Foreword

As the core component connecting traditional finance and the crypto asset ecosystem, the strategic position of stablecoins is constantly rising. From the earliest centralized custody model (USDT, USDC) to the stablecoins issued by the protocol itself and driven by on-chain synthesis and algorithmic mechanisms (such as Ethena's USDe), the market structure has changed fundamentally.

At the same time, the demand for stablecoins from DeFi, RWA, LSD and even L2 networks is also expanding rapidly, further promoting the formation of a new pattern of coexistence, competition and collaboration of multiple models.

This is no longer a simple market segmentation issue, but a deep competition about the "future form of digital currency" and "on-chain settlement standards". This report focuses on the main trends and structural characteristics of the current stablecoin market, systematically sorting out the operating mechanisms, market performance, on-chain activity, and policy environment of mainstream projects, to help effectively understand the evolutionary trends and future competitive landscape of stablecoins.

Stablecoin market trends

1.1 Global stablecoin market value and growth trend

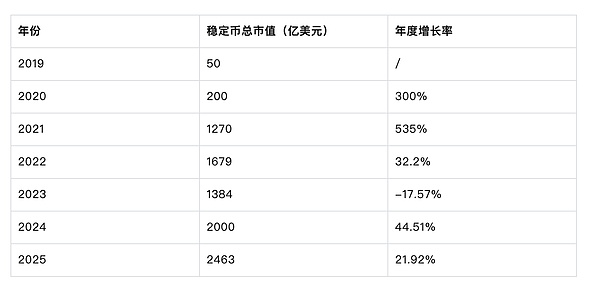

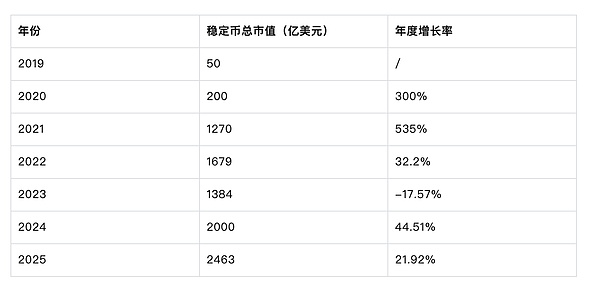

As of May 26, 2025, the global stablecoin market value has climbed to approximately US$246.382 billion (approximately RMB 2.46 trillion), an increase of approximately 4927.64% from approximately US$5 billion in 2019, showing an explosive growth trend. This trend not only highlights the rapid expansion of stablecoins in the cryptocurrency ecosystem, but also highlights its increasingly irreplaceable position in payment, trading and decentralized finance (DeFi).

In 2025, the stablecoin market will continue to maintain rapid growth, with a market value of 78.02%compared to the market value of

in 2023, and currently accounts for

7.04%of the total market value of cryptocurrencies, further consolidating its core position in the market. The following table shows the annual data and growth of the stablecoin market value from 2019 to 2025:

Trend Insights:

2019-2022:The market value of stablecoins surged from $5 billion to $167.9 billion, a 32-fold increase, mainly driven by the outbreak of the DeFi ecosystem, increased demand for cross-border payments, and market risk aversion.

2023:The market value fell back by 17.57%, mainly due to the collapse of TerraUSD (UST) and tightening global crypto regulation.

2024-2025:The market value rebounded strongly, up 78.02%, reflecting the increase in institutional participation and the continued expansion of DeFi applications.

1.2 Recent growth drivers

Macro-financial environment:

Against the backdrop of increasing global inflationary pressures and financial market turmoil, investors’ demand for “on-chain cash” has risen significantly. The U.S. Treasury Department has defined stablecoins as “on-chain cash”, providing policy logic support for its absorption of traditional capital. At the same time, when crypto assets fluctuate violently, stablecoins are also seen as safe havens.

Technological progress and cost advantages:

Some efficient public chains represented by Tron have significantly reduced transaction costs. USDT transfers on the Tron chain are almost free of fees, attracting a large number of trading users. High-throughput blockchains such as Solana also help expand the use of stablecoins due to their high speed and low fee characteristics.

Institutional adoption is enhanced:

In 2024, BlackRock issued the BUIDL tokenized fund based on USDC settlement to explore the on-chain of assets such as bonds and real estate, highlighting the importance of stablecoins in institutional-level settlement. According to OKG Research, under the optimistic scenario of the gradual rollout of the global compliance framework and widespread adoption by institutions and individuals, the global stablecoin market supply will reach 3 trillion US dollars in 2030, with monthly on-chain transaction volume reaching 9 trillion US dollars, and the annual transaction volume may exceed 100 trillion US dollars. This means that stablecoins will not only be on par with traditional electronic payment systems, but will also occupy a structural foundation in the global clearing network. In terms of market value, stablecoins will become the "fourth type of basic currency assets" after government bonds, cash, and bank deposits, and become an important medium for digital payments and asset circulation.

