Philippines SEC Takes Action Against eToro for Offering Unregistered Securities

In the wake of the country's crackdown on Binance, the Philippines' securities regulator has shifted its focus to the online trading platform eToro.

Catherine

Catherine

Source: 4 Pillars; Compiled by: Techub News

The rules of the narrative game for the development of the cryptocurrency industry are beginning to change, and market participants are forming a meta-awareness of the driving force of the narrative game itself.

The cryptocurrency industry is in urgent need of applications that can bring demand for block space.

The biggest advantage of cryptocurrency is that its value will weaken any ability to envision an economy and provide a trading platform. Recently, some new experimental forms that utilize focus economy and speculative characteristics have emerged in the market, such as memecoin, social trading, and prediction markets. More flexible on-chain applications and business models may emerge.

For on-chain applications, speculation is the most powerful function. The increasing social demand for speculation can attract "degens".

In the long run, the industry's goal should be to provide value beyond speculation. It is necessary to transform users attracted by speculative demand into users who truly appreciate the core value of the service, build a sustainable token economy, and ultimately provide social graphs and product value beyond speculation.

Source: Dawn Delivery | 4844 Movies

As Paradigm Co-founder Matt Huang said, we are like a casino built on Mars. From redefining currency to the interaction between the bottom layer and the application, the systems and mechanisms established by society are being rebuilt to adapt to the new paradigm called "cryptocurrency". It goes beyond the globalization of technological innovation and embodies different cultural and social meanings. For libertarians, cryptocurrency provides a path to free markets and autonomy. For crypto-punks, it provides a censorship-resistant, permissionless value exchange network. For entrepreneurs, cryptocurrency is the foundation for building the next generation of the Internet. For traders, it is an endless source of dopamine and potential profits. Depending on personal perspectives, the casino built by cryptocurrency will be very different. What do you think about the future of cryptocurrency drills?

2024 is already halfway through, and looking back, this year is full of vitality, highlighting the multifaceted nature of the cryptocurrency industry. Bitcoin has gained institutional recognition through ETFs. Ethereum successfully implemented the Dencun upgrade including the EIP-4844 note. Rollup was deployed to blockchain projects and became a mainstream solution for launching new chains. Solana has started an amazing revival after a difficult period, and the bull run that began last year has also triggered a frenzy for memecoins and celebrity coins.

In terms of applications, we have seen significant developments in the cryptocurrency space. Over time, DeFi protocols have matured and are expected to grow. At the same time, scenarios such as SocialFi and narratives such as restaking and artificial intelligence have emerged, attracting attention and speculation.

The market has clearly recovered compared to the previous bear market. However, with the recovery, there have been bipolar valuations in the industry. In the case of memecoin, on one hand, opponents call it meaningless speculation, while proponents believe that the innovation it represents is "going to support the market" (Go-To-Market) and is a derivative of the emerging model of the focus economy. In addition, in terms of narrative, the industry is also divided into two camps, one praising the new narrative and the evolution of infrastructure, and the other belonging to the elitist realm.

Since the birth of Bitcoin in 2008, the cryptocurrency industry has gone through a more turbulent path than any other industry, going through multiple growth and funding cycles to usher in the current recovery. When public interest fades, the industry will make a dramatic comeback, triggering new narratives and hype. Similarly, the future development of the cryptocurrency industry also contains countless scenarios and possibilities. This article reflects on the narrative game that drives the cryptocurrency industry tonight, explores the latest trends in the ever-changing industry landscape, and reflects on the direction of the cultural industry.

