SEC主席祝贺比特币白皮书16周年,Gary Gensler的强硬政策即将结束?

在美国证券交易委员会(SEC)主席Gary Gensler最近的一次采访中,他不仅表示将继续考虑如何监管加密货币,还罕见地预祝了比特币白皮书发布16周年。这是否暗示着他可能即将离职?

Weiliang

Weiliang

Author: Lyn Alden, Broken Money author; Translator: AIMan@Golden Finance

Over the past year or so, the Bitcoin ecosystem has been largely driven by the rise of Bitcoin treasury companies.

While Strategy (MSTR) pioneered this trend as early as 2020, subsequent adoption by other companies has been slow. However, after another round of bear and bull market cycles, and the Financial Accounting Standards Board (FASB) made major updates to the way Bitcoin is accounted for on balance sheets in 2023, 2024 and 2025 ushered in a new wave of companies adopting Bitcoin as a treasury asset.

This article explores this trend and analyzes its pros and cons for the entire Bitcoin ecosystem. In addition, this article explores the nature of Bitcoin as a medium of exchange rather than a store of value. In my opinion, this is often misunderstood from an economic perspective.

Back in August 2024, when this trend was still relatively unknown, I wrote an article titled "A New Perspective on Bitcoin Treasury Strategy" that explained the utility of Bitcoin as a corporate treasury asset. At the time, only a few companies were using Bitcoin on a large scale, but since then, a wave of new and old companies have adopted this strategy. Companies that adopted Bitcoin on a large scale at the time, such as Strategy and Metaplanet, have seen their prices and market capitalizations rise significantly.

The article explained why public companies should consider implementing this strategy. But what about investors? Why is this strategy so popular with them? From an investor's perspective, why not just buy Bitcoin directly? There are several main reasons.

Capital management firms manage trillions of dollars in capital, some of which have strict regulations.

For example, there are portfolio managers of some equity funds who can only buy stocks. He or she cannot buy bonds, ETFs, commodities, or other products. Only stocks. Likewise, there are bond funds where portfolio managers can only buy bonds. Of course, there are more specific rules, such as some managers can only buy healthcare stocks or non-investment grade bonds.

Some of these fund managers are bullish on Bitcoin. In many cases, they own some Bitcoin themselves. But they can't express that view by putting Bitcoin into a stock fund or bond fund because that would violate their duties. However, if someone created a stock with Bitcoin on its balance sheet, or issued a convertible bond for a stock with Bitcoin on its balance sheet, they could buy it. Portfolio managers can now express their bullish view on Bitcoin for themselves and their investors in their own funds. This is a previously untapped market that is gaining traction in the United States, Japan, the United Kingdom, South Korea, and other countries.

I'll use myself as a specific micro-case example of how Bitcoin Treasury can help achieve this. Since 2018, I have been running a model portfolio based on real money for my free public newsletter. It allows readers to transparently track my holdings.

In early 2020, I strongly recommended Bitcoin as an investment in my research service and bought some myself. In addition, I wanted to add some Bitcoin exposure to my Newsletter portfolio, but the brokerage firm I used at the time did not offer access to Bitcoin-related securities. I couldn't even buy Grayscale Bitcoin Trust (GBTC) for my model portfolio at the time because it was traded over the counter and not on a major exchange.

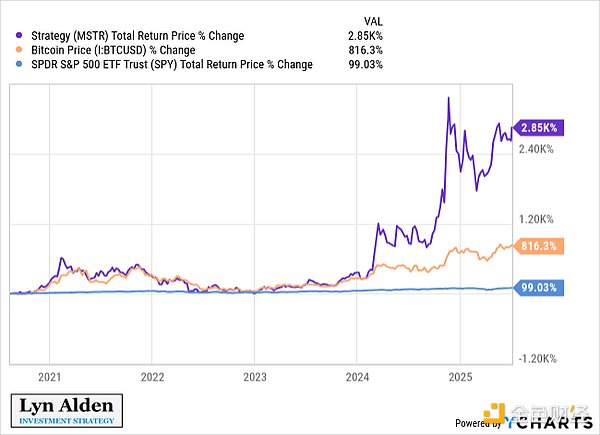

Fortunately, Strategy (then called MicroStrategy) added Bitcoin to its balance sheet in August 2020. MicroStrategy was trading on the Nasdaq at the time and was available to my model portfolio broker. Therefore, given the various restrictions I had for that particular portfolio, I was happy to buy MSTR in the Growth Stock sector to express my bullish view on Bitcoin. Since then, my portfolio has held a long position in MSTR, and it has been a wise decision for nearly five years:

Brokers eventually added GBTC as a security to buy, and of course, eventually added the major spot Bitcoin ETFs when they were listed, but I continued to hold MSTR in the portfolio (for the second reason described below).

In short, many funds can only hold stocks or bonds related to Bitcoin due to their authorization regulations, but cannot hold ETFs or similar securities. Bitcoin Treasury Company gave them the authority to invest in Bitcoin.

This is complementary to Bitcoin, not primarily competing with it, because Bitcoin is a bearer asset that individuals can keep in their own custody.

The basic strategy for public companies to adopt Bitcoin as a treasury asset is to hold some Bitcoin instead of cash equivalents. The first people to come up with this concept tend to have high confidence in the idea. Therefore, the current trend is not only to buy Bitcoin, but to buy Bitcoin with leverage.

In fact, public companies have better leverage capabilities than hedge funds and most other types of capital. Specifically, they have the ability to issue corporate bonds.

Hedge funds and some other capital pools often use margin loans. They borrow money to buy more assets, but if the value of the assets falls too low relative to the amount borrowed, they risk being called on margin. If asset prices fall too quickly, margin calls can force hedge funds to sell assets, even if they firmly believe they will rebound to new highs. Liquidating high-quality assets at a low point is a surefire disaster.

