Today I'm going to do an in-depth analysis of the true state of our current economy. If you've been following the previous macroeconomics, you should have some clues.

Currently, only artificial intelligence is still driving GDP growth; other aspects such as the labor market, households, affordability, and asset acquisition are declining.

Everyone is waiting for a "cycle reversal." But there is no cycle at all.

The market is no longer trading based on fundamentals.

AI capital expenditure is actually a key factor in preventing a technical recession.

AI capital expenditure is actually a key factor in preventing a technical recession.

1. Market dynamics are not driven by fundamentals

Over the past month, asset market price fluctuations occurred without the release of new economic data, but were significantly volatile due to the Federal Reserve's change in attitude.

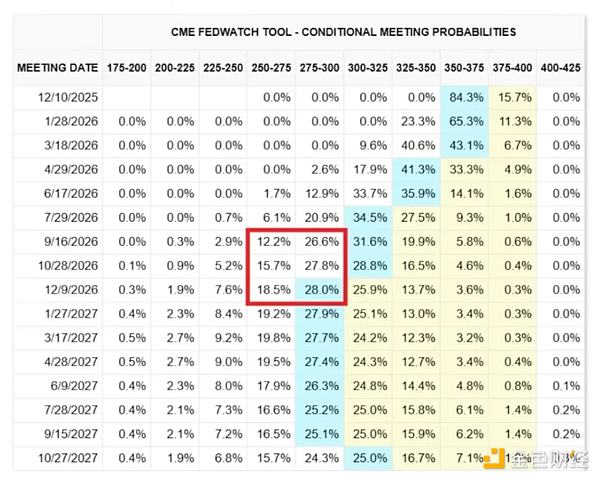

The probability of an interest rate cut dropped from 80% to 30%, and then back to 80%, solely due to comments from individual Federal Reserve officials. This aligns with market conditions where systemic capital flows overwhelmingly exceed macroeconomic assessments. Here is some microstructural evidence: Volatility-targeting funds mechanically deleverage when volatility spikes and re-leverage when volatility compresses. These funds don't care about the "economy" because they adjust their risk exposure based on only one variable: market volatility. When volatility increases, they reduce risk exposure → sell. When volatility decreases, they increase risk exposure → buy. This results in automatic selling when the market is weak and automatic buying when the market is strong, thus amplifying two-way volatility. CTAs switch long and short positions at preset trend levels, creating forced capital flows. CTAs (Commodity Trading Advisors) follow strict trend rules: • If the price breaks through a certain level → buy. • If the price falls below a certain level → sell. There is no "logic" behind this. It's just mechanical. Therefore, when enough CTAs place stop-loss orders at the same price level at the same time, large-scale, coordinated buying or selling occurs, even though there are no changes in the fundamentals. These fund flows can affect the entire index for several days. Stock buyback windows remain the largest source of net equity demand.

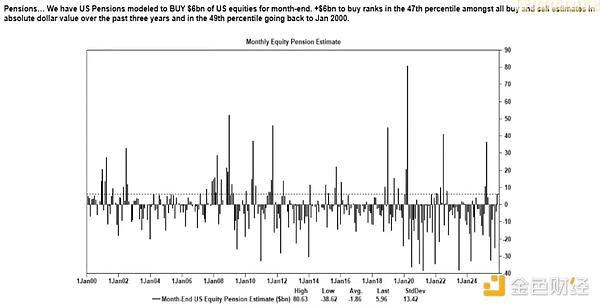

Corporate buybacks of their own shares are the largest net buyers in the stock market, exceeding the purchases by retail investors, hedge funds, and pension funds. During stock buyback windows, companies steadily inject billions of dollars into the market every week.

This will produce: 1. An inherent upward trend during the buyback season; 2. A significant weakening when the window closes; 3. A structured speculative buying activity unrelated to macroeconomic data. This is why the stock market can rise even when market sentiment is extremely poor.

