Highlights

① From $40,000 to $70,000, the approval of the Bitcoin spot ETF has played a good catalyst role in the price of Bitcoin. Now, the market is looking forward to the approval and full trading of the Ethereum spot ETF to further boost confidence.

② The 19 b-4 forms of 8 spot Ethereum ETFs have been approved by the SEC and are expected to officially start trading after the S-1 registration statement takes effect in a few weeks. The participation of traditional asset management giants such as BlackRock is expected to bring Ethereum into the vision of more traditional investors.

③ The cost and liquidity of the ETF, the background and reputation of the issuing institution are important considerations for investing in Ethereum ETFs. The current crypto market is ushering in a new innovation cycle. Superimposed with the monetary cycle with improved macroeconomic conditions and the expected further release of liquidity, and the upcoming US election cycle, the crypto market is expected to continue to usher in a good upward trend.

Since the US SEC approved the Bitcoin spot ETF at the beginning of this year, the legitimacy of crypto assets as an emerging investment category has been greatly strengthened. This is undoubtedly an important moment for global investors - we are getting closer and closer to the turning point of the integration of traditional finance and crypto assets.

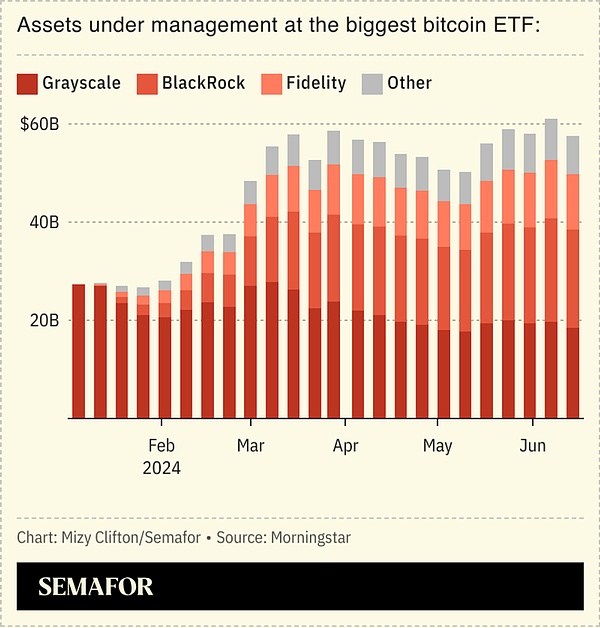

Since the launch of the Bitcoin spot ETF, it has attracted the attention of various important institutional investors. US state government investment funds, major banks, top hedge funds, well-known asset management companies, investment consulting companies, and other commercial companies have poured in. Currently, the Wisconsin State Government Fund is one of the largest holders of BlackRock's Bitcoin spot ETF.

The massive entry of institutional investors has also played a good catalyst role in the price of Bitcoin itself (the increase is close to 70% in less than 2 months). Now, the market is looking forward to the approval and full trading of Ethereum spot ETFs to further boost confidence.

As the second largest cryptocurrency by market value, Ethereum has the most extensive decentralized application ecosystem (dApps). A few weeks ago, the US SEC officially approved the 19b-4 forms of 8 spot Ethereum ETFs from BlackRock, Fidelity, Grayscale, etc. This news not only caused the price of Ethereum to rise by more than 10% within a few hours, but also opened the door for Ethereum to further move towards the traditional financial market.

Although it still needs the S-1 registration statement to take effect before it can officially start trading, the approval of 19b-4 has in fact consolidated Ethereum's position as a digital commodity. This article will analyze the investment value, selection strategy and future prospects of various spot ETFs of Ethereum, the second largest cryptocurrency in the crypto market.

1. ETHE, up 303% in one year

Grayscale Ethereum Trust Fund ETHE was once one of the most important tools for US stock investors to invest in Ethereum. The fund is issued and managed by Grayscale Fund, a subsidiary of Digital Currency Group, and its asset size once exceeded US$10 billion. It was established in December 2017 and listed for trading in July 2019, using the same trust structure as GBTC.