Companies, by contrast, can issue bonds, typically with maturities of multiple years. If they hold Bitcoin and the price of BTC falls, they don’t have to sell too soon. This makes them more resilient to market volatility than entities that rely on margin loans. While there are still some bearish scenarios that could force companies to liquidate, these scenarios require a longer bear market and are therefore less likely to occur.

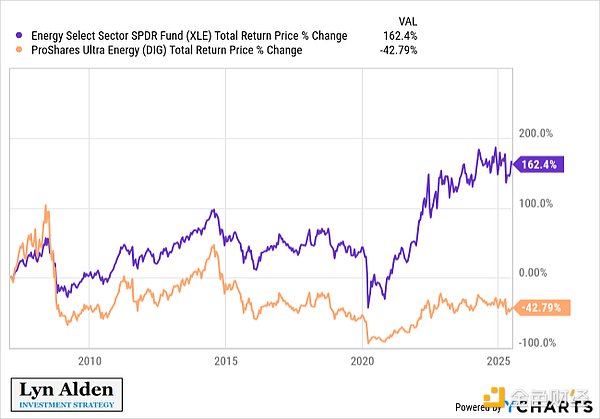

This longer-term corporate leverage is also typically longer-term than leveraged ETFs. Since leveraged ETFs don’t use long-term debt, their leverage is reset every day, so volatility is generally not in their favor. Fidelity has a great article that breaks down these numbers with examples.

The article includes a helpful chart showing how a 2x leveraged ETF performs when the underlying asset's yield fluctuates between +10% and -10%. Over time, the leveraged product will gradually depreciate relative to its leveraged index:

In fact, despite the increase in Bitcoin prices during this period, the 2x leveraged Bitcoin ETF BITU has not really outperformed Bitcoin since its inception. You might think that the 2x leveraged version would perform significantly better than Bitcoin, but it actually just increased volatility without delivering higher returns. In the same vein, if you look at the long-term history of more volatile equity sectors, like a 2x leveraged version of the Financials or Energy sectors, they have lagged far behind in volatile periods: style="text-align: center;">

So, unless you are a short-term trader, daily leverage is pretty bad. Volatility hurts this kind of leverage.

However, tying long-term debt to an asset does not usually lead to the same problems. An asset that is appreciating in value and tying it to multi-year debt is a powerful combination. Thus, Bitcoin Treasury is a useful security for those who are firmly bullish on Bitcoin and want to use reasonably safe leverage to extract returns.

Not everyone should use leverage, but those who do will naturally want to do so in an optimal manner. Currently, there is a wide variety of Bitcoin Treasury companies, with varying risk profiles, sizes, industries, jurisdictions, and more. This is a real market need that is being met over time.

Similarly, some of the securities issued by these companies, such as convertible bonds or preferred stocks, can provide exposure to the price of Bitcoin with lower volatility. Some investors may want higher volatility, while others may want lower volatility, and there is a wide variety of securities to choose from that can provide investors with the specific type of exposure they need.

Now that we know why they exist and the niche market they fill for investors, the next question is: Are Bitcoin Treasury Companies Good for the Bitcoin Network as a Whole? Does their existence itself undermine the value of Bitcoin as a free currency?

To determine whether Bitcoin Treasury Companies are good or bad for Bitcoin, we must first understand how decentralized currencies can theoretically become popular (if they do become popular). What steps need to be taken? In what general order?

As such, this section will contain two steps. The first step will be an economic analysis of how a new form of money could take off, i.e., what the path to success would look like. The second step will be an analysis of whether Bitcoin Treasury would facilitate or hinder that path.

What would it look like if it were a global, digital, sound, open-source, programmable currency that was monetized from absolute zero?

Ludwig Wittgenstein once asked a friend, “Please tell me why it is more natural for the sun to revolve around the earth than for the earth to revolve around itself?” The friend said, “Well, it’s obvious, because it looks like the sun revolves around the earth.” Wittgenstein replied, “Well, what would it look like if the earth did revolve around itself?”

As Bitcoin’s quadrennial bull run begins, we must prepare for a sudden and unexplained attention from the world. Many newcomers will come with open minds—as we did—but there will also be many disruptors emerging from the background insisting that what we are witnessing is not actually happening because, according to their theory, it simply cannot happen.

Bitcoin cannot be a store of value because it has no intrinsic value. It cannot be a unit of account because it is too volatile. It cannot be a medium of exchange because it is not widely used to price goods and services. These three properties make up the three major properties of money. Therefore, Bitcoin cannot be money. But Bitcoin has no other basis for value, so it is worthless. Proof Complete (QED).

I call this argument "semantics, therefore true." How can it be falsified? Fundamentally, it is a claim about the physical world; about what happens in real life, or in this case, what does not happen. Yet it seems to rely entirely on the meaning of words. Discussing Ecuador’s dollarization—the instructive process by which an “official” currency was spontaneously replaced by a simpler, superior one—Larry White says of those who, by definition, deny that such a thing could happen, “stare at the blackboard and not at what’s going on outside the window.” This is a strange way to understand a novel phenomenon, and one that I would not recommend, in general. Reality doesn’t care how you describe it.

—Allen Farrington, Wittgenstein’s Money, 2020

Bitcoin was launched in early 2009. Between 2009 and 2010, a few enthusiasts mined it, collected it, tested it, speculated on it, or figured out whether they could contribute to it or improve it in some way. They liked the idea of Bitcoin.

In 2010, Satoshi Nakamoto himself described on the Bitcoin Talk forum how the network was initially bootstrapped with some tiny initial value:

As a thought experiment, imagine there was a base metal as scarce as gold, but with the following properties:

– It’s a boring grey in colour

– It’s not a good conductor of electricity

– It’s not particularly strong, but also not ductile or easily forged

– It’s not suitable for any practical or decorative purposesAnd one special, magical property:

It can be transmitted over communications channelsIf it somehow, for whatever reason, acquired any value at all, then anyone who wanted to transfer wealth over a long distance could buy some, transmit it, and then have the recipient sell it.