Source: Fractal Life

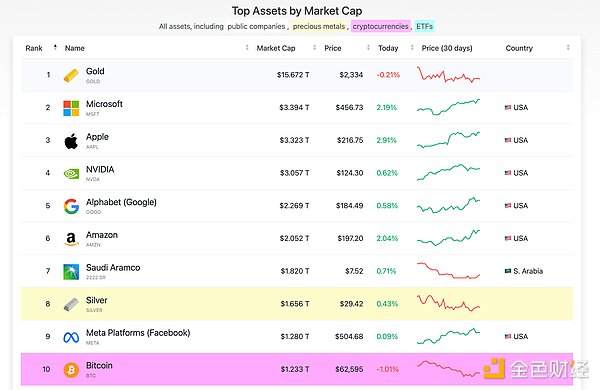

It all started with Bitcoin. Since its inception, the cryptocurrency industry has undergone countless developments and changes, but Bitcoin remains the benchmark for the entire industry. As of writing, Bitcoin's market value has reached $1.2 trillion, ranking tenth among all asset classes. And with the approval of spot ETFs, Bitcoin has further consolidated its position as "digital gold." The reason why Bitcoin can achieve a market value of $1.2 trillion is not that it is a business based on operating profits, but that it is considered an asset with scarcity and legitimacy. Even Visa and Mastercard, the world’s most widely used payment networks, have a market capitalization less than half of Bitcoin’s.

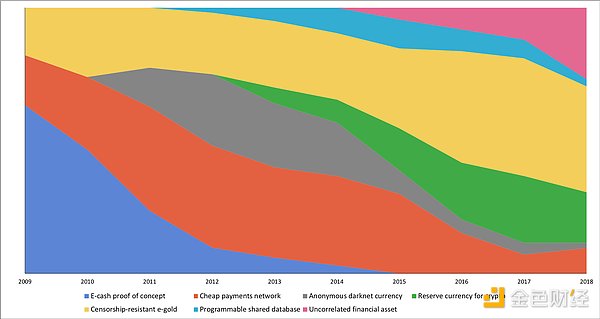

Source: Bitcoin Vision

Bitcoin was not seen as “digital gold” from the beginning. In the early days, most people believed that Bitcoin was a new electronic currency or a low-cost payment network. In the early 2010s, Bitcoin was also widely believed to be a dark web. However, over time, Bitcoin gradually gained legitimacy, and its narrative shifted from transaction value to value storage. The second half of the above chart, the same period in 2018, clearly shows that public opinion is more inclined to view Bitcoin as an asset class rather than a payment network. Although the above chart does not show data after 2018, the argument that Bitcoin is "digital gold" has not only been around, but has also been strengthened.

Satoshi Nakamoto's view on Bitcoin is that the essence of currency stems from social opinion. Blockchain is just an encrypted implementation of social opinion between participants. The value of this network dominates the participants' evaluation of the network. If Bitcoin is also considered a payment network or darknet currency rather than a value storage narrative, the current value realization will be very difficult.

The success of Bitcoin set the standard for the protocols and tokens that came after it. Like Bitcoin, most tokens in cryptocurrencies have both commercial and asset characteristics. In addition, the censorship resistance and consumption permission of the blockchain provide a basis for anyone to issue tokens and allow others to trade tokens. In order to increase the value of the token, each protocol needs to get more people to agree with its vision and believe that its token has value.

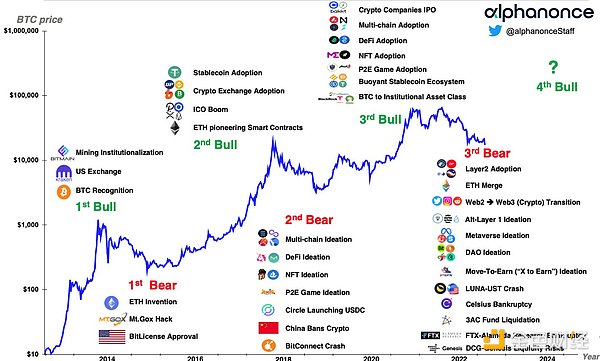

Source: X(@alphanonceStaff)

As a result, a unique "narrative game" culture began to prevail throughout the cryptocurrency industry. Emerging industries usually value future potential more than the actual benefits to users in the present. However, in the cryptocurrency field, this narrative-driven approach has dominated the status quo. Marketing strategies based on fascinating stories have been effective since the rise of the ICO boom, when people rushed to publish white papers, and even today. In the cryptocurrency field, the most influential figures have always been idols, researchers, and thought leaders. The trend of worshipping these figures as idols has become one of the most notable characteristics of the industry.

