt, the Trump team began to work on "saving the market":

On April 9, Trump announced a 90-day suspension of "reciprocal tariffs" for 75 countries around the world that had not taken retaliatory tariff measures against the United States, and reduced the tariffs of these countries to 10%;

On the 12th, the United States exempted some Chinese high-tech products (such as smartphones, semiconductors, etc.);

On the 22nd, Trump expressed his willingness to negotiate with China in a "very friendly" attitude, and it is possible to significantly reduce tariffs on Chinese goods in the future, but not to zero; on the same day, he also expressed "no intention of firing" Federal Reserve Chairman Powell, giving the market a "reassurance";

On the 28th, U.S. Treasury Secretary Benson declared that he did not want the Sino-U.S. trade situation to escalate further, trying to calm the panic in the financial market. At the same time, the Federal Reserve also began to calm market sentiment; On the 24th, Cleveland Fed President Hammack said that although it was almost impossible to cut interest rates in May, if the economic data in June could provide clear and convincing signals, interest rate cuts might be taken as early as June - in any case, market expectations have been ignited. Although the "compromise" of the Trump team temporarily eased the selling pressure of U.S. debt, the U.S. debt alarm has not been lifted.

#02U.S. Treasuries are no longer a "safe haven"

The risk premium of U.S. Treasuries is rising, and the market is beginning to price U.S. Treasuries as "risky assets" rather than "risk-free assets."

For a long time,U.S. Treasuries have been regarded as safe-haven assets, mainly relying on the credit of the U.S. dollar. But now, the market no longer regards U.S. Treasuries as a "safe haven", and the reason behind this is very simple - the credit of the U.S. dollar has been overdrawn.

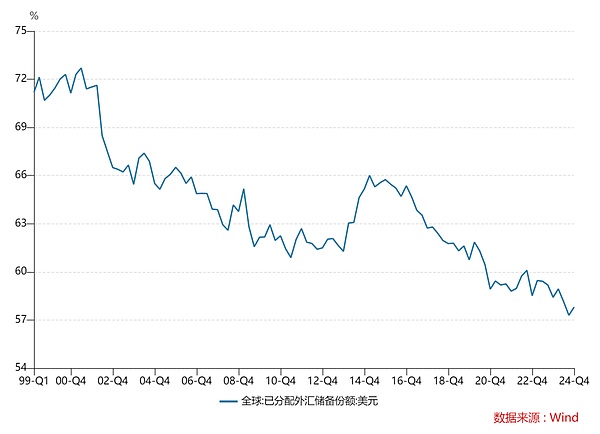

As soon as the Bretton Woods system was established in 1944, the U.S. dollar became the only currency in the world pegged to gold. The currencies of all countries had to be pegged to the U.S. dollar, and global trade and reserves revolved around the U.S. dollar. By 2001, the U.S. dollar accounted for 72.7% of global foreign exchange reserves. That was the peak period of the U.S. dollar's credit. However, with the rise of the euro and global multipolarization, the share of the U.S. dollar in global foreign exchange reserves began to slowly decline, which means that the credit of the U.S. dollar also began to decline.

The United States frequently uses the dollar hegemony as a weapon to strike at the economies of other countries through sanctions, asset freezes and other means. Especially during the Russia-Ukraine conflict, the United States froze Russia's foreign exchange reserves, which directly aggravated the global crisis of confidence in the U.S. dollar and caused many countries with trade surpluses with the United States to "abandon" U.S. debt.

Then there is the US debt problem, which has now reached the "dangerous edge". The size of the US national debt has long exceeded 36 trillion US dollars, and the debt accounts for more than 120% of GDP. Analyst Larry McDonald pointed out that if the interest rate remains at 4.5%, the US debt interest expenditure may reach 1.2 trillion to 1.3 trillion US dollars by 2026, exceeding defense spending, and the US fiscal deficit will be overwhelmed.

The pressure on the US short-term debt is even more urgent. In 2025, 9.2 trillion US debts will mature, and 6 trillion US debts will mature in June alone.

The US dollar credit is now like an overdraft on a credit card. Global capital has begun to turn to non-US assets such as gold. The proportion of the US dollar in global foreign exchange reserves has also continued to decline, falling to a minimum of 57.3% in 2024.

Another logic supporting US debt is that after countries with trade surpluses with the United States obtain US dollars, they must return these dollars to the United States, mainly because they can earn interest by investing in US debt, forming a closed loop of "commodities-dollars-US debt".. However, Trump's "reciprocal tariff" policy will break this closed loop. If the global trade war does not ease, the scale of the US trade deficit will decrease, which will directly affect the US dollar accumulation capacity of surplus countries.

When US debt is no longer a "refuge", traditional safe-haven funds will turn to alternative assets such as gold and non-US currencies. The International Monetary Fund predicts that the proportion of US dollar reserves may fall below 50% in 2026.

#03Will US debt default?

This issue has always attracted much attention. The market's trust in US assets has a systemic crisis. How great is the risk of US debt default?

The possibility of direct short-term default of US debt is very low. Miaotou has said many times that if the United States faces a debt crisis, the status of the US dollar as the world's reserve currency will be greatly threatened, and it may even trigger a new round of global financial crisis, which is undoubtedly an unbearable disaster for the United States.