—Satoshi Nakamoto, 2010, Re: Bitcoin does not violate Mises’s regression theorem

A year later, in 2011, Xapo founder Wences Casares used it for the same purpose. Here’s an excerpt from Masters of Scale Episode 56:

Wences Casares: We take a bus for a week every year, starting in Buenos Aires, around the world. We have a lot of fun. We just get together, drink yerba mate, and run lots and lots of miles.

Reid Hoffman (LinkedIn co-founder): This is Wences Casares, a serial entrepreneur from Argentina, and he’s taking us on our annual trip with a group of close friends. I want you to imagine this beloved bus. It looked like a school bus had crashed into an RV, then retired and lived in a Mad Max apocalyptic world. Before one of their epic trips, Wences learned that the bus had broken down. It wasn't hard to fix, but it was expensive. Especially since Wences lived in California at the time and the bus was in Argentina.

Casares: We had to send money to fix the bus, but Argentina had shut down all payment methods, including Western Union and PayPal. You could wire money to the central bank, but it was cumbersome and expensive.

Hoffman: It looked like their next trip would have to wait until Argentina's financial system was back on track. But that could take months, even years. Then a friend came up with a suggestion.

Casares: "Have you researched Bitcoin?"

Hoffman: Bitcoin. It was 2011, just two years after the online currency was launched. Wences was caught off guard.

CASARES: I was supposed to be a tech guy, I was supposed to be a finance guy, but I had never heard of this stuff before. I asked, "What is that?" He said, "Oh, well, it's a new currency that you can send money to anywhere without a third party." I was very skeptical and even a little cynical.

HOFFMAN: But the bus wasn't going to fix itself. Argentina's financial system wasn't going to fix itself anytime soon. So Vince decided to give Bitcoin a try. And that's when a mysterious journey began.

CASARES: I saw an old man on Craigslist who was willing to sell me $2,000 worth of Bitcoin, and he asked me to meet him at a coffee shop in Palo Alto. We met this guy who looked like Gandalf, and I gave him $2,000 in cash.

HOFFMAN: Vince wasn't entirely convinced by what Gandalf did next.

CASARES: He had me download an app, scan a QR code, and then he sent me supposedly $2,000 worth of bitcoin. I went back to the office, convinced I'd been scammed. Then I sent my friend $200—that was the amount I was supposed to send. After get off work that day, my friend said, "Hey, Vinces, I got the bitcoins and I sold them for pesos, and that's all." I was like, "What just happened?"

HOFFMAN: Vinces's view on bitcoin shifted.

CASARES: I got stuck—for six months—and I was very cynical at first. But after six months, I said, you know, I want to spend the rest of my life helping it succeed because I think a world where bitcoin works for billions of people is more important than a world where the internet succeeds.

Soon thereafter, Casares convinced a lot of big investors to buy bitcoin. His Wikipedia page currently describes it as follows:

Casares, widely known as “Patient Zero,” is the entrepreneur who convinced Bill Gates, Reid Hoffman (founder of LinkedIn), Chamath Palihapitiya (founder of Social Capital), Bill Miller (chairman of Legg Mason Capital Management), Mike Novogratz, Pete Briger (co-CEO of Fortress), and other Silicon Valley and Wall Street tech veterans to invest in Bitcoin, according to Quartz.

It’s much more than that. I personally know several people active in institutional finance who bought Bitcoin early on, either directly because Casares explained the value of Bitcoin to them or because of speeches he gave on Bitcoin.

The challenge for Bitcoin after some initial success is that the network spawned millions of competitors. Countless altcoins emerged, all with similar features, primarily being able to be bought, transferred, and sold by the recipient. The introduction of stablecoins in 2014, which allow for these operations using tokens collateralized by the dollar rather than free-floating units, helped smooth out volatility.

In fact, the rise of competitors was the biggest reason I didn’t buy Bitcoin in the early 2010s. I wasn’t against the concept (quite the contrary), but I thought the industry was 1) rife with speculative bubbles and 2) easily copied to oblivion. In other words, the supply of Bitcoin may be finite, but the idea is infinite.

But by the late 2010s, I noticed something: Bitcoin’s network effect was succeeding as a portable form of capital. It was breaking through that ceiling. Like a communications protocol (whether a spoken language, written word, or digital standard), money as a concept benefits greatly from network effects. The more people use it, the better it is for others to use it, and it’s self-reinforcing. And this is where the willingness to hold it really matters. This is also why the network effect must grow and become large to break through this niche and crowded stage.

In this context, we can divide currencies into two categories:

The first category of currencies are “situational currencies,” which are currencies that solve a specific problem but have not otherwise gained widespread traction.An asset that can be purchased with local currency, transferred across high friction points (capital controls, payment platform delisting, etc.), and sold/converted into local currency by the recipient is a situational currency. It has value, but success in this area does not necessarily lead to broader success.

The second category of currencies are “universal currencies,” which are currencies that are widely accepted within a specific region or industry.Importantly, recipients do not sell or convert the currency immediately after receiving it; they hold it as a cash balance and may then use it again elsewhere.

For something to be used as universal money, the user must already own it, and the recipient must be willing to hold it. It’s worth noting that people generally want more of something they already have. After all, if potential recipients want to hold it, they’ve probably already bought some. So if a new universal money emerges, most people will probably first view it as an investment, buy some because they think its purchasing power might appreciate, and then be willing to accept more of it as payment. At that point, they don’t need to be convinced to accept it as payment; they already like the asset, so whether they buy more of it or people just hand it over to them as payment is pretty much the same thing.