The inverted VIX curve reflects a short-term hedging imbalance, not "panic." Typically, long-term volatility (3-month VIX) is higher than short-term volatility (1-month VIX). When this reverses, i.e., when near-month option prices rise, it's perceived as a surge in "panic." However, the current VIX curve inversion is often caused by: short-term hedging demand; options traders adjusting their risk exposure; funds flowing into weekly options; and systematic strategies hedging at month-end. This means: a VIX surge ≠ panic. A VIX surge = hedging fund flows. This distinction is crucial because it indicates that volatility is now driven by trading, not market sentiment. This makes the current market environment more sensitive to market sentiment and fund flows. Economic data has become a lagging indicator of asset prices, while the Federal Reserve's communication has become a major trigger for market volatility. Liquidity, positioning, and policy tone now have a greater influence on price discovery than fundamentals. 2. Artificial Intelligence is Preventing a Full-Scale Recession. Artificial intelligence has begun to act as a macroeconomic stabilizer. It has effectively replaced cyclical hiring, supported corporate profitability, and sustained GDP growth despite weak labor fundamentals. This means that the US economy is far more dependent on AI capital expenditures than policymakers publicly acknowledge. Artificial intelligence is suppressing demand from the lowest-skilled and most easily replaceable third of the labor market. This is often the area where cyclical economic recessions first manifest themselves. Increased productivity masked a general deterioration in the labor market. Output remained stable because machines absorbed work previously done by entry-level labor. Corporate profits increased due to fewer employees, while households bore the resulting socioeconomic burden. This led to a shift in income from labor to capital—a typical recession dynamic masked by increased productivity. Capital formation related to artificial intelligence artificially maintained GDP resilience. Without capital expenditure in AI, overall GDP figures would be significantly weaker. Regulators and policymakers would inevitably support AI capital expenditure through industrial policies, credit expansion, or strategic incentives, or a recession would occur.

3. Inequality has become a macro-level constraint

Mike Green's analysis (poverty line ≈ $130,000 to $150,000) has sparked strong opposition, demonstrating how profound the concern surrounding this issue is.

Mike Green's analysis (poverty line ≈ $130,000 to $150,000) has drawn strong opposition, demonstrating how much attention this issue has garnered.

Mike Green's analysis (poverty line ≈ $130,000 to $150,000) has drawn strong opposition, demonstrating how much attention this issue has received.

Mike Green's analysis (poverty line ≈ $130,000 to $150,000) has drawn strong opposition, demonstrating how much attention this issue has garnered.

<

Key Facts:

Childcare costs > Rent/Mortgage;

Structural unaffordability of housing;

Baby boomers dominate asset ownership;

Younger generations only have income, not capital;

Artificial Intelligence Economy (Expansion)

Real Economy (Contraction)

Weak Labor Absorption Capacity

Consumer Pressure

Decreased Mobility

left;">Asset Concentration

High Inflationary Pressures

The most valuable companies of the next decade will build solutions to bridge or capitalize on this structural disparity.

6. My Outlook for the Future

Artificial intelligence will be supported, or it will fall into a recession.

Artificial intelligence will be supported, or it will fall into a recession.

Artificial intelligence will be supported, or it will fall into a recession.

Artificial intelligence will be supported, or it will fall into a recession.

Artificial intelligence will be supported, or it will fall into a recession.

Treasury-led liquidity will replace quantitative easing as the primary policy channel. Cryptocurrencies are becoming a political asset class linked to intergenerational equity. Energy, not computing power, will become the real bottleneck for the development of artificial intelligence. Over the next 12 to 18 months, markets will continue to be driven by sentiment and capital flows. Inequality will increasingly influence policy decisions.

Miyuki

Miyuki

Miyuki

Miyuki Weatherly

Weatherly Anais

Anais Weatherly

Weatherly Joy

Joy Alex

Alex Miyuki

Miyuki Anais

Anais Joy

Joy Weiliang

Weiliang