With Trump about to take office as the US President again, investors are full of expectations for the future of the crypto market. Since Trump won the presidential election, Bitcoin has broken the $100,000 milestone. And $Trump, officially announced by Trump, reached a total market value of $82 billion in just two days, soaring 472 times from the opening peak. Alphas of other American celebrities and politicians have emerged. "The president's issuance of coins" not only gave a shot in the arm to the crypto market, but also more liquidity in and out of the market will further accelerate the rise of Solana's ecosystem.

During last year's campaign, Trump promised to include all the Bitcoin currently held by the US government and the Bitcoin purchased in the future into the "National Strategic Bitcoin Reserve". He will stop the government's crackdown on cryptocurrencies within an hour of taking office and propose policies that can promote the comprehensive development of cryptocurrencies. If Trump can really fulfill these promises of support, then the United States may greatly accelerate the popularity of cryptocurrencies and become a "global cryptocurrency center."

We expect that Trump will prioritize the FIT21 Act (Financial Innovation for Technology in the 21st Century Act), which will allow tens of thousands of cryptocurrencies to be almost clearly classified as "commodities" and "securities", and promote a new round of entrepreneurship and innovation under the reasonable supervision of the SEC and CFTC. Traditional VCs and funds can enter the market under the guarantee of compliance, bringing the market value of the entire crypto market to a new height. For investors like us, different types of cryptocurrencies have different risk characteristics. The price fluctuations of "commodity" cryptocurrencies may be related to factors such as market demand and supply, while securities cryptocurrencies may be affected by factors such as project operations and market expectations. After clarifying the classification, we can also more accurately assess the risks of the cryptocurrencies we invest in and make more reasonable investment decisions.

I. FIT21: Clarify the attributes of "commodities" and "securities"

From the perspective of US regulation, since 2015, whether cryptocurrencies are "commodities" or "securities" has been a game between the SEC and the CFTC.

SEC's judgment basis: Howe Testing

-Is it related to capital investment?

-Is there a profit expectation?

-Is there a common entity?

CFTC's judgment basis:

-Is it substitutable?

-Is it tradable in the market?

-Is it scarce?

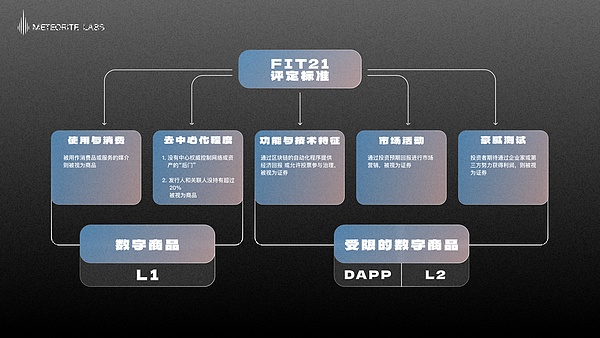

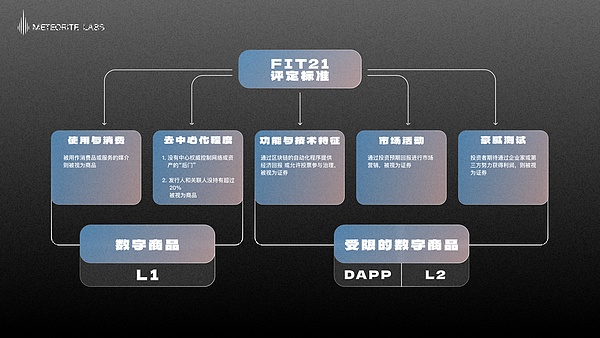

In the "Financial Innovation for Technology in the 21st Century Act" (FIT21 Act) passed by the U.S. House of Representatives in May this year, a broad digital asset regulatory framework was established by clarifying the regulatory responsibilities of the two regulatory agencies and updating the existing securities and commodity laws. The framework classifies cryptocurrencies (digital assets) other than stablecoins into two categories:

-"Digital commodities", which are exclusively regulated by the CFTC

-"Restricted digital assets", which are actually similar to securities, but are not explicitly stated to be exclusively regulated by the SEC

Hereinafter, they are simply referred to as "commodities" and "securities".

FIT21 proposes five key elements to distinguish whether cryptocurrencies are securities or commodities

Howey Test: Consistent with the SEC's long-standing judgment, if the purchase of a cryptocurrency is considered an investment and the investor expects to make a profit through the efforts of entrepreneurs or third parties, it is generally considered a security.

Use and consumption: If a cryptocurrency is primarily used as a medium for consumer goods or services, such as tokens that can be used to purchase specific services or products, it may not be classified as a security, but as a commodity.

Degree of decentralization: The bill places special emphasis on the degree of decentralization of the blockchain network. If the network behind a cryptocurrency is highly decentralized and there is no "backdoor" for a central authority to control the network or assets, such an asset will be considered a commodity.

Functionality and technical features: If a cryptocurrency mainly provides economic returns or allows voting to participate in governance through automated procedures on the blockchain, they are likely to be considered securities.

Marketing activities: How a cryptocurrency is promoted and sold in the market is also an important factor. If a token is mainly marketed through the expected return on investment, it may be considered a security.

From the perspective of use and consumption, public chains and PoW tokens are more in line with the standards of commodities. Their common feature is that they are mainly used as a medium of exchange or payment method, rather than as an investment in the expectation of capital appreciation. Although in the actual market, these assets may also be purchased and held speculatively, they are more likely to be regarded as commodities from the perspective of design and main use.

The bill mentions that "if no relevant person has owned or controlled more than 20% of the voting rights alone or through relevant persons in the past 12 months, this indicates that the digital asset has a high degree of decentralization." This usually means that no single entity or small group can control the operation or decision-making of the asset. From this perspective, a high degree of decentralization is an important factor that drives assets to be regarded as commodities, because it reduces the control of a single entity over the value and operation of the asset, which meets the characteristics of commodities, that is, it is mainly used for exchange or use, rather than for investment returns.

From the perspective of functional and technical characteristics, utility tokens governed by DAOs are more in line with the standards of securities. "If a cryptocurrency mainly provides economic returns or allows voting to participate in governance through automated procedures on the blockchain, they will be regarded as securities" because this shows that investors are expecting to gain benefits through the efforts of third-party companies.

