Author: Kyle Torpey, Source: Cointelegraph, Compiled by: Shaw Golden Finance

This year, the U.S. government's support for stablecoins has reached an unprecedented level. From the acceptance of these assets by politicians and the industry to the passage of the GENIUS Stablecoin Act in the Senate, 2025 marks an important turning point.

U.S. Treasury Secretary Scott Bessent even gave stablecoins a vital mission to ensure that the U.S. dollar continues to remain the world's number one currency. "As President Trump has directed, we will ensure that the U.S. dollar remains the world's primary reserve currency, and we will use stablecoins to achieve this goal," he said at the Digital Asset Summit in March.

U.S. Treasury Secretary Scott Bessant praises U.S. Senate approval of GENIUS Act

U.S. Treasury Secretary Scott Bessant praises U.S. Senate approval of GENIUS Act

That’s why it’s mind-boggling to realize that stablecoins are the descendants of Bitcoin. Bitcoin is a decentralized currency that aims to level the playing field in a world rife with central banking system manipulation and government overreach. Stablecoins and Bitcoin seem to have two irreconcilable goals — the former supports the existing fiat-based financial system, while the latter seeks to overthrow it.

So what happens once the GENIUS Act passes? Will there be a showdown between stablecoins and Bitcoin?

FalconX research director David Lawant said that this idea may not be the right one...at least in the short term.

"The two are not competing, but complementary," Lawant said. "As finance becomes increasingly digital, it makes sense to have both a digital fiat currency that can be used for transactions and a digital gold equivalent that can be used to store value."

Bitcoin and stablecoins won't take a piece of the pie

Zack Shapiro, policy director at the Bitcoin Policy Institute, agreed, calling Bitcoin and stablecoins "fundamentally different" with non-competitive selling points.

He explained: "Stablecoins are dollar-denominated assets built on the blockchain that enable fiat currencies to circulate more efficiently on the internet, similar to digital cash with fast and low-cost settlements. They solve the inefficiencies of the traditional banking system, where settlements can take days and involve multiple intermediaries."

He added that while they share blockchain infrastructure with Bitcoin, the similarities end there.

Bitcoin is a completely new form of money - decentralized, scarce, censorship-resistant, and governed by code rather than policy. It should be understood more as a digital commodity or monetary asset like gold, while stablecoins are just tokenized forms of fiat currencies, functioning more like payment infrastructure than a new asset class.

Stablecoins may even help Bitcoin

Galaxy research director Alex Thorn said that the United States Stablecoin National Innovation Guidance and Establishment Act (GENIUS Act), which aims to establish a clear legal framework for stablecoins, is advancing in the U.S. Congress and is expected to be submitted to Trump's desk in August.

After the U.S. Senate passed the GENIUS Act, U.S. President Trump declared: "This is the best embodiment of American wisdom. We will show the world how to win with digital assets in an unprecedented way!"

The bill lays the foundation for the establishment of a comprehensive regulatory system for stablecoins anchored to the U.S. dollar. A key feature of the bill is its strict standards for issuing stablecoins: only qualified entities approved by the federal or state governments, or subsidiaries of insured depository institutions, can issue stablecoins.

2025 will be the year of stablecoins

2025 will be the year of stablecoins

The bill requires that stablecoins must be backed by a one-to-one reserve with the U.S. dollar or similar liquid assets. It is worth noting that stablecoins under the bill are not considered securities.

Shapiro said: "The GENIUS Act is a reasonable, bipartisan bill that reflects a pragmatic step forward in the regulation of digital assets."

While stablecoins are already legal under existing U.S. law, the bill will strengthen consumer protections and provide long-term regulatory clarity for institutions that want to use stablecoins as payment infrastructure.

However, Shapiro pointed out that the bill will not have a direct impact on Bitcoin. "But its passage may strengthen the perception both at home and abroad that the United States is embracing digital assets in a bipartisan, rules-based manner," he said. This perception may provide some support for Bitcoin and promote further legitimization of the entire cryptocurrency space.

Lawant believes that Bitcoin and stablecoins will promote each other and grow together. He specifically pointed out that the development of Taproot assets is worth paying close attention to. Taproot assets are a way to use non-Bitcoin tokens (such as stablecoins) on Bitcoin and the Lightning Network. It is worth mentioning that Tether launched the stablecoin USDT on Bitcoin's Omni layer as early as 2014.

At the Bitcoin 2025 conference held in Las Vegas in May, Tether CEO Paolo Ardoino pointed out that channel-based systems like the Lightning Network, rather than Layer 2 networks on alternative blockchains such as Ethereum, are the right way to achieve expansion.

Lawant said: "Stablecoins also play a key role in expanding the popularity of Bitcoin. For many users, stablecoins lack the price volatility of fiat currencies, which makes them more familiar with digital wallet infrastructure and perhaps even blockchain-based finance. This may eventually lead them to explore Bitcoin."

Tether pays close attention to the GENIUS Act

As Paolo Ardoino revealed in May this year, stablecoin issuers such as Tether (whose USDT stablecoin has exceeded $150 billion in size) are gradually adapting to the GENIUS Act. Tether may launch a branch in the US market to ensure compliance with the requirements of the act.

Tether may be the best example of how Bitcoin and stablecoins can coexist and prosper together in the real world. Tether is reported to invest part of the interest it earns from its holdings of U.S. Treasuries and other sources of profit in Bitcoin.

A Tether spokesperson said the company sees "Bitcoin as the cornerstone of the future of decentralized finance," noting that it has accumulated 100,000 bitcoins for company reserves and a sustainable bitcoin mining business.

