Author: Steven Ehrlich Source: unchainedcrypto Translation: Shan Ouba, Golden Finance

While some companies are raising billions of dollars to buy Bitcoin, why is the price not reflecting this craze?

In the past few weeks, the crypto industry has been flooded with news about a new type of public company: Bitcoin Vault. These companies' main business is to raise funds and use most of the funds to buy cryptocurrencies, especially Bitcoin. Since the beginning of April, these companies have raised a total of about $11.3 billion, most of which they plan to invest in Bitcoin.

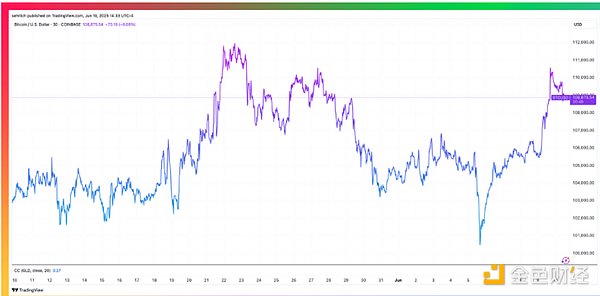

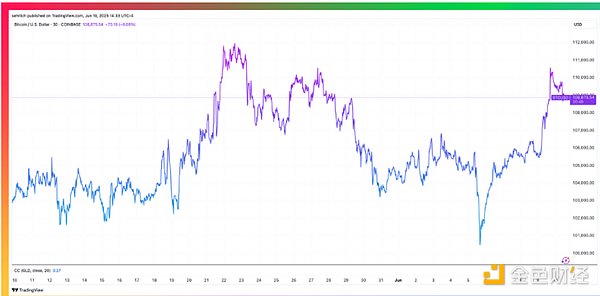

While the craze is approaching white-hot, the price of Bitcoin has strangely not risen as expected. Currently, Bitcoin is only one step away from its all-time high of $111,814, but the price has been hovering between $100,000 and $110,000 for more than a month (the price is $108,855 at the time of writing).

If there are billions of dollars coming in, especially under the leadership of a government that supports Bitcoin, people should think that Bitcoin will move towards new highs. But several experts interviewed said that this is not the case, and it may take some time for Bitcoin to reach $130,000 to $150,000.

Here are three key reasons why Bitcoin has been slow to break out:

Lack of retail interest

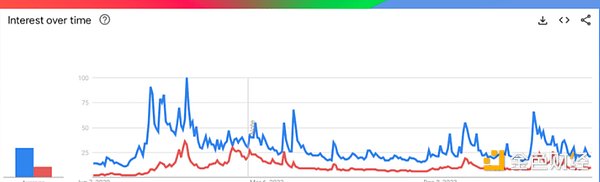

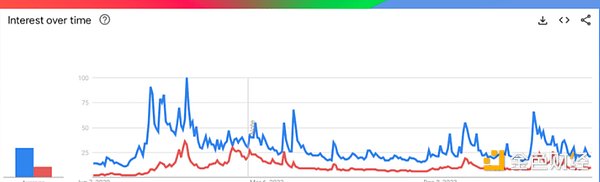

Previous crypto bull runs, even if they eventually crashed, were usually accompanied by a strong upsurge in retail participation. Take a look at the Google Trends chart below, where the blue line shows searches for "bitcoin" and the red line shows searches for "crypto." Searches spiked during the pandemic and in the second half of 2024 (when Trump fully supported crypto), but are now gradually declining.

Why are retail investors not interested? There are many reasons: for example, people believe that Bitcoin has hit an all-time high and may now pull back; for example, they lack understanding of the operating model and profit logic of "crypto vault companies".

Unlike the craze for NFTs and meme coins, these leveraged listed hedge funds have failed to capture the imagination of the public. Remember the NFT satire skit starring Pete Davidson and Jack Harlow on "Saturday Night Live" (SNL) in 2021? And the craze for a bunch of celebrities issuing meme coins in 2024?

