Author: @Web3_Mario

Abstract: In recent days, the cryptocurrency market has experienced a wave of large-scale corrections. The market is in chaos, and the continuous superposition of the negative impact of huge hacker attacks in the cryptocurrency circle has made it difficult to understand the recent market trends in the short term. I have some opinions on this, and I hope to share and discuss with you. I think there are two main reasons for the current retracement in the cryptocurrency market. First, from a micro perspective, the successive hacker attacks have caused concerns among traditional funds and increased risk aversion. Second, from a macro perspective, DeepSeek Open Source Week further punctured the US AI bubble, coupled with the actual policy direction of the Trump administration, which on the one hand triggered market concerns about US stagflation, and on the other hand started the revaluation of China's risky assets.

Micro-level: The continuous huge amount of capital losses has caused traditional funds to worry about the short-term trend of cryptocurrencies, and the risk aversion sentiment has intensified

I believe that everyone still remembers the Bybit theft that happened last week and the recent Infini theft. There have been many discussions about it, so I will not repeat them here. Here I will talk a little about the impact of the stolen funds on these two companies and the impact on the industry. First of all, for Bybit, although the amount of 1.5 billion US dollars is roughly equivalent to its net profit for about a year in terms of scale, it is definitely not a small amount for a company in the expansion stage. Under normal circumstances, it is sufficient for a company to maintain a cash reserve of 3 months to a year. Considering that the exchange business belongs to a high cash flow industry, its cash reserves are likely to be closer to the left level. Then we look at Coinbase's 2024 financial report and can roughly draw some preliminary judgments. In 2024, Coinbase's annual revenue more than doubled from last year to $6.564 billion, with a net profit of $2.6 billion. In terms of expenditure, the total operating expenses in 2024 will be $4.3 billion.

Then referring to the data disclosed by Coinbase, combined with Bybit's current expansion stage, expenditure control will be more aggressive, and it is estimated that Bybit's cash flow reserves are basically between $700 million and $1 billion, which is more appropriate. Then the loss of 1.5 billion user funds cannot be paid with self-owned funds alone. At this time, methods such as fund borrowing, equity financing or shareholder capital injection are needed to survive this crisis. However, no matter which model is used, considering the concerns about the weak growth of the cryptocurrency market in 2025, the resulting capital cost is probably not small, which will obviously bring a certain burden to the future expansion of enterprises.

Of course, I saw the news today that the core vulnerability of the attack is in Safe rather than Bybit itself, so there may be some incentive to recover some losses, but a very important factor that plagues the crypto industry is the imperfect legal framework, so the relevant litigation process must be lengthy and costly. It may not be easy to recover the losses. As for Infini, it is obvious that the loss of 50 million US dollars is an unbearable burden for a start-up, but it seems that the founder is strong and it is indeed rare to rely on capital injection to overcome difficulties.

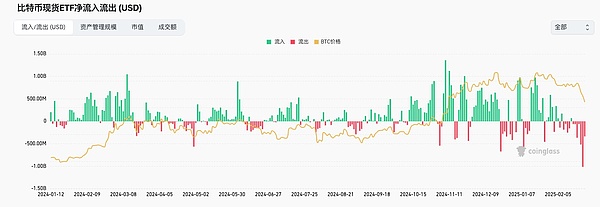

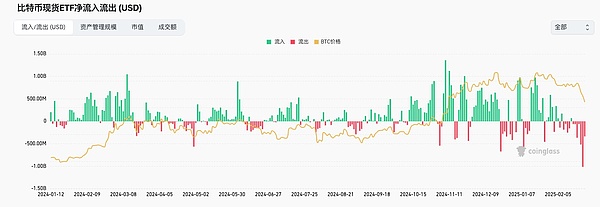

These two consecutive large losses seem to be nothing new to currency traders who are accustomed to high risks, but they have obviously shaken the trust of traditional funds. Specifically, from the flow of funds of BTC ETF, it can be seen that the attack on the 21st has obviously triggered a large outflow of funds, which means that the impact of this incident on traditional investors may be negative. If the concerns caused focus on whether it will hinder the process of formulating a regulatory-friendly legal framework, then this matter is serious. Therefore, it can be said that the theft incident was the trigger for this round of callback at the micro level.