There is a contradiction. What if a utility token is highly decentralized in governance? Shouldn't it be defined as a commodity?

The point that should be considered here is whether the main purpose of the holder holding the asset is to obtain economic returns (for example, through asset appreciation or dividends), or to use the asset for transactions and other activities on the platform or network?

In the context of the approval of the ETH spot ETF application (Form 19b-4), the definition of ETH is more inclined to functional use. The nature of its pledge and governance is more to maintain network operation rather than economic returns. Therefore, in the future, L1 digital assets similar to ETH can be regarded as commodities in theory if they meet the preconditions such as the degree of decentralization.

From this perspective, if the protocols governed by DAO, including DeFi and L2, are closer to obtaining economic returns or dividends in terms of governance, their positioning is more likely to be defined as securities.

Therefore, in summary, only from the perspective of the FIT21 Act, we temporarily regard L1 tokens as commodities, and protocol tokens and L2 tokens with DAO governance as securities.

At the same time, we found that this result is basically consistent with the results of the Type 1 (digital goods) and Type 2 (equity governance tokens) methods proposed by Frax Finance. A detailed interpretation will be made in the third part.

Although it was passed by the House of Representatives as early as May, FIT21 has not yet been voted in the Senate. Analysts at JPMorgan Chase believe that when Trump officially takes office, several stalled cryptocurrency bills, including FIT21, may be quickly approved.

With Trump about to enter the White House, FIT21 may be coming soon, which will create a stable and effective regulatory environment for the healthy growth of the crypto market. It is necessary to continue to pay attention to the progress of the bill (House of Representatives √ - Senate - President Signed).

The bill clearly defines the concept of decentralization. No one can control the entire blockchain network alone, and no one who owns more than 20% of digital assets or voting rights is likely to be regarded as a "digital commodity". The definition of commodity cryptocurrencies is expected to strengthen the expansion of these cryptocurrencies in the payment field. At the same time, with a high degree of decentralization, more ETFs may come out. SOL ETF is expected to become the third crypto spot ETF after ETH ETF, as Geoffrey Kendrick, head of foreign exchange and digital asset research at Standard Chartered Bank, and Anthony Scaramucci, founder and managing partner of Skybridge Capital, said. There are also XRP and LTC, which have recently soared due to ETF rumors.

For "restricted digital assets", that is, security tokens, such as DeFi, the FIT21 bill will be more conducive to DeFi compliance and may even trigger "mergers and acquisitions". It will become more convenient for both entrepreneurship and traditional finance to invest in DeFi projects. Considering the attitude of traditional financial institutions represented by BlackRock towards the crypto market in recent years (promoting ETF listing and issuing US debt assets on Ethereum), DeFi is likely to be their key layout area in the next few years. For the end of traditional financial giants, mergers and acquisitions may be one of the most convenient options, and any related signs, even if it is just the intention of mergers and acquisitions, will trigger a revaluation of the value of DeFi leading projects.

II. In-depth analysis of L1, L2, and DeFi, are they commodities or securities?

Bitcoin BTC

The value of a commodity depends on labor time, in other words, the realization of labor time; the value of a security depends on profit margin, in other words, the realization of profit expectations.

A commodity is an economic product, usually a resource, with complete or substantial fungibility. That is, the market treats instances of a commodity as equivalent or almost equivalent, regardless of who produces it.

Bitcoin is the first, most popular, and largest cryptocurrency by market value. The total amount of Bitcoin is constant at 21 million. Through the PoW consensus mechanism, the process of "miners", "mining", and the acquisition of labor products, it condenses human labor and can be transferred, traded, and generate income through money as a consideration. It corresponds to the property actually enjoyed by the holder in real life and has use value and exchange value.

At the same time, its computing power distribution, node distribution and network hash rate indicators continue to rise, making it the most decentralized cryptocurrency. So far, no cryptocurrency can compete with Bitcoin in terms of decentralization.

The core idea of Bitcoin is to establish a decentralized currency payment system that anyone can participate in without the approval or supervision of the government or banks. After more than ten years of development, Bitcoin is now used as legal tender in El Salvador and the Central African Republic, and countries such as the United States, Australia, Canada, and the United Kingdom have allowed Bitcoin to be used for legal payments.

Therefore, whether in terms of decentralization or usage, Bitcoin is undoubtedly a "digital commodity".

Ethereum ETH

As the first blockchain network to support smart contracts, Ethereum is known for its decentralized applications, ERC token standards, security, decentralized features, and innovation in the financial services field. It provides developers with the infrastructure to build and deploy decentralized applications, while promoting the development of popular tracks such as DeFi and GameFi.

Crypto enthusiasts often call ETH "digital oil", why?

First of all, ETH plays the role of basic fuel in the Ethereum network, which is used to pay transaction fees and acts as the fuel for transactions, that is, Gas. You have to use it to pay for various operations, such as sending transactions, purchasing services or goods, and deploying smart contracts. This is similar to the use of oil as fuel and energy in the real world, and is a basic resource for driving various activities and applications. From this perspective, it is more like a commodity, mainly used as a medium of exchange or payment method.

With the increasing number of applications on Ethereum and the increasing frequency of network activities, such as DeFi and GameFi, the demand for ETH is also growing. This growth in demand is similar to the increase in demand for oil during the industrialization process, which has driven the value of ETH up. At the same time, DeFi mining and LSDFi derived from ETH can be regarded as interest paid to ETH holders, which is a commodity premium.

It is worth mentioning thatfrom the perspective of issuance and burning, Ethereum ETH has a lower annual issuance rate than Bitcoin BTC, and even in extreme narrative fanaticism such as xxFi Summer, there may be a deflationary situation where the amount of burning is greater than the amount of issuance. This deflationary characteristic is similar to the scarcity of oil resources.

Since Ethereum switched to the PoS mechanism, the issuance mechanism of ETH has undergone major changes. PoS rewards users for holding and staking ETH to maintain network security. This mechanism links the newly issued ETH to the security and vitality of the network.

