Author: BitpushNews

Financial markets were relatively calm on Friday. U.S. stocks fluctuated in early trading and closed higher in the afternoon. At the end of the day, the S&P, Dow Jones and Nasdaq indexes rose 0.47%, 0.13% and 0.51%, respectively.

The crypto market consolidated slightly. Bitcoin broke through resistance yesterday and soared to nearly $63,000 in the rebound. On Friday, Bitcoin hovered below $62,000 for most of the time. As of press time, BTC was trading at $60,224, up 0.98% in 24 hours. Altcoins were mixed this week, with Celestia (TIA), Cronos (CRO), and Zcash (ZEC) leading the gains among the top 200 tokens by market cap, up 16.6%, 16.3%, and 16.1%, respectively. Meme coin cat in a dogs world (MEW) led the decline, down 7%, followed by Galxe (GAL) down 6.9%, and XRP (XRP) down 6.5%.

The current overall market value of cryptocurrency is 2.11 trillion US dollars, and Bitcoin accounts for 56.6%.

Stablecoin supply surges

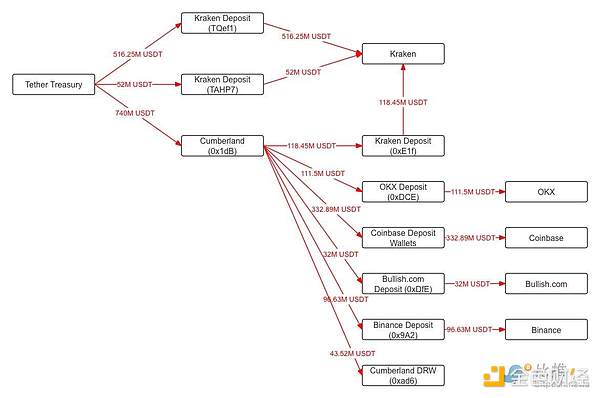

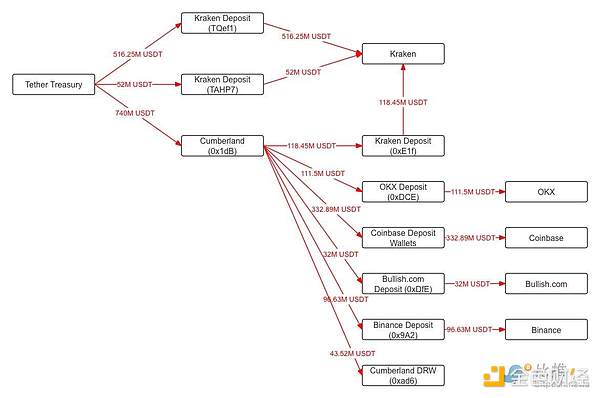

On-chain data platform Lookonchain pointed out that the supply of the two major stablecoins Tether (USDT) and Circle (USDC) increased by nearly US$3 billion in a week, indicating that after Monday's plunge, investors rushed to buy cryptocurrencies at lower prices.

Lookonchain pointed out that since Monday, Tether has transferred $1.3 billion worth of USDT to exchanges and market makers. With the latest issuance, USDT's market value climbed to more than $115 billion, a new high. The market value of the second-largest stablecoin USDC also increased by about $1.6 billion this week to $34.5 billion, the highest level since March 2023.

