If you can't beat it, join it.

If you can't drain the swamp, become it.

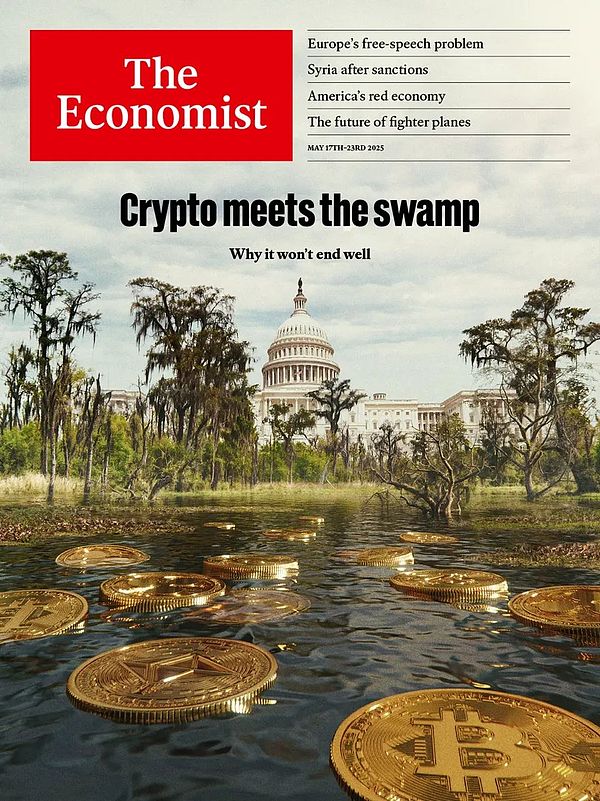

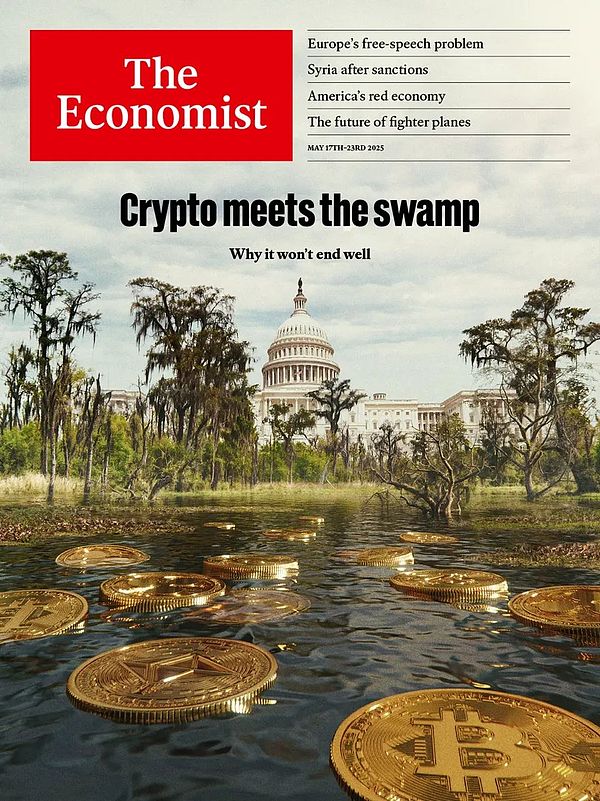

"Drain the Swamp" was Trump's core campaign promise, meaning to clean up political corruption and special interest groups in Washington. However, when it comes to cryptocurrency, he seems to be digging a new, more hidden, and potentially more dangerous "digital swamp" with his own hands.

Once upon a time, the protagonist of the crypto world was Satoshi Nakamoto, but now, the protagonist isthe President of the United States, who said “no one understands it better than me.” Trump hasassert,Cryptocurrency"Extremely volatile and unsupported" ;But now it has changed its mind, saying that the crypto community is "full of the spirit of the founding era, which is exciting."

This

dramatic turn, is not only a change in personal attitude, but also reflects the cryptocurrency - this "dramatic turn" that once carried subversion and ideals,

hasbehind it. style="font-family:sans-serif">step by step"swamping", and even alienated into the "philosopher's stone" in the hands of some power players.We are at a paradoxical node of the times: a technology that claims to be

"decentralized" and free from the control of power is now flirting with the top political power and even deeply tied to it. This is not only a betrayal of its original intention, but is also likely to lead to an existential crisis beyond the financial level. The cover article of the latest issue of The Economist magazine, cryptocurrency has become the ultimate "swamp asset". In a sense, is this a victory for the revolution?