When Ethereum adopts the POW mechanism, a block is generated approximately every 14 seconds, and the generator of each block receives a reward of 2 ETH. In fact, the number of newly added ETH per year is about 4.5 million (that is, about 12,300 are released every day).

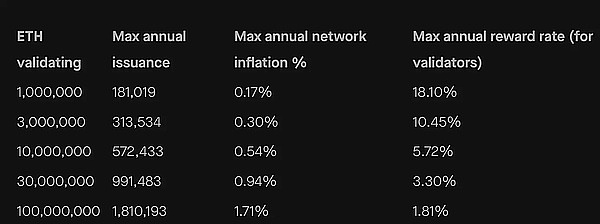

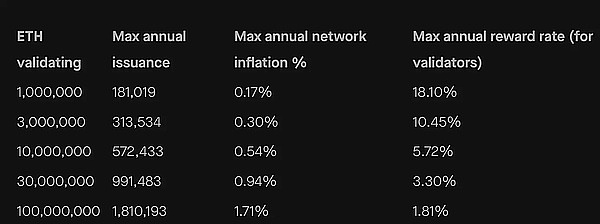

When the POS mechanism is adopted, the issuance model also changes: that is, the more staked validator rewards, the less the yield, and the less staked, the higher the reward, achieving self-regulation.

The table below shows that after adopting the POS mechanism, when the annual ETH inflation rate is determined to be no higher than 1.71%, the range of newly added ETH is roughly 180,000-2.09 million per year (that is, about 4.96-5,700 per day).

In 2021, the Ethereum Foundation introduced the EIP-1559 "burning" mechanism.

EIP-1559 improves the transaction fee structure of Ethereum. The BaseFee (basic fee) in each transaction will be burned in full, and the Priority Fee (priority fee) will be paid directly to the miners.

This means that the higher the network usage rate, the higher the BaseFee reflecting the degree of network congestion, and the more ETH will eventually be burned.

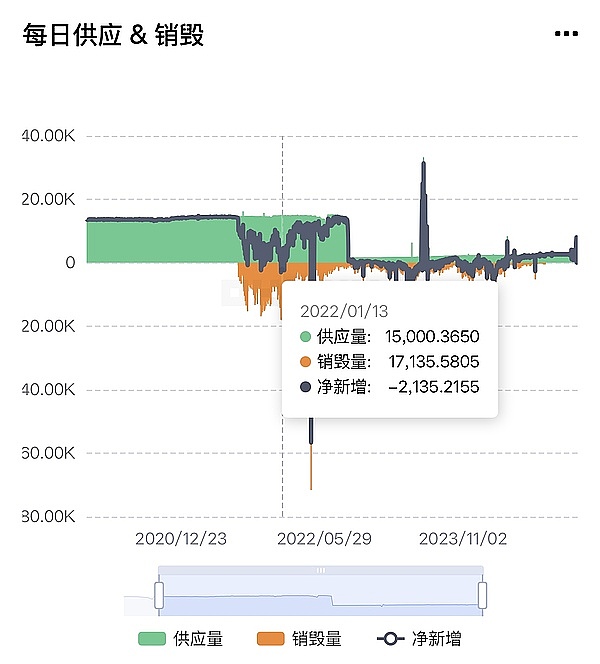

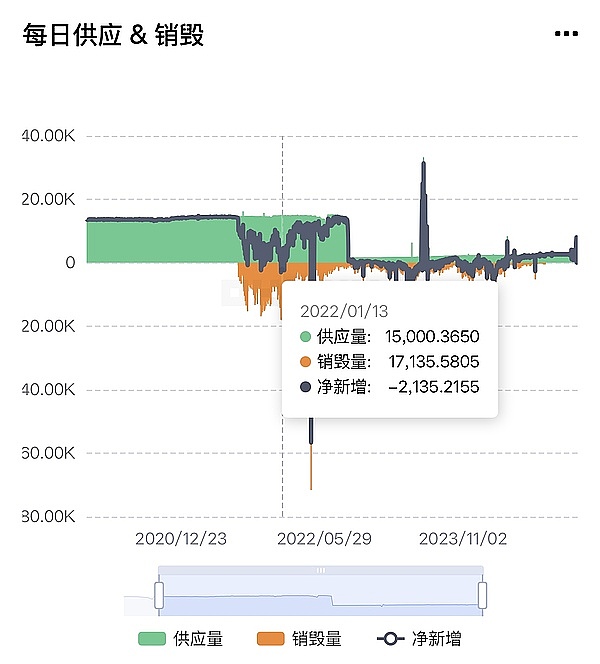

Let's take a look at the status of burning and supply in the PoW and PoS periods through specific data.