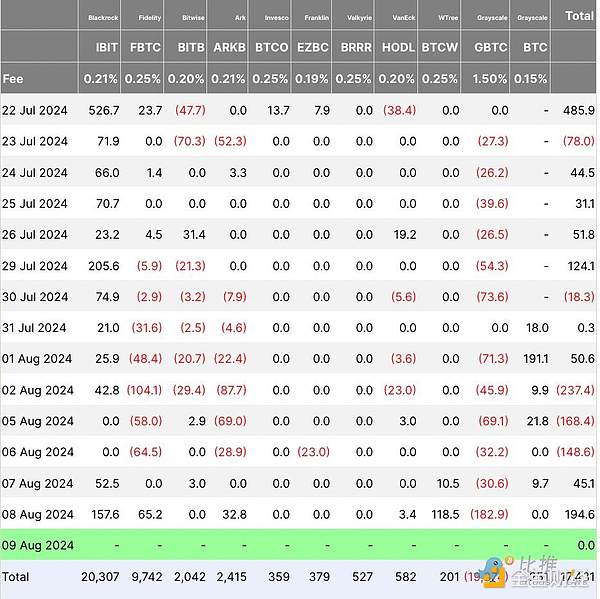

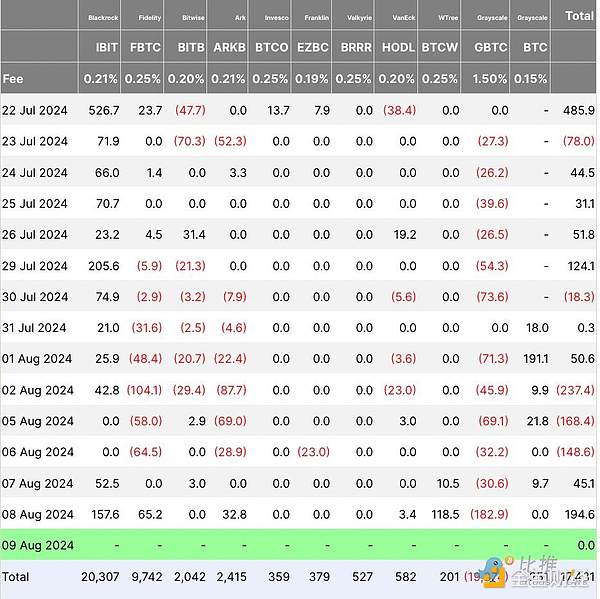

The recent rebound in the crypto market is consistent with the recovery of inflows into U.S. spot Bitcoin ETFs. As of August 9, the funds managed about $54.31 billion worth of BTC, up from $48.43 billion on August 5.

After three consecutive days of outflows from these investment products, spot Bitcoin ETF flows turned positive in the past two days, recording net inflows of $45.1 million on August 8 and $194.6 million on August 9, data from Farside Investors showed.

Bear or Bull? Opinions are mixed

Despite a slight extension of Friday’s gains, investors remain wary.After Bitcoin’s flash crash below $50,000 on Monday, market analysts are divided on what to expect going forward, with some calling the drop and reversal a bear trap, while others believe it hints at a possible pullback to the $40,000 support level ahead.

Market analyst DonAlt said in a recent YouTube update:“It’s bearish on the weekly timeframe right now and unless we reclaim $60,000, the bearishness will continue… I think $60,000 is the key level right now.”

While Bitcoin is currently trading above $60,000, DonAlt said that Bitcoin would need to close above that level on a weekly basis to confirm support and overturn the bearish view. Nonetheless, he noted that Bitcoin’s ability to hold the $52,000 support level is a positive sign and to be wary of a return to the $52,000 support level in the coming days.

He said:“If we start to plummet [below $52,000] in the next few days... I would be surprised, probably retest lower lows easily, but I think there is a good chance that $50,000 is where we are trading. Unless there is a catastrophic black swan event in the macro world.”

