Author: Sumanth Neppalli Source: decentralised.co Translation: Shan Ouba, Golden Finance

This article continues the theme we have repeatedly discussed: income and capital flow. It deeply analyzes the source of miner extractable value (MEV) and the new methods to mitigate MEV. He started with an advertising bidding mechanism proposed by Google in 2010 and made an analogy with the auction system of crypto miners. As the old saying goes: "History always repeats itself."

You may have noticed that almost all of our articles recently revolve around a common point: the primitive of frequent and large-scale capital flow. Our core point remains: blockchain is the new financial "rail", and those products that can promote capital flow at a high frequency will become the winners in the next stage of crypto evolution. This logic also guides how we view the M&A market.

Now, it’s time to understand how value is extracted from each block.

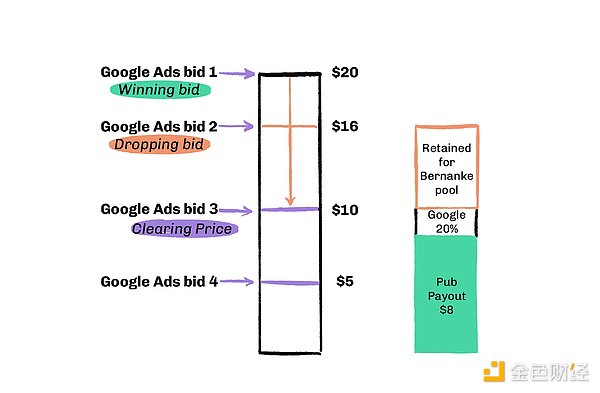

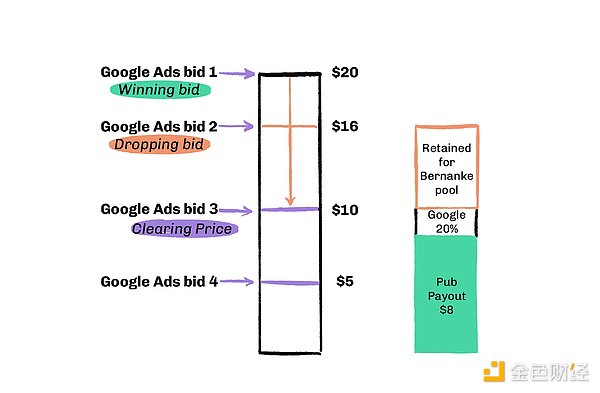

Welcome back to 2010. That year, Google launched the "Second-Price Ad Auction System". The operating principle is simple: the highest bidder wins the ad space, but only has to pay the second highest price.

This is perfect in the eyes of economists: advertisers don’t have to worry about "paying too much". However, Google was secretly pulling strings behind the scenes, quietly siphoning off millions of dollars in profits.

For example, if the highest bid was $20 and the second highest was $16, advertisers only had to pay $16. But Google paid the publisher the third highest bid (e.g., $10), meaning Google quietly swallowed $6 in profits. They put this hidden profit into an internal fund called the "Bernanke Pool" to meet quarterly profit targets and curry favor with Wall Street. It wasn't until an antitrust lawsuit in 2016 that the truth was revealed.

Although Google switched to a "one-price auction" in 2019, where advertisers pay what they bid (minus platform fees), this history shows that even the most "fair" mechanisms can be distorted when the auctioneer controls the underlying structure.

Interestingly, history is repeating itself in the blockchain world. The Maximum Extractable Value (MEV) phenomenon is essentially an extension of a secret auction, which allows miners/validators to extract profits by reordering, inserting, or excluding transactions in blocks.

For ordinary users, this operation is mostly invisible and intangible, but it affects every participant in the chain behavior - it is simply a stealth tax.

So will MEV go secretive and centralized like Google? Or can it be built into a public, transparent system that returns value to users? Can we design a system so that this inevitable value extraction benefit the entire ecosystem, rather than making a few people rich?

The Physics of Delay

A blockchain is a distributed network of thousands of computer nodes (miners or validators) that work together to receive and process transactions.

A validator has two roles:

a communication node (receives and broadcasts transactions);

a computing node (executes and verifies transactions).

Since these nodes are distributed around the world, communication delays are inevitable—limited by the speed of light.

To ensure that transactions are in the same order, each chain sets a "block time" to synchronize all nodes. Each round will rotate and select a validator to package the next set of transactions, and this mechanism is maintained secure by consensus protocols (such as PoS).

Bitcoin: One block every 10 minutes

Ethereum: 12 seconds

Solana: About 400 milliseconds

Layer 2 chains (such as Arbitrum and MegaETH): 10ms to 250ms

Each time window, regardless of its length, creates an opportunity for validators to rearrange transactions within a block to maximize their own profits rather than prioritizing user fairness. Ideally, it should be first-come, first-served. But with nodes distributed around the world, this is difficult to achieve. When a user initiates a transaction, it is almost guaranteed that not all nodes will receive the transaction at the same time due to network latency. This means that sometimes an unfair order of transactions (which costs end users extra fees and profits to MEV exploiters) can be packed into blocks without violating any block construction rules.

MEV is a big business

If Joel buys ETH at $1800 on a decentralized exchange (DEX) like Uniswap and sets a 10% slippage tolerance, he can accept the price to rise to a maximum of $1980 at the time of the transaction.

