Article:Zeping Macroeconomics Team

A wave driven by stablecoins, reshaping the global asset and payment landscape, has arrived. This article aims to systematically analyze five core investment opportunities across the upstream, midstream, and downstream of the stablecoin industry, accurately identifying the value of this historic and transformative sector.

The core of upstream investment lies in coinage and the cornerstone of trust. Stablecoin issuance represents the most clearly defined and lucrative segment of the entire market. Its cost-free scale-up model, coupled with the interest rate spread on reserves, has generated over tens of billions of dollars in annual profits for global giants. Custodian institutions, acting as the safe havens for the stablecoin ecosystem, have also provided incremental revenue certainty for many traditional giants and emerging digital banks. Midstream opportunities are concentrated at the entrance of stablecoin traffic. Future exchanges will be the core hubs for stablecoin circulation, and some of the world's leading trading platforms have already established a moat of top-tier traffic and liquidity. Furthermore, with the influx of institutional capital and the booming regional markets, more licensed exchanges are expected to be the first to realize the scarcity value dividend of compliance. Downstream stablecoin application scenarios will explode in the future. Among them, the on-chain circulation of trillions of physical assets represented by RWA is the largest application scenario driven by stablecoins. In the future, new infrastructure and new energy will realize the tokenization of traditional assets, greatly improving asset liquidity and information transparency, and opening up a new asset class for investors. At the same time, stablecoin + cross-border payments are also posing a fundamental challenge to the traditional SWIFT system with their low-cost and high-efficiency advantages, bringing clear strategic opportunities to licensed payment institutions, hardware suppliers, and large e-commerce technology giants. The stablecoin wave provides investors with investment opportunities across the entire value chain, from infrastructure to application scenarios. Understanding the core drivers and key players in different upstream, midstream, and downstream links is the key to seizing the dividends of the next generation of financial transformation. 1. Investment Opportunities in the Upstream Stablecoin Industry: Issuance and Custody Investment opportunities in any emerging industry begin at the source of value creation. Issuance and custody, upstream of the stablecoin sector, together form the cornerstone and anchor of trust upon which the entire ecosystem relies. Stablecoin issuers are the starting point of the ecosystem, with a proven profit model worthy of attention. Opportunity 1: Stablecoin Issuers, the Starting Point of the Stablecoin Ecosystem The business model of stablecoin issuers deserves attention. This is the clearest and most direct profit model in the entire sector, centered on cost-free deposit collection and interest rate spread profits. When a user exchanges $100 for 100 stablecoins, that $100 becomes the issuer's reserve. Since stablecoins don't pay interest to users, this essentially amounts to a cost-free deposit for the issuer. The issuer then invests this substantial reserve in highly liquid and safe assets like short-term U.S. Treasury bonds. The interest generated, after deducting operational costs like custody and auditing, constitutes the issuer's net profit. This model, when scaled to hundreds of billions of dollars in reserves, yields extremely profitable returns. For example, Tether, the world's largest stablecoin issuer, with a team of just 100, boasts reserve assets exceeding $140 billion by the end of 2024 and an annual net profit exceeding $13 billion, surpassing Citigroup. The vast majority of this income comes from investment income on the reserves, with a smaller portion coming from transaction fees on fiat-to-stablecoin conversions. Globally, stablecoin issuance currently forms a duopoly, with more expected to enter the market in the future. Tether and Circle are the two largest stablecoin issuers, with USDT and USDC holding over 90% of the market share. Both issue stablecoins committed to a 1:1 USDT peg, but differ in their positioning and profit models.

From a positioning perspective, Circle takes a compliant and transparent approach, which is more in line with regulations, and has strict and regular audit reports: since January 2023, it has cooperated with Deloitte to have the latter conduct monthly audits of its reserve certificates and publish public reports. Tether, on the other hand, takes a market-oriented approach, so the transparency of USDT reserves has always been a focus of market controversy. Tether occasionally publishes reserve audit reports, but these reports often lack detailed information and rigorous review by independent third parties. In October 2021, Tether was fined $41 million by US regulators for reserve issues. The two major stablecoin issuers also exhibit significant differences in their profit models: On the revenue side, Tether (USDT) has a more diversified reserve asset structure. The 2024 audit report shows that Tether holds approximately $143.7 billion in USDT redemption reserve assets, primarily invested in six categories. Cash equivalents (primarily US Treasuries) account for over 80%, 5% in Bitcoin, and the remainder in corporate bonds, precious metals, and secured loans. Circle (USDC) reserves, on the other hand, primarily consist of cash and short-term US Treasuries, with 80% invested in US Treasuries and 20% in cash deposits. On the cost side, Circle incurs higher compliance costs and platform fees. Not only does it have to maintain a massive compliance team of over 800 people and pay monthly audit fees to Deloitte, but it also has to pay up to 55% of its reserve earnings to the trading platform. In comparison, Tether has lower costs and doesn't have to share any profits with the platform. As a result, Tether exhibits higher profit margins. In 2024, its reserves will be $143.7 billion, with a net profit of $13.7 billion, primarily from investments. Of this, investments in gold and Bitcoin contributed approximately $5 billion in profits, government bonds contributed approximately $7 billion, and other traditional investments contributed approximately $1 billion. In contrast, Circle's reserves are $37 billion, a quarter of Tether's size, but its net profit in 2024 was $156 million, less than one percent of Tether's. With the imminent implementation of Hong Kong's Stablecoin Ordinance, a group of potential local issuers are emerging, offering an opportunity to capture the "next Circle." On July 18, 2024, the Hong Kong Monetary Authority officially announced the participants of the Stablecoin Sandbox Program, marking the imminent launch of Hong Kong's stablecoin ecosystem. A sandbox is a security mechanism in computer security that provides an isolated environment for program execution, allowing for technical testing in a controlled environment. Participating in the sandbox program and potential future stablecoin issuers include JD CoinChain Technology, Yuanbi Innovation Technology, and Standard Chartered Bank. JD CoinChain Technology may develop the JD-HKD stablecoin; Yuanbi Innovation Technology is developing the HKDR stablecoin; and Standard Chartered Bank, along with Anmi Group and Hong Kong Telecom, is jointly developing the HKDG stablecoin pegged to the Hong Kong dollar. In June of this year, news broke that Ant Digits, a subsidiary of Ant Group, would apply for a stablecoin license in Hong Kong, suggesting a potential stablecoin issuer. Opportunity Two: Custodians, Key to the Trustworthiness of the Stablecoin Ecosystem Stablecoin custodians are financial institutions responsible for the safekeeping of stablecoin reserve assets. They are key to the entire stablecoin ecosystem and directly impact market trust in stablecoins. For example, during the collapse of Silicon Valley Bank in March 2023, Circle (USDC) held 8% of its reserves there, triggering a market run and sell-off. Stablecoin issuers are required to deposit their corresponding fiat currency reserves with licensed custodians. These custodians ensure the safe storage, transparent management, and compliance of reserve assets, and charge custody fees, thus potentially benefiting from the stablecoin boom. Custodians play a crucial role in the ecosystem and therefore face high regulatory requirements. From a policy perspective, Hong Kong's Stablecoin Ordinance requires that reserve assets be held independently, separate from the issuer's own business assets. Issuers can manage their reserves themselves or delegate management to institutions such as banks, subject to regular verification, auditing, and disclosure. Similarly, the US GENIUS Act also stipulates that reserve assets must be segregated from the issuer's operating funds and held by a qualified third-party custodian. The reserve composition and value must be disclosed to the public monthly, audited quarterly by an independent accounting firm, and annual reports must be submitted to regulators and made public. The responsibilities of a custodian include asset custody, fund segregation, audit disclosure, and liquidity management. Asset custody involves the custodian holding the stablecoin issuer's reserve assets to ensure a 1:1 peg. Fund segregation is a regulatory requirement, requiring the custodian to separate reserve assets from its own assets to prevent misappropriation risks. The custodian must also undergo regular independent audits and disclose the reserve asset composition to the market to enhance transparency. Traditional financial giants and emerging digital banks have begun developing stablecoin custody services. For example, Circle entrusts approximately 86% of its reserves to Bank of New York Mellon as custodian and BlackRock as administrator, creating a new growth trajectory for their traditional businesses. Tether has confirmed a partnership with Deltec Bank & Trust Limited, a 72-year-old financial institution headquartered in the Bahamas. In Hong Kong, ZhongAn Bank has become the first digital bank to provide reserve banking services to a stablecoin issuer, collaborating with sandbox program participant Yuanbi Innovation Technology. Another industry trend worth noting is issuer "self-custody." Once an issuer obtains a banking license, the stablecoin becomes more than just a payment tool; it possesses its own financial infrastructure. Circle officially announced that it has submitted an application to the U.S. Office of the Comptroller of the Currency to establish a national trust bank, First National Digital Currency Bank. Upon approval, Circle will self-custody over $60 billion in reserves. In January 2021, Anchorage became the first truly compliant national trust bank for digital assets in the United States. If Circle's application is successfully approved, it will become the second digital currency bank to hold a national trust license. 2. Investment Opportunities in the Midstream of the Stablecoin Industry: Stablecoin Trading Institutions The midstream of the stablecoin industry focuses on core hubs that provide deep liquidity, diversified trading scenarios, and secure clearing services for stablecoins: exchanges. This is the core link that connects upstream issuance with downstream applications, enabling large-scale value circulation and price discovery. Opportunity Three: Stablecoin Exchanges, the Core of the Circulation Chain Exchanges are the primary venues for stablecoins to fulfill their function as a "universal medium of exchange." Exchanges not only provide basic deposit and withdrawal services between fiat and stablecoins, but also have established a vast ecosystem of stablecoin-based trading pairs, such as BTC/USDT and ETH/USDC, providing pricing and liquidity for thousands of crypto assets. Furthermore, derivatives trading settled in stablecoins further amplifies the pivotal value of stablecoins. For investors, this sector has clearly diverged, forming three key areas of focus. Focus Area 1: Global Top Exchanges Already Possess Superior Traffic and Liquidity In the stablecoin and cryptocurrency trading sector, network effects are significant, and the market presents a highly concentrated oligopoly. Exchanges with traffic advantages are worthy of attention. According to TokenInsight's Q2 2025 report, Binance, OKX, Bybit, and Bitget are the four leading exchange platforms, with spot and derivatives market shares of 35.39%, 14.34%, 12.26%, and 11.45%, respectively. All of these exchanges support stablecoin services, and these four leading exchanges collectively hold over 70% of the market share. These platforms, with their vast user base, top-tier trading depth, and diverse product offerings, possess high trading liquidity and a significant competitive advantage. Focus Area 2: Participants that Meet Regulatory Compliance Requirements With the gradual entry of institutional capital and the increasingly clear regulatory framework, trading volume alone is no longer the sole criterion for measuring an exchange's value. Compliance and credibility are becoming core competitive advantages in attracting incremental capital. Forbes' January 2025 ranking of the world's most trusted crypto exchanges used compliance, security, and financial health as core evaluation criteria. CME Group topped the list, with Coinbase and Bitstamp ranking second and third, respectively. Other exchanges on the list include Binance, Robinhood, Kraken, Crypto.com, Fidelity, Bitget, OKX, HTX, and Bybit. CME Group, a traditional exchange that has long been considered a symbol by investors, ranked first because it offers products such as Bitcoin futures, Ethereum futures, and options based on these futures within the globally regulated cryptocurrency derivatives market. This trend suggests that compliant exchanges that earn the trust of institutional investors will be more highly valued in the next phase of stablecoin trading competition. Focus Area 3: The "License" Benefits of Regionally Compliant Exchanges: Taking Hong Kong as an Example Hong Kong is actively building an international financial center for the Web3 ecosystem, and those licensed by local regulators are worthy of attention. To ensure market security, Hong Kong implements a strict licensing system for virtual asset trading platforms, and 11 institutions have currently received licenses. Licensed platforms such as OSL and HashKey have already established a certain first-mover advantage in serving both institutional and retail investors. For investors, regional exchanges that are the first to embrace regulation and obtain local licenses are expected to be the first to realize the benefits of the license by attracting regional compliant capital inflows.

3 Downstream Investment Opportunities in the Stablecoin Industry: Key Application Scenarios

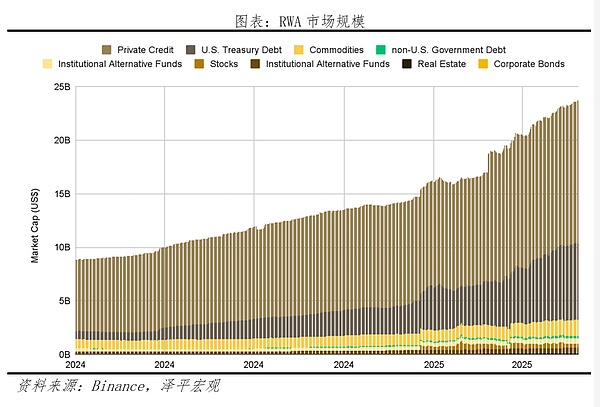

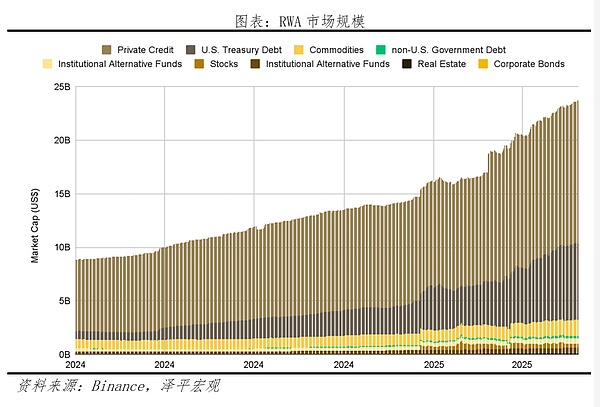

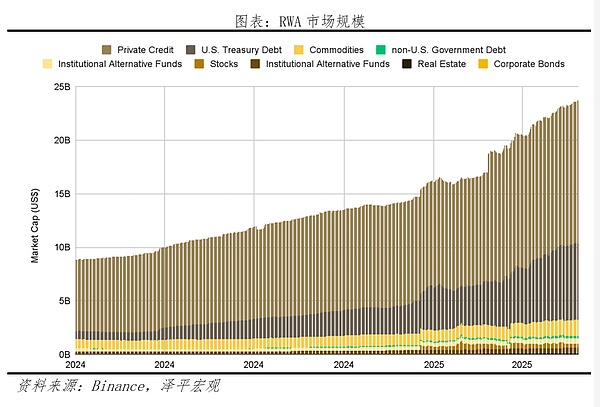

For investors, downstream application scenarios represent a relatively clear trajectory for stablecoins. Using stablecoins to revitalize and restructure the vast physical assets of traditional finance and to enable cross-border payments at a certain scale presents new opportunities that truly represent a paradigm shift. Opportunity Four: The Largest Application Scenario: Stablecoins + RWAs, Bringing Trillions of Assets to the Blockchain RWAs, or the tokenization of real-world assets, have been called the "third revolution in asset management," and their ecosystem is growing rapidly. As of June 2025, global RWA assets have exceeded $23 billion. Boston Consulting Group predicts that by 2030, the global RWA market will reach $16.1 trillion, representing 10% of global GDP. RWAs specifically refer to the process of converting physical or financial assets in traditional financial markets into digital tokens through blockchain technology, enabling these assets to be recorded, traded, transferred, and managed on a blockchain network. RWAs and asset securitization share certain similarities and can be considered an on-chain version. The overall process consists of three key steps: Off-chain title confirmation: confirming asset ownership and assessing value through legally compliant procedures. On-chain mapping: mapping asset rights to the blockchain and generating corresponding tokens. On-chain governance: automating management such as profit distribution and pledge liquidation through smart contracts. Stablecoins have become an accelerator of the RWA ecosystem, their core function being to provide a stable pricing and payment method for RWA transactions. Stablecoins maintain a 1:1 peg to fiat currency, making them an ideal medium for RWA transactions and pricing. Unlike the more volatile cryptocurrencies like Bitcoin and Ethereum, stablecoins provide a fundamentally stable value scale, allowing investors to focus on the fundamentals of the underlying assets rather than the volatility of the denomination currency. For investors, the greatest significance of the RWA stablecoin lies in its broadening of the investment universe. Traditionally illiquid assets, such as real estate, art, private equity, and intellectual property, can be tokenized and broken down into smaller units and put on-chain, thus achieving sufficient liquidity. In the future, standardized financial products like stocks and bonds may also create a new on-chain market, further enhancing investor asset allocation flexibility. Compared to traditional financial financing, RWA offers a significant advantage in significantly increasing the transparency of project financing and reducing information asymmetry between investors and projects. This offers three key advantages for investors: First, it enables the on-chain transfer of information at the source. Infrastructure projects are typically large-scale, involve multiple parties, and have long construction cycles. Under traditional financing models, data from the design, construction, and operation phases is fragmented, leaving financial institutions reliant on audit reports or secondary information from rating agencies. The RWA model leverages the Internet of Things (IoT) and blockchain to log key operational data (such as charging station usage, photovoltaic power generation, and battery swap frequency) onto the blockchain in real time, creating a single, tamper-proof, and fully verifiable data source. This effectively breaks open the black box, significantly reducing information asymmetry. Secondly, it provides full process traceability. Traditional bond or loan disclosures are often limited to the offering prospectus and quarterly and annual financial statements, making it difficult for investors to track the specific flow of funds and the real-time status of assets. RWA uses smart contracts to automatically record every cash flow, maintenance history, and profit distribution, with timestamps and hash values ensuring that any modifications remain traceable. For infrastructure projects, which often have a lifecycle of over ten years, this continuous audit capability significantly outperforms traditional static disclosures. Third, investors can directly verify. Traditionally, investors can only trust the endorsement of banks, rating agencies, or governments. RWAs slice the underlying assets into tradable tokens, allowing anyone to query their real-time performance through a block explorer without having to wait for regular reports from issuers or intermediaries. This not only improves transparency but also shortens the information transmission chain and reduces moral hazard. As green energy and other infrastructure projects increase in the future, investment in my country's green energy RWA projects will gradually become more active. For example, in August 2024, Longxin Group partnered with Ant Digital to complete China's first RWA project based on new energy physical assets. This project bundled the revenue rights of 1.2 million charging piles across 28 provinces and cities nationwide, leveraging Ant Chain's cross-chain technology to synchronize operational data, including charging volume and revenue, to the Hong Kong issuance chain in real time. Another example is GCL Energy. In December 2024, GCL Energy partnered with Ant Digital to complete China's first RWA project for photovoltaic assets, with a total investment of 200 million RMB. The underlying assets consisted of 82MW of photovoltaic power plants serving 12,000 households in Hubei and Hunan provinces. Power generation data was uploaded to the blockchain via smart meters, with the data being posted daily no later than 8:00 AM the following day. Daily settlement was achieved through smart contracts, with proceeds automatically converted into USDC and distributed to investor wallets. In March 2025, the Cruise Eagle Group launched my country's first RWA project deployed on a public blockchain platform. Ant Digital partnered with Cruise Eagle to package approximately 4,000 electric vehicle battery swap cabinets from Cruise Eagle Mobility, a subsidiary of Cruise Eagle Group, into the RWA project. TreeGraph Blockchain Research Institute provided technical support for the public blockchain platform. These cabinets, located in over 20 cities across China, contain over 40,000 lithium batteries and have been used for over 50 million battery swaps.

Opportunity Five: Important application scenarios, stablecoins + cross-border payments, challenging the traditional system

The application of stablecoins in the field of cross-border payments is posing a fundamental challenge to the traditional payment system with its significant efficiency and cost advantages. Its advantages are twofold: First, it improves transaction efficiency. While traditional cross-border payment methods (such as SWIFT) typically require time for settlement, stablecoins enable near-instant peer-to-peer settlement. Second, it significantly reduces transaction costs. According to World Bank data, settlement costs using stablecoins can be reduced to less than one-tenth of traditional methods. Different types of companies are tapping into cross-border payment applications based on their respective strengths. Focus Area 1: Licensed Payment Institutions Leverage Compliance Advantages to Build Settlement Networks. A group of fintech companies holding cross-border payment licenses are leveraging their compliance credentials and business experience to pioneer stablecoin settlement services. For example, Lakala, a third-party payment institution, is the only one in China with a full cross-border RMB license. Its Hong Kong subsidiary also holds an MSO (Money Service Operator) license, making it well-suited to handling cross-border settlement needs for stablecoins. Focus Area Two: Hardware and Technology Suppliers: Controlling Offline Access and Laying the Foundation for Circulation. The transformation of the payment ecosystem has also extended to hardware and technology. Suppliers are upgrading their infrastructure to pave the way for the offline circulation of stablecoins. For example, Newland, one of China's leading POS terminal suppliers, has expanded its smart POS devices to 120 countries worldwide. Its terminals are the first to integrate digital RMB hard wallet functionality, laying the technical foundation for future expansion into offline real-time stablecoin exchange scenarios and becoming key circulation nodes. Focus Area Three: E-commerce and Tech Giants Focus on B2B Stablecoin Scenarios to Optimize Their Ecosystems Large tech and e-commerce platforms are more focused on leveraging stablecoins to optimize their vast B2B and supply chain finance ecosystems, with the core goal of improving internal capital turnover efficiency. For example, JD Technology, through its subsidiary, is participating in the Hong Kong Stablecoin Sandbox, aiming to explore the use of stablecoins for direct settlements with suppliers in Asia Pacific, the Middle East, and other regions, shortening traditional settlement cycles from days to minutes. Ant Group, through its international business unit, is focusing on leveraging new technologies such as stablecoins to empower its global supply chain finance and cross-border payment businesses.

JinseFinance

JinseFinance