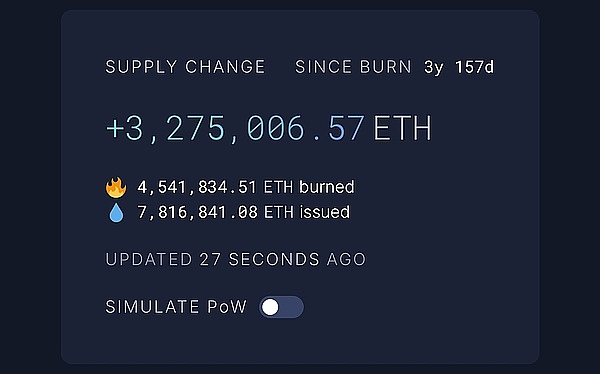

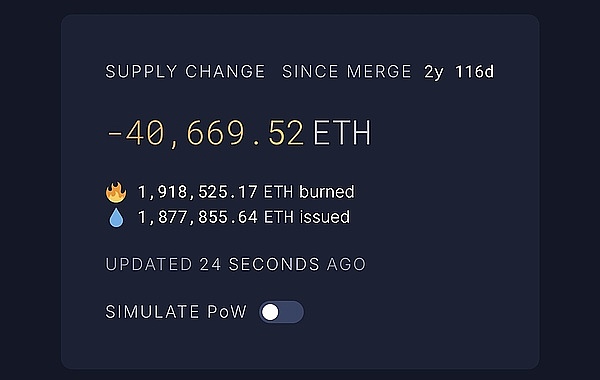

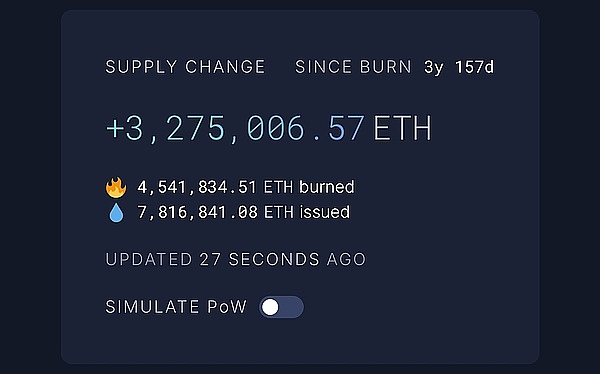

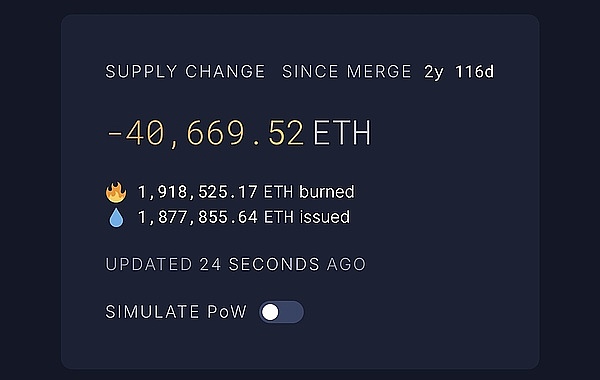

As can be seen from the figure below, in August 2021, EIP-1559 was officially launched. From this time to now, 4.54 million ETH have been burned and 7.81 million have been issued, that is, the actual number of additional issuances is as high as 781-454=3.27 million.

As can be seen from the figure below, in September 2022, Ethereum completed The Merge and switched to the PoS mechanism. From this time to date, 1.91 million coins have been burned and 1.87 million coins have been issued. In fact, after switching to PoS, the issuance and burning status is generally deflationary, about -40,669 coins.

It is obvious from these two sets of data:

1. From the perspective of burning, August 2021-September 2022 was at the beginning of the end of the last bull market. In 11 months, the burning volume was as high as 454-191=2.63 million.

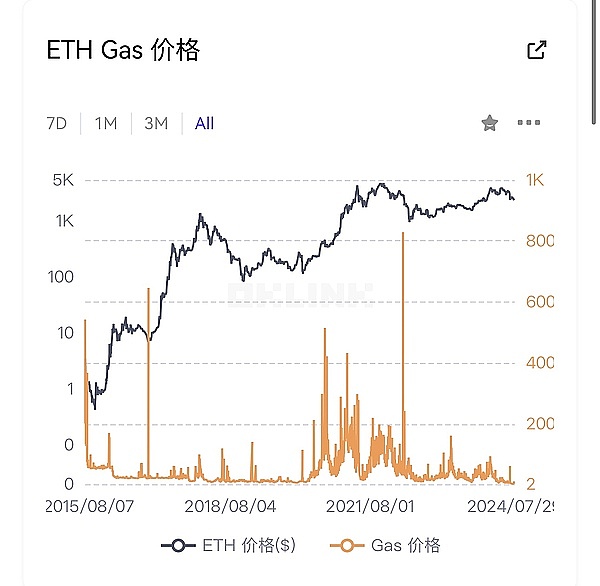

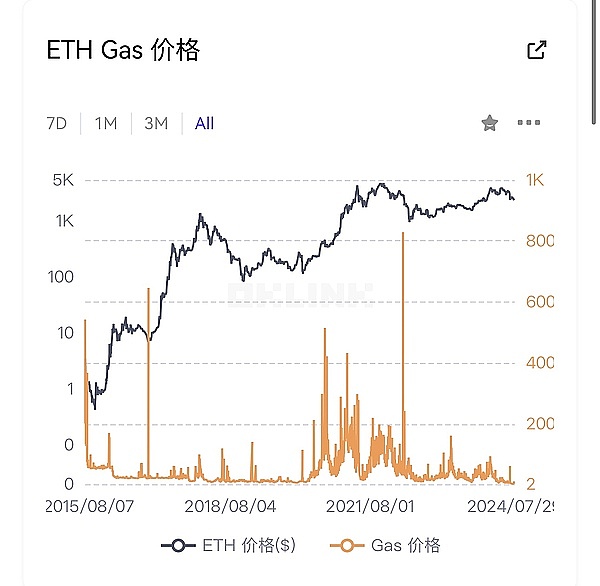

This period was at the beginning of the end of the bull market. According to the Gas price in the figure below, Gas remained between 30-156 US dollars, and on-chain activities were still frequent. The network utilization rate is high and the burning volume is high.

However, it cannot be balanced with the newly issued amount of 781-187=5.94 million during this period.

2. From the perspective of additional issuance, from August 2021 to September 2022, it was still the PoW consensus mechanism, with an additional issuance of 5.94 million. But since the transition to PoS in September 2022, only 1.87 million new coins have been issued.

Therefore, the issuance of PoS is much lower than that of the PoW mechanism.

With the parallel issuance and burning mechanisms, we expect that when the market focuses on the Ethereum network and triggers a new wave of phenomenal narrative crazes similar to DeFi Summer and AI Meme Season, the transaction volume will increase significantly. If the transaction volume is large enough, we have the opportunity to see the number of ETH burned exceed the number of ETH issued, thus forming a deflation phenomenon.

However, the current market focus is not on the Ethereum chain, the transaction volume and Gas fees are relatively low, the issuance is greater than the burning, and it is in an inflationary state. According to ETH Burned, in the past seven days, ETH has cumulatively issued 18,199 and burned 8,711, that is, the total amount has actually increased by only 9,488, which has well controlled the inflation rate.