Joel’s transaction goes into the mempool (transaction memory pool, the “waiting room” on the chain), where it waits to be included in a block by a validator. At this time, a bot finds this transaction, copies the same buy order, and submits it with a higher gas fee, so that its transaction will be executed first.

The higher gas fee is essentially a bribe to the validator to make them prioritize the bot’s transaction before Joel’s. The bot’s buy order will push up the price of ETH on the DEX, for example, to $1900. Joel’s transaction is only executed at this time, and it is traded at this increased price. The bot then immediately sells its ETH at $1900, making a profit on the spread (net profit after deducting gas fees).

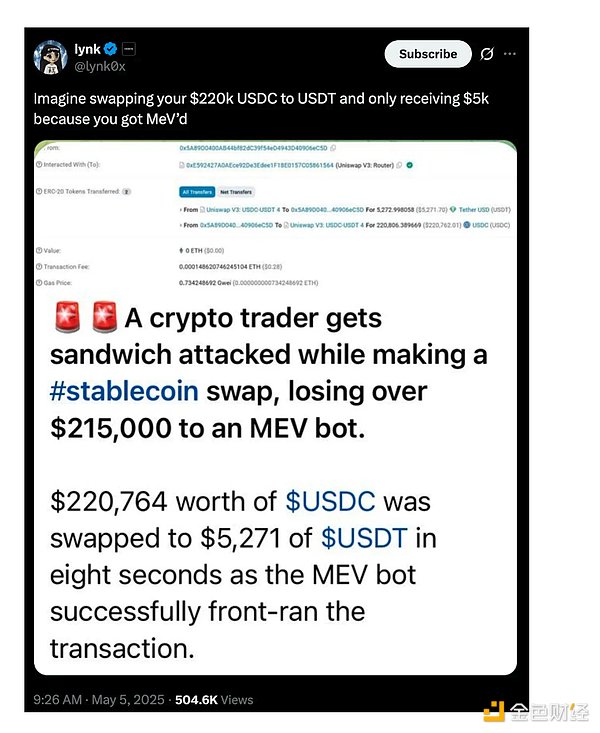

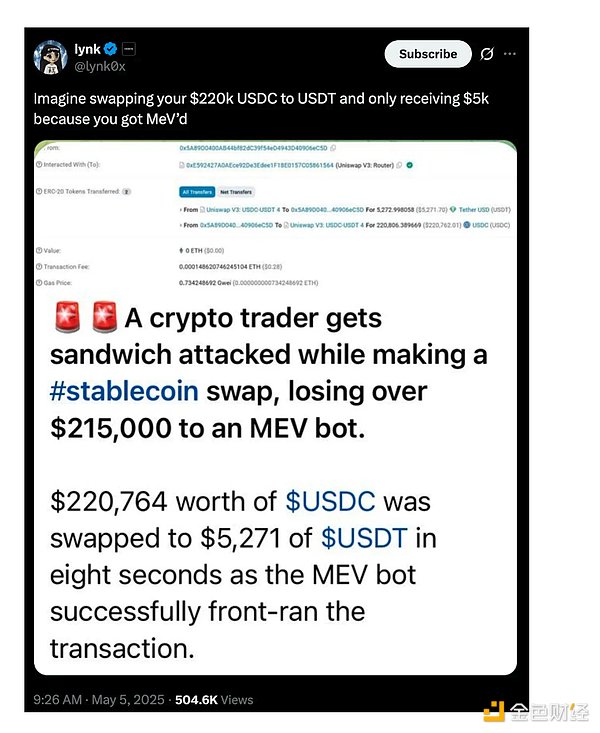

Joel does get the ETH, but he overpaid $100. And the robot got the $100 profit. This happens thousands of times a day in the crypto market. More extreme cases also exist. For example, a poor trader forgot to set slippage, and the robot swallowed up $200,000 in profits. The attacker this time was the famous jaredfromsubway.eth, a robot address that has long dominated the Ethereum gas consumption list with extremely high gas consumption, and specifically inserted the transactions he wanted to attack first. It is estimated that Jared made more than $10 million in profits through the MEV attack.

MEV mainly manifests in three forms:

Arbitrage: Finding price mismatches between exchanges, buying low and selling high within the same block. For example, ETH is trading at $2,500 on Uniswap, but at $2,510 on Sushiswap. A bot can buy ETH on Uniswap and sell it on Sushiswap in the same block, locking in a profit of $10 per ETH without taking on market risk. Notably, this is good for the market because it will eventually bring asset prices across different platforms into line.

Sandwich attack: Look at Alice’s large buy order in the memory pool, buy before her (pushing up the price), make her pay a higher price, and then sell immediately. The bot makes the difference and Alice takes the slippage. The example mentioned above is a sandwich attack. Joel paid an extra $100, which is actually profit for the MEV value chain. This is undesirable because users end up paying more than necessary.

Liquidation: In a lending protocol, when a position becomes eligible for liquidation, MEV extractors compete to be the first to liquidate and receive the liquidation reward. Let’s say Saurabh borrowed $15,000 worth of ETH against $10,000 worth of USDC on Aave. After the price drops, his ETH collateral drops to $11,000, breaching the liquidation threshold. A bot races to liquidate 50% of his loan. It repays $5,000 of USDC and in return receives $5,500 worth of ETH (thanks to the 10% liquidation bonus). That’s $500 in profit, just for being the first to act. This can be good or bad, depending on the circumstances. Incentives in the form of liquidations are good for the overall health of DeFi. But most of this revenue ends up going to validators.

