Introduction

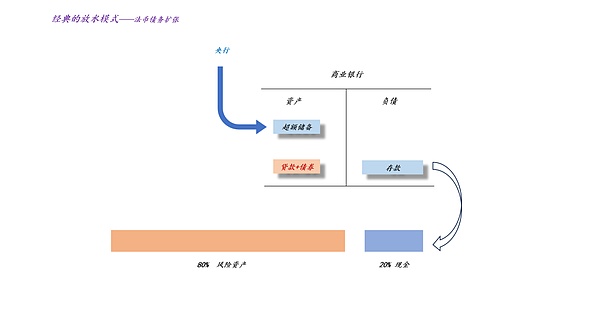

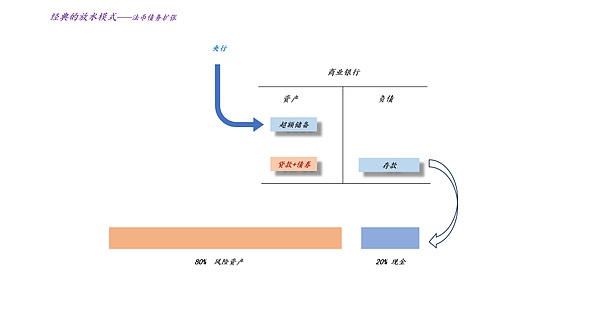

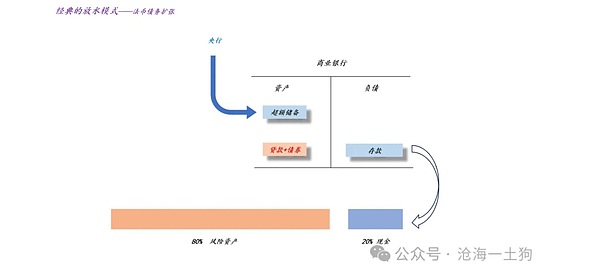

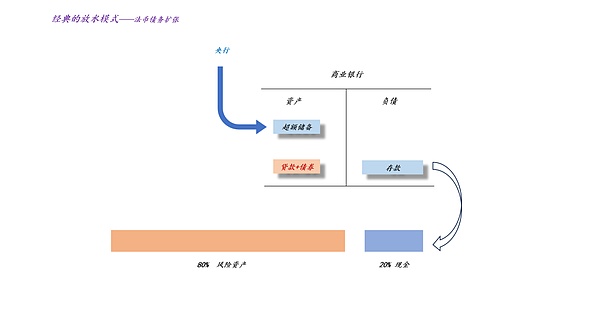

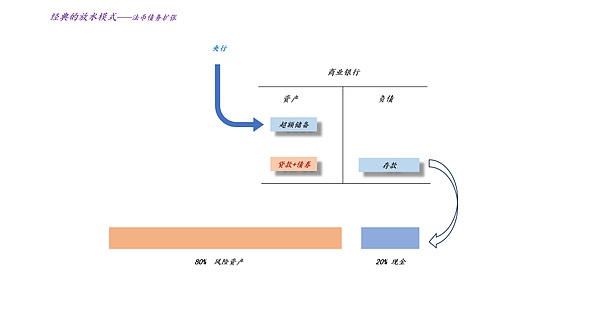

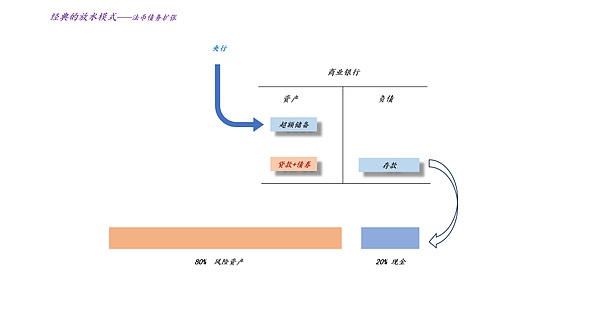

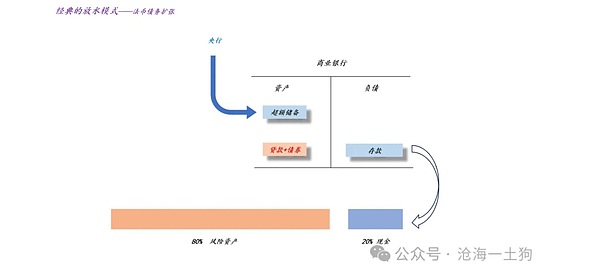

Generally speaking, traditional monetary and banking theory is a monetary and banking theory based on the expansion of fiat currency debt, with the expansion of fiat currency debt being the core of everything.

As shown in the diagram above, under this system, on the one hand, the central bank expands excess reserves; on the other hand, commercial banks expand credit, resulting in an expansion of the scale of fiat currency debt such as loans and bonds ...>

It is obvious that the traditional model implicitly assumes that the impact of cross-border capital flows is weak. So, why was this assumption reliable in the past? Because mostcentral banks would follow the Federal Reserve's lead, but now this assumption has failed.

