Translated by: Plain Language Blockchain

Why do I no longer advise friends to "learn cryptocurrency first"?

Last month, I tried again to guide a non-cryptocurrency user into the industry. Ten minutes later, she was confused between "choose a wallet" and "pay gas fees with another token." I realized: we are not facing a knowledge gap, but a design gap.

An obvious fact is that speculation brought the first wave of users, but it cannot attract the next billion users. Real popularization will begin when cryptocurrency products become "invisible"-users can benefit from them without knowing it. From the rise of stablecoins, institutional pledges, to the increasingly important role of artificial intelligence in shaping the digital economy, the foundation for mass adoption has been laid. But to unlock this future, we must stop expecting users to learn about cryptocurrency, and instead build products that they don't even realize they are using cryptocurrency.

Here are my thoughts on the eight trends:

01 Next-generation wallets will win by focusing on doing one thing well

We are witnessing a tectonic shift: users tend to use two complementary wallets - one wallet that acts like an "everyday" fintech app, and another vault that acts like a "bank" app.

The wallet experience is diverging. Developers who try to cram all features into a single interface will lose to combination wallets that focus on (a) frictionless onboarding and (b) high-security storage.

Current situation:

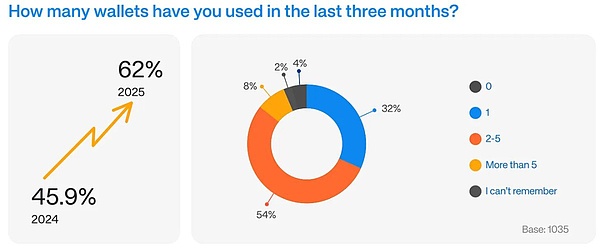

More than half of users use 2-5 wallets at the same time, and nearly 48% of users said that this is because each blockchain network is still an isolated "walled garden".

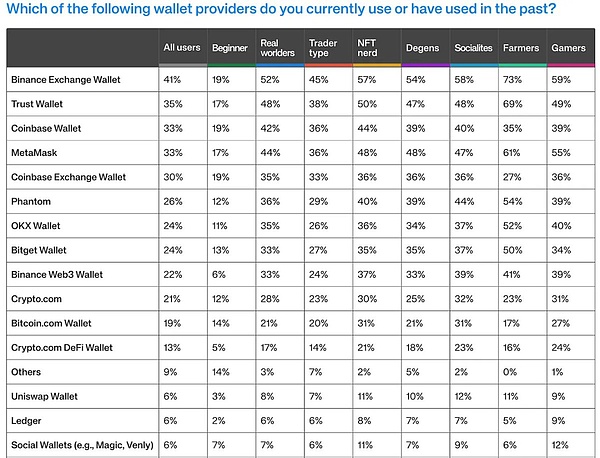

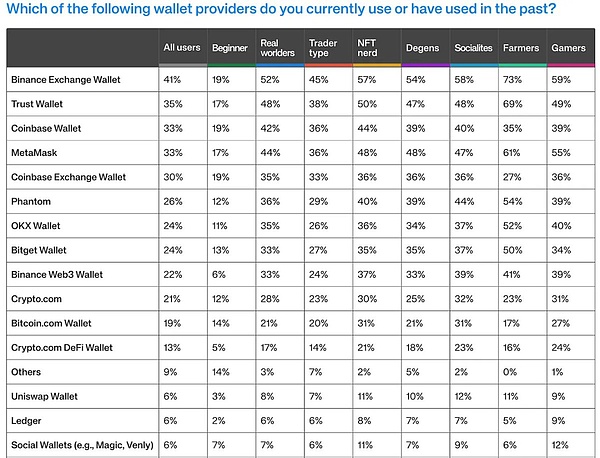

Head concentration: Among users with more than 2 years of experience, 54% are concentrated on Binance, Coinbase, MetaMask or Trust wallet, while the market share of a single wallet among novice users is less than 20%.

Self-custody is still daunting:Even in familiar brand ecosystems (such as Binance’s Web3 wallet), only 22% of users choose self-custody.

The frustration of multiple wallets: Users don’t want to manage multiple wallets, they just have no choice.

The “seamless multi-chain future” has not yet been realized, and 48% of users are forced to use multiple wallets due to different blockchain ecosystems.

44% of users intentionally separate wallets for security reasons, up from 33% last year.

Insights:

The industry has failed to achieve true interoperability, pushing operational complexity onto end users.

Users are becoming more sophisticated and no longer blindly trust a single wallet to handle all scenarios.

02 Misalignment of Behavior and Belief

54% of users used cryptocurrencies for payments or peer-to-peer transfers in the past quarter, but only 12% said payments were their favorite activity.

On the contrary, trading (spot, meme, DeFi) remains the main weekly behavior for all types of users (with a few exceptions).

Speculation suppresses practicality with three major resistances:

Cost resistance: 39% of users believe that high gas fees on the first-level network (L1) are the biggest barrier to adoption.

User experience resistance: Only 11% of users believe that the current onboarding experience is attractive enough for the general public.

Network resistance: Payments need to flow smoothly between merchants and friends, and fragmented wallets and chains disrupt this cycle.