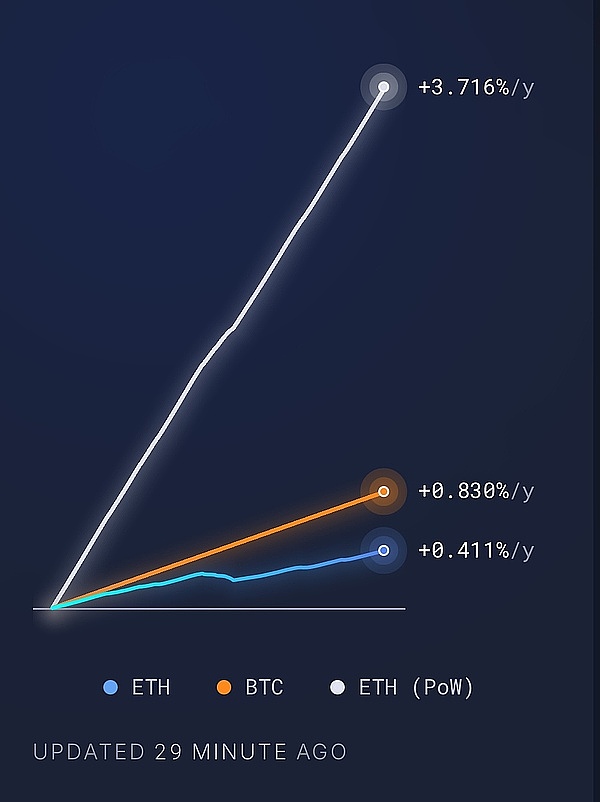

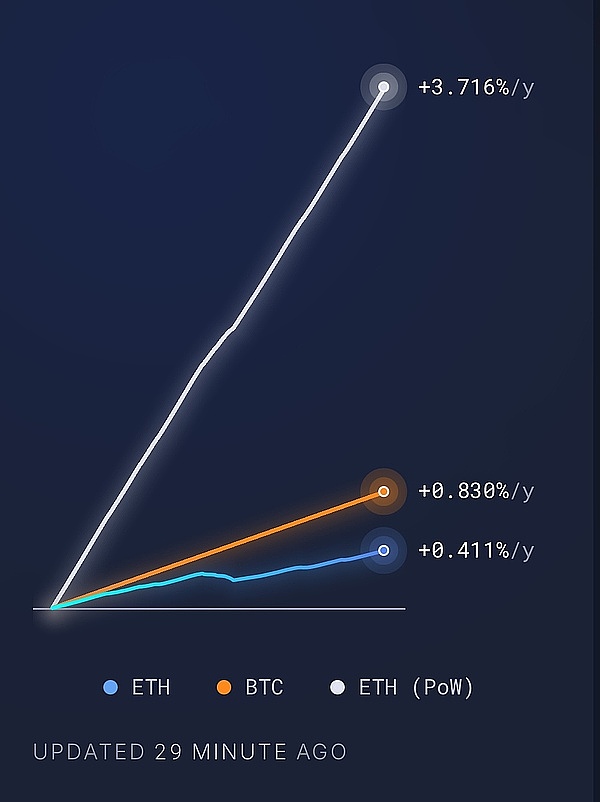

As shown in the figure below, Ethereum currently adds about 0.411% per year, but compared with the PoW version of Ethereum 3.716% and Bitcoin 0.83%, it has remained low.

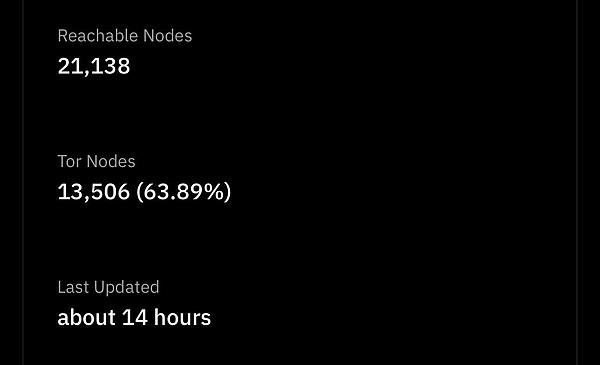

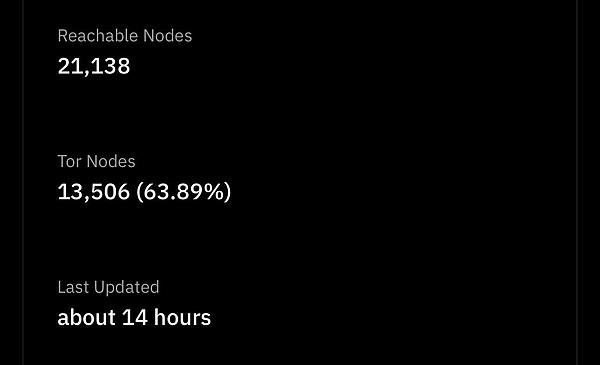

Finally, still from a regulatory perspective, the Ethereum network is highly decentralized and there is no centralized control entity. Although there is a known founding team, the current operation and development mainly rely on the community. Protocol-level upgrades come directly from proposal governance.

Observing the top 10 ETH holdings, except for the ETH 2.0 staking contract, which ranks first and holds 46.06% of ETH, the rest of the ETH holdings, whether personal wallet addresses or contract addresses, do not exceed 3%.

According to FIT21's decentralization method, this further supports the commodity attributes of ETH.

Similar to other L1s of ETH, they are all Gas tokens of their own chains, and they are all the core of the ecosystem built around them. The token holding address does not exceed 20%, which we all think belongs to commodity attributes. But here we need to focus on L2.

ETH L2

The Ethereum ecosystem is already very large. Not only does it have a thriving L1, but there are also more than a hundred L2s with various verification forms such as Rollup, Optimium, zkRollup, etc. Each L2 is its own ecosystem.

The decentralization of L2 block producers is not as important as L1, which means that tokens are not necessary. Optimism and Arbitrum have worked well without tokens before. ETH has a special function in all L2s, which is the Gas token for all L2s.

Why does L2 use ETH as a Gas token?

The birth of Ethereum L2 is to improve the scalability of Ethereum and reduce transaction fees, while inheriting Ethereum's security and data availability.