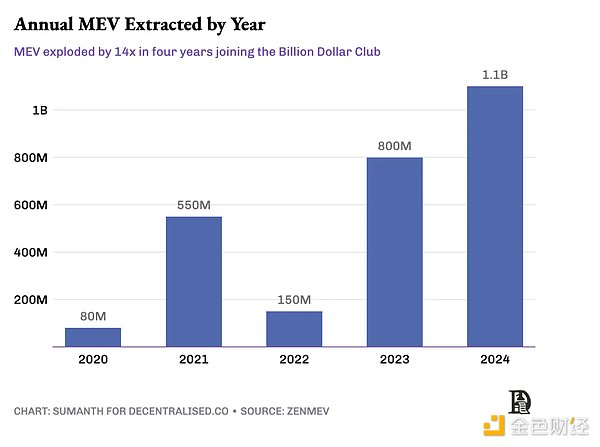

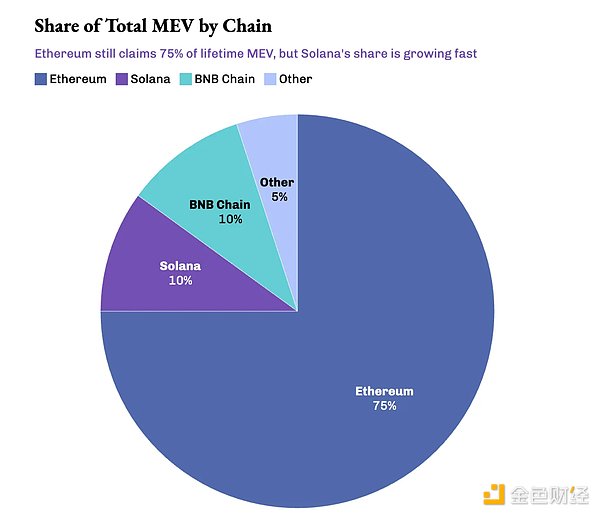

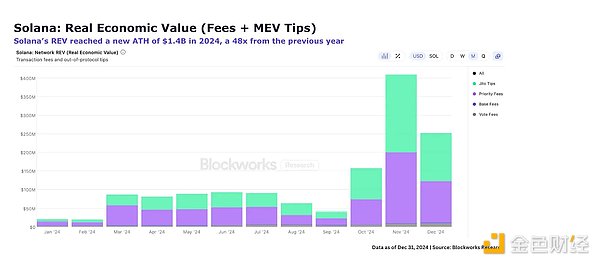

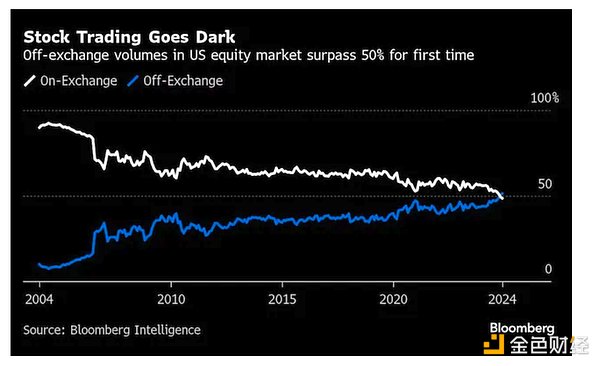

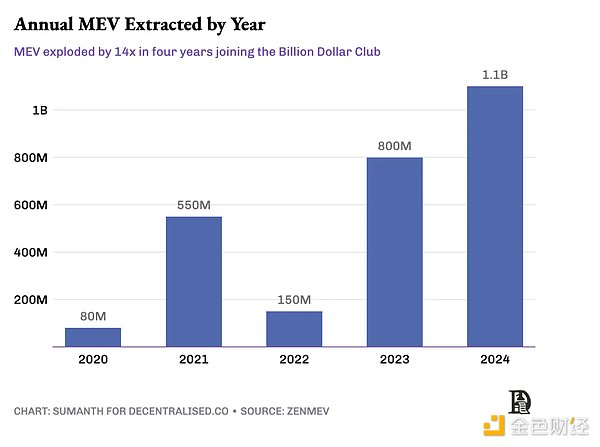

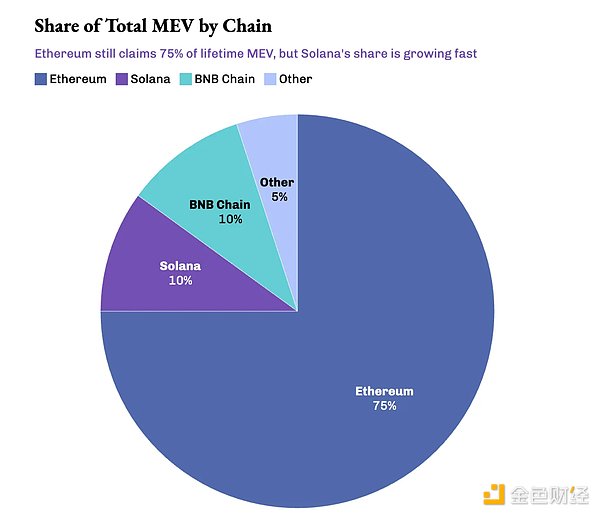

From $550 million in 2021 to double to $1.1 billion in 2024, the scale of MEV extraction has exploded. Due to Ethereum's open memory pool and deep DeFi liquidity, it remains the "epicenter" of MEV, with more than 100 active robots active here. To date, about 75% of MEV has occurred on Ethereum.