Bitcoin’s simple and secure design (proof of work, fixed supply, limited script complexity, modest node requirements, and decentralization left after the founder disappears) and first-mover advantage (bootstrapping network effects) give it optimal liquidity and robustness, so many people start wanting to buy and hold it. Bitcoin’s great success so far has been this: it’s a robust and portable store of value that users can choose to spend or redeem.

A sound, liquid, fungible, portable store of value that is somewhere between situational and universal money. Unlike situational money, it is increasingly seen as something worth holding for the long term, rather than selling/exchanging immediately after receiving it. But unlike universal money, it is not yet widely accepted in most areas, as the number of people who have taken the time to analyze it is still a minority. This is a necessary step to connect the two currencies, and I think it is a very long process.

The reason it takes so long to go through this stage is because of volatility, and because of the sheer size of the existing network effects, people's spending and liabilities are measured against it.

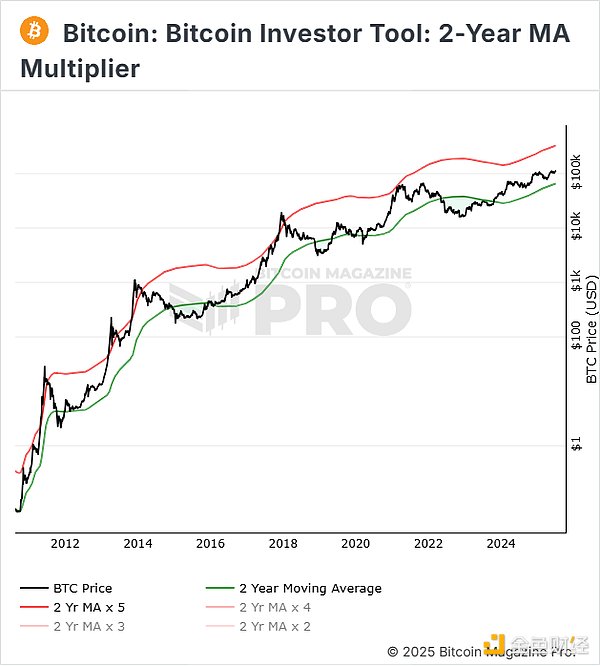

If a new monetary network with independent units (i.e. not pegged to an existing currency as a credit rail on it, but a completely parallel system with a central bank) is to grow from zero to huge volume, it needs to fluctuate upwards. Any appreciating asset with upward volatility will attract speculators and leverage, which will inevitably lead to a period of downward volatility. In other words, it would look like this:

In its adoption phase, Bitcoin’s value has soared from worthless to trillions of dollars, but it’s a rather flawed form of short-term money. If you receive some Bitcoin and want to use it to pay your rent at the end of the month (and you’re on a very tight budget, i.e. no extra cash), neither you nor your landlord can afford the possibility that Bitcoin drops 20% in a month. The landlord has expenses in the existing fiat currency network effect; she needs to know exactly what the value of the rent she’s receiving from her tenants is. And you, as the tenant, need to make sure you can pay your rent at the end of the month without that money being caught off guard by a rapid depreciation in value. The same goes for other living costs.

So, in this day and age, Bitcoin is primarily viewed as an investment. Hardcore enthusiasts are more likely to want to use it. People facing specific payment issues (capital controls, payment platform delisting, etc.) are also more likely to want to use it, even though they increasingly have similar liquidity options such as stablecoins. If you primarily use a stablecoin like a checking account for a few days, weeks, or months, then the centralized nature of stablecoins is irrelevant.

There are some very well-intentioned Bitcoin supporters trying to convince Bitcoin holders to spend more Bitcoin. I don't see this as a sustainable approach. Bitcoin is not going to become popular as a charity. In order for Bitcoin consumption to continue to become popular at a large scale (i.e., global medium of exchange transactions not just billions of dollars per year, but trillions of dollars), it must solve problems for consumers and/or recipients that other solutions have not yet solved. And at this stage of adoption, this is not necessarily the case, especially if capital gains taxes are imposed on every transaction and options like stablecoins can meet short-term spending needs because volatility needs to be reduced. The best advice I can give to these backers is that while educating people is good (keep up the work!), it’s important to manage expectations along the way and understand the economic path dependencies.

This is where the theme of optionality becomes important and, from what I’ve observed, is widely misunderstood or underestimated.

Having a reliable, liquid, fungible, portable store of value that is becoming ubiquitous gives holders advantages or options that other assets don’t have.The main thing is that they can take this store of value anywhere in the world without having to rely on central counterparties and credit. It also allows them to make cross-border payments, including to off-platform payees, without experiencing significant friction even if they stay where they are. They may not be able to pay with it everywhere, but if they need to, they can find ways to convert it into local currency in most environments, and in some cases even pay with it directly.

From this perspective, Bitcoin has been incredibly successful. To understand why, we first have to understand how shockingly unsalable most currencies are.

Imagine you're going to a random country. What currency or other portable, liquid, homogeneous bearer asset can you bring with you that will ensure you have enough purchasing power without relying on the global credit chain? In other words, all your credit cards are deactivated, how do you ensure you can still make transactions without some hassle and friction?

The best answer by far is usually physical dollars. If you carry dollars with you, while you may have trouble spending them directly at many types of merchants, it's easy to find merchants willing to exchange dollars for local currency at a reasonable exchange rate and with sufficient liquidity.

The second, third, and fourth best answers are probably gold coins, silver coins, and euros. Again, in most countries, it's not hard to find a broker willing to accept gold, silver, or euros and exchange them at a reasonable local price.

After that, it starts to fall rapidly: the Chinese yuan, the Japanese yen, the British pound, and a few other currencies make the top ten. These currencies tend to have more exchange friction. At this point, I think Bitcoin should be in the top 10, somewhere between 5 and 10, especially if you're going to be in a city center. Most cities will have plenty of exchange options that you can look for if you need to. That's pretty impressive considering Bitcoin is only 16 years old.