Furthermore, narrative games are particularly effective because the majority of participants in the cryptocurrency market are investors and traders. The success of cryptocurrency narrative games exceeds effective marketing campaigns. Its biggest advantage is that it replaces the characteristics and models of permissioning, allowing anyone to tokenize any idea and give it economic value. The more compelling and attractive narrative a project can carry, the more critical factor that the market will directly hook. As token prices rise and trading volume increases, traders will continue to look for the next fascinating story, and projects create an endless cycle to provide these narratives. The cryptocurrency industry maintains its growth in a cycle of constant acceptance and disappearance of new narratives.

Source: X(@intuitio_)

The memecoin craze this year has exposed the essence of narrative games in the cryptocurrency industry. The phenomenon that these tokens that provide little practical utility or vision are sought after in the market fully demonstrates that narrative games are still the dominant force driving the development of the cryptocurrency market.

The rise of Memecoin is not just due to speculation. It also reflects a criticism of the elitism of pursuing complexity in cryptocurrency and the market imbalance between retail investors and VCs. As the industry matures, the narrative of true innovation is becoming increasingly rigorous. Less. More and more projects have the gap to brand themselves as the next "blockchain revolution". This has led to overcrowded platforms, excess block space, and fatigue with repeated narratives. In addition, mainstream projects can even obtain exaggerated valuations from VCs before the sale, and try to control prices through limited circulating supply. This situation makes it difficult for many retail investors to participate in the narrative game.

Source: X(@gainzy222)

The meaning of cryptocurrency narratives and the way practitioners consume them are changing. It remains to be seen how long the old routine of justifying high market capitalizations and creating new stories can last. But we can't expect new technological innovations or business models to appear every week.

The crypto industry has always been based on a narrative of technological breakthroughs and capital efficiency. Now, investors and users seem to have developed a meta-awareness of the narrative game itself. The narrative game of crypto seems to be developing in two extreme narratives. One side complains that new innovations and narratives are not as good as before, while the other side continues to hype up new meme coins and hot projects, and then watch them burst like a bubble. In the near future, we may see this change become more obvious.

Since its inception, the narrative game of crypto has undoubtedly played a vital role in building the foundation of the industry. More than just maintaining token prices, the crypto industry needs goals and visions to prove its existence and potential, especially after deceiving many people into accepting the vision of blockchain and Web3, who are committed to promoting the industry and have played an important role in shaping the current form of the industry.

However, the technical limitations of blockchain and Web3 are obvious. For everyday applications, networks with sufficient security and censorship resistance are too slow and costly. During the DeFi and NFT summer, the single transaction fee on Ethereum easily exceeded $100.

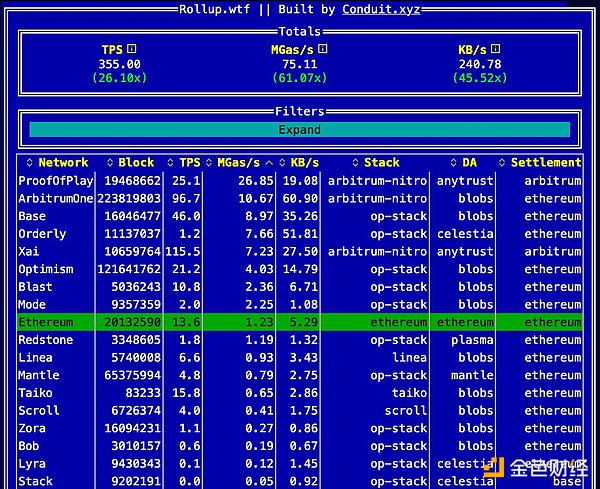

Source:Rollup.wtf

Thanks to the efforts of engineers and researchers, blockchain technology has been advanced. Now, a secure and scalable blockchain space has become a reality. Most L2 or high-performance chains have transaction fees of less than $0.01 and speeds comparable to traditional applications.