First, security. All transactions on L2 must eventually be confirmed and stored on L1. Second, data availability. In order for L2 data to be verified by the Ethereum main chain and ensure legitimacy, transaction data on L2 must be published on Ethereum. Both processes require the use of ETH to pay settlement fees and DA fees on Ethereum.

To pay L1, even if L2's own native token can be paid, it is essentially to convert the token to ETH first. For example, Starknet is the first of several well-known L2s to plan to support the use of its native token STRK to pay for Gas, but it is the validator who bears the exchange of STRK <-> ETH and quotes the exchange rate through a third-party oracle.

So what is the significance of L2's own native token?

This goes back to the L2 chain itself. Although in terms of security, L2 is as safe as L1. However, L2 usually uses centralized sorter nodes in the execution layer of processing transactions, which is responsible for transaction sorting and packaging. Although this centralized design can provide better user experience, lower fees and faster transaction confirmation, it also brings potential censorship risks. For example, centralized sorters can maliciously censor user transactions, squeeze MEV, and rush to start.

In this case, how can we decentralize the sorter? The current answer is that tokens are decentralized through governance and block rewards. For example, token holders can participate in network governance by voting to determine the operating rules and parameters of the sorter.

This also explains why most L2s will issue their own tokens, but most of their actual uses are only for participating in governance.

Therefore, the native token of L2 is not the Gas of its own chain in essence, nor does it have to develop an ecosystem around the token (most of them are still mainly ETH). It is only applicable to network governance and staking, and is more likely to be classified as securities at the regulatory level.

DeFi

The DeFi Summer of 2020 is a truly flourishing round of applications, with a large number of new protocols emerging, and old protocols such as UniSwap, Maker, and Aave reaching new highs. Every new chain, every Layer 2 launch, basically has the three major items: Swap, stablecoin, and lending. These three items, every chain, are commercialized in large quantities.

From a utility perspective, DeFi protocols provide financial services and products, which are essentially similar to products in the traditional financial field, and traditional financial products are generally regarded as having securities attributes.

Moreover, most of the current DeFi protocols are still in a state of "partial decentralization", and decentralization is only reflected in the application and governance layers, but the underlying code is still controlled by the core development team. This makes DeFi only suitable to be a "securities" in FIT21. At the same time, according to the Howey test, DeFi protocol tokens that meet the conditions of investment, profit expectations, common entities, and profits from the efforts of promoters or third parties should also be defined as securities.

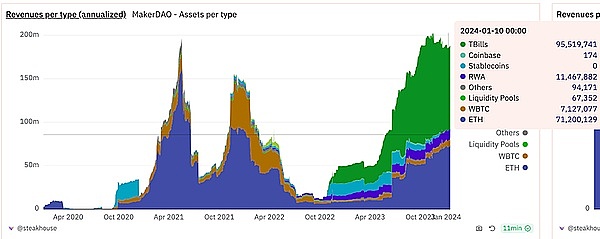

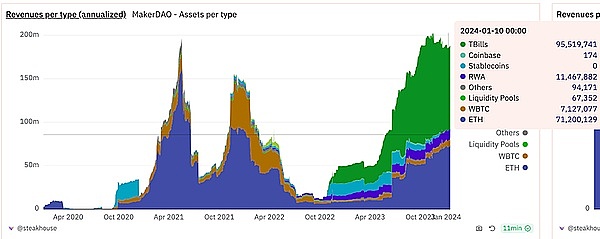

Let's take Maker as an example. Maker is one of the core lending protocols in the DeFi ecosystem and has earned about $25 million in revenue in the past 30 days.

MKR is its governance token and currently has a governance function. MKR holders can participate in Maker's governance and vote on changes and updates to the protocol, including adding new types of collateralized debt positions, modifying existing types of collateralized debt positions, and modifying sensitive parameters.

Here we focus on analyzing the token mechanism of MKR.

Maker manages and adjusts the supply of MKR tokens through its unique stock repurchase model. The core of this model is a mechanism called the "Surplus Buffer", which is the primary destination of all revenues of the Maker protocol. The main purpose of the Surplus Buffer is to provide a first line of defense for loan gaps.

When there is a loan gap, the funds in the surplus buffer will be used to fill the gap first. Only when the funds in the surplus buffer are insufficient to fill the gap will the Maker protocol fill the debt by issuing additional MKR tokens. (There is currently no additional issuance data for the entire network, but the average daily transaction volume on the chain is as high as 120 million US dollars)

It is worth noting that there is a set upper limit for the surplus buffer. When the funds in the surplus buffer exceed this upper limit, the additional Dai will be used to repurchase MKR tokens, and the repurchased MKR tokens will be destroyed before June 2023. This mechanism is designed to reduce the total supply of MKR, thereby providing value to existing MKR holders.

So far, 22,368.96 MKR tokens have been repurchased and destroyed, accounting for 2.237% of the total supply.

However, this mechanism was replaced by the newly launched smart burning engine in July 2023. When the surplus funds of the protocol exceed 50 million US dollars, Maker will automatically repurchase MKR and burn it. Otherwise, it will regularly accumulate LP from Uniswap (replacing the previous direct repurchase and destruction). Since July 2023, more than 22,335.1 MKR (about 35.19 million US dollars) have been repurchased and burned, accounting for about 2.23% of the total, with an average daily burn of 40.31 (about 63,500 US dollars).

A total of 22,368 MKRs were destroyed before June 2023, but after the launch of the new burning engine in July 2023, a similar number of 22,335 were destroyed in just 18 months. However, the faster burning speed is not due to the mechanism, but the RWA narrative that emerged in late 2023. Maker officially began to implement RWA in early 2023 and introduced US bonds. At that time, the income from the RWA part accounted for more than half of Maker's total income.

Although MKR has a burning mechanism in paying stability fees, it reduces the circulating supply through destruction, making it have a certain degree of scarcity. Only based on the judgment of the CFTC, it has the opportunity to be classified as a commodity.

However, considering the protocol level, even if the current DeFi protocol usually uses the form of proxy contracts or multi-signature wallets to upgrade the protocol to minimize the centralization problem, the management authority of the smart contract is still controlled by a few people. At the same time, since token holders have governance rights, according to FIT21, DeFi protocol tokens such as MKR are more likely to be classified as securities.