And then below that, there's the long tail of 160+ other fiat currencies. I often use the Egyptian Pound and the Norwegian Krone as examples because I go to Egypt every year and Norway every few years and always have some of their notes on me. These currencies do terrible outside of their home countries, as do most currencies.

Q: If you don't spend Bitcoin, do you treat it as currency?

A: Yes. Currency gives you liquidity options. Holding it is using it. Bitcoin is not yet a ubiquitous currency, so it serves the early stages as a hobbyist's currency, situational currency, and/or portable capital.

Q: When will it become a medium of exchange?

A: Probably not unless it scales an order of magnitude and becomes less volatile. Only a small percentage of people understand it and hold it as a store of value. It is a tiny percentage of global assets (about 0.2%). It can go up 100%+ in a year, or down 50%+. And because ubiquitous money is money you're happy to hold once you receive it (rather than quickly sell/redeem like situational money), mass adoption of a store of value often precedes mass adoption of a medium of exchange.

The market for mediums of exchange is very competitive. Stablecoins pegged to existing fiat currencies have the best chance of achieving scale in the next few years. The downside to stablecoins is that they lose value when someone wants to hold them for more than a few months, and can be censored/confiscated by the issuer or an institution with influence over the issuer, whereas no central authority has that power over Bitcoin.

Q: Is Bitcoin too volatile to be a currency?

A: Yes and no. Volatility is not an inherent property of Bitcoin, and it would not be if its various properties were unstable and changed frequently. Bitcoin's properties are quite persistent and robust. Volatility is something that the rest of the world has given it as it explores and adopts it.

Since the network is starting from scratch and stepping into a vast ocean of global capital, it needs upward volatility to develop. Sustained upward volatility creates excitement and leverage, followed by painful pullbacks and deleveraging events. Because of this, it is often viewed as a long-term investment at this stage. Unlike other investments, it also gives investors monetary capabilities through liquidity, portability, and divisibility, that is, it is a currency-type asset.

If it becomes larger and more widely held, its volatility will decrease, both upward and downward.

Q: If Bitcoin is denominated in US dollars, how can it be its own asset? Isn't it just a derivative of the US dollar?

Bitcoin is an asset that can be priced in any currency. It can be priced in any currency, and it can be priced in terms of goods and services. There is nothing about its code itself that is related to the dollar. It is usually priced in other currencies on foreign exchange exchanges, and traded peer-to-peer in other currencies.

The dollar is the most liquid currency in the world today. Smaller, less liquid assets are almost always priced in terms of larger, more liquid assets, not the other way around. People use the larger, more liquid monetary network as their unit of account, and denominate most of their liabilities in terms of that network, so it is their reference point.

Long ago, the dollar was defined by a certain amount of gold. Eventually, the dollar network became larger and more ubiquitous than gold, and the situation reversed: gold is now primarily priced in dollars. In the long run, Bitcoin may replace the dollar in this way, but it is far from there yet. It doesn't matter what Bitcoin is priced in; it is a bearer asset that can be priced in whatever the largest, most liquid currency is, and if it one day becomes the largest, most liquid currency, then other things will naturally be priced in terms of it.

While people are free to psychologically price in whatever currency they want, it’s unrealistic to expect most people to price in Bitcoin anytime soon. Critics have little reason to characterize this as a flaw in Bitcoin; there is no alternative to conventionally pricing an emerging decentralized currency asset in existing currencies while it is still small and growing.

Back in 2014, Pierre Rochard wrote a prescient article called “Speculative Attacks”.

Speculative attacks in the foreign exchange market involve borrowing a weak currency to buy more of a stronger currency or other high-quality asset. This is one reason why central banks raise interest rates to strengthen their currencies; it helps to disincentivize too rapid borrowing of their currencies relative to other currencies. When this doesn’t work well, some countries will turn to outright capital controls to prevent entities from arbitrage trading against their poorly managed currencies (and these capital controls themselves have economic costs, because who wants to do business in a country with tight capital controls when there are better options?).

Wikipedia provides a useful definition:

In economics, a speculative attack is when previously inactive speculators quickly sell off untrustworthy assets and correspondingly acquire some valuable asset (currency, gold).

—Wikipedia, July 2025, “Speculative Attack”

Well, Rochard describes in the article that, due to the appreciation properties of Bitcoin, eventually various entities will borrow money to buy more Bitcoin. At the time, the price of Bitcoin was just over $600, and the market cap was just over $8 billion.

Initially, borrowing money to buy Bitcoin was a fringe activity. But today, the Bitcoin network is extremely liquid, with a market cap of over $2 trillion, and it has entered mainstream capital markets on a massive scale, with billions of dollars of corporate bonds outstanding, specifically for the purpose of buying more Bitcoin.

Now, eleven years later, this still happens from time to time, is this a good or bad thing for the Bitcoin network?

From what I have seen, there are two main types of critics who think this is bad for the Bitcoin network.