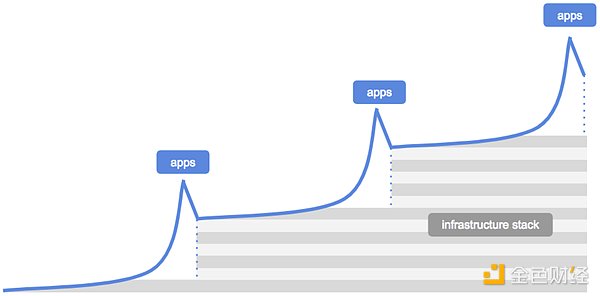

Source:The Myth of the Infrastructure Phase

Looking back, Bitcoin has been around for 16 years and Ethereum has been around for 9 years. Over the years, the cryptocurrency industry has gone through several cycles of infrastructure and application development, experiencing both technological progress and decline caused by greed. In the initial stages, the industry developed relatively slowly due to insufficient demand and the need to procure the required resources. By the DeFi and NFT summer of 2020, the demand for applications began to explode, but there were insufficient systems to support this demand. Subsequently, we deeply met the need for stable and scalable infrastructure.

The crypto winter after 2022 marks a period of rapid development of blockchain infrastructure. Rollup, data availability layer, and ZK technologies have entered the commercialization stage from the research stage. The market is actively adopting these innovative technologies. Integrated chains such as Solana have attracted new users with low progress and fast transactions. Performance chains such as Sui and Monad have also attracted people's interest and are expected to launch more applications in the foreseeable future.

The development of infrastructure and applications complement each other. There is no saying that one is more important than the other or which needs to be developed first. Applications stimulate the demand for infrastructure. In turn, advanced infrastructure lays the foundation for new applications. YouTube was born in 2005 instead of 1995 because of the widespread use of broadband infrastructure. The popularity of broadband is due to the success of early Internet companies such as Amazon and eBay.

Source:X(@Imrankhan)

Blockchain technology has a lot of room for improvement. We look forward to wider adoption of networks that can provide better user experience and security. However, it is undeniable that the narrative of the cryptocurrency industry is entirely focused on technical improvements and previous concepts. Now, it is time for the application of the crypto industry to stimulate the development of infrastructure. Most importantly, we need applications that can bring block space demand.

As mentioned earlier, there has always been a market demand for new narratives in the cryptocurrency industry, and this tendency is extremely strong in the Web3 environment where value accumulation is concentrated at the protocol layer. Therefore, almost out of inertia, the industry continues to show a preference for platforms and foundations, the emergence of application facilities is relatively lagging, and the impact on users is also underestimated.

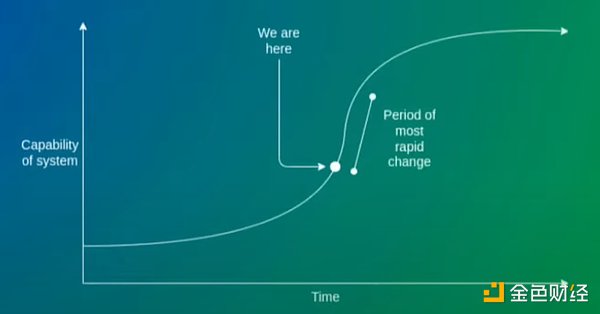

Source:Vitalik Buterin (EthCC 2022)

After the Ethereum Dencun upgrade earlier this year, Vitalik Buterin expressed his views on the future direction of the cryptocurrency industry.

Today, I think that we are clearly on the right side of an S-curve, the termination period. Before the end, the two biggest changes in Ethereum, the switch to proof of stake and the re-architecting of spots, have become a thing of the past. Further improvements are still important, but will not have the same direct impact as proof of stake and sharding.

The first ten years of Ethereum were largely in the "practitioner" stage, with the goal of getting Ethereum L1 off the ground, and applications were mainly used by some interests. Until a few years ago, we still set a low standard for ourselves, that is, to build applications that obviously cannot be used at scale, as long as they can run as prototypes and are reasonably decentralized.

