Written by: 636Marx Source: Muddy Waters Blockchain

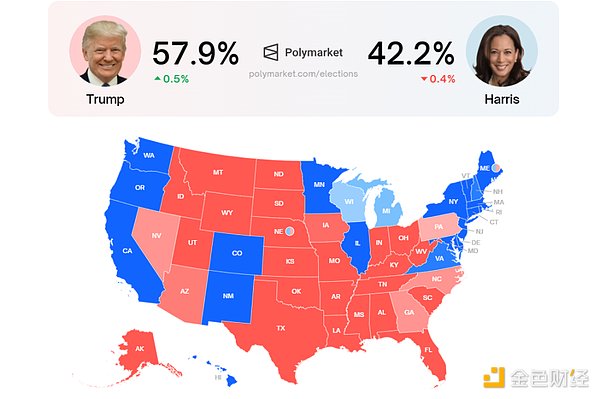

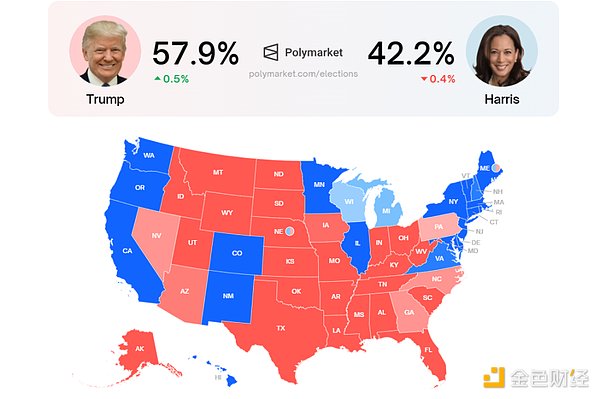

Friends in the cryptocurrency circle like to repost the Ploymarket US presidential prediction chart. Ploymarket is the world's largest decentralized prediction platform, which can bet on various gambling games related to politics, news, culture and technology. Of course, Ploymarket is also the world's largest centralized platform.

Rednecks shouted "Aramex, Trump King!" In fact, the Democratic Party is still leading in mail-in ballots. If you look at Harris's prediction curve like a king cobra raising its head, you will know that this is not a simple matter. November 5 (Beijing time November 6 09:00) is the voting deadline for the 2024 US presidential election, which will determine whether it is Trump of the Republican Party or Harris of the Democratic Party. The author reviewed the political and economic propositions of the Democratic and Republican parties for half a century, and described in a glimpse of the new changes that the falling United States will bring to the global crypto market and Chinese crypto investors.

This article will facilitate Chinese crypto investors to cope with possible market changes from multiple dimensions such as the historical review of the Chinese crypto market, the independence and linkage of global crypto finance, and the potential impact of Trump and Harris' policies on the Chinese market.

1. Historical review of the Chinese crypto market. Can the Hong Kong experience indicate further deregulation of the Chinese crypto market?

