Author: Mason Nystrom, Pantera Partner; Translator: 0xjs@黄金财经

Consumer DeFi

As interest rates fall, DeFi yields start to become more attractive. Increased volatility brings more users, yields, and leverage. Coupled with the more sustainable yields brought by RWA, it suddenly becomes much easier to build consumer-grade crypto financial applications.

When we combine these macro trends with innovations in chain abstraction, smart accounts/wallets, and a general shift to mobile, there is a clear opportunity to build a consumer-grade DeFi experience.

Some of the most successful crypto financial applications in the past few years were born out of a combination of improved user experience and speculation.

●Trading bots (e.g. Telegram) – giving users the ability to trade within a messaging and social experience

●Better crypto wallets (e.g. Phantom) – improving existing wallet experiences and providing a better experience on multiple chains

●New terminals, portfolio trackers, and discovery layers (e.g. Photon, Azura, Dexscreener, etc.) – providing advanced features for power users and giving users access to DeFi through a CeFi-like interface

●Robinhood for memecoins (e.g. Vector, Moonshot, Hype, etc.) – crypto has largely favored desktop so far, but mobile-first experiences will dominate future trading apps

●Token launchpads – (e.g. Pump, Virtuals, etc.) – providing permissionless token creation to anyone, regardless of technical ability.

As more consumer DeFi applications are launched, they will look like fintech applications, with standard user experiences that users prefer, but they will aggregate and provide a personalized experience of DeFi protocols on the back end. These applications will focus on the discovery experience, the products they offer (e.g., types of yields), their appeal to advanced users (e.g., convenient features like multi-collateral leverage), and generally abstract the complexity of on-chain interactions.

RWA Flywheel: Endogenous vs. Exogenous Growth

Since 2022, high interest rates have supported a massive influx of on-chain real-world assets (RWAs). But now, the shift from off-chain to on-chain finance is accelerating as large asset managers such as BlackRock realize that issuing RWAs on-chain brings meaningful benefits, including: programmable financial assets, a low-cost structure for issuing and maintaining assets, and greater asset accessibility. These benefits, like stablecoins, are 10x better than the current financial landscape.

According to data from RWA.xzy and DefiLlama, RWAs account for 21-22% of Ethereum assets. These RWAs are primarily in the form of A-rated, US government-backed U.S. Treasury bonds. This growth is primarily driven by high interest rates, which make it easier for investors to be long the Fed rather than DeFi. Although the macro winds are shifting, making Treasuries less attractive, the Trojan Horse of on-chain asset tokenization has entered Wall Street, opening the floodgates for more risky assets to enter the chain.

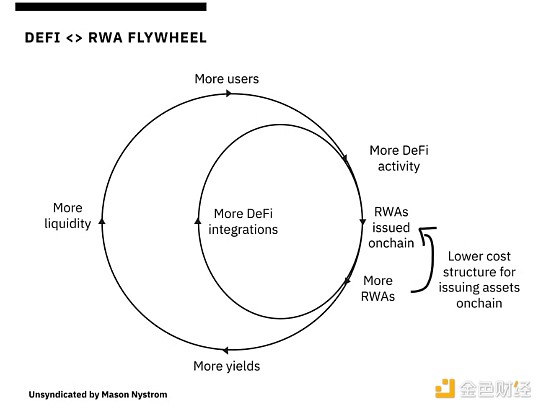

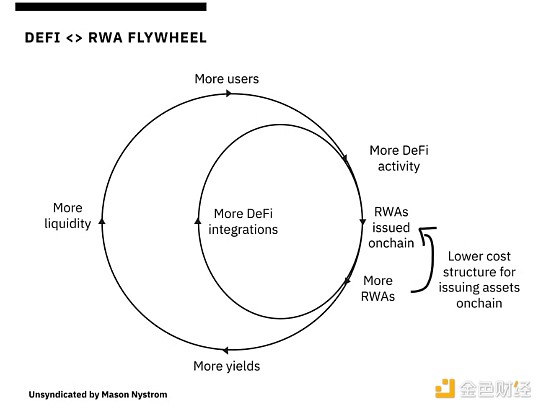

As more traditional assets move on-chain, this will trigger a compounding flywheel effect, slowly merging and replacing traditional financial rails with DeFi protocols.

Why does this matter? Crypto growth comes down to exogenous capital vs. endogenous capital.

Much of DeFi is endogenous (essentially circular in the DeFi ecosystem) and is able to grow on its own. However, historically it has been quite reflexive: it would go up, it would go down, and then it would go back to square one. But new primitives have steadily expanded DeFi’s share over time.

On-chain lending through Maker, Compound, and Aave has expanded the use of crypto-native collateral as leverage.

Decentralized exchanges, especially AMMs, have expanded the range of tradable tokens and enabled on-chain liquidity. But DeFi can only grow its own market to a certain extent. While endogenous capital (e.g., speculation on on-chain assets) has driven crypto markets to a robust asset class, exogenous capital (capital that exists outside of the on-chain economy) is essential for the next wave of DeFi growth.