By now, we already have most of the tools needed to build applications with a crypto-punk style and user interface. We let go and look for it. Developers have no excuses.

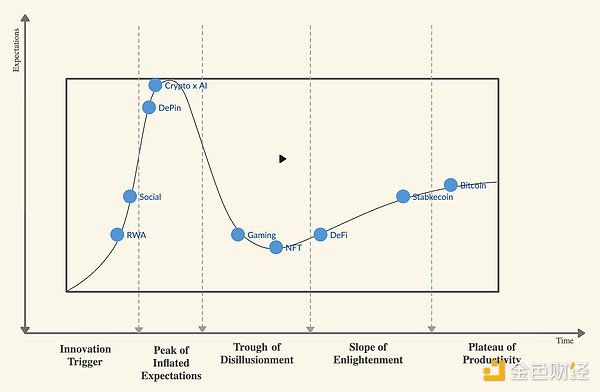

Source: X(@QwQiao)

If we follow the analysis of analysts, tokens as value stores (such as Bitcoin) and stablecoins as payment methods have entered a mature stage. Stablecoins have become on-chain reserve currencies and are used by countries with unstable currencies such as Latin America or Africa. The DeFi field has also emerged from the disillusionment stage, and the business of mainstream projects has also stabilized. According to Token Terminal data, MakerDAO generated $3 million in revenue in the first quarter of 2024, an annualized rate of about $12 million. The market value of the token is about $20 billion, with a price-to-earnings ratio of about 16. Even compared with traditional fintech companies, this does not seem to be a high valuation.

On the other hand, for a wider user base, the application in some areas is still limited. NFT seems to be experiencing a "disillusionment". After the bull market in 2021, most NFT projects have failed to gain social favor, except for a few core IPs. In addition, even if the market has high hopes for games, the performance of the project is not optimistic, and users are greatly neglected. As for other scenarios, such as artificial intelligence, DePIN, and social networking, they have not yet reached the peak of hype, or they are just the starting stage of innovation.

The cryptocurrency industry has passed a critical framework. Despite various challenges including the Terra and Luna incidents, the collapse of FTX, the increasingly severe macro environment, and regulatory pressure, cryptocurrencies will continue to move forward. Even in extreme hypothetical scenarios, it becomes unreasonable to imagine a scenario where the entire industry collapses. But it is undeniable that blockchain applications still dominate the financial and trading fields, cater to a limited user base, and lack mainstream appeal.

The current cryptocurrency industry is at a crossroads and may continue in its current state, with only incremental improvements in mature areas such as tokens as value stores or DeFi. This does not mean that it does not make sense to continue to play the role of a money market, but that the cryptocurrency industry is ultimately a participant-driven market, just like the stupid or marijuana industry. Cryptocurrency as an application layer has huge potential. Ideally, after leveraging this, it is entirely possible to drive mainstream application adoption and the emergence of new business models.

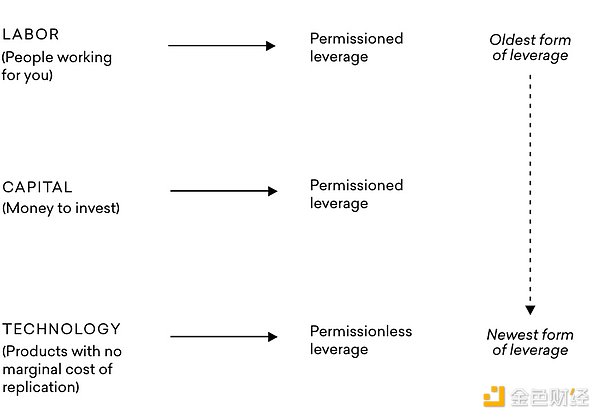

Source: Insights from the Annals of Nawal Ravikant

Traditionally, only those individuals or businesses with capital and labor had leverage. However, the popularity of software and media broke this status quo. Software enables any individual with very little capital to develop applications and services, which brings innovation and gives birth to mass platforms and SaaS products. The widespread use of platforms such as YouTube and Instagram can expand personal influence, triggering the "Cambrian Explosion" of influencer markets and small media.