DeFi demand pull:

Citibank pointed out that stablecoins are the "main entrance" of DeFi, and their low volatility makes them the first choice for value storage and trading. The Chainalysis report shows that stablecoins account for more than two-thirds of on-chain transactions and are widely used in scenarios such as lending, DEX liquidity provision and mining. In 2024, the TVL (locked volume) of leading DeFi protocols such as Uniswap and Aave increased by about 30%, with USDC and DAI as the main trading pairs. After the 2024 US election, the market value of stablecoins increased by US$25 billion, further verifying its core role in the DeFi scenario.

Stablecoin market structure and competition landscape

2.1 Market concentration and overall pattern

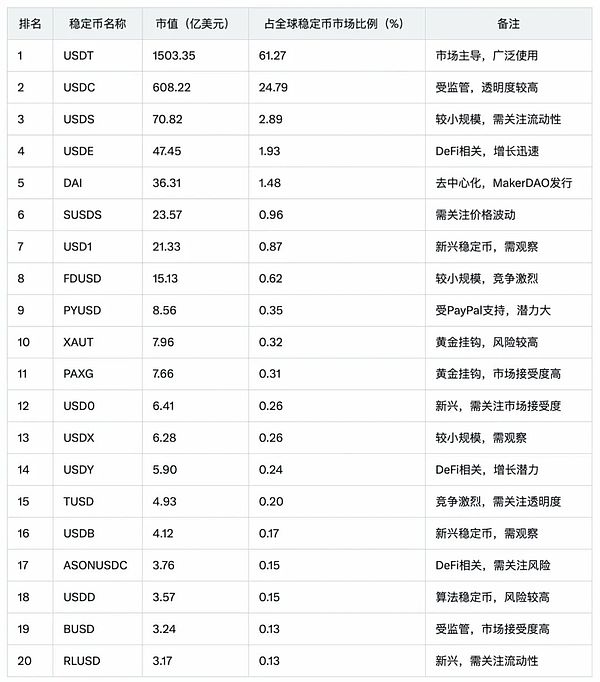

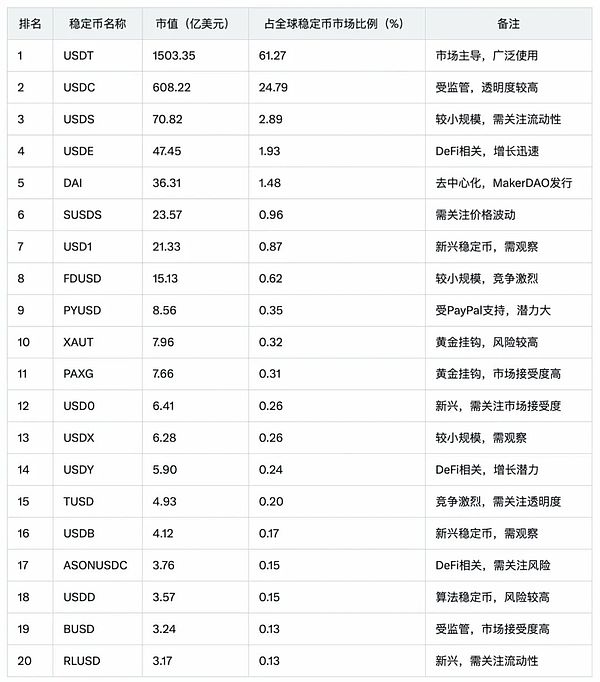

Currently, the stablecoin market is highly concentrated. The market value of Tether (USDT) has reached 150.335 billion US dollars, accounting for 61.27%; the market value of USD Coin (USDC) is 60.822 billion US dollars, accounting for 24.79%. The combined market share of the two is as high as 86.06%, forming a duopoly. Despite this, emerging stablecoins are gradually rising to challenge the dominant position. For example, USDE launched by Ethena Labs has grown from US$146 million at the beginning of 2024 to US$4.889 billion, an increase of more than 334 times, becoming the fastest growing stablecoin. In addition, USD1 (US$2.133 billion) and USD0 (US$641 million) also showed a good market expansion trend, but it is not enough to shake the dominant position of USDT and USDC in the short term.

The following is the market capitalization ranking of the top 20 stablecoins in the world. The data comes from (5.16) CoinGecko:

2.2 Analysis of Competition Landscape

Market competition mainly unfolds between three types of stablecoins:

Legal currency-collateralized stablecoins:USDT and USDC are backed by US dollar reserves and have an advantage over centralized exchanges and traditional finance with transparency and compliance (such as USDC's monthly audit). For example, USDT added $30 billion in market value in 2024, demonstrating its market trust.