RWAs represent a large pool of potential exogenous capital. RWAs (commodities, equities, private credit, FX, etc.) offer the greatest opportunity for DeFi to expand beyond just recycling capital from retail pockets to traders’ pockets. Just as the stablecoin market needs to grow through more exogenous uses (rather than on-chain financial speculation), other DeFi activities (e.g., trading, lending, etc.) need to grow as well.

The future of DeFi is that all financial activity will move to the blockchain. DeFi will continue to see two parallel expansions: similar endogenous expansion through more on-chain native activities, and exogenous expansion through the transfer of real-world assets to the chain.

DEFI's Platformization

"Platforms are powerful because they facilitate relationships between third-party suppliers and end users." - Ben Thompson

Crypto protocols are about to have their platformization moment.

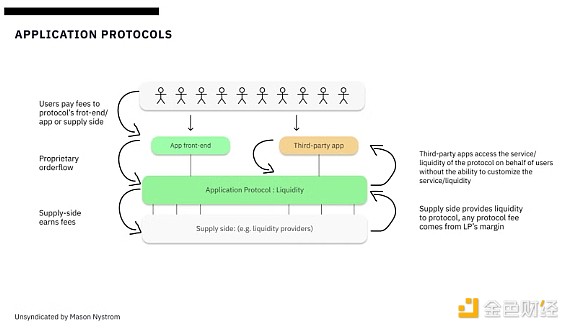

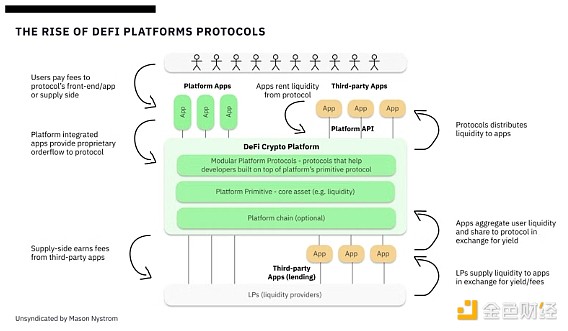

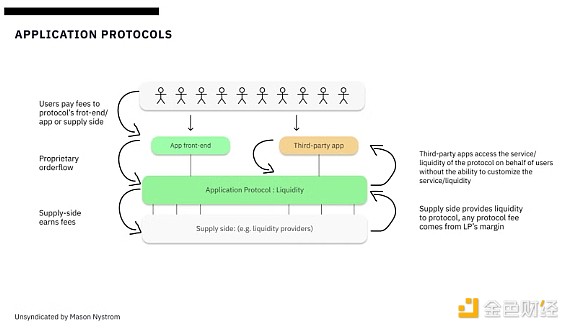

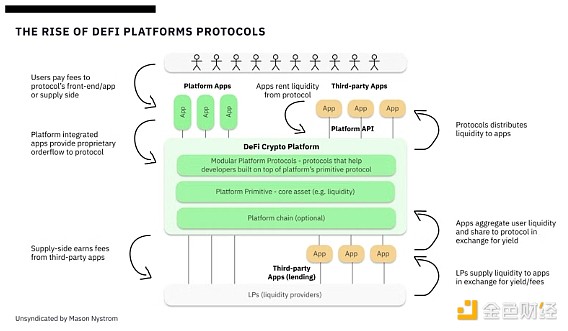

DeFi applications are all moving towards the same business model, evolving from independent application protocols to mature platform protocols.

But how exactly do these DeFi applications become platforms? Today, most DeFi protocols are relatively rigid, providing one-size-fits-all services for applications that want to interact with these protocols.

In many cases, applications simply pay fees to the protocol for its core assets (such as liquidity) like standard users, rather than being able to build differentiated experiences or programmatic logic directly within the protocol.