The greatest value provided by cryptocurrencies is the ability to give any idea of economic value and provide a trading platform. In traditional systems, the formation of markets requires internal intervention and permission to maintain economic value and mutual trust. However, blockchain technology provides the basis for tokenization, allowing users to exchange economic value with others through the Internet and form markets on the premise of gaining the trust of others or obtaining their permission.

The term "meme" was first proposed by Richard Dawkins in his book "The Selfish Gene". It is a concept similar to genes, which transmit genetic information through physical means. In society, memes are a cultural unit that can represent Later, memes adapted to Internet culture and were widely used in their current meaning. Memes, like genes, spread through social interactions and continue to evolve in the process of copying, modification and reproduction.

Recently, Michael Rinko of Delphi Digital emphasized in his article "Attention is all you need" that cryptocurrencies give economic value to people's ideas and interests, allowing users to own their interests and earn profits.

On Instagram, we follow brands and influential people. But the most I can do is to repost and share this content with friends. 100% of our attention value is obtained by others.

Cryptocurrency is different. Cryptocurrency democratizes attention and allows us to own it. If you find yourself spending a lot of time on some topic, you can actually own your topic and estimate the benefits. This principle may seem silly at first glance, but it represents a major shift in the economics of the Internet.

Memecoins take the "attention is value" framework to the extreme. They provide the purest way to buy a token because you think it will attract attention in the future.

Source: X(@jessewldn)

It must be admitted that memecoins themselves are not the most important thing. They are just a meme at the bottom, and once they become boring, they will quickly disappear from people's sight. Memecoins are the raw potential of tokenization, hinting at the possibility of new applications. From identity to data to the maker economy, the ability to assign economic value to focus paves the way for cutting-edge markets and applications.

This was particularly evident in the 2024 breakout. Crypto markets are revitalized, and applications that convert attention into speculative demand are growing rapidly.

Solana’s Pump.fun became the leading platform for memecoin, generating the highest fees of all protocols.

Friend.tech and Fantasy.top integrated social trading features related to Twitter, generating strong speculative demand, achieving $65 million in fees and over $36 million in transactions, respectively.

The Farcaster-based Scenecoin DEGEN attracted a large number of users and activities through innovative airdrops and community incentives, contributing to the success of the Farcaster ecosystem.

During the US presidential election, Polymarket saw a significant increase in activity and trading volume, recording $100 million in trading volume in June alone.

TON ecosystem’s Hamster Kombat achieved 100 million users with its simple functionality and seamless integration with Telegram.

While this list is not eye-catching, the launch and experimentation of large-scale applications continues. Although the industry has been around for more than 10 years, the work of developing applications that leverage the characteristics emphasized by cryptocurrencies has just begun. A series of unique user experience decisions that on-chain applications may provide. We should pay more attention to these initiatives because they provide meaningful experimental results for how cryptocurrency applications can meet user needs and adapt to the market. We expect more experiments to be carried out in the underexplored areas of cryptocurrency social, gaming, NFT, and prediction markets.

Blockchain is a head technology. In addition to chains for specific applications, most networks provide a general execution environment and database for the operation of applications. In principle, most of the applications we use daily can be run on the blockchain. Just as software no longer refers to its ability to run on mobile devices or uses cloud marketing keywords, encryption technology should not become the final standard for describing application functions. , "blockchain" or "cryptocurrency" will no longer be used to describe applications, and users should be able to use applications without knowing the underlying chain or wallet.

When someone wants to launch a product or service, no one asks why it should be released online. Because the deployment cost is relatively high, the speed is faster, and except for special circumstances, customers can enjoy greater convenience and accessibility than offline. Similarly, it is foreseeable that applications running on the chain will eventually be regarded as a natural thing. As the use of wallets in permissionless markets and interconnected application ecosystems becomes more and more common, we will no longer question why applications need to run on the blockchain.

