Author: Sankalp Shangari, Source: Hashtalk, Compiled by: Shaw Jinse Finance

Creating a Vibe

If you've spent even a few minutes on crypto Twitter lately, you might have noticed: Perpetual Swap (perps) season has arrived. Perpetual Swap Decentralized Exchanges (DEXs) have dominated the conversation, with record-breaking trading volumes and offering user points, rebates, and airdrops. Hyperliquid opened the market with a $3 billion airdrop and near-centralized exchange-like speed, and now every new entrant is scrambling to emulate its strategy. For traders, it's a feast of incentives; for developers, it's an opportunity to gain liquidity and market share in DeFi's most lucrative sector. MaelstromFund bluntly stated in a recent article: Currently, the top few Perp DEXs account for approximately half of all on-chain derivatives trading. This concentration creates a gravitational pull; once liquidity and traders flock to a platform, the moat becomes increasingly deeper and harder to cross. This is precisely why competition is so fierce: each new DEX must offer some radical strategy (zero fees, a faster engine, or aggressive incentives) to steal users from incumbent platforms. Hyperliquid: The Industry Benchmark Hyperliquid remains at the forefront. Its custom Layer-1 and HyperCore engines achieve sub-second execution speeds, while its fee model makes trading virtually free. Makers effectively receive rebates, while traders pay only 5 basis points. Furthermore, 99% of fees are used to buy back $HYPE tokens, creating a direct virtuous cycle between trading volume and token value. The data speaks for itself: Hyperliquid's 30-day cleared volume exceeds $300 billion, with open interest hovering in the billions. It can already easily handle slippage on orders over $10 million, while competitors struggle. Even after the points program ended, total value locked (TVL) and trading volume continued to climb—proving that liquidity depth and user engagement can transcend simple incentives. If Hyperliquid is the established heavyweight, then Lighter is a worthy competitor. Built by former high-frequency trading (HFT) traders using zk-rollup technology, it promises to provide traders with an absolutely fair and fee-free trading environment. This isn't a gimmick: Maker and Taker fees are actually set at 0%; the incentives for liquidity providers (LPs) are key. Lighter is growing rapidly. Its monthly trading volume has exceeded $140 billion, second only to Hyperliquid. Large orders have weaker liquidity, but for most retail and mid-sized traders, volume is tight. The question is whether Lighter can continue to scale once the invite-only beta expands, and whether its zero-knowledge proof engine can withstand the pressure of sustained institutional-level traffic. Avantis and SunPerp Enter the Market Avantis has quickly become one of the most notable Perp DEXs, not only due to its significant trading volume but also because it incorporates real-world assets (RWAs) such as FX, commodities, and stocks into Base's trading portfolio, a rare feature in today's DeFi landscape. Over the past 30 days, it has processed approximately $6.9 billion in perpetual contract trades (approximately $520 million in 24 hours), yet its total value locked (TVL) remains around $22 million, indicating high turnover given limited collateral. With a market capitalization of approximately $600 million and a fully diluted valuation (FDV) of approximately $2.1 billion, and backed by major investors such as Pantera, Founders Fund, Galaxy, and Base Ecosystem Fund, Avantis is well-positioned. However, the challenge lies in whether its incentive-driven growth and high leverage options can translate into sticky, sustainable liquidity once the yield farming and airdrop craze cools. This means: Advantages: RWAs give Avantis a unique advantage: you can trade not only long and short cryptocurrencies, but also indices, commodities, and forex. This broadens Avantis's appeal. Strong incentives: zero or very low fees for traders, and generous returns for limited partners. This attracts both yield-seeking investors and speculators.

Weakness

A high FDV relative to circulating supply suggests expectations are already priced in. If growth or volume stagnates, a significant decline is possible.

Airdrops and reward cycles tend to induce selling pressure once rewards are claimed. SunPerp is Tron's entry into the market. Justin Sun announced SunPerp on Space, positioning it as Tron's first native Perp DEX, offering the lowest fees and minimal friction. It aims to convert Tron's massive USDT trading volume into Perp DEX trading volume. SunPerp is still in its early stages, but has already attracted approximately 3,000 users without any marketing or paid promotion.

Furthermore, it has committed to using 100% of protocol revenue for $SUN token buybacks to support holders.

Buybacks = good story, but actual revenue figures need to be seen. If revenue is low (because fees are low), then buybacks may be just tokens rather than strong value capture.

