Stablecoin L1/L2 is becoming a hot topic. From Plasma to Arc, and then to Stable, Converge, and Tempo, global fintech giants and top stablecoin issuers like Tether, Circle, Coinbase, Stripe, and Ethena Labs are shifting away from general-purpose public chains and turning their attention to building their own proprietary settlement layers, accelerating the development of their respective blockchain or L2 solutions. This article will delve into the logic, risks, and potential landscape of stablecoin chain-building, exploring the profound implications of this trend for users and the ecosystem.

Stablecoins have long become the "elephant in the room".

As the "holy grail" of the crypto world, stablecoins have always been one of the most imaginative tracks in the market. Whether it is payment, cross-border transfers or DeFi mortgages, they are subtly rewriting the way funds flow on the chain and even globally. Looking back, the DeFi Summer of 2020 marked a clear watershed. Leveraging the explosion of native DeFi scenarios, the demand for stablecoins was fully unleashed. In particular, the potential for profitable combinations within the stablecoin market was explored, leading to a true "demand-driven supply" boom in the market. This, in turn, led to a transformation in the role of stablecoins: Over the past five years, stablecoins have evolved from simple on-chain transaction vouchers and global payment tools to the underlying liquidity infrastructure of crypto finance. CoinGecko data shows that as of September 30, the total stablecoin circulation across the entire network had exceeded $300 billion, with USDT ranking first with $174.6 billion and USDC second with $73.5 billion. This also means that the stablecoin market has grown by over $280 billion over the past five years, roughly 15 times the total growth of the previous several years combined. To be honest, with a market capitalization of over $300 billion, coupled with its continued rapid growth, the massive collateral requirements, and the impact on traditional financial and payment systems, stablecoins undoubtedly face inevitable regulatory scrutiny. From this perspective, after experiencing a frenzy of issuance in 2020 and 2021 and gradually breaking out of the cryptosphere and entering the mainstream in 2022-2025, stablecoins have entered a new stage of development. They will play a more important role in both their deep integration into the crypto world and their deep penetration into the global financial system. It is precisely in this context that stablecoin issuers are no longer content to play a "supporting role" and are instead building their own chains. For example, Tether launched Plasma and Stable, Circle developed Arc and Base, and Ethena Labs is promoting Converge.

So whether from the perspective of profit and control, or from the perspective of risk resistance and compliance pressure, this is indeed a natural thing:

Profit and network effect:The exclusive settlement chain can charge transaction settlement fees and network gas fees. The economic model and network effect formed can feed back to the stablecoin issuer, which is undoubtedly very attractive to the already large and mature stablecoins, such as USDT and USDC;

Risk resistance and compliance:Building your own chain can reduce dependence on other public chains (such as Ethereum and Tron), disperse technical and compliance risks, and meet the requirements of institutional users for deterministic execution and predictable fees;

Strategic game margin: Stablecoins are bound to exclusive public chains and may become the next "digital dollar settlement layer" or "global financial infrastructure" competitor;

Players in the stablecoin chain issuance

This also explains why stablecoins are building chains. A review of the current players reveals that they encompass nearly all major stablecoin issuers and potential payment giants. They are all shifting from general-purpose public chains to specialized vertical chains, offering end-to-end optimization for payment, settlement, and scalability. Whether it's throughput, latency, or gas design, they all share a common thread: high performance, low fees, and native stablecoin payments. Among these, Tether's Plasma is undoubtedly the most anticipated. Featuring zero USDT transfer fees, ultra-high throughput, and a native, trust-minimizing bridge to Bitcoin, Plasma aims to optimize large-scale USDT transfers and cross-border usage. This natively integrated, chain-level experience optimization is expected to reshape the overall stablecoin payment landscape. In fact, Tether isn't betting on a single platform, but rather adopting a multi-chain parallel development strategy. In addition to general-purpose public chains like Tron and Ethereum, Tether also has its own proprietary chain, not just Plasma. Tether has also partnered with Bitfinex to launch Stable L1, which allows users to pay gas fees with USDT, comprehensively diversifying risk and enhancing control. Following closely behind are Arc and Noble, launched by Circle. Noble, a Cosmos native asset issuance chain, is designed specifically for introducing USDC and other stablecoins to IBC-connected application chains, representing an early test for Circle. Arc, on the other hand, is Circle's purpose-built blockchain for stablecoin finance, integrating fast settlement, native USDC integration, and global foreign exchange tools. The most noteworthy aspect of Arc is that it uses USDC as its native gas token, supports the interest-bearing USYC token, and has a built-in foreign exchange engine that enables on-chain institutional exchange through a price inquiry model. In other words, it is not built for maximum decentralization, but rather to embed tokenized US dollars into corporate payments, foreign exchange, and capital flows. There is also Converge for institutional capital and Tempo for integrating with the Stripe merchant system. : In general, this wave of stablecoin chain building may bring three main paths:

Exclusive settlement chain/L1 (such as Plasma, Stable, Arc, Tempo): Full control of the technology stack, economic model and compliance environment to achieve the optimal solution for performance and customization;

Bound to public chain/L2 (such as the deep binding of Circle and Base, Converge): Leveraging the security and developer community of the existing ecosystem, but gaining dominance over performance and Gas fees through L2;

Cross-chain aggregation and account abstraction: Through infrastructure such as wallets, a unified user interface is provided to shield the complexity of the underlying chain;

The Battle for the Settlement Layer: Traditional Public Chains vs. Stablecoin Chains

This also leads to an inevitable topic:

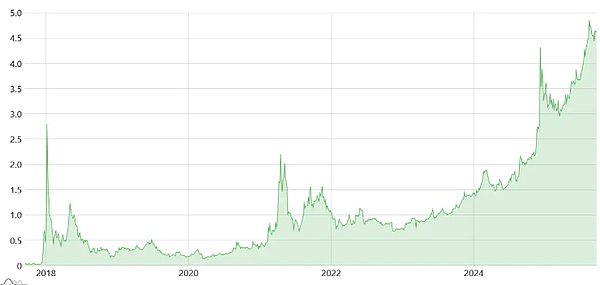

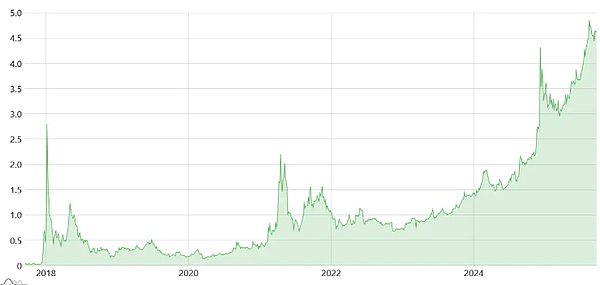

The fact that stablecoins, especially the two giants USDT and USDC, are beginning to compete to build chains will undoubtedly directly challenge the dominance of general-purpose public chains like Ethereum and Tron in the high-frequency scenario of "payment and settlement." This competition is essentially a functional differentiation between "high-frequency financial settlement" and "general computing platform," which is of course closely related to actual market changes. After all, according to historical statistics from gasfeesnow, transfer fees on the Tron network have already soared from an average of less than $0.5 before 2021 to over $4.5 today. Even after the energy price was reduced from 210 Sun to 100 Sun on August 29th (a drop of approximately 60%), the cost of a single USDT transfer is still in the range of $1.9-4.5.

Not to mention the Ethereum mainnet, the high volatility of gas fees has always been an obstacle to high-frequency small payments until some L2 (such as Arbitrum, Optimism) and new public chains (such as Aptos, Sui) provided alternative options in the past two years. However, in comparison, stablecoin chain-building can solve the fatal weaknesses of traditional general-purpose public chains of "high and unpredictable gas fees" and "low throughput" through customization.

Of course, building a stablecoin chain is not an easy road - it is equivalent to taking on more "issuance + settlement" functions. They will inevitably face stronger regulatory pressure and face two core challenges:

Security and decentralization: In pursuit of extreme performance, stablecoin chains have sacrificed some decentralization. Whether they can maintain long-term security and censorship resistance like Ethereum will be an open question;

Ecological attractiveness: Can these vertical settlement chains attract developers and users to build diverse applications? If they are merely "highways" without a "destination," their long-term value will be limited;

However, for users, stablecoin chain-building also means further fragmentation of the cross-chain experience and account system, which places more complex and timely aggregation requirements on wallet infrastructure.

Like imToken's recently added support for Plasma accounts, this is an attempt to simplify this complexity at the user experience level—allowing users to more easily manage and call assets in a multi-chain environment through a unified account. This is a key piece of the puzzle in the evolution of stablecoin infrastructure, designed to allow users to enjoy the performance dividends of L2 while maintaining operational convenience. In conclusion, in the long run, stablecoin payments will no longer rely on Visa or Mastercard channels as the primary clearing layer. The true endgame for crypto payments will inevitably be a self-custodial model where transactions originate directly from user wallets, with clearing and settlement handled directly by the blockchain. This also means that the future of stablecoins lies not simply as "dollar alternatives" but as "reinventors of the settlement layer." These stablecoins are no longer content to play a supporting role on public chains like Ethereum and Tron, but are instead attempting to control core clearing and settlement rights by building their own chains. Driven by the wave of chain creation and the innovation of account systems, a trillion-dollar crypto-financial infrastructure is bound to take shape at an accelerated pace.

The battle for this trillion-dollar cake has already begun.

Brian

Brian