The spokesperson said: "In many emerging markets, USDT has become an important tool for responding to economic instability and currency devaluation, and often serves as a reliable hedge against inflation."

Shapiro also sees a similar interaction between the two. "In the United States, stablecoins may be used behind the scenes by banks, fintech companies, and payment processors to improve efficiency, and end users often don't even know that they are interacting with blockchain technology."

Stablecoins may even become a transition currency to Bitcoin. Over time, direct consumer exposure to stablecoins and digital wallets can serve as a gentle bootstrap mechanism for broader adoption of digital assets, including Bitcoin.

A spokesperson for Tether said: "We believe that stablecoins are not the end goal, but a fundamental path towards the wider adoption of decentralized assets such as Bitcoin. This is why we invest in Bitcoin and support educational programs that aim to provide knowledge to communities around the world so that they can use digital assets wisely and confidently."

Outside the United States, especially in developing countries around the world, stablecoins (mainly USDT) are often a key way to obtain US dollars in places where physical cash or bank accounts are not available.

There, they (stablecoins) act as a short-term, low-volatility store of value, while Bitcoin serves as a long-term hedge against local currency collapse or political turmoil. In this case, stablecoins and Bitcoin, as "safe haven" and "risk appetite" tools, together provide complementary roles for financial sovereignty.

What is the ultimate outcome of Bitcoin and stablecoins?

Bitcoin and stablecoins have evolved together over time, with varying views on the ultimate outcome.

More than a decade ago, Jal Toorey proposed that Bitcoin could serve as a standard or ideal foundation for John Forbes Nash Jr's concept of ideal money to measure and incentivize improvements in fiat currencies.

But Michael Saylor, a Bitcoin super bull and founder of Strategy, said the ultimate outcome is not that Bitcoin replaces the dollar.

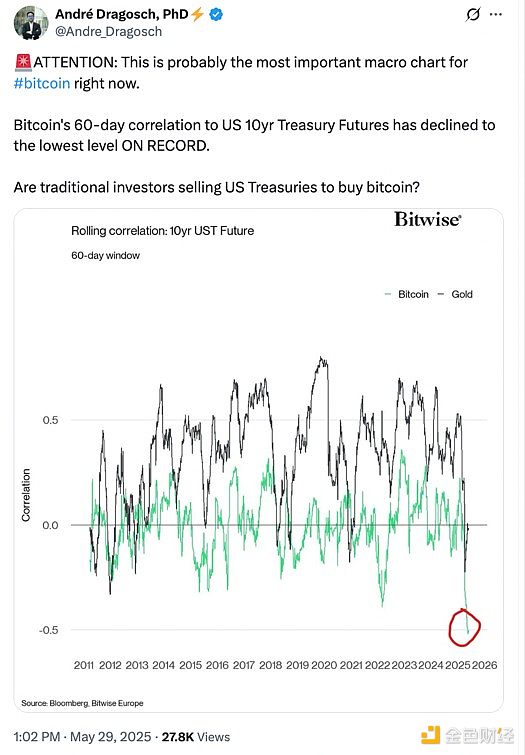

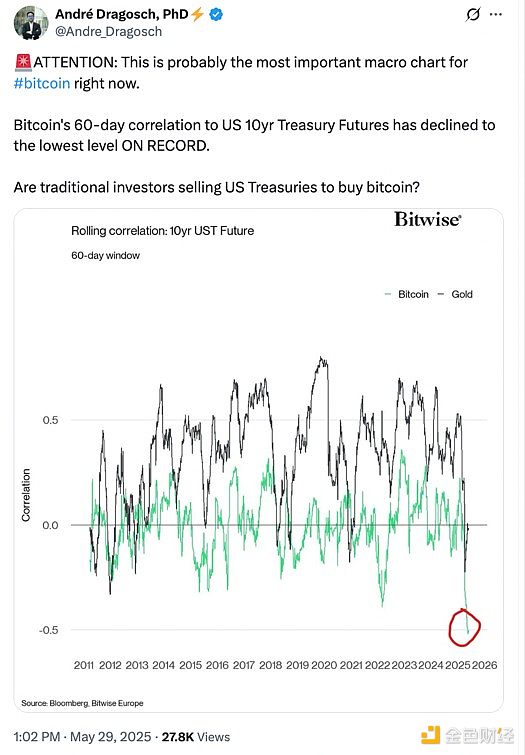

Bitwise's head of European research André Dragosch asked if U.S. Treasuries were sold in exchange for Bitcoin

Bitwise's head of European research André Dragosch asked if U.S. Treasuries were sold in exchange for Bitcoin

In a speech at the Bitcoin 2025 conference, Saifedean Ammous, author of The Bitcoin Standard, outlined a potential scenario in which Tether would eventually hold more Bitcoin reserves than U.S. dollars or dollar equivalents.

From this perspective, Tether looks more like the kind of Bitcoin bank that cypherpunk Hal Finney once envisioned, issuing its own notes backed by reserves, rather than just spreading the technology of the dollar.

This is also similar to Meta's original intention in proposing the concept of the Diem stablecoin, which is that the digital currency can be backed by a basket of fiat currencies rather than simply pegged to the US dollar.

A Tether spokesperson said: "At Tether, we have made Bitcoin a core part of our strategy because we believe in its long-term value. As the strongest form of money ever created, Bitcoin has outperformed all asset classes over the past decade, and its adoption as a reserve asset is accelerating."

The spokesperson added: "Its ability to hedge against inflation and economic uncertainty makes it a natural complement to traditional reserves such as gold and U.S. Treasuries."

"Saifedean has presented a compelling vision for the direction of global finance, and we agree that Bitcoin will play a central role in that future."

Anais

Anais