However, in the current limited blockchain environment, such an assumption is nothing more than a hope. The current blockchain development environment is still full of challenges, and users are not only unfamiliar with wallets, but also tend to avoid wallets. Except for some enthusiasts, most users need strong motivation to use on-chain applications. This is not just a matter of increasing the adoption rate by 10% or 20%. What we need is the user experience and functions that can only be achieved in the on-chain environment.

Source: Sound.xyz

Most users in the industry are airdrop "hunters" and traders, whose main purpose is to meet speculative needs. People who pursue cryptocurrency ideals believe that such speculation subverts the essential purpose of cryptocurrency and try to maintain a balance with these behaviors. However, we need to re-evaluate the role these "Degens" play in the industry. It is no exaggeration to say that the cryptocurrency industry is built on the basis of capital injection through speculation. The fact that most on-chain transaction volumes are based on speculative demand, arbitrage, or MEV profits cannot be ignored. There is no value in infrastructure without users, and no need for vulgar investment. Degens are important promoters of the cryptocurrency industry.

During the 2021 NFT Summer, many companies and brands teased and excited about entering the cryptocurrency industry. However, it was not Disney that succeeded, but Pudgy Penguins. Cryptocurrency has reached a level where it can sustain growth on its own. Compared with external entities entering the cryptocurrency industry, the outward expansion of successful products in the industry may be a more likely way to achieve mainstream adoption. Ultimately, Degens are the early adopters and basic user base of all on-chain applications, and meeting their needs should be the first step to verify product-market fit.

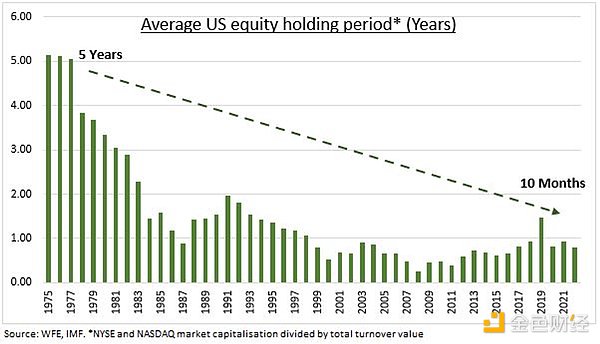

Source: eToro

The preference for speculation is not limited to cryptocurrency, it is a social phenomenon. Growing economic inequality and the shortening of people's attention span under the influence of social media have led to an increasing risk tolerance for investment assets. In the 1970s, the average American held a stock for 5 years, while by 2020, this number had dropped to 10 months.

Because of the high risk appetite of Generation Z, there is a fear that they are not paying enough attention or gambling will lose their bias. In most major countries today, it has become more difficult for younger generations to live a better life than their parents. Recognizing that labor income cannot exceed capital, many investors invest with the idea of "nothing to lose". They have few chips, but if they don't bet actively, the chances of surviving in the casino will become more and more slim.

While the current situation is undoubtedly dystopian, the high volatility of tokens is also seen by many as a good opportunity for dynamic adjustment. It turns out that easily accessible speculative assets such as memecoins are attracting new users to the cryptocurrency industry. Driven by the Solana ecosystem memecoin craze, Phantom Wallet ranks third in the utility rankings of the US App Store, with 7 million monthly users. In the process of using the application, users attracted by speculative demand will not consciously understand digital wallets, wallets and markets, so Finnish culture and may be converted into organic traffic.

Source: X(@0xJim)

Although most on-chain applications have attracted a lot of attention in the short term by leveraging unique user experience and speculative demand, their life cycle is often short due to their rough design and strong speculation. However, based on this point, the conclusion that on-chain applications cannot achieve structural retention does not rule out residual haste.

Reasons for the launch of the on-chain application lifecycle include: the majority of the user base consists of consumers and traders, who have very low product loyalty; very little time and resources are allocated to product development compared to infrastructure development; and most products are overly focused on short-term speculation rather than long-term effectiveness.

Finally, I think that if speculation is the only use of cryptocurrency, then I will not contribute to this industry. However, for cryptocurrency to achieve the vision of Web3 and make general applications such as games and social platforms interconnected and accessible, we must consider not only the goals but also the solution path to achieve the goals. Given the current industry and social environment, speculative demand seems to be the most powerful tool that cryptocurrency can use.