Decentralized Stablecoins:USDE became a popular trading pair on Uniswap in 2024 through its synthetic dollar mechanism and native income model, and its locked position increased by 50% (DefiLlama), rapidly rising in the DeFi ecosystem; while DAI relies on MakerDAO's decentralized governance to attract DeFi users, but its scale is relatively small, at only $3.631 billion.

Emerging stablecoins: USD1 has rapidly expanded to $2.133 billion through institutional endorsements (such as Binance investment); USD0 attracts users with DeFi incentive mechanisms, with a market value of $641 million.

Others: The collapse of TerraUSD (UST) in 2022 led to a trust crisis in algorithmic stablecoins, prompting the market to tilt towards more transparent fiat-collateralized stablecoins, and USDC's market share will increase by about 10% between 2023 and 2024.

2.3 The logic of the rise of USDE

USDE is a synthetic dollar stablecoin based on Ethereum, developed by Ethena Labs, using staked Ethereum (stETH) as collateral and adopting a delta-neutral hedging strategy to maintain its peg to the US dollar. Its rapid growth can be attributed to the following factors:

Innovative income mechanism

USDE provides holders with high returns through the "Internet Bond" function, which comes from the staking income of stETH and the funding rate difference in the perpetual contract market. This high-yield model has attracted a large number of DeFi users and institutional investors, especially in a low-interest environment, where traditional financial products find it difficult to provide similar returns.

Deep Integration of DeFi Ecosystem

USDE's wide support on DeFi platforms (such as Uniswap, Curve) makes it one of the preferred stablecoins for DeFi users. Users can easily trade, provide liquidity, or participate in lending without worrying about price fluctuations. DefiLlama data shows that the locked volume of USDE on Uniswap has increased by 50%, reflecting its important position in the DeFi ecosystem.

Decentralized and Censorship-Resistant Features

As a stablecoin based entirely on crypto assets, USDE does not rely on the traditional financial system, which is significantly attractive to users who pursue decentralization, especially in some regions where traditional financial services are limited or restricted.

Growth in Market Demand

With the expansion of DeFi and the cryptocurrency ecosystem, the demand for stablecoins continues to increase. As an innovative, fully decentralized stablecoin, USDE meets the market's demand for new stablecoin solutions.

Institutional Support and Cooperation

Ethena Labs' collaboration with well-known crypto investment institutions such as DragonFly Capital and Delphi Ventures and exchanges such as Binance has enhanced market confidence and liquidity in USDE.

Marketing and Community Engagement

Ethena Labs quickly attracted the attention of users and developers and promoted the adoption of USDE through effective marketing strategies and community incentive programs (such as the airdrop of governance tokens ENA).

2.4 Challenges of Emerging Stablecoins

USD1: USD1, issued by World Liberty Financial (WLFI), has a market value of US$2.133 billion and ranks 7th. Its market value soared from US$128 million to US$2.133 billion in just one week, with a rapid growth momentum.

WLFI is associated with the Trump family and has received $200 million in investment from Binance and MGX, which has enhanced institutional endorsement. The New Money report pointed out that USD1 was selected as the settlement currency for major transactions, such as the Pakistani government cooperation project, further enhancing its market influence.

USD1 has expanded rapidly through exclusive agreements and institutional adoption, but its political background may raise regulatory risks.

USD0: USD0 issued by the Usual platform has a market value of $641 million and ranks 12th. Usual Blog introduced that it attracts users through the USUAL token incentive mechanism, allowing holders to participate in governance and share platform revenue.

USD0 combines the low volatility of stablecoins with the profit potential of DeFi, attracting users who focus on decentralized innovation.

USD0's unique positioning in the DeFi ecosystem brings it growth potential, but it needs to improve market awareness and liquidity.

Emerging stablecoins challenge the market through differentiated strategies (such as institutional endorsement or DeFi incentives), but it is difficult to shake the dominant position of USDT and USDC in the short term.

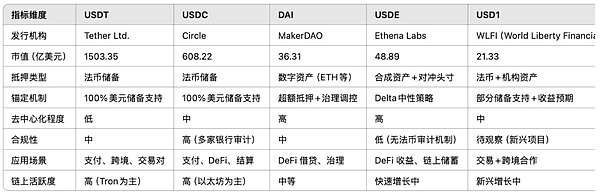

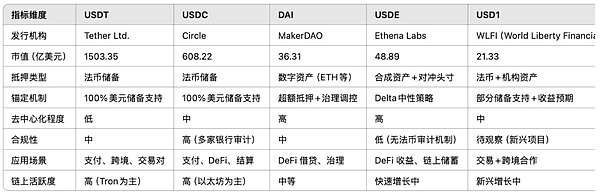

Analysis and comparison of mainstream stablecoins

This section systematically analyzes and compares the top five mainstream stablecoins (USDT, USDC, DAI, USDE, USD1) by current market value from the dimensions ofmechanism structure,asset support type,liquidity and application scenarios, andrisk points.

3.1 Core parameter comparison table

3.2 Liquidity and trading pair distribution

USDT, USDC and other mainstream stablecoins have extremely sufficient liquidity, and there are deep trading pairs on most mainstream exchanges (Coinbase, Binance, OKX, etc.) and decentralized trading platforms. They cover almost all major public chains: USDT/USDC can be traded on Ethereum, Tron, Solana, BSC, Polygon and other chains; while emerging stablecoins (such as USD1, FDUSD) are mainly launched on specific public chains (such as Tron, Solana, etc.) and some centralized exchanges in the early stage. The Tron network recently introduced zero handling fees for USDT, further increasing the transaction volume and liquidity of USDT on the chain. Overall, USDT and USDC are the most globally liquid stablecoins, while the liquidity of other stablecoins is concentrated in specific ecosystems and exchanges.

Stablecoins are the "bridge assets" of the multi-chain ecosystem, and their activity directly reflects the payment capabilities, liquidity and real user usage of each chain. The current issuance of stablecoins is mainly concentrated on leading assets such as USDT (Tether), USDC (Circle), DAI (MakerDAO) and emerging USDE (Ethena). The following is based on public chain data, focusing on the four mainstream public chains of Ethereum, TRON, Solana, and BSC, and comparing key indicators such as active addresses, number of transactions, single transaction amount and user stickiness (retention rate) of stablecoins in the past 30 days:

The technical form of stablecoins will no longer be limited to the "on-chain IOU" model, but will evolve towards a more underlying native chain clearing and settlement tool:

Judgment: In the long run, stablecoins will gradually get rid of their identity as "bank asset mapping objects", evolve into trusted settlement units on the chain, and become an important value anchoring layer for L2/L3 economies.

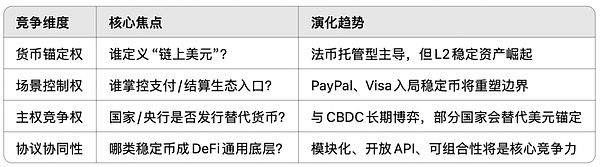

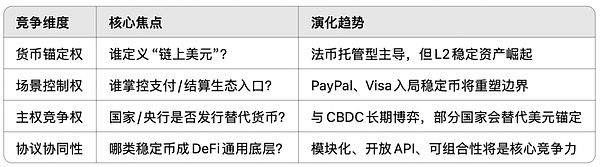

6.2 Evolution of the competition landscape: from "anchoring to the US dollar" competition to the triple confrontation of "scenario, sovereignty and protocol"

The competition in stablecoins will move away from the single market value and circulation competition and turn to multi-dimensional structural competition:

Judgment: The core of the future stablecoin competition is not "whose US dollar is the most stable", but who can become the "preferred liquidation asset" and "payment entrance" for DeFi protocols and on-chain economies.

6.3 Narrative Upgrade and Ecological Binding: From “Stability” to “Network Native Currency Layer”

With the rise of AI Agent, RWA mapping, and on-chain settlement accounts, the narrative of stablecoins is also upgrading:

From “trading pairs” to “liquidity engines”: Stablecoins are replacing ETH/BTC to become the absolute axis of the liquidity pool; projects like Ethena USD and USD0 emphasize “internal production capacity and system control” and will become the new generation of DeFi “underlying currency”.

Deeper binding with RWA: In the future, stablecoins will not only map to T-Bill, but will also be deeply integrated with on-chain government bonds, on-chain credit bonds, and on-chain commercial bills; Circle, Ondo, and Matrixdock are promoting the "on-chain bonds + stablecoin" dual-wheel model.

"settlement bottom layer" in the on-chain account system: After the rise of Account Abstraction, MPC wallets, and Layer 2 payment networks, stablecoins will becomethe default asset of the AI Agent payment account; for example: Agent accepts a task → automatically requests stablecoins → completes the task → settles with stablecoins → AI continues to execute, and stablecoins become "agent-native currency".

Conclusion

Stablecoins have evolved from early trading media to the liquidity cornerstone and value anchoring core of the entire crypto economy. Whether it is the mainstream centralized stablecoins (USDT, USDC), decentralized stablecoins (DAI, LUSD), or AI-driven synthetic coins with structural innovations (USDE, USD0), they are constantly exploring the balance between stability, security and scalability.

The development of stablecoins not only reflects the technological innovation and institutional evolution of Web3, but is also becoming part of the digitalization of the global monetary system. In the future, stablecoins will no longer be "encrypted dollars", but a bridge in the multi-center financial world, and a carrier of credit and autonomous experiments.

Kikyo

Kikyo