In the past 30 days, 66% of MEV transactions on Ethereum were sandwich attacks, 33% were arbitrage, and clearing exchanges accounted for less than 1%.

As on-chain transactions expand to other public chains, MEV also spreads. Solana, BNB Chain, and various Ethereum Rollups (L2) have become "hunting grounds" for robots to pursue profits. Even Binance founder CZ suffered a sandwich attack when exchanging coins.

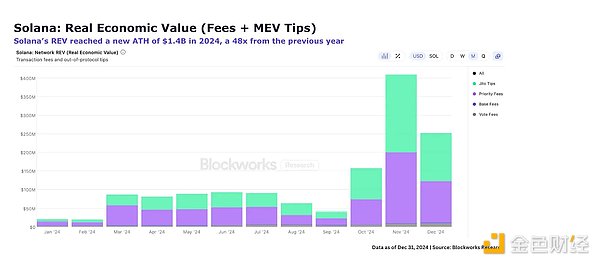

The sandwich robot on Solana has earned more than $4 million (about 24,000 SOL) in the past 30 days, which is almost 50 times the income of Ethereum robots in the same period (about $80,000).

Cross-chain bridges have also turned the competition for MEV into a cross-chain competition, with robots shuttling back and forth between different ecosystems, trying to capture every opportunity. In December 2024 alone, MEV activity on Solana exceeded $100 million, mainly affected by market fluctuations brought about by Trump's re-election campaign.

In 2024, the total volume of transactions on DEX reached $1.5 trillion, and the cost of MEV accounted for about 0.1% of trading activity. Frontier Labs estimates that this figure may rise to 1%, which is costly for large transactions.

It is easy to think of MEV as "bad and evil". But the fact is: value loss is inevitable in any financial market. The really important question is whether we can reduce this loss or distribute it more fairly to all market participants.

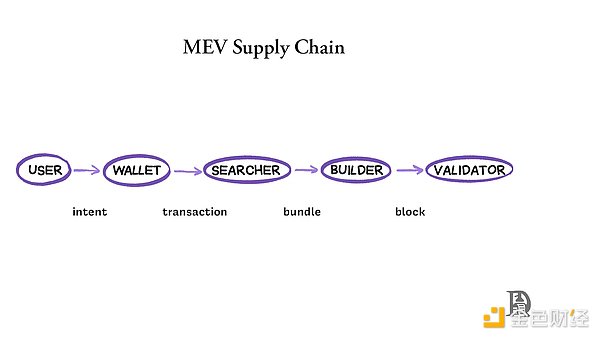

MEV's supply chain

Early blockchains gave validators two "super powers":

Determine which transactions are included in the next block;

Determine the order of these transactions.

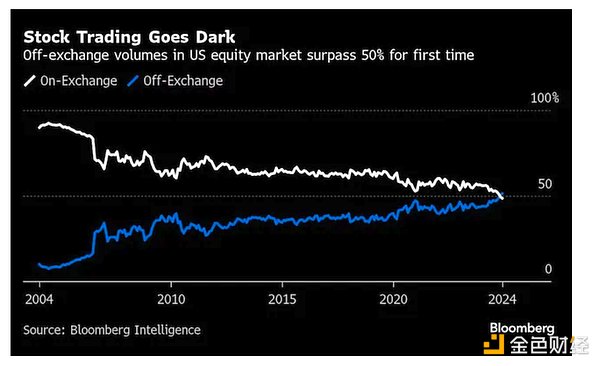

This caused a serious problem, like the dark pool described in "Flash Boys". Just as stock exchanges provide "privileged channels" for high-frequency traders, validators in blockchains can also privately reach cooperation agreements with robots to ensure that these robots' transactions are processed before ordinary users' transactions.

This "pay first" mechanism allows insiders to always get the best prices, while ordinary users can only eat "leftovers".

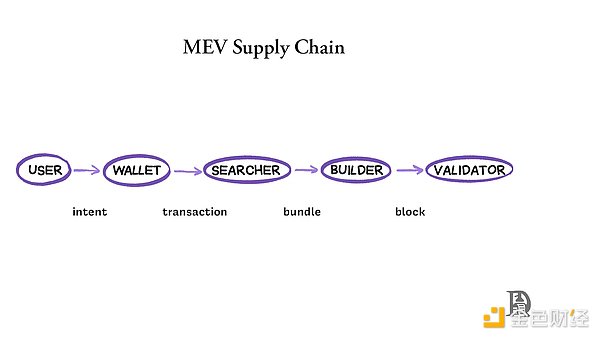

To address this risk of centralization, the Ethereum ecosystem is promoting an architecture called Proposer-Builder Separation (PBS). It separates the processes of block "construction" and "on-chain":

Users submit transactions or high-level intentions (such as "exchange token A for token B at the best price");

The wallet processes these transactions and sends them to searchers/builders/memory pools through nodes;

Searchers scan the memory pool for arbitrage opportunities and package related transactions;

Builders build complete blocks from these packaged transactions and auction them off;

Verifiers (or proposers) select the best block from them, check its legitimacy, and add it to the chain.