However, in the long run, users attracted by speculative demand must be converted into users who truly enjoy the core value of the service, so as to establish meaningful funnels and promote interactions beyond speculation. In addition, a token issuance and distribution framework that can withstand the price and demand in the short term needs to be developed, and ultimately provide social graphs and product value beyond investment opportunities.

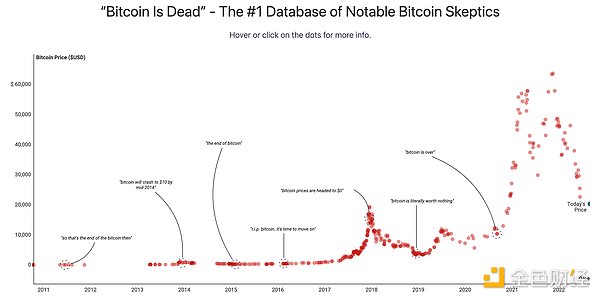

Source: "Bitcoin is Dead"

People's emotional fluctuations are even more exciting than the price fluctuations of a token. When the price falls, everyone will judge the market for Bitcoin. Bitcoin has caused "death" every year since its birth. I believe that the cryptocurrency industry has developed to the point of consumption. However, the next two to three years will determine whether the industry can realize the Web3 vision and become mainstream. If the fit of important products and markets cannot be verified within this cycle, then there is no excuse.

It has been 10 years since the launch of Ethereum, the first general-purpose blockchain. Although Ethereum has been extensively researched and developed over the years, and the industry has experienced ups and downs, it is only recently that it has developed into a technology that is reliably used by actual users. While token prices and narrative games have always driven the industry, now more than ever, we should focus on the impact of its products on actual users.

In the wake of the country's crackdown on Binance, the Philippines' securities regulator has shifted its focus to the online trading platform eToro.

Catherine

CatherineSolana’s first-generation mobile phone airdrop made buyers earn a lot of money, triggering a wave of web3 mobile phone craze. According to the latest data, the pre-order volume of Solana Mobile’s second mobile phone “Chapter 2” has exceeded 100,000 units.

JinseFinance

JinseFinanceSince 2017, Binance has been striving to obtain a phased 'partially legal' status in certain global regions through diplomacy, acquisitions, joint investments, philanthropic funding, and other means.

CaptainX

CaptainXBinance and CEO Zhao Changpeng admit intentional violations, facilitating billions in unregulated crypto transactions. Zhao resigns as CEO, faces potential 18-month sentence. Legal battles continue over sentencing and extradition. Binance.US claims independence from Zhao's governance.

CaptainX

CaptainXBinance faces $34 billion in fines from FinCEN and $9.68 billion from OFAC for not reporting over 100,000 suspicious transactions involving terrorism, ransomware, child exploitation, and other illegal activities. Future penalties and strict regulations may impact Binance for the next five years.

CaptainX

CaptainXThe lawsuit examines eToro's assessment method to determine if retail customers fell within the intended market during the period from Oct. 5, 2021, to July 29, 2023.

Davin

DavinStock trading is coming to Twitter. And, reportedly, crypto trading. Via a new partnership with eToro, users can now make use of eToro’s market charts on a range of financial investments, simply by searching for the relevant "cashtag," usually by putting a "$" sign in front of the ticker, like "$TSLA" for Tesla stock. A chart then appears, reflecting the asset’s 24-hour price performance along with a link that says “View on eToro” where users can then view more in-depth market information and p...

decrypt

decryptThe firm is reportedly seeking a new funding round that would infuse with more cash at a 50% lower valuation than one year ago.

Cointelegraph

CointelegraphSome projects have been more severely impacted by the bear market than others. However, no coin has endured greater hardship ...

Bitcoinist

BitcoinistThe move came as a surprise to some users, as ADA has not been on the watchdog’s radar in the near term.

Cointelegraph

Cointelegraph