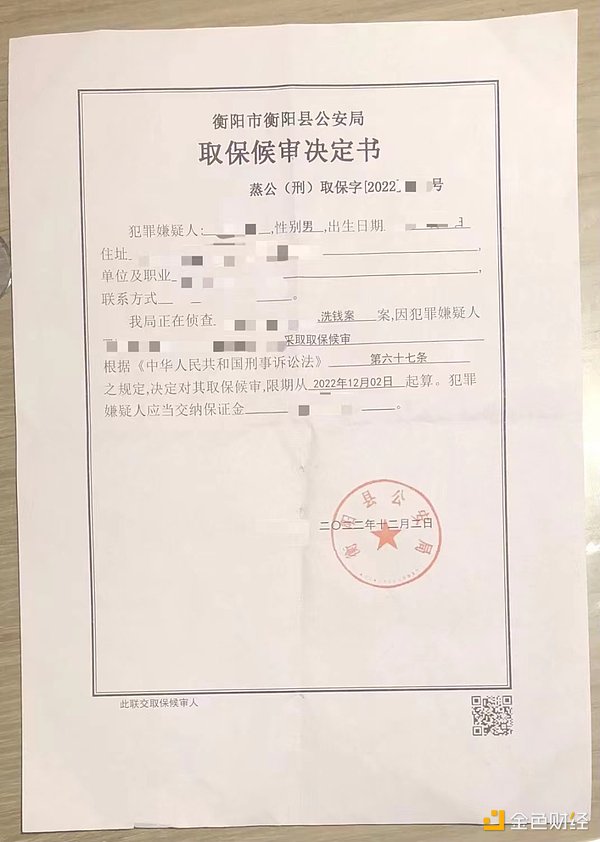

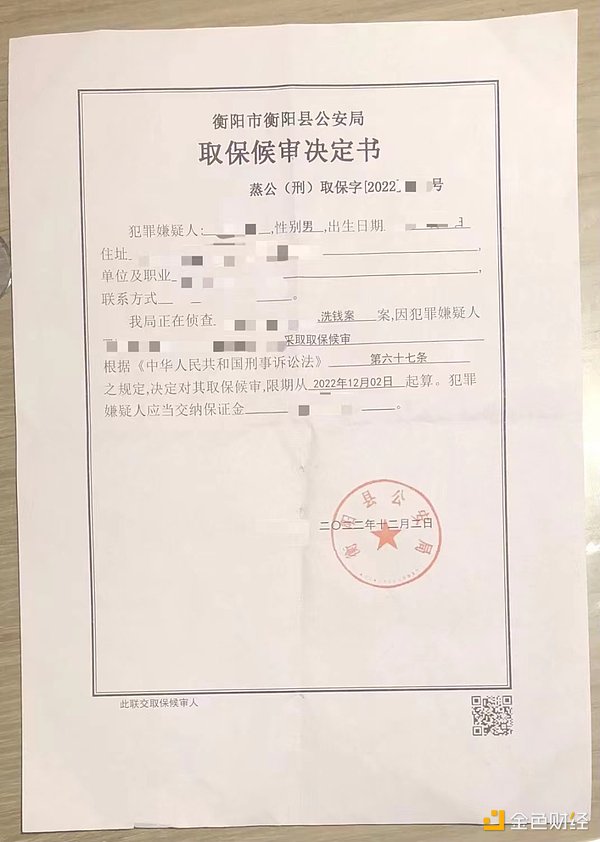

China's attitude towards cryptocurrencies has undergone many adjustments. As early as 2013, the People's Bank of China and five other ministries and commissions issued the "Notice on Preventing Bitcoin Risks". Bitcoin does not have the legal status of currency. By 2017, 94 bans were issued by seven ministries and commissions, successively banning ICO (initial coin offering) and the operation of virtual currency exchanges. However, with the rapid development of the global cryptocurrency market, China's policies have undergone some subtle changes in recent years, especially in Hong Kong. (For this period of history, the author's previous article "China's cryptocurrency market trends worth paying attention to in the second half of 2024" has a detailed description) Hong Kong has played the role of a "test field" in the development of the cryptocurrency market. In mainland China, USDT cash exchange is an illegal financial activity and is not protected by law. The author has blocked 3 bank cards with transfer links and 2 bank cards of his family members for bank card withdrawals, and was frozen by the Humen Police Station in Dongguan for more than 30,000 yuan. Finally, he issued a variety of certification materials through Dongguan petitions, and finally thawed them with difficulty. At present, OTC can apply for a Hong Kong bank account, buy and sell USDT in a specific foreign currency zone, and then exchange it to an overseas payment account, which can be transferred to the country for legal use. The following picture is a cryptocurrency OTC money laundering case in Hengyang, Hunan, which I found from lawyer Pan in my circle of friends. It is described that due to the epidemic, the parties were not allowed to meet after being detained, and the case was difficult to promote.