This mechanism limits the power of validators - they can only choose from the sorted blocks submitted by builders, thereby distributing MEV opportunities more widely to market participants and forming a fairer block construction competition market.

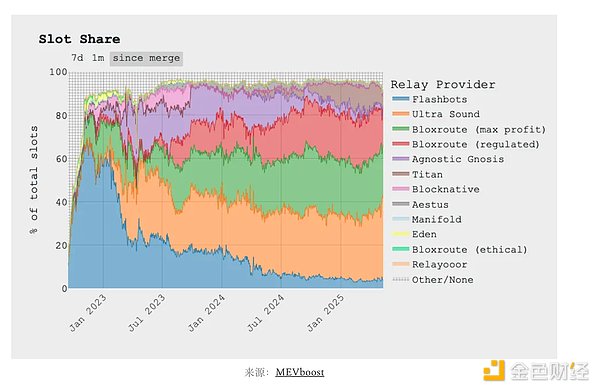

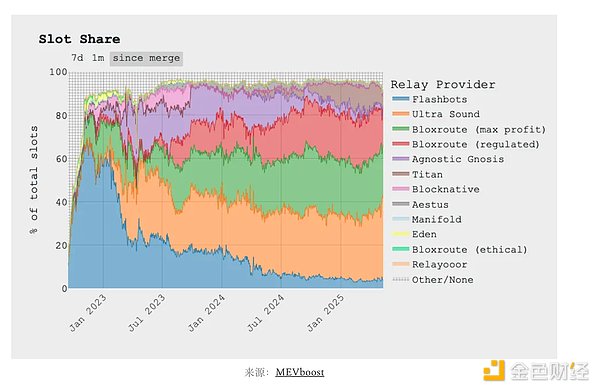

The most widely used application of PBS is MEV-Boost launched by Flashbots, and as of early 2025, more than 90% of Ethereum validators have adopted it.

From "Miners" to "Maximum" Value Extractors

MEV, the extractable value of miners, was initially dominated by miners, and has now evolved into the maximum extractable value. Extractors are no longer just miners, but a huge ecosystem composed of multiple roles.

When you click "Swap" on Uniswap (DEX based on automated market makers) or Raydium (DEX based on order books), it is almost impossible for your opponent to be another ordinary person.

You are facing professional market makers like Wintermute. They make profits by capturing the bid/ask spread (i.e. bid/ask spread). In the AMM model, they provide liquidity by depositing funds into the liquidity pool and earn fees from user transactions.

It is unrealistic to "eliminate" MEV because it is deeply embedded in the block time economic structure.

Positive side: arbitrage helps price consistency between CEX and DEX markets, while subsidizing network security through MEV commissions;

Negative side: Sandwich attacks and gas bidding wars make ordinary users pay higher costs.

MEV is the inevitable product of an efficient market - where there is profit, there are people to fight for it.

In the current ecosystem, professional searchers, builders, and market-making robots are the biggest beneficiaries. And it is ordinary traders who bear the costs: they are front-runners, suffer additional slippage, or their transactions are opaque because liquidity migrates to invisible "dark pools".

Robots frantically send "bullet transactions" to compete for MEV opportunities, complete front-running in milliseconds, causing memory pool congestion, bandwidth waste, and rising transaction fees. This is what we call "invisible tax".

The rules of the game for MEV are not "elimination", but to clarify - who should enjoy the benefits, and under what rules these benefits are distributed.

Strategies to Reduce MEV

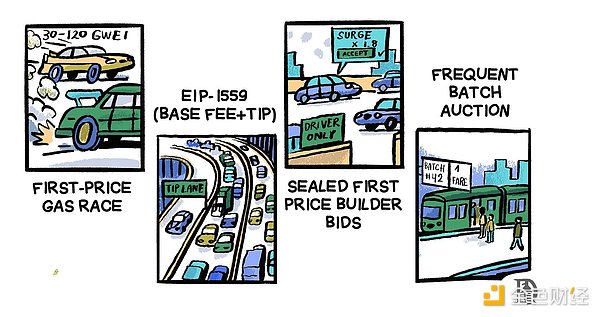

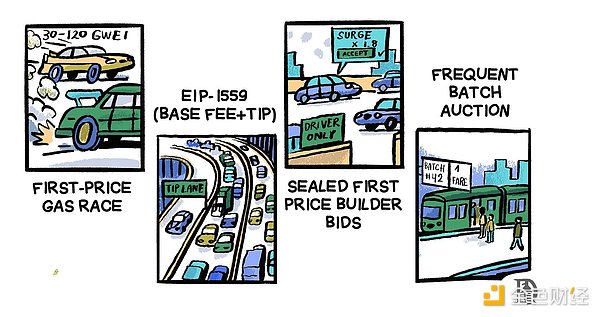

The ecosystem is currently trying four main ways to deal with the MEV problem: hiding, exploiting, minimizing, and redirecting. Each approach has different trade-offs between efficiency, fairness, and technical complexity.

MEV Hiding

The simplest strategy is to not disclose the contents of a transaction until it is included in a block. Such tools include Flashbots Protect and Cowswap's MEV Blocker.

The use of these services is straightforward: instead of sending a user's transaction to a public memory pool, it is submitted privately to block builders. This way, MEV bots cannot see the transaction before it is processed.