Here we will focus on Uniswap's native token UNI.

Whether it is transaction volume, user base, or technological innovation, Uniswap has always occupied an unshakable leading position in the DeFi field.

Two months ago, Uniswap Labs officially launched the Ethereum L2 network Unichain based on OP Stack, which is scheduled to be launched on the mainnet in January 2025. The launch of Unichain is not only a technological innovation, but also brings new usage scenarios and economic value to the UNI token, bringing about a transformation from a governance tool to a productive asset.

First of all, the UNI token will become the core of the Unichain network, because the prerequisite for becoming a validator is to stake the UNI token. Unichain's verification network adopts a unique economic model that encourages users to stake UNI tokens to participate in network governance and revenue distribution.

This mechanism is equivalent to adding the practical function of staking to UNI, making it no longer just a governance token. While staking, users can not only help maintain network stability, but also obtain actual benefits through transaction fees and block rewards.

Whether it is the previous protocol governance or the current upgrade to an ETH L2, UNI is more inclined to securities attributes.

Jito is the leading LSD protocol in the Solana ecosystem, and its TVL has been steadily hitting record highs in 2024. In the recent Meme craze, Jito's LST token jitoSOL has an annualized interest rate of up to 8% due to the MEV income captured by its memory pool, far exceeding stETH's 3%. That is, the greater the Meme craze on Solana, the higher the APY of jitoSOL.

JTO, as Jito's governance token, has the functions of governance voting, MEV dividends, and staking, which are similar to the shareholder rights in traditional securities and may be more inclined to securities attributes.

III. Decoding the unique classification method of the founder of FXS

Sam, the founder of Frax Finance, a long-established algorithmic stablecoin, proposed the concepts of type 1 and type 2. He believes that L1 Tokens are all Type 1 categories, and all other dapp Tokens and L2 Tokens are Type 2 categories.

This is basically consistent with the conclusions drawn from our above research.

His judgment logic is:

L1 tokens (ETH, SOL, NEAR, TRX, etc.) are the "sovereign scarce assets" of their own chain economies. They are the most liquid assets on the chain. Dapps accumulate it, build DeFi with it, and incentivize liquidity, making it a safe haven asset in a crisis. In fact, if you think about it carefully, it is similar to the use and consumption in FIT21. L1 tokens are mainly used as a medium for consumer goods or services. Users take L1 tokens to pay or purchase services, and the protocol builds services around L1 tokens. L1 tokens are the "core tokens" of the on-chain economy.

Dapps issue their tokens to L1 asset holders through liquidity, ICO, DeFi, airdrops, and other innovative forms, making L1 assets "interest-bearing".

Dapp tokens represent the actual labor/GDP of humans in the economy. L1 tokens generate interest on the labor of people who build on-chain economies.

L2 tokens are generally not sovereign scarce assets in their digital economies, even if they have half of the elements: on-chain economies and vibrant builders. They belong to "type 2". In fact, some L2s don't even have tokens.

SOL is doing really well not because TVL is up, nor because people expect billions of dollars of SOL to be burned/earned in some distant year. ETH has billions of dollars of earnings/burns, and it is not doing better than SOL. The real reason SOL is rising is because the Solana on-chain economy uses it in liquidity pools, memecoin trading, DeFi, and you need it to participate in the Solana network state.

Sam finally expressed his vision to make FXS, which should be type 2, leap to type 1. How will this be achieved?

FXS has been the governance token of Frax Finance for the past four years.

Frax Finance launched the Ethereum L2 blockchain Fraxtal in February 2024, which is very much like the Unichain we mentioned above. You need to stake FXS to become a validator of the chain. According to our and Sam's conclusion, this still belongs to the category of type 2, or securities.

With Fraxtal, FXS actually has its own on-chain economy. But it still lacks an opportunity to become the "core asset" of this economy.

In February 2025, FXS will become Fraxtal's Gas token through Fraxtal hard fork and be renamed FRAX.

This approach makes FXS a type 1, FSX becomes the core asset of this on-chain economy, and all dapps must be built around FXS. Analogously, Uniswap, which also builds its own chain, even with Unichain, the core is still built around ETH, not UNI.

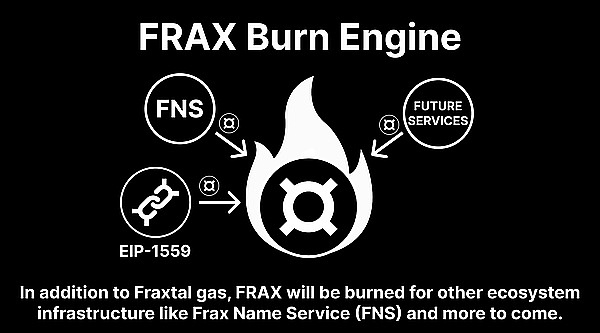

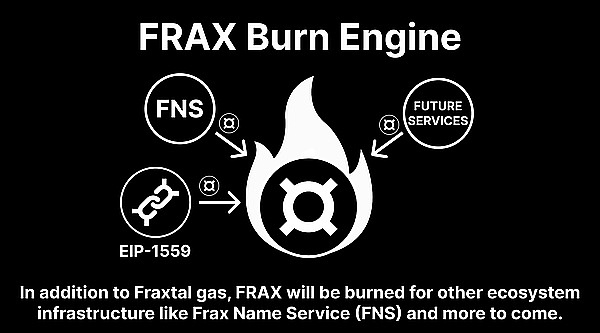

Frax Burn Engine

It is worth noting that the burning mechanism Frax Burn Engine will be launched in the future. The figure below shows the concept of the FRAX burning engine. In addition to being the Gas of Fraxtal, FRAX tokens will also be used to support other infrastructure services in the ecosystem.

Frax Name Service, as well as Future Services, suggest that some official protocols will burn all/part of their revenue in the form of FRAX.

EIP-1559 is Ethereum's burning mechanism, and FRAX may adopt a similar mechanism to reduce the supply by burning transaction fees.