Macro level: The geopolitical game between major powers has intensified, DeepSeek open source week reconstructs the competition pattern of the AI track, and the liquidity migration under the resonance of China's risk assets entering the revaluation stage

Then let's look at some of the impacts at the macro level. The conclusion is obviously unfavorable to the crypto market in the short term. In fact, after a period of observation, the policy direction of the Trump administration has been relatively clear, that is, through strategic contraction, space for time, complete internal integration and industrial reconstruction, so that the United States can obtain the ability to re-industrialize, because technology and production capacity are the most core factors in the game between major powers. The most crucial factor in achieving this goal is "money", which is mainly reflected in the US fiscal situation, financing capacity and the real purchasing power of the US dollar. The relationship between these three points is complementary, so it is not easy to observe the changes in related processes. However, we can still sort out some core concerns: 1. The US fiscal deficit problem; 2. The risk of US stagflation; 3. The strength and weakness of the US dollar; Let's look at the first point, the fiscal deficit problem of the United States. This problem has been analyzed a lot in previous articles. Simply put, the core cause of this round of fiscal deficit problems in the United States can be traced back to the extraordinary economic stimulus bill of the Biden administration to respond to the new crown epidemic, and the Treasury Department represented by Yellen adjusted the structure of US debt issuance and caused interest rate inversion by over-issuing short-term debt, thereby harvesting wealth on a global scale. The specific reason is that over-issuing short-term debt will lower the price of short-term US debt on the supply side, thereby increasing the yield of short-term US debt, and the increase in the yield of short-term US debt will naturally attract the return of US dollars to the United States, because there is no need to lose time costs, you can enjoy excess risk-free profits, this temptation is very great, which is why capital represented by Buffett chose to sell a large number of risky assets in the last cycle and increase cash reserves. This puts great pressure on the exchange rates of other sovereign countries in the short term. In order to avoid excessive depreciation of the exchange rate, central banks of various countries have to sell short-term debt at a loss on the basis of a discount, and turn floating losses into real losses in exchange for US dollar liquidity to stabilize the exchange rate. In general, this is a strategy of global harvesting, especially for some emerging countries and countries with trade surpluses. However, there is also a problem with doing so. That is, the debt structure of the United States will increase its debt repayment pressure in the short term, because short-term debts need to be repaid with interest when they mature. This is the origin of the debt crisis caused by the current round of US fiscal deficits, and it can also be said that the Democratic Party has left a mine for Trump.

The biggest impact of the debt crisis is that it affects the credit of the United States, thereby reducing its financing capacity. In other words, the US government needs to pay a higher interest rate to finance through treasury bonds, which raises the neutral interest rate of American society as a whole. This interest rate cannot be influenced by the monetary policy of the Federal Reserve. The raised neutral interest rate puts great pressure on business operations and will cause economic growth to stagnate. The economic growth stagnation will be transmitted to ordinary people through the job market, and then cause investment and consumption to shrink. This is a negative feedback loop that causes economic recession.

The focus of observation on this main line is on how the Trump administration can reshape the fiscal discipline of the US government and solve the fiscal deficit problem. The specific policies involved are the process of the DOGE Efficiency Department led by Musk to reduce US government spending and layoffs, as well as the impact on the economy in the process. At present, Trump's internal integration is very powerful, and the reform has entered the deep water zone. I will not track the progress here, but only introduce some of my own observation logic.

1. Pay attention to the radical degree of the efficiency department's policy promotion. For example, if the layoffs and cuts are too drastic, it will inevitably cause concerns about the economic outlook in the short term, which is usually unfavorable to risky assets.