The US government has a variety of means to avoid default and will never easily reach the brink of default. For example,

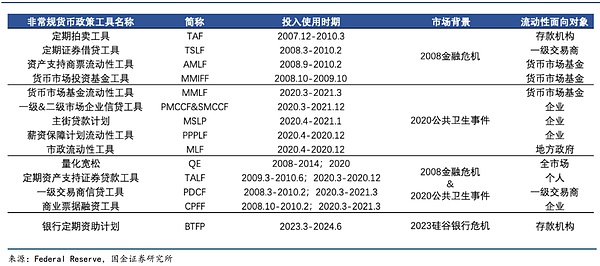

Trump once used tariffs as a bargaining chip to ask other countries to promise to buy more US debt-the tariff plan introduced on April 2 is a typical "extreme pressure" method. In addition, Trump may also adopt a "debt swap" strategy. As the recently rumored "Mar-a-Lago Agreement" suggests, one of the items is that the Trump administration plans to swap some U.S. debt for 100-year, non-tradable zero-interest bonds. Another means is to replace high-interest bonds with low-interest bonds. Trump has publicly criticized the Federal Reserve many times and pushed the Federal Reserve to cut interest rates as soon as possible through policy pressure, which can directly lower the face interest rate of short-term new bonds. However, the impact of interest rate cuts on long-term government bonds is not direct. In fact, long-term U.S. bond yields may rise instead of fall against the backdrop of interest rate cuts, especially when U.S. inflation expectations rise and deficits remain high. As Nobel economist Paul Krugman said: "When the debt scale exceeds the critical point, monetary policy will become a vassal of fiscal policy." Today, the U.S. bond market is entering a new normal of "diminishing effectiveness of interest rate cuts." If the market loses confidence in U.S. bonds and is unwilling to buy new bonds, it will eventually have to rely on the Federal Reserve to "take over", which is a typical "balance sheet expansion" behavior. Although this approach can ease debt pressure in the short term, it is not a sustainable solution.

The core goal of the Federal Reserve is to maintain price stability and promote full employment, not to fund fiscal deficits. Direct bond purchases through balance sheet expansion may be regarded as fiscal monetization, which will undermine the independence of the central bank. If the Federal Reserve "takes over" for a long time, it may make the Ministry of Finance more bold in issuing bonds.

In extreme cases, the Federal Reserve may have to start the "printing machine" and directly purchase government debt, which is considered the last "trump card".. Although this can avoid default in the short term, it also brings another hidden risk - as these additional dollars eventually flow back to the United States, they will significantly increase the domestic money supply, thereby pushing up inflation.This situation is essentially equivalent to a "hidden default", that is, the actual interests of creditors are damaged through currency depreciation, and the risks and losses will be "shared" among investors holding dollars and U.S. bonds around the world.

In fact, the vast majority of countries and institutions do not want to see the U.S. debt default, because once it defaults, it will bring immeasurable consequences. As the cornerstone of the global financial system, the default of U.S. debt will not only directly impact the global market, but also bring huge losses to investors, institutions and even countries.

In summary, although the probability of a direct default of U.S. debt in the short term is extremely low, the risk of its price falling still exists.

#04In conclusion

For us investors, we need to pay special attention to the following points:

(1) If you invest in U.S. debt through QDII funds or related financial products(domestic account + RMB), there is no need to exchange currency or open an overseas account, but you need to be alert to the risk of a sharp drop in U.S. debt prices. For example, if tariffs are further escalated, the Federal Reserve loses its independence, and market confidence in the U.S. economy declines, the attractiveness of U.S. debt will drop significantly; on the contrary, if the tariff war eases, U.S. inflation falls, and the economy achieves a soft landing, then U.S. debt yields are expected to fall and U.S. debt prices may continue to rebound. In particular, U.S. debt has high short-term volatility, like a "swinging ball" with violent emotional fluctuations. At present, the U.S. debt market is extremely sensitive to Trump's policies and the Fed's "pivot", and any signal may bring about short-term violent fluctuations. If Trump insists on high tariffs or the Fed takes a hawkish stance, the price of U.S. debt may fall sharply. On the contrary, if the Trump team makes remarks to ease trade conflicts, sends signals of deficit control, or shows signs of policy easing, U.S. debt may rebound quickly. (2) If you buy U.S. debt directly through overseas securities firms or banks (overseas accounts + US dollars), you need to pay special attention to the risk of exchange rate fluctuations. If the RMB appreciates, you may face exchange losses, resulting in the "wiping out" of interest rate differentials, and even the possibility of negative returns. Note: From the perspective of debt structure, domestic institutions and individuals in the United States are the main holders of U.S. debt. According to the latest International Capital Flows Report (TIC) released by the U.S. Treasury Department, as of the end of February 2025, domestic institutions and individuals in the United States held about 76% of U.S. debt, while foreign investors held a total of $8.8 trillion in U.S. debt, accounting for 24.2% of the total size of U.S. debt.

Among them, Japan is still the largest creditor of U.S. debt. As of the end of February, the amount of U.S. debt held reached $1,125.9 billion, an increase of $46.6 billion in a single month; Mainland China ranked second with $784.3 billion, an increase of $23.5 billion; the United Kingdom ranked third with $750.3 billion, a month-on-month increase of $10.1 billion.

Catherine

Catherine

Catherine

Catherine YouQuan

YouQuan Jasper

Jasper Jixu

Jixu Catherine

Catherine Kikyo

Kikyo Jasper

Jasper Hui Xin

Hui Xin Catherine

Catherine Alex

Alex