The downside is: you have to wait until a validator using these services becomes a block producer. On Flashbots Protect, this wait can be as long as 6 minutes. However, you can cancel the transaction at any time during this period, as the transaction has not yet been sent to the memory pool.

Market makers and large capital traders usually use such services to avoid premature exposure of trading intentions. So far, more than $43 billion in transactions have been sent through Flashbots Protect.

However, I have reservations about this centralized privacy solution because it reminds me of the "dark pool exchange" in traditional finance. These platforms were originally designed to protect users, but they often evolved into internal privilege systems like Robinhood.

Flashbots and Beaverbuild are exploring the use of a trusted execution environment to cryptographically prove that their behavior is honest and reliable. This direction is exciting, but it has not yet been proven effective on a large scale.

Some communities have also begun to take the initiative. For example, the BNB community voted to pass the "Good Will Alliance", requiring validators to only accept block proposals from compliant MEV builders. These builders will filter out malicious MEV transactions, and validators will be punished if they do not use compliant infrastructure.

MEV Exploitation

Some protocols are not trying to eliminate MEV, but to "fight fire with fire" by weaponizing competition between robots through private bidding mechanisms.

For example: suppose Joel wants to exchange 100 ETH for USDC. In the traditional AMM model, this transaction will appear publicly in the memory pool and is prone to sandwich attacks. But if the RFQ (Request-for-Quote) model is used, Joel will send the exchange request to a group of market makers.

For example, Wintermute quoted $2000/ETH, while DWF Labs quoted $2010/ETH. Joel chose the latter and completed the transaction at a good price of 2010, without slippage and avoiding front-running attacks.

Behind the scenes, each market maker is evaluating how much profit they can make from this transaction. They will draw liquidity from different sources to give Joel the best execution price while ensuring profitability, while outperforming their competitors.

However, the RFQ system also has its costs. It relies on a stable, 24/7 online, liquid market maker network to respond in real time. If there are not enough participants, the system will respond slowly - users can only wait, and prices are still fluctuating.

The RFQ model is more used in illiquid markets such as bonds, because the order books in these markets are usually too shallow. And if the institutions involved in market making are not credible enough or lack decentralization, RFQ may degenerate into another "insider club".

To solve these problems, Pyth built Express Relay on Solana, which is an off-chain market maker market. Any DeFi protocol can access a competitive market maker pool through it, without having to develop a separate interface for each market maker, which simplifies the integration process and reduces MEV losses.

Jito took a different tack and ultimately became the dominant validator client on Solana, currently controlling over 90% of staked SOL. Jito attempted to introduce a Solana memory pool, but that was quickly exploited by an attacker who was willing to spend over $300,000 to seize block priority, and the attempt was ultimately abandoned.

Now, Jito runs an off-chain auction every 200 milliseconds to select the most profitable transactions to be packaged into the next block. If users want to execute transactions first, they add a "tip" to the transaction to prevent MEV attacks. Users with the highest bids have priority in executing transactions, and these tips are converted into income for validators - currently accounting for more than half of Solana validators' income.

MEV Minimization

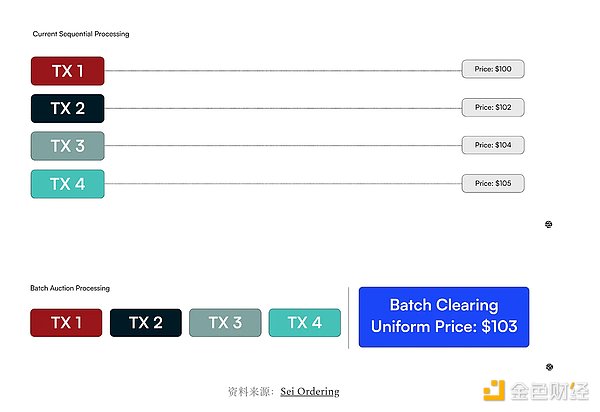

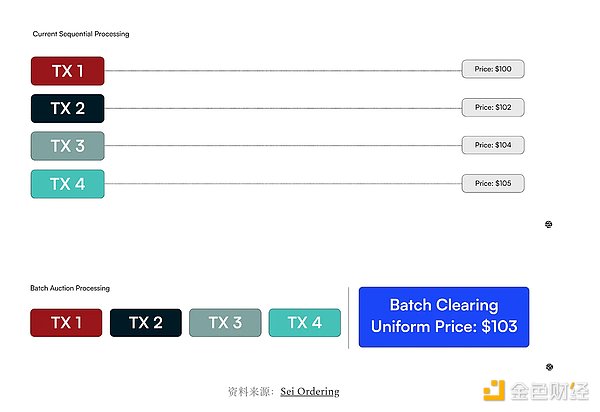

This approach builds on the order flow auction mechanism, with the goal of reducing the total amount of MEV that can be extracted by designing a smarter auction mechanism.

When trades are processed one by one, it creates opportunities for robots - they can observe each trade and quickly insert profitable arbitrage operations to profit from it. If multiple orders are packaged and executed at the same price, the MEV opportunities brought by the ordering and time difference will be eliminated.

CoWSwap is the pioneer of batch trading. Its core concept is very simple: when one user wants to exchange ETH for DAI and another wants to exchange DAI for ETH, they can actually exchange directly without going through traditional exchanges. CoWSwap collects users' trading intentions within a short time window and gives priority to matching these "natural counterparties". It will only seek help from the liquidity pool on the chain when it cannot find a match.