2. Pay attention to the feedback of macro indicators on its policies, such as employment data and GDP data.

3. Pay attention to the progress of tax reduction policies.

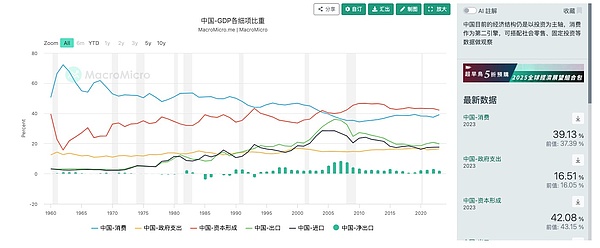

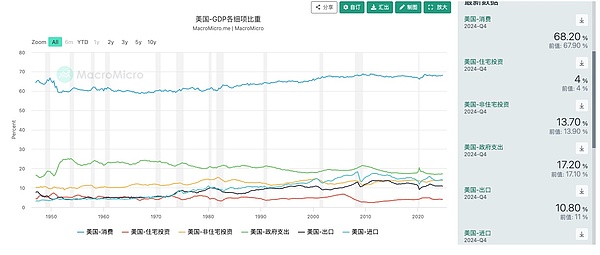

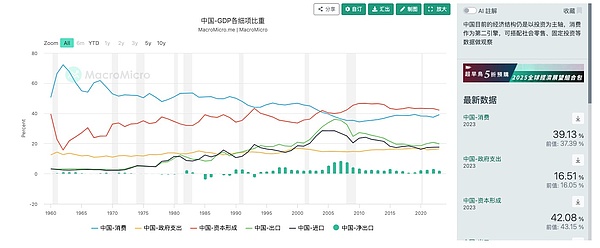

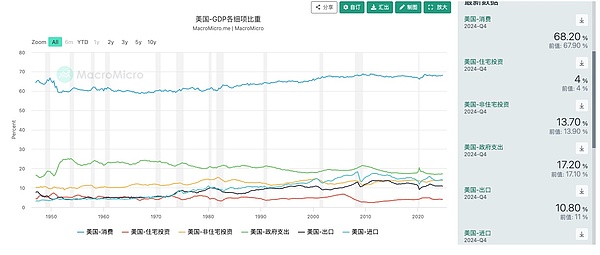

We cannot underestimate the impact of government spending and government employees on the US economy. Usually we think that China's government spending must be higher than that of the United States, but in fact this is a wrong impression. The US government expenditure accounts for 17.2% of GDP, while China's is 16.51%. Government expenditure is usually transmitted to the entire economic system through the industrial chain. The structural difference between the two sides is mainly reflected in the high proportion of consumption in the US GDP, while imports and exports account for a higher proportion of China's GDP. This represents two different ideas for boosting the economy. For the United States, expanding external demand and increasing exports are means to boost the economy, while for China, domestic demand still has great potential to be tapped.

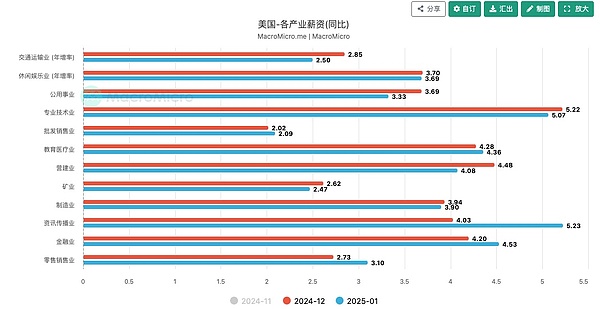

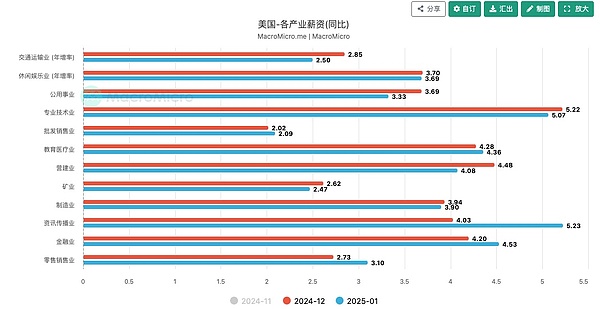

The same is true for consumption. In this picture, we can see that the salary level of government departments is not low in the whole industry chain, and the reduction of government redundancy has also hit the US economic growth on the consumption side. Therefore, overly radical policy promotion will definitely cause panic about economic recession. Some things will be rounded up slowly, but they must also be in line with the pace of the Trump administration's overall policy promotion. As for the promotion of tax reduction policies, it seems that Trump's focus is not here at present, so the hidden worries of reduced income in the short term do not seem to be obvious, but we must also remain vigilant.