Today, based on the content of the article, let's talk about why the overbearing president fell in love with encryption, the reversal, money power game and crisis behind it.

1. Trump’s “Crypto Feast”: A Carefully Choreographed “Gilded Game”

The climax of the story is text="">The planned dinner on May 22, 2025. A few weeks ago, Trump personally released the Memecoin—$TRUMP, which was on the verge of zero and almost became a joke in the currency circle.

However, the president's personal "blessing" was like a shot of adrenaline, which instantly gave it a certain "real value". The founding team of $TRUMP coin launched a "pilgrimage" invitation: the top 220 coin holders can have the "honor" of having dinner with Trump, and the top 25 big holders can participate in the VIP reception and have "close contact" with the president.

As soon as the news came out, the coin circle went crazy and a rush to buy came. The final list of "lucky ones" constitutes a bizarre picture of all kinds of people: there are wealthy crypto tycoons, fanatical MAGA (Make America Great Again) fans, and pure speculators. One planned to fly from Asia to the United States, hoping to attract investment for his blockchain project to "promote the next generation of Meme culture"; another Trump supporter from New York spent a lot of cryptocurrency on Trump brand watches; there was even a mysterious person wearing a mask and posing as a "cyber detective" who specializes in tracking stolen digital assets. Blockchain data ruthlessly revealed that foreigners were not uncommon in VIP seats.

This seemingly celebrity-filled banquet was undoubtedly full of controversy.

U.S. government watchdog groups have condemned the banquet, pointing out that it may violate federal regulations prohibiting officials from accepting gifts. What's more, if people with ties to foreign governments appear at the banquet, the banquet may even violate the solemn Emoluments Clause in the U.S. Constitution, which strictly prohibits federal officials from accepting any gifts of money from foreign governments. Former White House Special Advisor on Ethics and Government Reform in the Obama AdministrationMoreA more incisive assessment:“This is a moral nightmare.”Trump was re-elected for only four months, His family has been expanding its private business interests at an unprecedented pace and scale. The Memecoin dinner was just the tip of the iceberg. Their crypto ventures extend far beyond that: a bitcoin mining company and a high-profile project launched by his son, World Liberty Financial, both bear the Trump family stamp.

Some critics sharply pointed out that

these actions constitute a serious conflict of interest against the backdrop of Trump's substantially relaxing cryptocurrency regulation. The White House spokesperson responded lightly, saying that Trump always puts the interests of the American people first, and that the Meme Coin dinner is a "private business event" and has nothing to do with the White House. If you can believe this, then Americans are naive. This is not just a dinner party, but more like a carefully choreographed"gold-plated game". The transaction fees of $TRUMP coins, as well as the approximately $10 billion worth of tokens allegedly still held by cronies,

show the real winners ofthis game. According to Chainalysis, although 58 investors have made more than $10 million in profits from this coin, about 764,000 wallets have suffered losses, most of which are probably retail investors attracted by the myth of "getting rich overnight". While the rich and powerful divide up the profits in the midst of drinking and chatting, the dreams of countless ordinary investors may be shattered.

2. The “swampification” of cryptocurrency: from “dragon slaying boy ” to “the dragon itself”

(I) Broken Utopia: Fading Ideals and Departure from Original Intentions

Looking back at the origin of cryptocurrency, we have heard so many exciting declarations.In 2009, Bitcoin emerged, and a movement full of utopian colors and shining with anti-authoritarianism emerged. Early cryptocurrency believers had lofty and even great goals: they were eager to completely subvert the existing financial system and protect personal property from the erosion of inflation and unjust expropriation. They dreamed of taking power back from large financial institutions and handing it over to every ordinary investor.

In their eyes, cryptocurrency is not just an asset, but also a liberating technology, a tool that can bring a fairer and more transparent world. Crypto evangelist Andreas Antonopoulos once passionately declared: "Bitcoin is subversion. The impact it brings is so great that most people still can't imagine it... a complete subversion. A completely decentralized currency without national boundaries... Bitcoin is born for the six billion unbanked people in the world."

text="">The crypto world at that time was filled with a kind of "tech geek"-style idealism. It tried to play multiple roles at the same time: a value storage tool, a high-return investment product, and a financial technology that allows people to transfer money peer-to-peer without going through channels controlled by governments and banks. It promised to provide a certain degree of anonymity and privacy protection, so that people don’t have to feel that "Uncle Sam" is always watching from behind. It fundamentally provides an option to jump out of the traditional system, because early supporters are full of extreme distrust of the existing financial system.

