Author: Ana Paula Pereira, Cointelegraph; Compiled by: Songxue, Golden Finance

Cryptocurrency businesses are looking forward to less volatile periods, institutional demand and growing demand after a long cryptocurrency winter. Bitcoin adoption helps drive innovation in the cryptocurrency space. Crypto industry trendsthis year include scalability and compliance solutions, industry players say.

Transaction speed and cost are challenges for both the Ethereum and Bitcoin networks. Axelar CEO Sergey Gorbunov said it is no accident that demand for Rollup projects is expected to be high in2024 . He thinks the Rollup development kit is “one to watch in 2024.”

Regarding the growing number of development tools for blockchain scaling solutions, Gorbunov explained: “We are starting to see an abstraction layer for Web3 developers similar to SaaS for consumer developers.”

Rollup is a Layer 2 blockchain designed to improve scalability. They merge multiple transactions into a single batch outside of the main blockchain (off-chain). This significantly reduces the amount of data that needs to be processed and stored on the main chain (on-chain), allowing for faster and cheaper transactions.

Gorbunov said that currently "projects scaling up in this space include DeFi innovators such as Frax and Lido, as well as leading DEXs such as dYdX, PancakeSwap and Uniswap."

Decentralized infrastructure is another area likely to gain momentum in the coming months. Frank Hu, chief operating officer of ByteTrade Lab, said: "Decentralized front-end and back-end are a key issue, including decentralized web hosting and cloud storage systems."

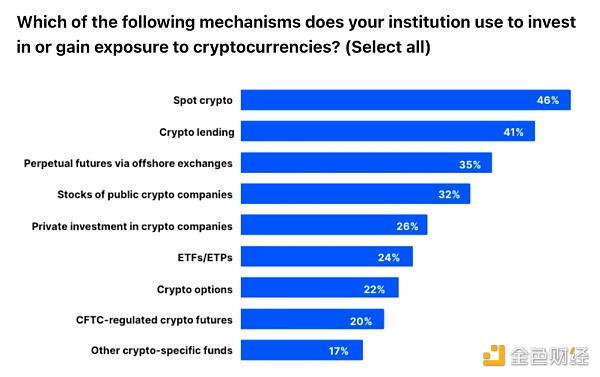

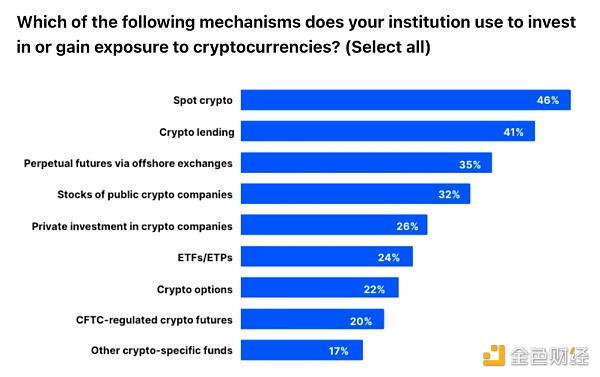

Behind these trends are Institutional investors and traditional businesses are increasingly participating in the cryptocurrency space. According to a November survey by Coinbase, 64% of current institutional cryptocurrency investors expect to increase their allocations over the next three years, while 45% of investors without cryptocurrency allocations plan to start investing during the same period.

Institutional investors seek exposure to cryptocurrencies through a range of products. Source: Coinbase 2023 Institutional Survey

Unstoppable Domains COO Sandra Carter seesprojects providing interoperability between Web2 and Web3 as a potential growth area. “There are a lot of people, brands and organizations in Web2 who haven’t moved to Web3 or even know about it. They need to take the first step, and (cryptocurrency) businesses will make it easier and more achievable , because they know there is so much value in Web2 that Web3 can unlock," she noted.

The approval of spot Bitcoin exchange-traded funds (ETFs) will also be a business driver in 2024. Variants of Bitcoin ETFs such as leveraged and short ETFs are expected to flood the market in the coming months, Ledn's Mauricio di Bartolomeo said. The hype surrounding cryptocurrencies is also expected to boost their use as collateral for crypto loans.

In addition,social media platforms, one of the foundations of the cryptocurrency industry, are also being disrupted. Juan Bruce, co-founder of DSCVR, said: "Cryptocurrency has always been driven by social media." He believes that it is only time for decentralized social media platforms to find product-market fit and replace traditional platforms question.

“Teams, including ours, are building social platforms that provide crypto transactions for users and projects not just on-chain, but in a social environment,” said Bruce.

However, growth prospects are not immune to challenges. Carter believes that the regulatory environment will still pose significant risks to the cryptocurrency business through 2024.

“There are a lot of variables when it comes to regulation, and while there are some victories and signs of hope (such as the court victories for Ripple and Grayscale), there are a select few who are determined to block cryptocurrencies Enter the mainstream. The United States wants to be competitive in blockchain technology, but regulators are doing their best to prevent or control this."

Sanya

Sanya