Steve Sosnick, chief strategist at Interactive Brokers, pointed out: "These vault companies do have a positive impact on Bitcoin prices because they are a source of demand and reduce the circulation to a certain extent - in theory, this is good for the price. But why doesn't it have a more significant driving effect? This makes people suspect that demand is decreasing in the market outside of these companies."

Liquidity is recycled, not newly injected

The issue of "liquidity" is more complicated.

If you have been in the crypto circle for a long time, you may remember the term "vampire attack", which is the strategy used by SushiSwap to drain liquidity from Uniswap. Similar things are happening now. A trading director at a primary broker said that many institutions investing in these new vault companies are actually selling Bitcoin to obtain cash to buy company stocks. In other words, the real new funds flowing into the crypto market are much less than people expected.

He gave an example: "Suppose I contribute $1 billion of Bitcoin to the company's treasury. Those who buy this Bitcoin are not actually putting money into the market, but buying 'yesterday's Bitcoin'. The market price reaction has already occurred."

Publicity is hot, but actual purchases have not yet occurred

Even if many companies announce large-scale fundraising and coin purchase plans, it does not mean that they immediately buy Bitcoin.

For example, Nakamoto, a crypto treasury company founded by Bitcoin Magazine founder David Bailey, announced that it has raised more than $700 million to buy Bitcoin. How many Bitcoins does it hold now? Only $2.3 million - because the transaction has not been completed and is not expected to be delivered until the third quarter.

This also reveals a larger problem: these companies' coin purchases are highly opaque.

A trader said: "For example, if MicroStrategy announced that it had raised $1 billion through an ATM mechanism, everyone knew that they would immediately use the money to buy Bitcoin. ETFs are more transparent and generally disclose the flow of funds on the same day or the next day. When there is a large inflow, the market will react."

But these vault companies are different. "Some announced transactions that took three months to complete," he said. "When banks promote projects, the market doesn't actually know when these bitcoins will actually be bought, so it's difficult for prices to react immediately."

Summary: Bitcoin still needs a new catalyst

Although the "crypto vault fever" is hot, it has not yet formed a real new demand driver. Katie Stockton, founder of Fairlead Strategies, pointed out: "In the short term, Bitcoin has been fluctuating between $100,000 and $108,000 for many weeks. We think the resistance level may still play a role, so it will not be broken in the short term." She also added that unless Bitcoin stabilizes above $108,000 to $109,000 for several consecutive weeks, there is still a risk of a correction in the market. The primary broker also agreed with Stockton's view: "The current price range makes trading very difficult. Our clients are generally frustrated with this sideways market as we are entering the summer when volatility and liquidity are traditionally low." In other words: Bitcoin may have to "mark its head" in the short term.

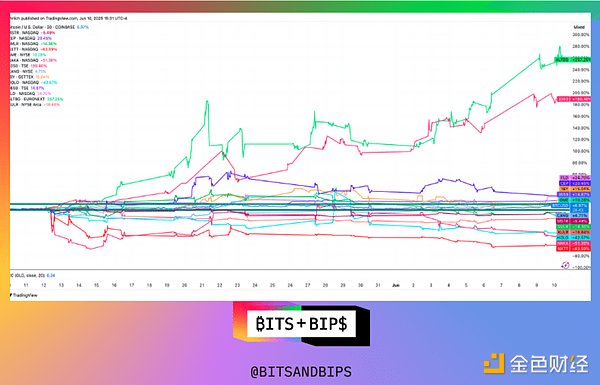

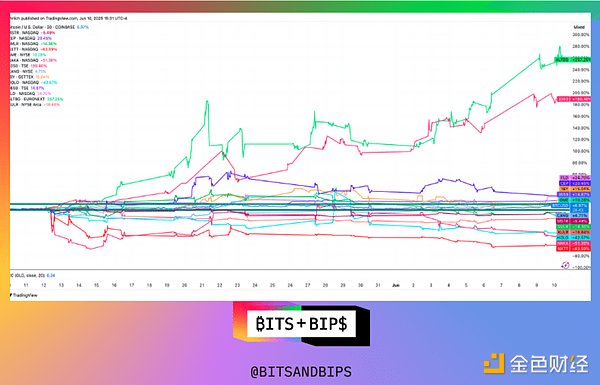

Chart of the Week: Bitcoin vs. Crypto Treasury Companies in the Last Month (Only Companies Holding More Than $100 Million in Bitcoin)

Not every crypto treasury company is worth a big buy. In fact, over the past month, Bitcoin has outperformed nearly half of the most valuable crypto treasury companies. Despite this, all of these companies are currently trading above their net asset value (NAV), that is, they are still trading at a premium.