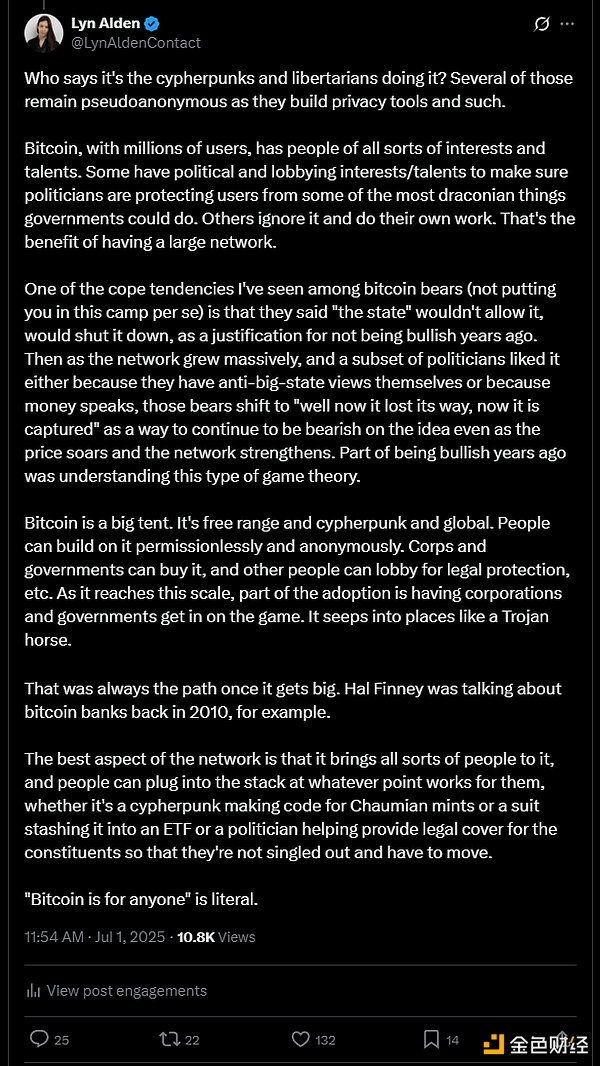

The first type of critics are part of the Bitcoin users themselves. Many of them belong to the cypherpunk camp, or the self-sovereign camp. To them, handing over Bitcoin to custodians seems dangerous, or at least contrary to the purpose of the network. I see some of them use the term “suitcoiners” to refer to Bitcoin treasury company supporters, which I think is a great term. The entire Bitcoin camp prefers that people hold their own private keys. Some of them go a step further and say that rehypothecation to major custodians could depress the price or otherwise undermine Bitcoin’s ability to succeed as free money. While I like the values of this camp (and I’m largely in it myself), some of them seem to have utopian dreams of everyone being as interested in full control of their own funds as they are. The second type of critics are usually people who have had a negative view of Bitcoin in the past. They question whether Bitcoin can succeed over the years. As Bitcoin continues to climb to new highs and become the best performing asset over the years and multiple cycles, some of them have changed their views instead and believe that “the Bitcoin price may be rising, but it’s already captured.” I take this camp less seriously than the first, viewing it primarily as a response. This is similar to the perpetual bears in the stock market who, when their bearish thesis hasn’t worked out after a decade, turn around and say, “The market is only going up because the Fed is printing too much money.” My response is, “Well, yeah, that’s why you shouldn’t be bearish.”

What I want to point out to both camps is that just because a few large pools of money choose to hold Bitcoin, it doesn’t mean that “free-range” Bitcoin is compromised in any way.It can be self-custodied and transferred peer-to-peer as usual. And, since many other types of entities hold Bitcoin, it makes the network larger and less volatile, thereby also increasing its utility as a peer-to-peer currency. It may also provide political cover, helping normalize the asset relative to policymakers who want to harm it. If Bitcoin reaches this scale, a lot of money buying Bitcoin is inevitable.

One of the skills of the perpetual bear (regardless of the asset being discussed) is to adjust the narrative when necessary so that no matter what happens, they are correct and the asset fails. For Bitcoin, this means creating a narrative where it has no viable path to success, and no reasonable definition of success. If it stays at the retail level? Then its price appreciation and ability to have a positive impact on the world are weakened - voila, it is failing! If it is adopted by large entities and governments and continues to grow massively? Then it is captured and lost!

But if it is to grow and become widely accepted, and to some extent change the world, how can that path not ultimately pass through corporations and governments? I was somehow reminded of the scene in The Notebook where Gosling keeps asking McAdams what she wants. The bull is Gosling, and the eternal bear is McAdams:

Bitcoin has gone through several major eras in terms of who is driving the price up and who is accumulating the fastest.

In the first era, people mined on their computers, or sent money to Japanese card exchanges (Mt. Gox) to buy, and other friction-filled early adopter type things. This was the ultra-early user era.

In the second era, especially after the Mt. Gox bankruptcy, Bitcoin became much easier to buy and use. Onshore exchanges made it easier than ever for people in many countries to buy Bitcoin. The first hardware wallets came out in 2014, making it safer to keep custody of Bitcoin yourself. This was the era of the retail buyer, and friction still existed, but was gradually decreasing.

In the third phase, Bitcoin became large and liquid enough, and had a long enough track record, to attract more institutional investors. Entities established institutional-grade custodians for it. Public companies began buying Bitcoin, and a variety of ETFs and other financial products emerged, providing investment opportunities for various funds and managed capital pools. Some nation-states, such as the Kingdom of Bhutan, El Salvador, and the United Arab Emirates, mined or purchased Bitcoin and held it at the sovereign level. Others, such as the United States, chose to hold confiscated Bitcoin rather than continue to sell it back to the market.

Fortunately—and this is important—each era contains the era before it. Although corporations currently account for the majority of net purchases, retail investors can still buy at will. It has never been easier to buy Bitcoin and keep it safely. There are now a wealth of resources explaining how to do it, there are multiple inexpensive and powerful wallet solutions, and on-chain transaction fees are currently low.

I see people saying, “I thought Bitcoin was supposed to be for the people, peer-to-peer cash. Now it’s all about big corporations.” Bitcoin is indeed for the people — anyone with an internet connection can buy, hold, or send it. The fact that large entities (also run by people) are buying it doesn’t invalidate it.

This is why I agree with the cypherpunks and suitcoiners. I want Bitcoin to be a useful, free currency, and that’s largely why I’m a general partner at Ego Death Capital. We fund startups that build solutions for the Bitcoin network and its users. It’s also why I support the Human Rights Foundation and other nonprofits, because they fund developers and educational institutions that are focused on providing financial tools to people in authoritarian or inflationary environments. However, once Bitcoin is figured out, it makes sense that a lot of capital would buy it, whether it’s corporations, investment funds, or sovereign entities. Bitcoin is large enough and liquid enough that it has now caught their attention.