In theory, the price of ETHE should fluctuate narrowly around the price of Ethereum, but in reality its secondary price performance is not completely close to the market. Since its listing in 2019, it has maintained a positive premium to Ethereum for a long time, even exceeding 1000% at one point. But since February 2021, ETHE has entered a bleak discount mode and continued to expand during the bear market.

The long-term discount is mainly related to the inability to redeem the product directly. In addition, the limitation of arbitrage opportunities, the forced liquidation of large speculators, the discount of opportunity costs, and the impact of competitive products have also led to the widening of the discount, so ETHE has not been able to track the price of Ethereum itself well in the past few years.

But it is precisely because of the bear market that this discount has created an excellent opportunity to buy at the bottom - compared with the nearly 100% increase in Ethereum in the past year, ETHE has increased by 300% in one year.

Given that many issuers are actively applying for Ethereum spot ETFs, Grayscale is also actively promoting the conversion of ETHE to a spot ETF, which is expected to eliminate the discount. In the foreseeable future, ETHE is expected to become one of the largest Ethereum spot ETFs in the United States, similar to GBTC for Bitcoin.

2. Ethereum spot ETFs expected to be formally approved

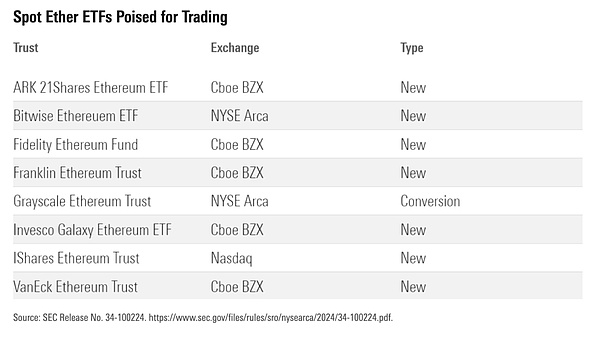

As mentioned earlier, the 19 b-4 forms of 8 spot Ethereum ETFs have been approved by the SEC, as shown in the figure below:

ARK 21Shares Ethereum ETF: jointly applied by well-known fund ARK Ark Fund and digital asset management company 21Shares. It should be noted that ARK has successfully issued Ethereum futures ETFs before-ARK21Shares Active Ethereum Futures ETF (code: ARKZ), which mainly allocates funds to Ethereum futures products.

Bitwise Ethereum ETF: Bitwise has taken the lead in updating the S-1 form of its Ethereum spot ETF, the first of all ETF issuers to file recently. It also said that Pantera Capital is interested in purchasing $100 million of the ETF product. Previously, as an investor in Bitwise, Pantera Capital had purchased $200 million of Bitwise's Bitcoin spot ETF (code: BITB).

Fidelity Ethereum ETF: Financial services giant Fidelity Investments hopes to launch an ETF that holds the Ethereum cryptocurrency, and this application document happened to be released the day after BlackRock submitted its own Ethereum ETF application.

Franklin Ethereum ETF: Franklin's application was submitted in early 2024.

Grayscale Ethereum ETF: As mentioned above, Grayscale hopes to convert its Ethereum Trust ETHE into a spot ETF product.

Invesco Galaxy Ethereum ETF: This ETF, jointly applied for by Invesco and Galaxy Capital, aims to provide exposure to the spot price of Ethereum.

BlackRock iShares Ethereum Trust: BlackRock submitted the application at the end of 2023. The ETF aims to provide direct investment in Ethereum and is expected to increase market confidence.

VanEck Ethereum ETF: As a well-known US asset management company and ETF giant, VanEck is known for its pioneering role. The company is also actively applying for Ethereum ETF products.

It is worth noting that these applications reflect the significant interest of mainstream financial institutions in integrating Ethereum into traditional investment portfolios, and most of them, similar to Bitcoin spot ETFs, have found Coinbase as an asset custodian, as shown in the figure below:

Why did the Ethereum spot ETF pass without causing Ethereum to continue to surge? To be precise, it is not "completely passed", and we need to clarify the difference between the two documents:

The 19b-4 document is used to notify the SEC of rule changes that allow ETFs to be traded on exchanges - such as introducing new products, modifying trading mechanisms or other related exchange policies. Once submitted, the SEC will review the proposal, publicly solicit public comments, and then decide whether to approve it.