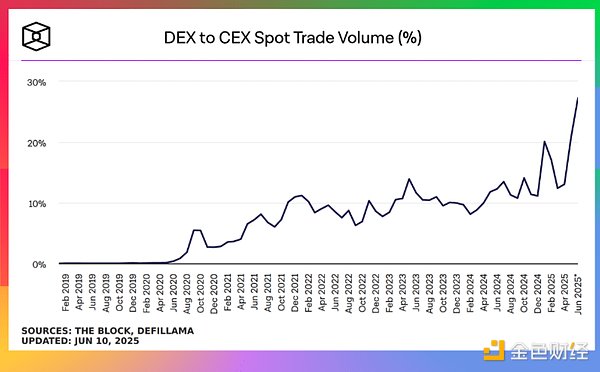

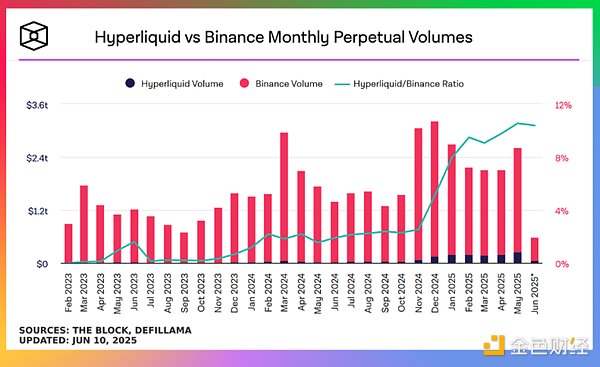

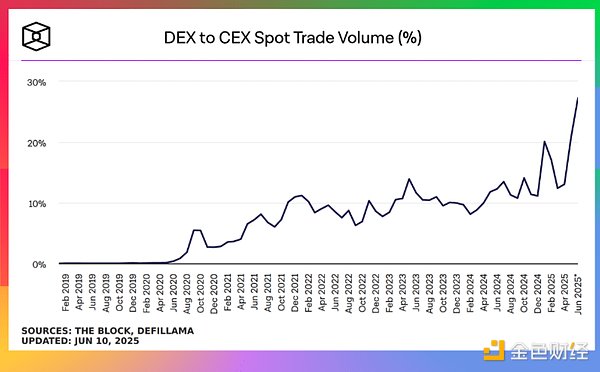

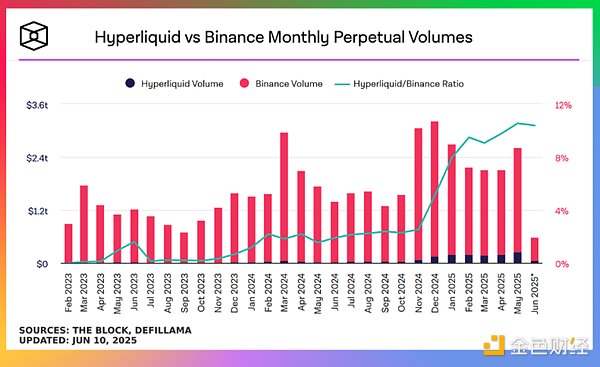

This week’s numbers: 27.26%

The ratio of decentralized exchange (DEX) trading volume to centralized exchange (CEX) trading volume reached a record high of 27.26%. This wave of growth mainly came from derivatives exchange Hyperliquid, which has rapidly expanded its market share and now has reached 10.38%, also setting a record high of its own.

Joy

Joy