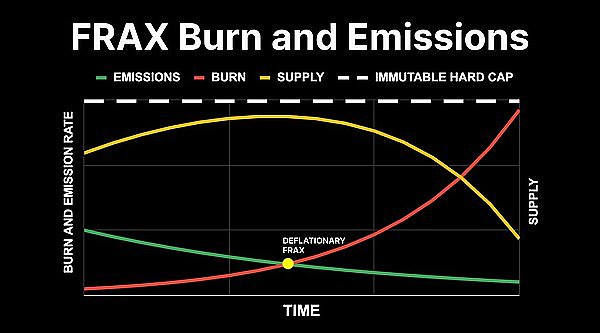

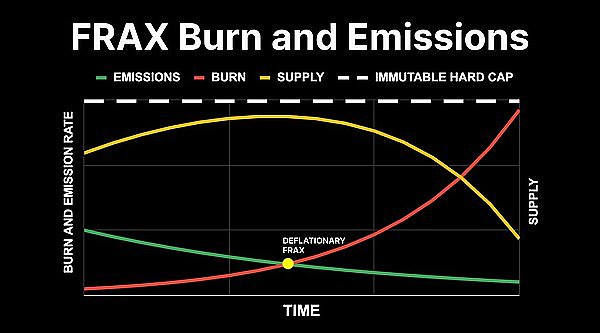

The following figure shows the relationship between the burning and emission of FRAX tokens. There are three main variables: Burn, Supply, and Emissions.

The red line represents the burn rate, which increases over time. This means that as the ecosystem grows, a portion of FRAX tokens will be burned regularly, reducing the number of tokens in circulation.

The yellow line represents the supply, which begins to decline after reaching a peak. This corresponds to the increase in the burn rate, indicating that the burning mechanism helps control the total supply of tokens and prevent inflation.

The green line indicates the issuance rate, which is high in the early stage and then gradually decreases. This may be related to the issuance of new tokens, which will decrease as the ecosystem matures.

The "DEFLATIONARY FRAX" marked in the figure indicates that the FRAX token has deflationary characteristics. Deflation means that the number of tokens in circulation will decrease over time, which usually causes the value of a single token to rise, thereby increasing the wealth of holders.

The dotted line in the figure represents the immutable hard cap, which means that there is a fixed upper limit to the total supply of FRAX tokens. This design helps to enhance the scarcity of tokens, which may increase their value

Fourth, "US-containing" may become a new trend: Which assets will usher in the "US compliance spring"?

In the months after the US election, XRP took over Solana and experienced a significant rise. Recently, Ripple President Monica Long said in an interview that Ripple's leadership has been in direct contact with the incoming US government, and she expects XRP's spot ETF to be approved "soon." LTC is next, and Canary Capital recently submitted an application for a Litecoin ETF to the SEC, and LTC prices have soared. XRP and LTC have become the most favored assets for US capital after Solana.

In the expectation of FIT21 passing, traditional US VC/funds may vigorously purchase tokens related to US concepts. So, from this perspective, which tokens will become the hot cakes in the eyes of US capital after SOL, XRP and LTC?

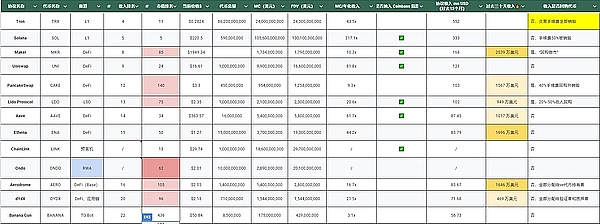

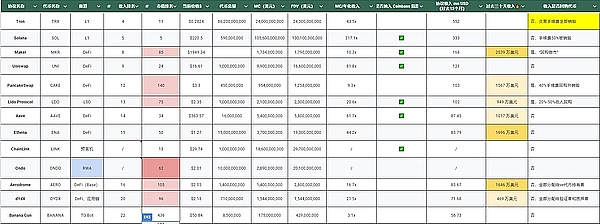

We have listed the top 100 tokens in terms of protocol revenue in the past year. You can select the most suitable tokens by protocol revenue and "US" content.

In terms of L1, the most suitable tokens are Avalanche (AVAX) and Near Protocol (NEAR). Since L1 is a commodity, it has the opportunity to be applied for as an ETF.

Avalanche ranks 24th in terms of protocol revenue. Its development team Ava Labs is headquartered in the United States and recently hinted that it will start a dialogue with the new US government. At the same time, Avalanche is extremely active in cooperation with traditional institutions. It has cooperated with JPMorgan Chase Onxy, Franklin Templeton and Citibank to create tokenized funds. a16z, Polygon, Galaxy, Dragonfly and other American VCs invested in it in the early stage;

Near ranks 57th in terms of protocol revenue, and has received early investment from American VCs such as a16z, Coinbase, Pantera, Electric, etc.

In terms of L2, the most suitable tokens are the well-known Arbitrum (ARB) and Optimism (OP). The protocol revenue is distributed between 30-50, and the team members are mainly located in the United States, and have received investment from American VCs such as a16z and DCG.

In terms of DeFi, there are many tokens that meet the conditions. These DeFi protocols have a high "US" content and are more or less ambiguous with American institutions. Specifically, Maker (MKR), Uniswap (UNI), Aave (AAVE), Ethena (ENA), Ondo (ONDO), Aerodrome (AERO) and Curve (CRV).

Maker ranks 8th in terms of protocol revenue, with revenue of $168 million in the past year, but the total token market value ranks only 85th. In addition to being led by the US team, US VCs such as Pantera and a16z also invested in it in the early stage.

Uniswap ranks 9th in terms of protocol revenue, with revenue of $121 million in the past year. Uniswap was created by US developer Hayden Adams and has received a Wells notice from the SEC. It is also invested by US VCs such as Pantera and a16z.

Aave and Ethena are also far ahead in terms of protocol revenue, with 14 and 15 respectively, and were recently bought by the Trump family project World Liberty.

As the only RWA protocol in the top 100, Ondo is famous for its cooperation with BlackRock's BUIDL fund. It was recently bought by the Trump family project World Liberty, and has also received investment from US VCs such as Coinbase, Tiger Global, and GoldenTree.

Cruvé and Aerodrome, which recently cooperated with BlackRock, are also worth paying attention to.

Anais

Anais