The Hong Kong government actively promotes a compliant virtual asset trading licensing system. Currently, more than 90 cryptocurrency companies have settled in Hong Kong. Not only can cryptocurrency funds be established, but also China's only legal digital currency exchange HashKey Exchange, and provides legal currency deposits and withdrawals. Xiao Feng, chairman of HashKey Group, was once the deputy director of the Securities Administration Department of the Shenzhen Special Economic Zone Branch of the People's Bank of China. At present, Hong Kong has become the most important cryptocurrency innovation center in China and even in Asia. Justin Sun, who posted on social media in August this year that China lifted the digital ban, has a nose that is usually more sensitive than a dog.

If Trump comes to power, as his vice president, J.D. Vances is a staunch supporter of cryptocurrency, and Trump's own family has also issued a cryptocurrency project, World Liberty Financial (WLFI). Trump publicly stated that "all Bitcoin should be minted in the United States", "Biden's hatred of Bitcoin will only help China, Russia and the radical communist left. We hope that all remaining Bitcoin should be 'Made in the USA'!! This will help us become an energy hegemon!!" Trump believes that Bitcoin is the last line of defense against China's central bank digital currency (DCEP), and his pro-crypto policy may prompt China to accelerate its exploration in this field. If Harris comes to power, her emphasis on stability and risk control will affect the Chinese government's assessment of Hong Kong's encryption policy, leading it to maintain a more cautious stance on the encryption market. Therefore, whether mainland China will accelerate the deregulation of the encryption market may depend on what kind of opponent it faces.

2. Is there a disconnect between the independence of China's crypto market and the linkage with global crypto finance?

China has implemented strict supervision on cryptocurrencies, but the demand for cryptocurrency investment in the Chinese market is still huge. Investors participate in the global market through overseas platforms or decentralized finance (DeFi), which keeps the Chinese crypto market and the global crypto financial system closely linked.

The Chinese crypto market is independent of global crypto finance. At the FOMC meeting in September, the correlation between Bitcoin and US stocks exceeded 70%. At about the same time, the People's Bank of China announced a cut in the reserve requirement ratio and interest rate, and the interest rate cut of 0.25% released trillions of RMB to the market. The A-share Shanghai Composite and the Hong Kong Hang Seng rose by 4.5% and 3.2% respectively, but BTC and ETH, which Chinese investors pay the most attention to, did not react in a coordinated manner.

Due to China's supervision, emerging cryptocurrencies such as BNB, SoL, DOGE, DOGE, etc. have different penetration rates in the Chinese market relative to BTC and ETH. Bitcoin's linkage with the reserve requirement ratio and interest rate cuts of the People's Bank of China is far lower than that of the Federal Reserve, which is a separation between the Chinese crypto market and global crypto finance.

The global market value of Bitcoin is about 2 trillion US dollars, accounting for 3% of the total market value of global stocks. The author believes that, unlike mature stock markets, the crypto market's response to interest rate cuts and reserve requirement ratio cuts mainly depends on incremental funds, as well as investors' investment of surplus funds in anticipation of a favorable market.