As shown in the image above, since 2022, the Federal Reserve has rapidly raised interest rates, but China's policy interest rates have remained low. Therefore, the monetary policies of China and the US are misaligned. According to traditional monetary and banking theory, US stocks should be in a bear market, while A-shares should be in a bull market. However, the opposite is true. This indicates that the effect of cross-border capital flows is primary, while the stimulus of low interest rates on the expansion of fiat currency debt is secondary. As shown in the image above, China's credit growth rate continued to decline during this period, a phenomenon many attribute to the real estate bear market. However, the real problem for most people is that they have reversed the relationship between policy interest rates and housing prices. The Substitution Effect of Safe-Haven Assets As discussed in a previous article, the development of modern financial instruments has altered the form of money supply. The popularity of all-weather strategies, essentially "shorting cash," has led to a stronger substitution of cash by safe-haven assets such as gold, gold contracts, BTC, and BTC contracts. Therefore, the pricing formula for risky assets has changed: Traditional: Risky asset price = Cash balance × Risk appetite; Modern: Risky asset price = Cash balance × Safe-haven asset coefficient × Risk appetite. It's easy to see that under the modern monetary supply system, "safe-haven assets" occupy a central position. They can completely bypass the constraints of "cash balance"—the constraints of the Federal Reserve—and inflate risky asset prices by increasing the safe-haven asset coefficient. Currently, global M2 is approximately $123 trillion, and the market value of gold is approximately $30 trillion. Therefore, the inflation of gold prices will indeed significantly change the global monetary supply mechanism. As shown in the image above, the price of spot gold in London was less than $2,000 at the beginning of 2024, but has now soared to $4,200. This means that the market capitalization of gold has increased by approximately $15 trillion in the past year. What does this mean? The Federal Reserve spent over two years implementing QT, shrinking its balance sheet by $2.4 trillion, while gold's market value increased by $15 trillion in just one year. Therefore, the modern monetary supply system has undergone a complete transformation.

Gold's "Frugal" Expansion Mechanism

In the traditional model, the increase in fiat currency depends on the increase in fiat currency debt:

In fact, this is a very expensive form of money supply, and lenders need to constantly pay high interest rates.

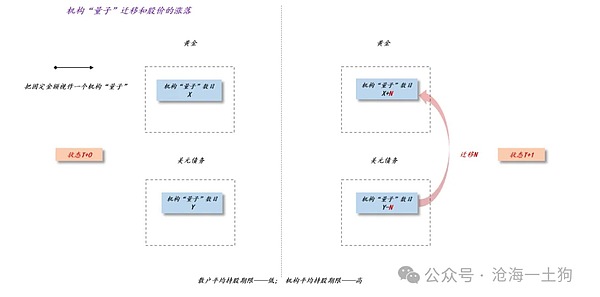

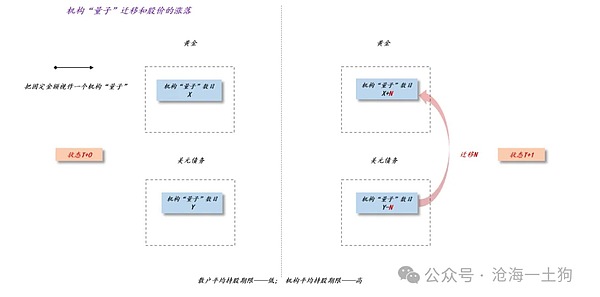

So, is there a cheaper way to supply money? Yes, that's decentralized currency. In this new model, the expansion of decentralized currency doesn't depend on the expansion of fiat currency debt, but only on the expansion of decentralized currency prices. This is a very clever expansion method; there's no increase in fiat currency debt, only a change in the concentration of gold holdings. In previous articles, we discussed the underlying principle: institutional investors have a longer average holding period than retail investors; therefore, institutional herding behavior significantly drives up stock prices.

Symmetrically, we can transfer this logic to gold. Central banks' average holding period is longer than that of financial institutions, and financial institutions' holding period is longer than that of individuals. Therefore, central banks' actions of selling dollar debt to exchange for gold will significantly push up the price of gold.

Theoretically, there is no limit to the rise in gold prices caused by this central bank alliance. As long as there is a reason for global central banks to continuously increase their gold reserves, the price of gold will continue to rise.

In theory, there is no limit to the rise in gold prices caused by this central bank alliance. As long as there is a reason for global central banks to continuously increase their gold reserves, the price of gold will continue to rise.

interest rate hikes > gold price increases"—we can achieve a kind of debt-reduction magic: by raising interest rates and expanding safe-haven assets to drive up the price of risky assets, a debt exchange is completed with overseas investors during the process of risky asset price increases. When the tide recedes, some overseas investors are locked into expensive fiat currency debt. The tragic experiences of these unfortunate individuals will serve as a warning to other investors, prompting them to re-evaluate the value of long-term US Treasury bonds. Conclusion Finally, we arrive at the following basic conclusions, which, rather than being counterintuitive, contradict the "classical monetary banking model": 1. Fed rate cuts are detrimental to US stocks. As the federal funds rate continues to decline, funds will eventually flow back to non-US currencies on a large scale; 2. Rising gold prices are beneficial to US stocks. They expand the safe-haven asset coefficient, offsetting the negative impact of Fed rate cuts; 3. When the 10-year US Treasury yield and gold price both decline, it is the most dangerous time for the US stock market. At this time, the original flow of funds is reversed, and the entire system faces huge chaos.

4. The final outcome is that the 10-year US Treasury yield and the federal funds rate fall together, and ultimately, the US debt crisis is resolved.

5. Only when the tide goes out do we know who is swimming naked, but we need to thoroughly study the tide.

6. On the surface, Powell is a hawk, but in reality he is a dove; on the surface, Trump is a dove, but in reality he is a hawk. 7. The biggest expectation gap in 2026 will be the new, extremely dovish FOMC, using dovish rhetoric to act hawkishly; 8. We will miss Powell.

Brian

Brian