Even better, users don’t need to have expertise in crypto market structure. When trading on CoWSwap, there is no need to manually set slippage tolerances or set routing strategies for different pools. Users simply submit what they want to trade, and the system will complete the execution through a group of specialized market makers called “solvers.”

These solvers compete in a fair auction to get you the best price. In each batch trading round, all assets are traded at the same price, which further prevents front-running.

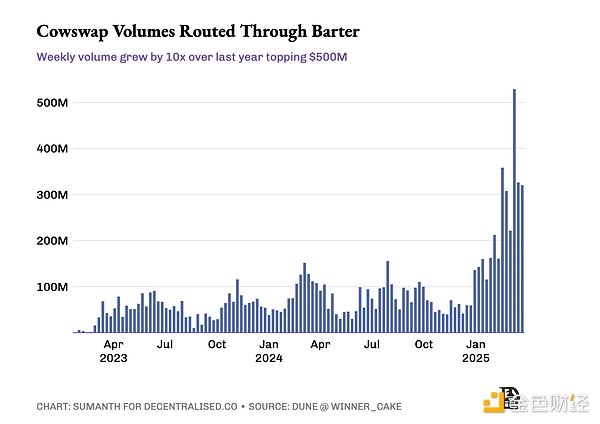

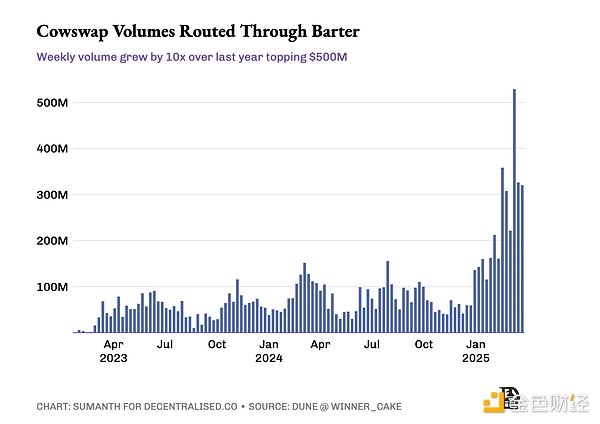

The actual results speak for themselves: the CoWSwap decentralized exchange has processed about $100 billion in trading volume to date. One of the leading solvers, Barter, has about 15% of the market share and has processed over $11 billion in trades through the protocol. Barter's continued growth further validates how CoWSwap's batch auction mechanism reduces MEV through fair pricing rather than time advantage.

This approach is also highly consistent with the research views of Eric Budish, professor of economics at the University of Chicago Booth School of Business. He believes:

"Processing orders once per second in high-frequency auctions eliminates meaningless competition for speed."

He pointed out that this batch processing mechanism can solve the "prisoner's dilemma" problem in continuous order book markets (such as the limit order model in centralized or some DEXs), and can also truly distribute the transaction costs saved by this to ordinary investors.

In the cryptocurrency market, continuous limit order books reward those who "move the fastest" - this leads traders to invest in better hardware, faster robots, or direct nodes, which are resources that are not beneficial to ordinary users and are just the cost of survival. The batch auction system like CoWSwap subverts this logic: all transactions are processed within a fixed time window and at the same price, speed is no longer important, and the focus is back on price discovery and user value.

MEV Recycling

Some innovators have taken a more pragmatic approach: Since MEV cannot be eliminated, why not capture it and return it to the community?

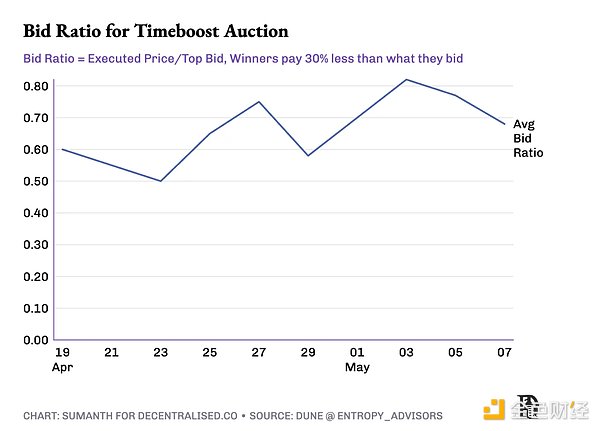

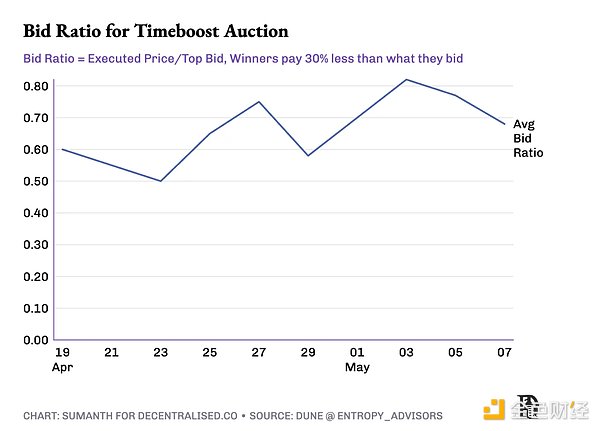

Arbitrum’s TimeBoost is a prime example of this approach. Every minute, it sells a 200-millisecond “fast lane” through a closed second-price auction—like a VIP fast checkout lane at a grocery store, where the highest bidder can jump the queue and execute their transaction.