It’s important to remember that most people are not active investors. They don’t buy individual stocks or deeply analyze the differences between Bitcoin and other cryptocurrencies. If they do speculate as a trader, they’ll likely buy at the highs and get wiped out at the lows. Investments are usually passively allocated to them, not selected by them. In the past, it was usually a pension. Today, it’s usually a 401(k) account automatically matched by an employer and combined with a variety of index funds, or a financial advisor picks investments for them.

In my opinion, it’s unrealistic to expect billions of people to actively flock to Bitcoin. However, it’s reasonable to work toward making it possible for anyone to choose to use Bitcoin, which can be achieved through technological solutions and educational resources that make barriers to entry as low as possible and reduce friction. Thanks to the efforts of many people, friction has never been lower.

The best way I’ve seen to put it is: “Bitcoin is for anyone, but not everyone.” What this means in practice is that everyone should be led to the water on this issue, but only a small percentage of people will choose to drink the water.

On the surface, the question of whether Bitcoin Treasury companies are good or bad for Bitcoin is almost irrelevant, because for Bitcoin of this scale, the existence of companies is inevitable.

Once this asset grows into a trillion-dollar liquid network, it will be difficult to expect it to belong only to individuals and not to companies or governments. As an open and permissionless network, anyone with access to the Internet can buy it. Therefore, if Bitcoin cannot succeed even if companies or governments buy it, then it will never succeed. This is like the science fiction alien invasion of the earth, which ultimately failed because it could not tolerate water ("Omens") or could not resist basic bacteria ("War of the Worlds"). It was never meant to be.

If I didn’t think the technical design and economic incentives of the Bitcoin network were strong enough to support large institutional purchases, I wouldn’t have bought it in the first place. In fact, that’s part of why I bought Bitcoin in the first place. I talked about this in my fireside speech at the 2023 Pacific Bitcoin Forum.

When we look past the surface and accept the inevitability of large entities emerging in the blockchain space, there are still many questions to ponder. What risks does it pose to the network if too many are acquired by corporations? If so, can these risks be mitigated in some way?

The main risk to consider is that Bitcoin could lose some of its decentralized properties if it becomes held by large amounts of capital.

While this concern is not negligible, I believe this risk is overstated because the network has strong antifragility. This is what has allowed it to survive to this day (16 years now) while remaining open and permissionless.

Bitcoin is a proof-of-work network, not a proof-of-stake network. In other words, holding a large amount of Bitcoin does not give the holder the power to censor transactions.

Bitcoin miners can censor transactions, but only if the vast majority of miners insist on doing so (i.e., most miners only mine on blocks where transactions have been previously censored, in addition to censoring transactions themselves). If they do censor transactions, these censored transactions can offer high fees to entice miners to switch mining pools or jurisdictions in order to uncensor the network and earn those fees. Furthermore, because Bitcoin mining is low margin and highly competitive, miners must go wherever there is a variety of cheap energy, which generally disperses the concentration of jurisdictions to a certain degree. This is a combination of simple but powerful technology and economic incentives.

Entities run nodes, which are software clients that run the Bitcoin network. No one can force users to run a certain type of node software or update it. It is not entirely impossible to change the Bitcoin network in a way that benefits a corporation or government at the expense of individuals, but it would be an extremely uphill battle compared to widely distributed software.

Bitcoin holders have always been large. In the early days, Mt. Gox was estimated to hold about 850,000 Bitcoins, when there were about half as many Bitcoins as there are today. Satoshi Nakamoto is estimated to hold over a million Bitcoins that he and others mined. As these Bitcoins have experienced multiple booms and busts over the past 16 years, it is widely believed that the private keys to these Bitcoins were burned or lost at the time.

Nevertheless, it is always best practice to monitor potential risks. Back in 2024, I collaborated with Ren of Electric Capital and Steve Lee of Block Inc (SQ) to write a paper analyzing Bitcoin consensus and its associated risks, and open sourced it as a living document so that it can be updated over time to reflect changing circumstances and other perspectives. You can view it here.

Critics of large institutions and sovereign Bitcoin holders can and should point out any bad behavior that exists. People can and should support or donate to legitimate causes or software development that they are interested in that can benefit small users. Like any public good, it relies on millions of individual participants working hard on areas they care about.

With the proliferation of spot ETFs and leveraged Bitcoin treasury companies, the biggest opportunity facing the Bitcoin network may be its transformation of retail exposure to Bitcoin.

Until recently, most users went to cryptocurrency exchanges to buy Bitcoin, only to be lured by casino-style marketing into buying altcoins instead. The vast majority of altcoins would only experience one big up cycle, after which they would flip and remain stagnant relative to Bitcoin forever, with late-stage retail investors eventually becoming arbitrageurs. However, in cycle after cycle, everyone is lured by marketing about “the next Bitcoin.” Read my “Digital Alchemy” article for more on this topic.

Right now, spot bitcoin ETFs and bitcoin treasury companies are more likely to be the first choice for people to get exposure to bitcoin than casino-like cryptocurrency exchanges. They will passively invest in bitcoin through index funds (as some bitcoin companies are now among the top indexes), they or their advisors may consider investing in spot bitcoin ETFs, etc. Some of these people may decide to further research and consider buying some bitcoins and taking care of them themselves to make the most of these assets.

Another use of altcoins historically is that people want to get bigger short-term gains than bitcoin can because of the larger overall size of the bitcoin network. Bitcoin is already one of the best performing assets of all time, but some people even want it to have more volatility.

Leveraged bitcoin companies offer a more volatile way for those who want to invest in bitcoin. As I mentioned before, the leverage used by bitcoin companies is generally higher than what individuals and hedge funds can get. Some leveraged bitcoin treasury companies will operate in a more conservative or more aggressive manner than others. If people really want to speculate and trade, they can even buy options on some of the most liquid Bitcoin treasury companies.