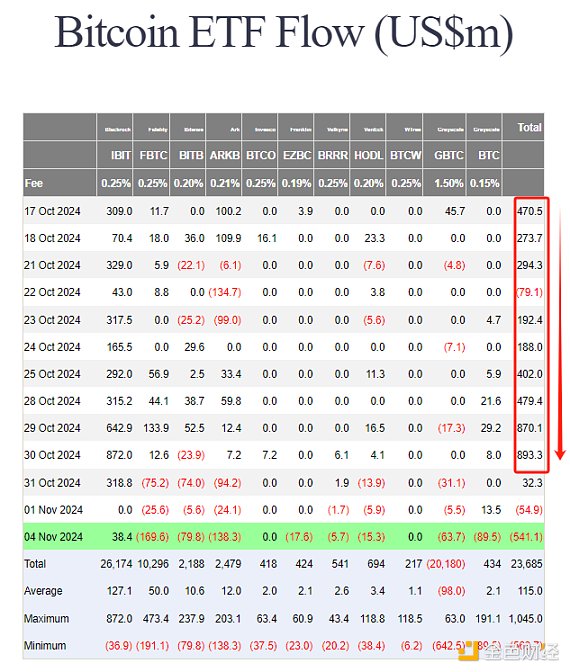

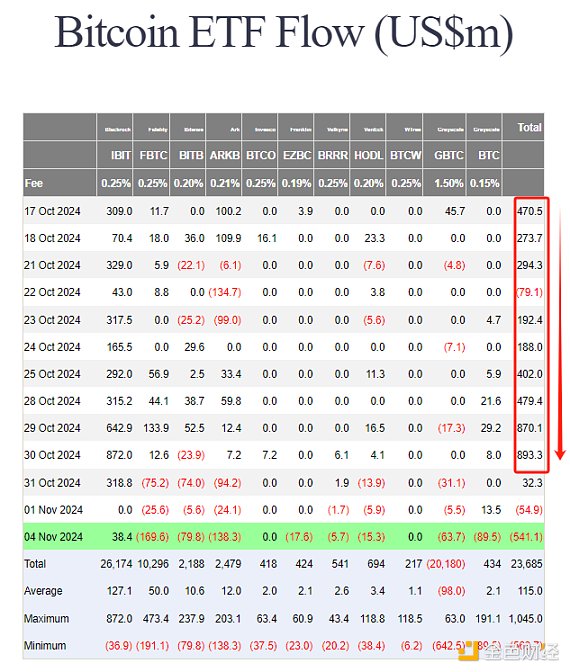

After Bitcoin broke through $70,000, ETF funds continued to double, but Bitcoin did not rise. Some investors believe that Bitcoin is already at a high level, or are waiting for the results of the US election before participating, thereby digesting the incremental funds flowing into the Bitcoin market. Compared with Western cryptocurrency ETFs, Hong Kong has taken some action, but its attitude is cautious. Unfortunately, the compilation of this part of the data will be very complicated. The author believes that the bearish expectations of the Chinese crypto market have digested the incremental funds flowing into Bitcoin.

The open crypto policy trend of the United States, especially in terms of economic policies such as the relaxation of capital gains tax, has a magnifying effect on the volatility of global crypto finance. China treats global crypto finance with a cautious mainstream attitude, and China's policies are more permanent than those of the United States. The world's crypto financial landscape will not be divided by these two major powers, and crypto investment will evolve into a higher level of cognitive behavior.

3. Risk Analysis: BTC Trend Forecast and Long-term Investment Advice after the Election

According to historical trends, the implementation of policies and market expectations after the election will have an impact on BTC prices. Currently, the US government's public debt is $28.1 trillion, accounting for about 99% of GDP. The Congressional Budget Office predicts that if Trump is elected, the debt will climb to 166% of GDP by 2034; if Harris is elected, it will grow to 109%. It can be seen that no matter who is in power, the US government will continue to expand its debt, and this is the time for BTC to re-enter the market.

Short-term positive expectations of Trump's victory

If Trump wins the election, the market generally expects him to promote a more relaxed policy environment. Against this background, BTC prices will experience a period of fluctuations and short-term rises, but this rise will not last for a long time. Based on historical experience, Trump cannot quickly introduce specific policies.

Long-term stability after Harris's victory

After Harris's victory, his regulation of cryptocurrencies may become stricter, which may suppress the price growth of BTC and other currencies. The crypto market may face pressure in the short term. Harris requires the protection of the US dollar and market stability. BTC may enter a long-term trough period, which is suitable for finding low prices to build positions in batches.

Finally, if you are optimistic about BTC. Regardless of the election results, investing in mainstream currencies such as BTC can still reduce the impact of price fluctuations through fixed investment. As long as the global economic environment is unstable, holding high-quality crypto assets is still an effective means of value-added.

Hui Xin

Hui Xin