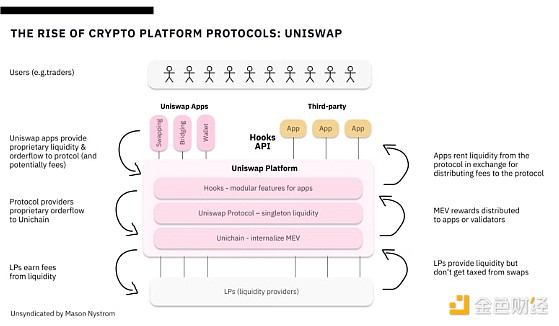

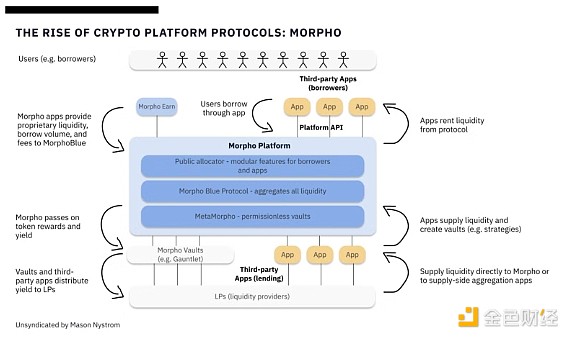

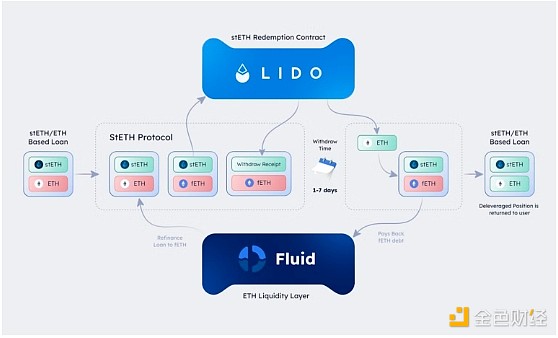

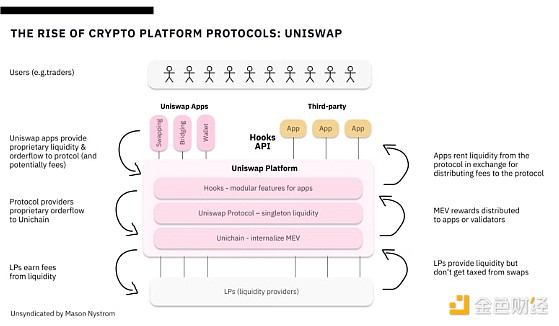

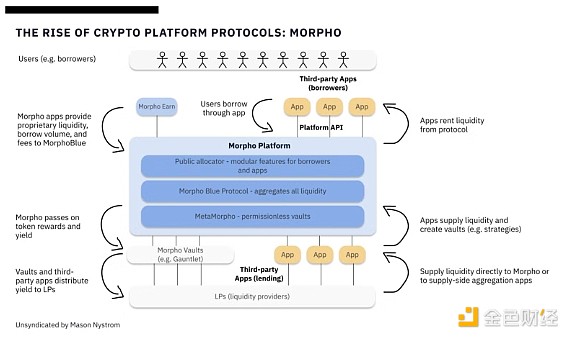

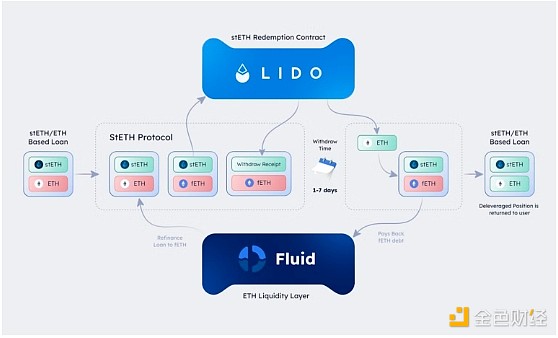

Most platforms start this way, solving a core problem for a single use case. Stripe initially provided a payment API that allowed individual businesses (such as online stores) to accept payments on their websites, but it only worked for a single business. When Stripe launched Stripe Connect, businesses were able to process payments on behalf of multiple sellers or service providers, making Stripe the platform it is today. Later, it gave developers better ways to build more integrations, which expanded its network effect. Similarly, DeFi platforms like Uniswap are now moving away from standalone applications (e.g., DEXs) that facilitate swaps to building DeFi platforms that enable any developer or application to create their own DEX on top of Uniswap’s liquidity. The key enabler of the transformation of DeFi platforms is the shift in business models, and the evolution of singleton liquidity primitives. Singleton liquidity primitives — Uniswap, Morpho, Fluid — aggregate liquidity for DeFi protocols, allowing access by both modular parts of the value chain (e.g., liquidity providers and applications/users). The experience for liquidity providers becomes more streamlined, allocating funds to a single protocol, rather than protocols with differentiated pools or siloed vaults. For applications, they can now rent liquidity from DeFi platforms, rather than simply aggregating core services (e.g., DEXs, lending, etc.).

Here are some examples of emerging DeFi platform protocols:

Uniswap V4 is promoting a singleton liquidity model, through which applications (e.g., hooks) can rent liquidity from Uniswap’s V4 protocol, rather than simply routing liquidity through the protocol as Uniswap V2 and V3 did.

Morpho has moved to a similar platform model, where MorphoBlue acts as a core liquidity primitive layer that can be permissionlessly accessed through vaults created by MetaMorpho (a protocol built on top of the liquidity primitive MorphoBlue).

Similarly, Instadapp’s Fluid protocol creates a shared liquidity layer that can be leveraged by its lending and DEX protocols.

While there are differences between these platforms, the commonality is that emerging DeFi platforms share a similar model, building a singleton liquidity contract layer on top and building more modular protocols on top to enable greater application flexibility and customization.

The evolution of DeFi protocols from standalone applications to mature platforms marks the maturity of the on-chain economy. By adopting singleton liquidity primitives and modular architectures, protocols such as Uniswap, Morpho, and Fluid (formerly Instadapp) are unleashing new levels of flexibility and innovation. This shift mirrors how traditional platforms, such as Stripe, empower third-party developers to build on top of core services, driving greater network effects and value creation. As DeFi enters the platform era, the ability to facilitate customizable, composable financial applications will become a defining feature, expanding the market for existing DeFi protocols and enabling a new wave of applications to be built on these DeFi platforms.

Joy

Joy