So, the outlook for altcoins has arguably never been bleaker.Given their generally poor track record, I think that's healthy. Right now, the altcoin industry seems to be running out of ideas on how to significantly improve their networks.It makes more sense to hold Bitcoin directly, and/or invest or speculate in companies that combine Bitcoin with the best leverage, rather than buying altcoins.

To summarize this long article, it's not surprising that the way Bitcoin monetization has developed so far is roughly as follows:

First, Bitcoin was originally just a collectible for enthusiasts and/or people with revolutionary dreams. It’s a brand new technology that may someday be valuable, or provide some value to people, depending on their level of conviction.

Second, Bitcoin is starting to become a useful medium of exchange in certain contexts, even for pragmatists who might not have paid attention to it.Need to send money to a country with capital controls, like Casares did? Bitcoin can succeed where other payment methods fail. Need to receive payments or donations, despite being banned from major online payment portals, like Wikileaks? Bitcoin may be a good solution. This establishes a somewhat new use case.

Third, high volatility, numerous competitors, and various frictions, such as capital gains taxes, have prevented Bitcoin from continuing to grow as a universal medium of exchange.While Bitcoin’s use cases are still growing, they are still relatively small compared to what some people expect 16 years later. If you use Bitcoin at a merchant who doesn’t hold Bitcoin and they automatically convert it to fiat currency, then Bitcoin’s advantages are not fully realized, and there is a limit to its usefulness for this use case. Friction exists at every currency exchange, and network effects are weak for “sell as you receive” assets/networks, leading to extremely fierce competition at this stage.

Fourth, Bitcoin is more widely recognized as an ideal portable, value-added capital. Unlike other cryptocurrencies, it has achieved a level of decentralization, security, simplicity, scarcity, and scale that makes it attractive and worth holding for many years. This is where the network effect is even stronger. While it is not always easy to buy coffee with Bitcoin, it has begun to rank among the top ten bearer assets that can be carried abroad and exchanged for local value, surpassing the vast majority of more than 160 fiat currencies in this regard.

Fifth, the Bitcoin network has achieved sufficient liquidity, scale, and longevity to attract active attention from companies and governments. A large pool of managed capital is interested in the asset, and companies and funds also provide them with indirect access. At the same time, Bitcoin continues to exist as an open and permissionless network, which means that individuals can continue to use it and build on it.

Then we can look at two more layers that could lead if the network continues to scale:

Sixth, as the Bitcoin network continues to grow in size, liquidity, and volatility, interest in it from large sovereign entities grows.What started out as a small sovereign fund investment could eventually become a currency reserve or a method of large-scale international settlement. While countries continue to try to build closed-source alternative payment methods, with few adoption or acceptance, this open-source settlement network with a limited supply of its own independent units is gradually gaining momentum around the world.

Seventh, as Bitcoin grows larger, more liquid, and less volatile, it becomes more attractive to hold in the short term, potentially becoming a more common medium of exchange.This is only possible if a large number of people holding Bitcoin have become accustomed to it and its purchasing power can be trusted in both the short and long term.

Overall, I still think Bitcoin is in good shape technically and economically, and its adoption path is expanding as expected.

在美国证券交易委员会(SEC)主席Gary Gensler最近的一次采访中,他不仅表示将继续考虑如何监管加密货币,还罕见地预祝了比特币白皮书发布16周年。这是否暗示着他可能即将离职?

Weiliang

Weiliang彭博社报道称,俄罗斯正试图通过在金砖国家内部使用比特币等加密货币来绕过西方制裁。此前,俄罗斯曾表态金砖国家将利用加密货币推动投资与经济发展。

Weiliang

WeiliangNorth Korean hackers are targeting crypto investors worldwide with a convincingly designed gaming site featuring AI-generated content. They have invested substantial resources into promoting this game, allowing them to exploit a zero-day vulnerability in Google’s Chrome browser that reportedly drains users’ wallets.

Catherine

CatherineRipple CEO Brad Garlinghouse revealed that Citigroup terminated his banking relationship due to his involvement in the crypto industry, highlighting the growing issue of de-banking for crypto professionals. He criticised the Biden administration's regulatory stance and expressed optimism for a more favourable crypto environment after the upcoming presidential elections.

Anais

AnaisDenmark will tax unrealised crypto gains from January 2026, covering holdings since Bitcoin's 2009 launch. While aligning with traditional asset taxes, it sparks debate: prudent regulation or risky precedent?

Kikyo

KikyoA mother is suing Character.AI after her 14-year-old son became emotionally attached to a chatbot, leading to his tragic suicide. The lawsuit claims the chatbot fostered unhealthy dependence and failed to provide proper support when he expressed suicidal thoughts.

Joy

JoyThe fraudsters stole $21.6 million from 40,000 investors to fund a lavish lifestyle, including $100,000 on sex workers. Some were sentenced, others acquitted, with investigations ongoing.

Catherine

CatherineEl Salvador's President Nayib Bukele donated two Bitcoins, worth about $134,000, to help build 1,000 schools in Honduras, a country facing poverty and educational challenges. The donation was received by philanthropist Shin Fujiyama, who co-founded Students Helping Honduras and is currently running a charity run in El Salvador to raise funds for the initiative.

Weatherly

Weatherly随着日本央行即将召开货币政策会议,市场关注是否会延续今年7月的升息政策。不过,路透社近日报道称,央行在本月再次升息的可能性较低,主要原因包括国内外经济不确定性及即将举行的日本国会选举等。

Weiliang

WeiliangVietnam has launched a national blockchain strategy aimed at becoming a leader in blockchain technology by 2025, focusing on improving infrastructure, developing regulations, and fostering innovation. The plan includes establishing 20 prominent blockchain brands, building three testing centers, and positioning Vietnam among the top ten blockchain research hubs in Asia by 2030.

Anais

Anais