SunPerp is now more speculative. As users migrate for low fees and reduced friction, it may shine in the short term. However, maintaining this advantage will be more difficult (once other platforms match fees, or scaling costs rise).

Aster and Bullet: A hype machine ready to go

The launch of Aster is like watching fireworks:Based on BNB Chain and supported by key ecosystem players such as Binance founder CZ. On the first day of the TGE, trading volume reached approximately $371 million, with approximately 330,000 new wallet addresses added, and the total value locked (TVL) soared to approximately $1.005 billion. The $ASTER token itself saw a roughly 1,650% increase in value upon its initial launch, garnering both market enthusiasm and real attention. However, metrics post-day tell a more nuanced story. While TVL has fallen from a peak of over $2 billion to a few hundred million, daily trading volume remains high. DefiLlama shows its 24-hour trading volume reaching hundreds of millions of dollars (many snapshots show it at over $400 million to $500 million).

Aster’s open interest is rising, but it still lags behind the heavyweights: Aster’s futures open interest has ranged between $840 million and $900 million at certain times, which is very strong for a recently launched product, but still far behind Hyperliquid’s figures.

On Solana, Bullet is building what may be the fastest Perp DEX to date. While still in the testnet phase, Bullet claims to have a latency of approximately 2 milliseconds—orders of magnitude faster than Hyperliquid's hundreds of milliseconds. Backed by Zeta Markets, Bullet aims to integrate perpetual contracts, spot trading, and lending into a single, native Solana experience. Bullet is also running a testnet "Trading Cup" and similar airdrop-like events to encourage early traders and participants to join before the mainnet launch. While the testnet doesn't yet include all features, there are risks involved, but for traders who prioritize low latency and minimal slippage, the potential is enormous.

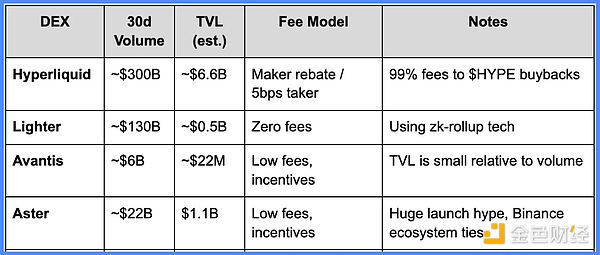

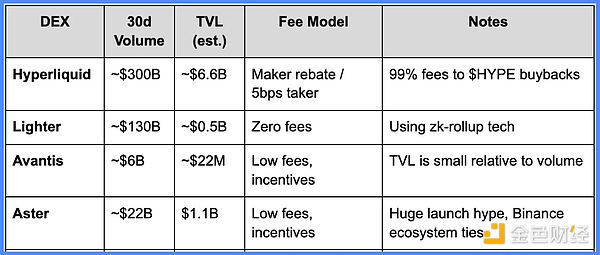

Key Data

Here is the current competitive situation:

Risks and Reality

Traders are earning fees, market makers are increasing trading volume, and exchanges are issuing high rewards. If users only come for the airdrop and leave once the rewards are exhausted, then trading volume will fall as quickly as it rose Liquidity risk is another key issue. For smaller exchanges, orders exceeding $10 million could distort order books and lead to slippage. Funding rates soared, with Aster experiencing an annualized long premium of 117% on the second day. This highlights the vulnerability of new perpetual swaps when hot money pours in. Of course, regulatory scrutiny looms: the larger these DEXs become, the more visible they become. Where the Competition Heads Next: The conclusion is simple: we're in an arms race. Hyperliquid set the standard; Lighter, Aster, and Bullet are all trying to outdo each other through fees, speed, or incentives. For users, this means a golden age of giveaways and near-free trading. For developers, it means finding a balance between growth hacking and sustainable economics. I expect consolidation. A few winners will seize stable liquidity and grow into true "DeFi exchanges," while dozens of smaller Perp DEXs will gradually decline or merge. The hallmarks of success are simple: a large and deep order book, sustainable returns for LPs, and a community that survives airdrops. Final Thoughts Right now, perpetual swap trading is a bit like a nightclub bash: everyone's handing out free drinks at the door, and Hyperliquid's music is the loudest. But when the bash is over, the only ones left will be those "nightclubs" with real business models.

JinseFinance

JinseFinance