03 Blockchain becomes a new infrastructure layer, but users should not be aware of its existence

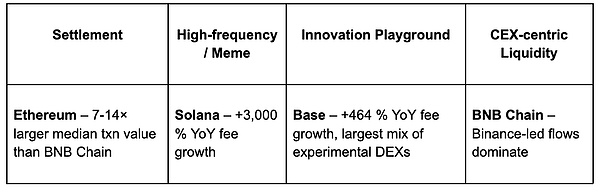

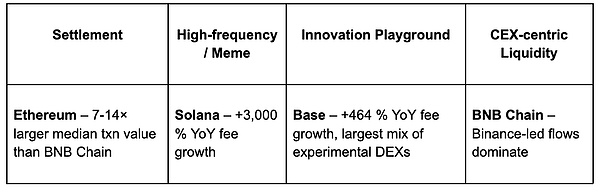

The multi-chain pattern is a division of labor:

Ethereum:Institutional settlement layer.

Solana:Due to its speed and low cost advantages, it has quickly become the preferred chain for high-frequency, high-participation retail activities.

Chain abstraction is the winning pattern:Wallet sessions fluidly route orders, balances, and identities to the optimal latency-cost-security backend, without users having to manually select a chain.

Data:

Solana is outperforming:Y/Y fee growth of +3000%, Total Value Locked (TVL) growth of +127%, highest among all L1s.

User Preference:43% primarily use Ethereum, 39% choose Solana, and only 10% primarily use L2 - proving that interoperability is still theoretical.

04 False Rise in User Confidence

Users claim to feel safer on-chain, but their wallet behavior tells a different story.

Reason for the paradox:Users confuse personal security measures (such as hardware wallets, multi-signatures) with systemic risks.

Reality:Attackers have industrialized “phishing as a service” and shortened the life cycle of malicious contracts by four times.

Product Priorities:Anti-phishing UX (clear signature interface, real-time transaction simulation, MPC transaction firewall) must move from premium add-on features to the default for “everyday” wallets.

05 NFTs as Infrastructure for Digital Culture

The NFT market is undergoing a necessary correction, moving from speculative PFP projects to real digital goods and utility-driven experiences that appear sustainable for the first time.

Trends:

Low-cost, high-frequency participation: The craze for low-cost collectibles such as Rodeo.Club and Base, similar to the in-game purchase model.

NFT becomes the participation infrastructure of the digital economy:Loyalty points, badges, and membership benefits will be on-chain in the form of NFTs, which can be carried and traded across platforms.

The rise of cultural capital:NFT becomes a mechanism for users to express their identity and cultural belonging in digital space.

New measurement criteria:The success of NFTs is no longer determined by floor prices, but defined by user retention and engagement.

AI + NFT:Dynamic NFTs generated by AI will evolve based on user behavior, emotions, or community events, bringing personalized experiences.

06 Bitcoin as a Macro Asset Class

Bitcoin has evolved from a speculative asset to a macro financial instrument and is becoming a transaction layer for global settlement.

Trends:

From hedging to strategic reserve assets:De-dollarizing countries are quietly exploring Bitcoin as part of their reserve diversification strategies.

L2 Unlocks Payment Utility:The Lightning Network matures into a scalable payment layer, and new protocols such as Fedimint and Ark address privacy and user experience issues ...

Bitcoin as collateral:Institutions are beginning to use Bitcoin for structured financial products, such as credit instruments and derivatives.

Global settlement networks:Bitcoin complements rather than competes with fiat currencies as a neutral, censorship-resistant trade settlement layer.

07 Institutional staking as a strategic funding model

After Bitcoin established its macro hedge status, institutions began to explore how to make these assets generate income.

Retail chasing speculation, institutions choose staking:Institutional funds are steadily flowing into the staking ecosystem of Ethereum and Solana.

Bitcoin Staking Potential:Bitcoin is also beginning to enter yield-generating strategies through protocols such as Babylon.

Infrastructure rather than validators:The next wave of institutional capital will flow to platforms that provide institutional-grade custody, compliance reporting, and risk-managed staking products.

Yield Diversification:Against the backdrop of declining attractiveness of traditional fixed income products, staking yield has become a new risk-adjusted return category.

08 Regulation, stablecoins and AI: the next entry

Regulatory optimism:86% of users believe that clearer rules will accelerate adoption, and only 14% believe that it will hinder innovation.

The rise of stablecoins:The holding rate nearly doubled year-on-year to 37%, and it has become the default payment track in more than 30 Stripe markets.

AI synergy:64% of users believe that AI will accelerate the development of cryptocurrency, and 29% expect a two-way flywheel effect.

09 Summary

Users are no longer obsessed with "Web3". They expect Web2-level simplicity, Web3-level ownership, and AI-level intelligence, all in one.

Teams that can abstract chain selection, eliminate fee pain points, and embed predictive safety nets will transform cryptocurrencies from speculative playgrounds to the connective tissue of the on-chain Internet. The next billion users won't even know they'reusing Web3 products, and this "invisibility" will be the ultimate user experience win.

Kikyo

Kikyo