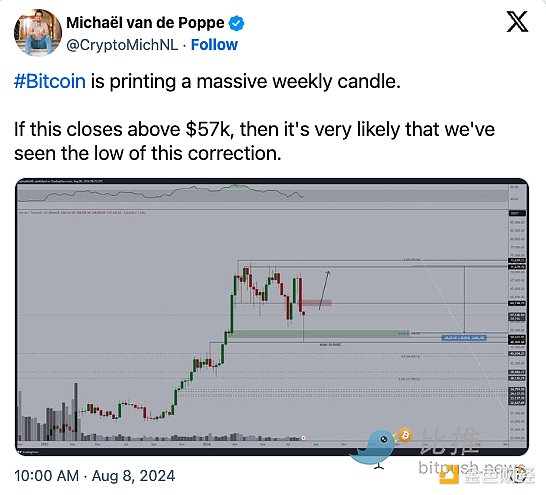

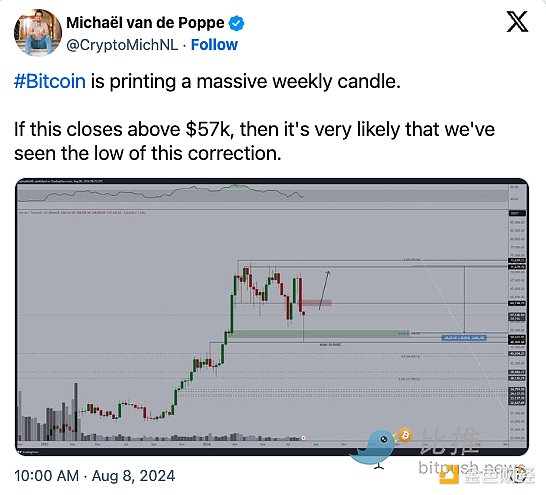

But according to Michaël van de Poppe, founder of MN Trading, as long as Bitcoin closes above $57,000 on a weekly basis, it is likely that a bottom has been reached.

Michaël van de Poppe noted in a tweet:“I would prefer to see it stay above $57,500, and as long as that happens I expect the bullish momentum to continue and set new all-time highs in September/October.”

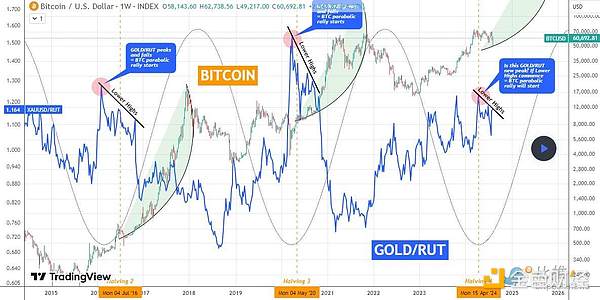

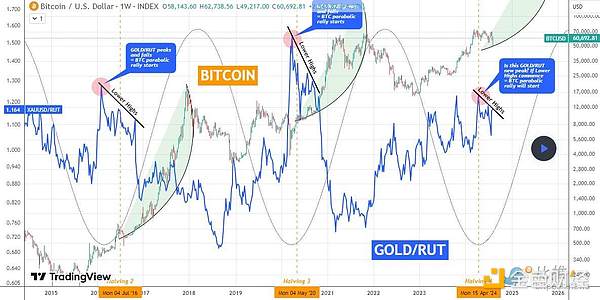

TradingView analyst TradingShot found a correlation between Bitcoin and the Gold/Russell 2000 ratio, which confirms van de Poppe’s point of view and suggests that Bitcoin’s parabolic run is imminent.

TradingShot analyzed: "Bitcoin has been under tremendous pressure recently, and has basically paused the upward trend that began at the end of 2022 in the past 5 months. We found that there is a significant correlation between gold (XAUUSD) and Russell 2000 (RUT), which is manifested as the gold/RUT ratio (blue trend line). This correlation is a negative correlation (that is, when BTC rises, the gold/RUT ratio falls, and vice versa), and exists cyclically."

TradingShot Explained, When the GOLD/RUT ratio peaks and begins to fall and form lower highs, Bitcoin tends to begin its parabolic rally (green arc) of its bull cycle above the previous all-time high, which usually happens before a halving. Now it appears that it happened at the last halving (mid-April), assuming we see the ratio form lower highs from now on, if that is the case, BTC is likely to start the most intense part of the bull cycle. The sine wave tracking the GOLD/RUT peak suggests that the April high may indeed be the new peak, whether it will form lower highs remains to be seen. ”

In addition, market sentiment will continue to be driven by political uncertainty. According to investment advisor Two Prime, the bias is bullish while BTC price holds support at $54,000, while geopolitical issues and Fed policy are key to the next big price move.

Two Prime said in a Telegram note to clients: “We continue to view $54,000 as the main support area, followed by $50,000. So far, these levels have remained intact and there has been sustained demand every time Bitcoin reaches this area.”

Two Prime added: “Now we wait to see whether the conflict between Israel and Iran escalates, whether the US government intervenes to curb geopolitical risks, and the direction of the Fed’s monetary policy.”

JinseFinance

JinseFinance