Seekers who want their transactions prioritized can bid by predicting the MEV potential in the next 60 seconds, rather than through fierce gas wars.

This mechanism changes the rules of the game for attackers: any transaction executed through the fast track cannot be attacked by front-running or sandwich attacks. And, because the auction rotates every minute and is open to all searchers, it is almost impossible to form an exclusive MEV monopoly alliance.

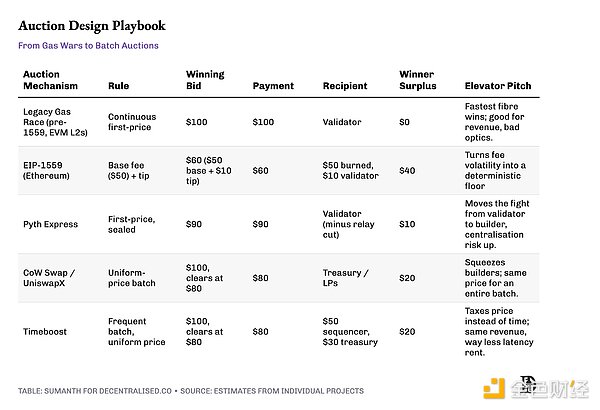

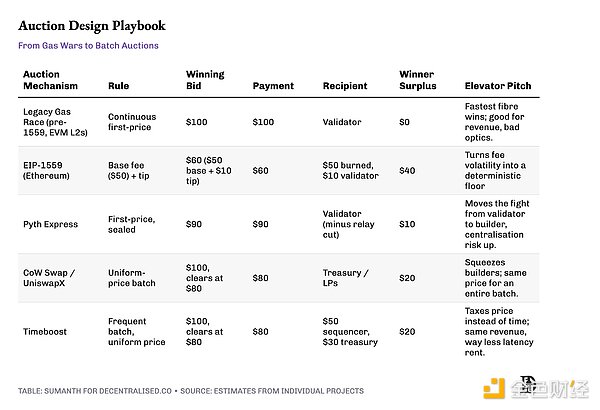

The end result is: MEV is no longer a mechanism for secretly raising taxes, but has become a "public benefit tool". Currently, 97% of TimeBoost’s revenue flows back to the ARB DAO treasury, which could theoretically generate up to $30 million per year. Even Jito, which we mentioned earlier, uses a hybrid strategy: 3% of the tips paid by users for priority transactions are redistributed to the Jito DAO and JitoSOL holders. Choosing the Right Auction Mechanism There are five main auction mechanisms that currently dominate the MEV space, and we can use a simple example to illustrate their differences: suppose there are three bidders (searchers/solvers/block builders) who bid $100, $80, and $60 for a block position respectively.

Which auction mechanism is "best"? There is no standard answer. It depends on the specific goals of your protocol:

If you are pursuing current considerable income, continue to use closed one-price auction

If you are pursuing community recognition and long-term sticky users, you can adopt a mechanism similar to EIP-1559 ——For example, a base fee plus a uniform price intention order system.

If you want to break the latency arbitrage alliance, use frequent batch auctions and let "price" rather than "speed" determine who can enter the block.

If your scenario requires extremely high transaction speed (such as DEX), then private order flow is the best choice.

Where to go next?

Does the strategy of hiding order flow and auctioning it to private market makers sound familiar? Wall Street's "dark pool" story is repeating itself on the chain. As the crypto market becomes increasingly institutionalized and intersects with traditional auction mechanisms, this trend is expected to accelerate.

Currently, only a very small number of the most professional teams can compete in the role of searcher, builder or solver. Their complexity advantage will accumulate over time: large institutions with top-tier infrastructure and engineering teams developing proprietary ML algorithms are likely to have an overwhelming advantage. We may even see traditional giants like Morgan Stanley or Goldman Sachs enter the field.

Blockchains are also beginning to form ideological positions on the MEV issue: Solana, with its obsession with ultra-low latency, naturally tends to emulate Nasdaq's speed advantage in private order flow mechanisms. In contrast, Ethereum has adopted PBS and MEV-Boost to democratize access. Other blockchains are exploring new directions based on their own architectural priorities.

But the most noteworthy innovations may appear in Layer 2. These new chains have the opportunity to design MEV-resistant architectures from scratch.

For example, Arbitrum’s TimeBoost demonstrates that L2 can experiment more freely on value distribution and auction mechanisms.

DeFi’s composability and permissionless nature make the crypto space an excellent laboratory for experimenting with auction mechanisms. In traditional finance, “frequent batch auctions” have been in the spotlight since 2015, but have been slow to advance due to regulatory resistance. On-chain, we can quickly iterate and implement within a few months, just like Sei did.

Another direction is to build a decentralized market maker network. In the future, we may see the emergence of a reputation market for block builders, where participants prove honesty by staking tokens. Combined with re-staking protocols such as EigenLayer, market participants can establish transparent reputation scores for upper-layer protocols to call.

If you think this sounds crazy, remember: Twenty years ago, no one could have imagined that microwave signal towers would reshape the S&P order book. Incentive mechanisms will always find new ways out.

Alex

Alex