The second is the concern about stagflation in the United States. The so-called stagflation refers to the stagnation of economic growth and the increase in inflation, which is unacceptable to society in terms of the pain index. In addition to the impact of government spending cuts on economic growth just mentioned, there are some important concerns about the stagflation problem:

1. How will DeepSeek further impact the AI track.

2. The progress of the US sovereign fund.

3. The impact of tariff policies and geopolitical conflicts on inflation.

Among them, the author believes that the most significant impact in the short term is the first point. Friends who are interested in technology may know that DeepSeek's open source week has many extremely shocking achievements, but they all point to one point: AI's demand for computing power has been greatly reduced. This is why the stock market can remain stable during the past interest rate hike cycle in the United States. The reason is the huge narrative of the AI track and the United States' monopoly on the upstream and downstream of the AI track. The market gives extremely high valuations to stocks related to the US AI sector, and naturally has an optimistic attitude towards the new round of economic growth driven by AI in the United States. However, all this will be reversed by DeepSeek, and the biggest impact of DeepSeek lies in two aspects. On the one hand, it is on the cost side, that is, it greatly reduces the requirements for computing power, which has led to a significant reduction in the performance growth potential of computing power providers represented by NVIDIA in the upstream. On the other hand, it breaks the monopoly of the United States on downstream AI algorithms through open source means, and then suppresses the valuation of algorithm providers represented by OpenAI. Moreover, this impact has just begun. It depends on how the US AI will respond at that time, but in the short term, it has already shown that the valuation of US AI stocks has been pulled back and the valuation of Chinese technology stocks has returned.

The second point worth noting is the construction of the US sovereign wealth fund. We know that sovereign wealth funds are a good supplement to government finances for any sovereign state, especially for countries with a large trade surplus of US dollars. Among the world's top ten sovereign wealth funds, there are 3 in China, 4 in the Middle East, and 2 in Singapore. The first one is the Norwegian Government Pension Fund Global, with a total asset size of about 1.55 trillion US dollars. Affected by the constitutional framework of the U.S. federal government, it is actually difficult for the United States to establish a sovereign wealth fund, because the federal government can only receive direct taxes and has limited financial resources. The United States is currently experiencing a fiscal deficit dilemma. However, Trump seems to have instructed the Treasury Department to establish a trillion-dollar sovereign wealth fund, which is naturally a means to alleviate the fiscal deficit. However, the question here is where the money comes from and what to invest in?

According to the new U.S. Treasury Secretary Bensont, it seems that he hopes to re-price the U.S. gold reserves to provide $750 billion in liquidity for the sovereign fund. The reason behind this is that according to Section 5117 of Title 31 of the United States Code, the current legal value of the U.S. government's 8,133 metric tons of gold is still $42.22 per ounce. If calculated at the current market price of $2,920 per ounce, the U.S. government has $750 billion in unrealized returns. Therefore, by amending the law, additional liquidity can be obtained, which is a wise approach. However, if it is passed, the US dollars used for investment or easing debt pressure will inevitably be obtained by selling gold, which will inevitably affect the trend of gold.

As for what to invest in, I think it is likely to be carried out around the purpose of returning production capacity to the United States, so the impact on Bitcoin is probably limited. In previous articles, I have analyzed the value of Bitcoin relative to the United States in the short and medium term, and it is a target for economic protection. This is based on the fact that the United States has sufficient pricing power on this asset. But in the short term, the economy has not shown a significant recession, so this is not the main axis of Trump's policy, but an important tool to get through the pain period of reform.

Finally, in terms of tariffs, the hidden concerns about tariffs have actually been well exchanged. At present, it seems that the tariff policy is more of a bargaining chip for Trump's negotiations, rather than a necessary choice. This can be seen from the proportion of tariffs imposed on China. Trump is still relatively restrained, which naturally takes into account the impact of high tariffs on internal inflation. Next, I am more interested in tariffs on Europe and what the United States can get in return. Of course, I am worried about the process of rebuilding the independence of the European Union. Harvesting Europe to restore its own strength is the first step for the United States to participate in this game of great powers. As for the inflation risk, although the CPI has been growing for several consecutive months, considering that the overall level is still controllable, coupled with the easing of Trump's tariff policy, the risk does not seem to be great at present.

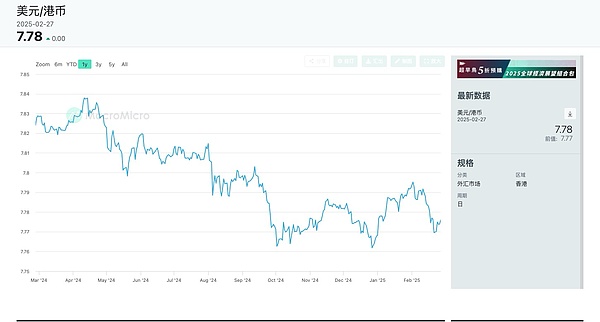

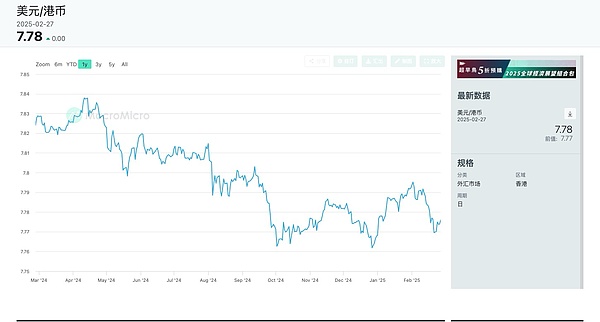

Finally, let's talk about the trend of the US dollar. This is a very critical issue that needs to be continuously observed. In fact, the debate about the strength of the US dollar under Trump's new term is ongoing. The speeches of some key figures here have significantly affected the market. For example, Stephen Milan, Trump's latest economic adviser and current chief of the White House economic think tank, said that the United States needs a weak dollar to boost exports and promote internal re-industrialization. After causing panic in the market, US Treasury Secretary Bensont came out to appease the market in an interview on February 7, saying that the United States will continue the "strong dollar" policy, but the RMB is a bit too undervalued.

In fact, this is a very interesting thing. Let's take a look at the impact of a strong or weak dollar on the United States. First of all, a strong dollar will have two main effects. First, on asset prices. As the dollar appreciates, dollar-denominated assets will perform better. For the US government, it is mainly beneficial to US bonds and US stocks of global companies, that is, it has increased the market's enthusiasm for buying US bonds. Secondly, in terms of industry, the stronger purchasing power of the dollar is beneficial to the cost reduction of US global companies, but it suppresses the competitiveness of domestic industrial products in the international market and is not conducive to internal industrialization. The impact of a weak dollar is just the opposite. Considering Trump's overall policy concept, it is based on improving production capacity through industrial repatriation, thereby enhancing the competitiveness of the game between major powers. Then it seems that a weak dollar policy is the right answer. But there is a problem here. A weak dollar will lead to the depreciation of dollar-denominated assets. Considering the current fragility of the US economy and financing pressure, a too-fast weak dollar policy will cause the United States to be unable to survive the pain period brought about by reform.

Here is a representative event to illustrate this pressure. In Buffett's annual letter to shareholders on February 25, he specifically pointed out his dissatisfaction with the US fiscal deficit problem, which obviously exacerbated market concerns. We know that Buffett's allocation strategy for a long time in recent times has been to choose to clear out overvalued risky assets in the United States in exchange for more cash reserves to allocate US short-term Treasury bonds, while also matching some of Japan's five major trading companies. However, this is obviously also a means of interest rate arbitrage. There is no need to expand on it here. What I want to say is that Buffett's views have a strong influence in the market. Capital that is over-allocated to the US dollar will naturally have a unified concern about the real purchasing power of the US dollar, that is, the concern about the depreciation of the US dollar. Therefore, the pressure of entering the depreciation channel too quickly is very great.

But in any case, exchanging space for time and slowly reducing debt will become the choice of both China and the United States, and the trend of the US dollar is likely to go out of the pattern of first strong and then weak. Explanation: Changes in US dollar-denominated assets will also move with this cycle. Cryptocurrency is also one of the assets affected by this wave.

Finally, I would like to talk about my views on the cryptocurrency market. I think there are too many uncertainties in the current market, so individual investors can choose a dumbbell strategy to enhance the anti-fragility of their portfolios. On the one hand, they can allocate blue-chip cryptocurrencies or participate in some low-risk DeFi returns, and on the other hand, they can allocate some high-volatility targets with small positions on dips. As for the short-term market trend, the superposition of many unfavorable factors has indeed led to certain price pressures, but there does not seem to be any clear structural risks, so if the market retreats excessively due to panic, it is also an option to build a position appropriately.

Brian

Brian