However, the listing of ETFs also requires the ETF issuer to obtain the S-1 document approved by the SEC. The S-1 document is not the last step, but it is a very critical step under the supervision of the US SEC. Only when the SEC approves the S-1 document can fund managers continue to prepare for the official listing of the ETF, including determining the listing date and marketing.

The approval of 19b-4 means that this thing is possible; the approval of S-1 is a done deal. Currently, this process takes weeks to months, so the price of Ethereum will not soar in a short period of time.

However, since multiple spot Ethereum ETFs have been listed on the DTCC website, they are likely to repeat the script of Bitcoin spot ETFs.

3. A Concise Investment Guide for Ethereum Spot ETFs

In the previous analysis of Bitcoin spot ETFs, the RockFlow investment research team gave some strategies, focusing on three indicators: fees, liquidity, and transaction costs. Buy-and-hold investors should focus on fees, active traders should pay particular attention to liquidity, and all parties involved should pay attention to how the issuer's own transaction costs ultimately affect ETF performance.

As an ordinary investor, if you want to invest in Ethereum ETFs, the idea is actually similar. Given that the underlying assets of the first batch of Ethereum spot ETFs are the same, the final returns will hardly be different. Therefore, the RockFlow investment research team believes that everyone can focus on two dimensions: 1) The cost and liquidity of Ethereum ETFs. For ETFs, cost is obviously very important. Giving priority to competitive low-fee ETFs will maximize your long-term returns; and liquidity is essential for the convenience of trading. ETFs with larger assets under management usually mean greater investor confidence and stability, and are therefore more suitable for long-term holding. 2) The background and reputation of the ETF issuer. The first batch of Ethereum ETF issuers are all established companies, and they can often provide higher reliability. The performance of the giants in issuing ETFs in the past is enough to prove this. 4. How do you view the future of Ethereum ETFs?

Bloomberg research shows that if the Ethereum ETF is successfully approved, future capital inflows will account for 10-20% of the inflows of Bitcoin spot ETFs. Given that the price of Bitcoin was about $40,000 when the ETF was launched and rose to $70,000 two months later (a 75% increase), ETH is expected to follow a similar trend (pushing the asset to break through the historical high of $4,800).

The logic behind this number depends on several factors: compared with Bitcoin, institutional investors are less interested in Ethereum at present; the current Ethereum futures ETF trading volume is much smaller than the Bitcoin futures ETF (10-20%); the current Ethereum spot trading volume is less than Bitcoin (about 50%); Ethereum currently accounts for about 1/3 of Bitcoin's market value.

That being said, Ethereum and Bitcoin themselves are very different, including but not limited to:

Ethereum does not have the same degree of "structural selling pressure" as Bitcoin, because Ethereum validators do not incur operating expenses like Bitcoin miners (forcing them to sell a portion of the mined Bitcoin);

Currently 38% of the Ethereum supply is staked on-chain, with a lower willingness to sell;

Ethereum is more reflexive than Bitcoin. This reflexivity can be expressed by price action leading on-chain activity, resulting in more Ethereum being destroyed, which can better promote Ethereum's narrative, more on-chain activity, and more Ethereum being destroyed;

Ethereum is a more resilient "crypto bull call option", while Bitcoin is "digital gold". Ethereum's volatility is expected to continue to expand in the short term.

On the whole, Ethereum is more likely to exceed Bloomberg's forecast of 10-20% net inflow of Bitcoin.

From a broader perspective, the current crypto market is ushering in a round of innovation cycle, coupled with the macro-environmental improvement, the monetary cycle with further liquidity release, and the upcoming US election cycle. The approval of spot ETF products has obviously eliminated the market's important compliance concerns. The RockFlow investment research team believes that the crypto market is expected to continue to usher in a good upward trend.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance Alex

Alex Clement

Clement Bitcoinworld

Bitcoinworld Bitcoinworld

Bitcoinworld Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph