Abstract: I have been a bit busy at work recently, so I have delayed the update for a while. Now I have resumed the weekly update frequency. Thank you for your support. This week, I found an interesting strategy in the DeFi field that has received widespread attention and discussion. That is, using Ethena's pledge income certificate sUSDe in Pendle's fixed income certificate PT-sUSDe as a source of income, and using the AAVE lending agreement as a source of funds to conduct interest rate arbitrage and obtain leverage income. Some DeFi Kols in the X platform have made relatively optimistic comments on this strategy, but the author believes that the current market seems to ignore some of the risks behind this strategy. Therefore, I have some experience to share with you. In general, the PT leveraged mining strategy of AAVE+Pendle+Ethena is not a risk-free arbitrage strategy. The discount rate risk of PT assets still exists, so participating users need to objectively evaluate, control the leverage ratio, and avoid liquidation.

Analysis of the mechanism of PT leveraged income

First, let me briefly introduce the mechanism of this income strategy. Friends who are familiar with DeFi should know that as a decentralized financial service, DeFi’s core advantage compared to TradFi is the so-called "interoperability" advantage brought about by using smart contracts to carry core business capabilities. Most DeFi experts, or DeFi Degens, usually have three jobs:

Explore interest rate arbitrage opportunities between DeFi protocols;

Find sources of leveraged funds;

Explore high-interest and low-risk income scenarios;

The PT leveraged income strategy more comprehensively embodies these three characteristics. This strategy involves three DeFi protocols, Ethena, Pendle and AAVE. These three are all popular projects in the current DeFi track, and only a brief introduction is given here. First of all, Ethena is a yield-based stablecoin protocol. Through the hedging strategy of Delta Neutral, it captures the short-selling rate in the perpetual contract market in centralized exchanges with low risk. In the bull market, due to the extremely strong demand for long positions by retail investors, they are willing to bear higher rate costs, so the yield of this strategy is higher, of which sUSDe is its yield certificate. Pendle is a fixed-rate protocol. Through the method of synthetic assets, the yield certificate token with a floating yield is decomposed into a Principal Token (PT) and a yield certificate (YT) with a similar zero-interest bond. If investors are pessimistic about future interest rate changes, they can lock in the interest rate level in the future by selling YT (or buying PT). AAVE is a decentralized lending protocol. Users can use designated cryptocurrencies as collateral and borrow other cryptocurrencies from AAVE to achieve the effects of increasing capital leverage, hedging or shorting.

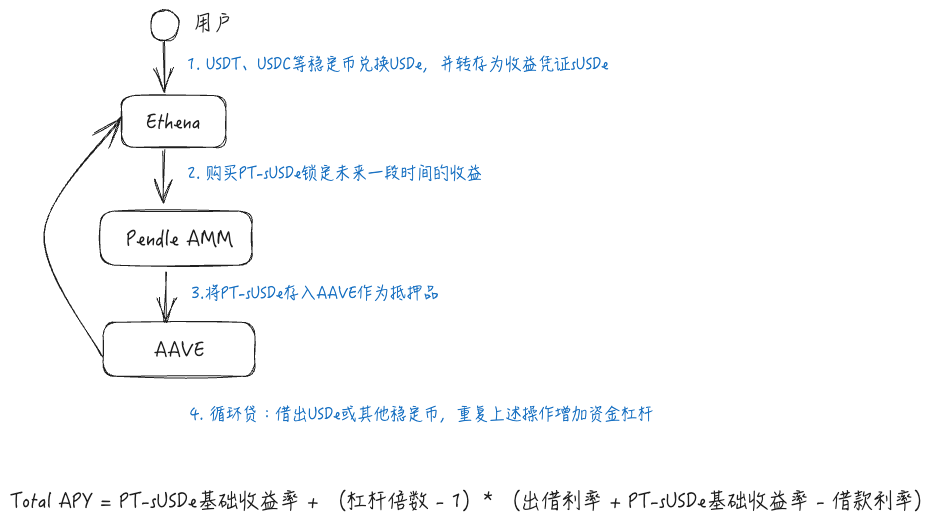

This strategy is the integration of the three protocols, that is, using Ethena's pledge income certificate sUSDe in Pendle's fixed income certificate PT-sUSDe as a source of income, and using the AAVE lending protocol as a source of funds to conduct interest rate arbitrage and obtain leverage income. The specific process is as follows: first, users can obtain sUSDe from Ethena, and completely convert it into PT-sUSDe through the Pendle protocol to lock the interest rate. Next, deposit PT-sUSDe into AAVE as collateral, and borrow USDe or other stablecoins through revolving loans, repeat the above strategy, and increase capital leverage. The calculation of income is mainly determined by three factors: the basic yield of PT-sUSDe, the leverage multiple, and the interest rate spread in AAVE.

Market status and user participation of the strategy

The popularity of this strategy can be traced back to the recognition of PT assets as collateral by AAVE, the lending protocol with the largest amount of funds, which released the financing capacity of PT assets. In fact, before this, other DeFi protocols have already supported PT assets as collateral, such as Morpho, Fuild, etc., but AAVE, with more abundant loanable funds, can provide lower borrowing rates, which amplifies the yield of this strategy, and AAVE's decision is more symbolic.

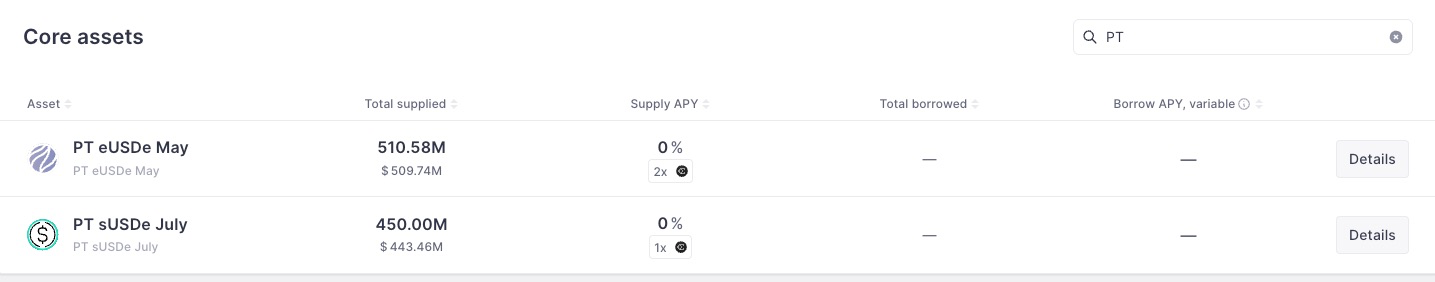

So since AAVE supported PT assets, the pledged funds have risen rapidly, which also shows that this strategy has been recognized by DeFi users, especially some whale users. Currently, AAVE supports two PT assets, PT sUSDe July and PT eUSDe May, and the total supply has reached about $1B.

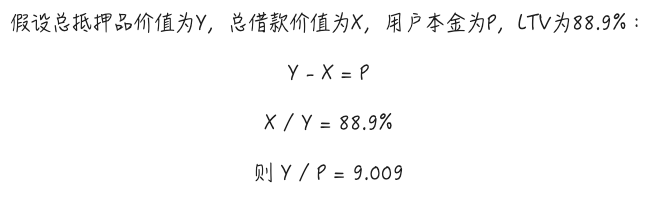

The maximum leverage ratio currently supported can be calculated based on the Max LTV of its E-Mode. Taking PT sUSDe July as an example, the Max LTV of this asset as collateral in E-Mode is 88.9%, which means that through revolving loans, the leverage ratio can theoretically be about 9 times. The specific calculation process is shown in the figure below. That is to say, when the leverage is the largest, excluding the flash loan or fund exchange costs caused by Gas and revolving loans, taking the sUSDe strategy as an example, the theoretical rate of return of the strategy can reach 60.79%. And this rate of return does not include Ethena points rewards.

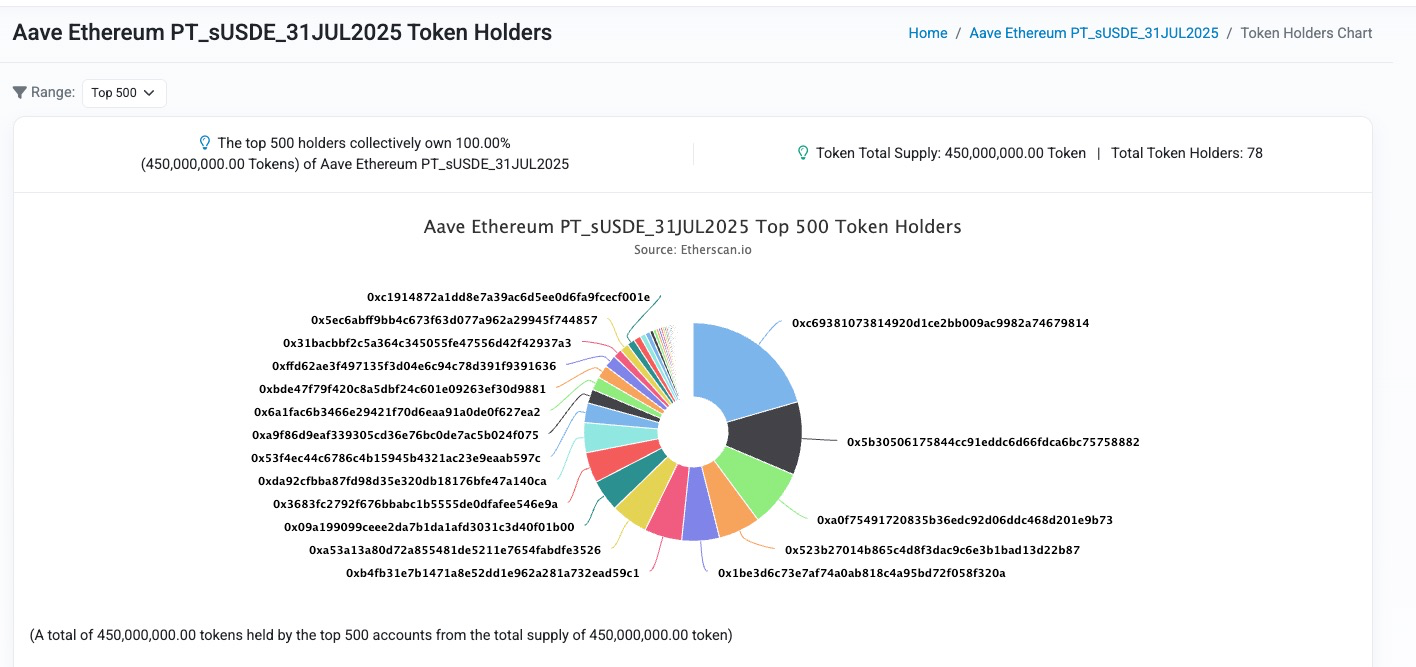

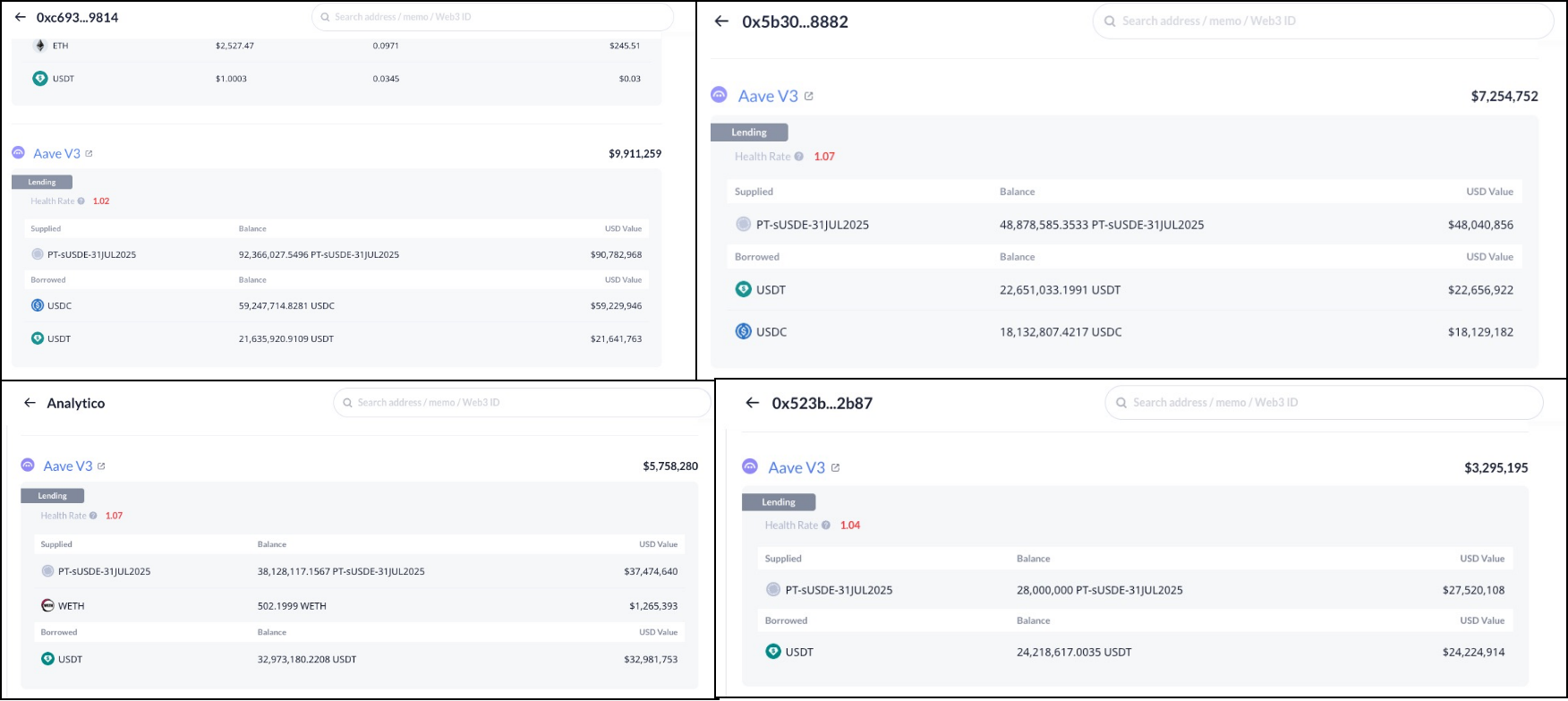

Next, let's take a look at the actual distribution of participants, still taking the PT-sUSDe fund pool on AAVE as an example. The total supply of 450M is provided by 78 investors. It can be said that whales account for a high proportion and the leverage ratio is not small.

Looking at the top four addresses, the leverage ratio of the first account 0xc693...9814 is 9 times, and the principal is about 10M. The leverage ratio of the second account 0x5b305...8882 is 6.6 times, and the principal is about 7.25M. The leverage ratio of the third analytico.eth is 6.5 times, and the principal is about 5.75M. The leverage ratio of the fourth account 0x523b27...2b87 is 8.35 times, and the principal is about 3.29M.

Therefore, we can see that most investors are willing to allocate higher capital leverage to this strategy. However, I think that the market may be a bit too aggressive and optimistic. This kind of emotional and risk perception bias will easily cause large-scale stampede liquidation. Therefore, let's analyze the risks of this strategy.

Discount rate risk cannot be ignored

I have seen that most DeFi analysis accounts will emphasize the low-risk characteristics of this strategy, and even label it as a risk-free arbitrage strategy. However, this is not the case. We know that there are two main risks in leveraged mining strategies:

Exchange rate risk: When the exchange rate between the collateral and the borrowing target becomes smaller, there will be liquidation risk, which is easier to understand because the collateral rate will become lower in this process.

Interest rate risk: When the borrowing interest rate rises, it may cause the overall return of the strategy to be negative.

Most analyses believe that the exchange rate risk of this strategy is extremely low, because as a more mature stablecoin protocol, USDe has experienced market tests and its price decoupling risk is low. Therefore, as long as the borrowing target is a stablecoin type, the exchange rate risk is low. Even if decoupling occurs, as long as the borrowing target is USDe, the relative exchange rate will not drop significantly.

However, this judgment ignores the particularity of PT assets. We know that the most critical function of the lending agreement is to achieve timely liquidation to avoid bad debts. However, PT assets have a concept of duration. During the duration, if you want to redeem the principal assets in advance, you can only trade at a discount through the AMM secondary market provided by Pendle. Therefore, transactions will affect the price of PT assets, or affect the PT yield. Therefore, the price of PT assets is constantly changing with transactions, but the general direction will gradually approach 1.

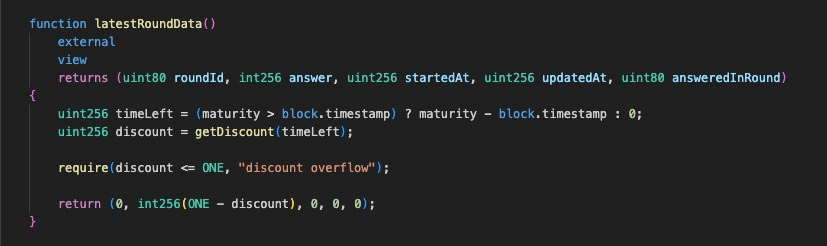

After clarifying this feature, let's take a look at AAVE's design of PT asset price oracle. In fact, before AAVE supported PT, the strategy mainly used Morpho as a source of leveraged funds. In Morpho, the price oracle for PT assets adopted a design called PendleSparkLinearDiscountOracle. Simply put, Morpho believes that during the bond life, PT assets will earn returns at a fixed interest rate relative to the original assets, and ignore the impact of market transactions on interest rates, which means that the exchange rate of PT assets relative to the original assets is increasing linearly. Therefore, the exchange rate risk can be naturally ignored.

However, in the process of researching the oracle solution for PT assets, AAVE believes that this is not a good choice, because the solution locks the yield and cannot be adjusted during the life of the PT asset, which means that the model is actually unable to reflect the impact of market transactions or changes in the underlying yield of PT assets on PT prices. If market sentiment is bullish on interest rate changes in the short term, or there is a structural upward trend in the underlying yield (such as a sharp rise in the price of incentive tokens, a new profit distribution plan, etc.), the oracle price of PT assets in Morpho may be much higher than the actual price, which may easily lead to bad debts. In order to reduce this risk, Morpho usually sets a benchmark interest rate that is much higher than the market interest rate, which means that Morpho will actively lower the value of PT assets and set a wider fluctuation space, which will lead to the problem of low capital utilization.

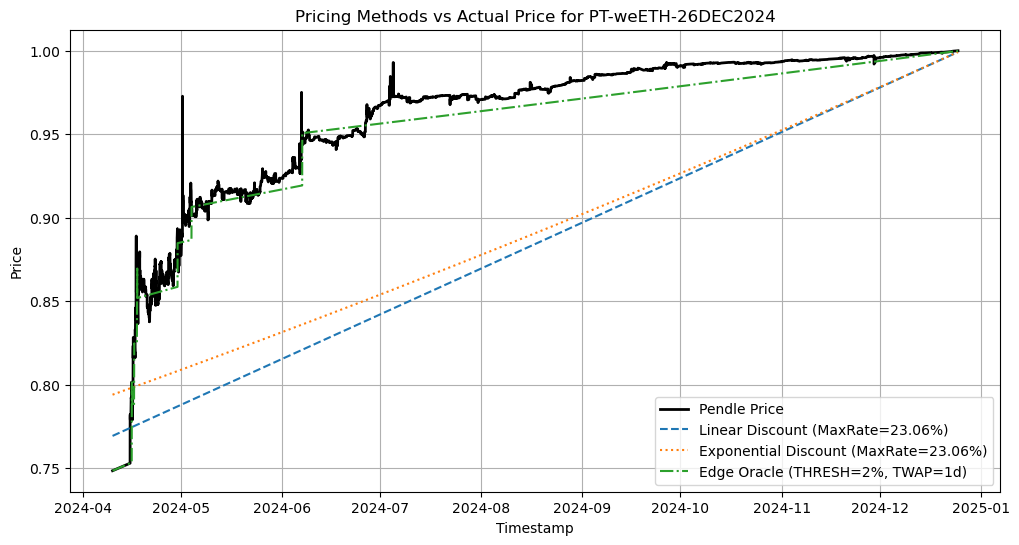

In order to optimize this problem, AAVE adopts an off-chain pricing solution, which can make the oracle price follow the pace of structural changes in PT interest rates as much as possible, and avoid the risk of market manipulation in the short term. We will not discuss the technical details here. There are discussions specifically on this issue in the AAVE forum. Interested friends can also discuss it with the author in X. Here we only present the possible price following effect of PT Oracle in AAVE. It can be seen that in AAVE, the Oracle price performance will be similar to a piecewise function, following the market interest rate, which has higher capital efficiency than Morpho's linear pricing model, and also better alleviates the risk of bad debts.

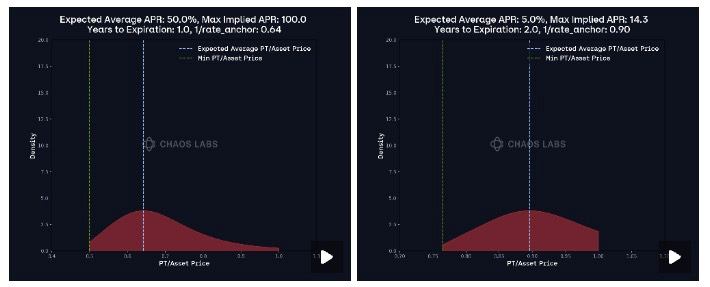

So this means that if there is a structural adjustment in the interest rate of PT assets, or if the market has a consistent direction for interest rate changes in the short term, AAVE Oracle will follow this change, so this introduces discount rate risk to the strategy, that is, assuming that the PT interest rate rises for some reason, the price of PT assets will fall accordingly, and the excessive leverage of the strategy may have liquidation risks. Therefore, we need to clarify the pricing mechanism of AAVE Oracle for PT assets so that we can rationally adjust leverage and effectively balance risk and return. Here are some key features for your consideration:

1. Due to the mechanism design of Pendle AMM, as time goes by, liquidity will be concentrated on the current interest rate, which means that the price changes brought about by market transactions will become less and less obvious, or it can be said that the slippage will become smaller and smaller. Therefore, as the expiration date approaches, the price changes brought about by market behavior will become smaller and smaller. In view of this feature, AAVE Oracle has set up the concept of heartbeat to indicate the frequency of price updates. The closer to the expiration date, the larger the hearbeat, the lower the update frequency, that is, the lower the discount rate risk.

2. AAVE Oracle will follow the 1% interest rate change as another adjustment factor for price updates. When the market interest rate deviates from the Oracle interest rate by 1%, and the deviation time exceeds hearbeat, it will trigger a price update. Therefore, this mechanism also provides a time window for timely adjustment of leverage and avoid liquidation. Therefore, for users of this strategy, try to monitor interest rate changes and adjust leverage ratios according to the mechanism.

Weiliang

Weiliang

Weiliang

Weiliang Alex

Alex Miyuki

Miyuki Kikyo

Kikyo Anais

Anais Alex

Alex Miyuki

Miyuki Weiliang

Weiliang Catherine

Catherine Weatherly

Weatherly