However, more than a decade has passed, and reality has gradually drifted away from the original ideal. It’s obvious that the ideals of cryptocurrency are constantly shrinking. Unless you are a die-hard crypto believer, you probably no longer believe that cryptocurrency can replace the global financial system, end the dominance of the dollar, euro, and yen, or make the banking system disappear completely.

(II) The reality of the muddy and the sand:The birth of “swamp assets”

Today’s cryptocurrency often presents a different picture. It has become a highly speculative tool. People buy and hold it, expecting it to rise in price; or short it, expecting it to fall in price; or invest in certain crypto companies, hoping that it can outperform the market

. Also, it has been criticized for playing a fundamental role in black market transactions and is widely used in illegal activities such as human trafficking, drug trafficking, and terrorist financing.

. Many encryption activities are carried out in jurisdictions outside the United States precisely because the relevant companies are unwilling or unable to comply with U.S. securities and banking regulations. "Swamp assets" - this concept proposed by The Economist accurately summarizes the current embarrassing situation of cryptocurrencies. An industry that once dreamed of "staying away from politics" has now become synonymous with "abusing power for personal gain" and has developed a "dirty relationship" with the US government's executive branch that far exceeds Wall Street or any other industry. This is undoubtedly a huge irony.

The giants in the cryptocurrency industry are investing hundreds of millions of dollars in political lobbying to maintain legislators who are friendly to them and ruthlessly attack opponents who try to regulate them.

The president's sons are touting their crypto projects around the world, while the president himself is exchanging interests with the biggest investors at crypto dinners. The cryptocurrency held by the US first family is now worth billions of dollars, which may even become the family's largest single source of wealth.

This

"swamping" trend is in sharp contrast to other major economies in the world. In recent years, countries and regions such as the European Union, Japan, Singapore, Switzerland and the United Arab Emirates have successfully provided new regulatory clarity for digital assets without similar rampant conflicts of interest.In developing countries where government expropriation is common, inflation is high and the risk of currency devaluation is real, cryptocurrencies are still playing the role that early idealists expected.

Ironically, all of this is happening against the backdrop of the maturing of the underlying technology of digital assets.

Speculation is still prevalent, but mainstream financial companies and technology giants are beginning to take cryptocurrencies more seriously. The process of "tokenization" of real-world assets is accelerating, and traditional financial institutions such as BlackRock and Franklin Templeton have become large issuers of tokenized money market funds. Applications in the payment field also show great potential, and companies such as Mastercard and Stripe have embraced stablecoins.

However, in the United States, a country that should have led innovation, the cryptocurrency industry seems to have chosen a shortcut to dance with power. They argue that under the Biden administration, due to the tough stance and frequent enforcement actions of SEC Chairman Gary Gensler, they have no choice but to "fight by hook or by crook." Banks are afraid of regulatory pressure and dare not provide services to cryptocurrency companies, nor do they dare to easily get involved in the field.

This argument has some truth to it. It is indeed inefficient and unfair to clarify the legal status of cryptocurrency through the courts rather than Congress. But now, with Trump taking office, the regulatory pendulum seems to be swinging violently to the other extreme, and most cases against cryptocurrency companies have been dropped. Is this a victory for the industry, or is it a foreshadowing of a greater crisis?

Three, TrumpWhy did he fall in love with encryption: Sugar-coated bullets or Pandora's box?

Trump's 180-degree turn on cryptocurrency is one of the most eye-catching phenomena in American politics in recent years. From "I don't like Bitcoin and other cryptocurrencies, they are not currencies, their values are extremely volatile, and they have no real basis" to now declaring that the United States will become the "global crypto capital" and "the undisputed Bitcoin superpower", is this a well-thought-out policy shift or a carefully calculated marriage of politics and business?

(I) Under the “Sugar Coating”: Why Does Trump Embrace Encryption?

Trump's "encryption preference" is by no means groundless, and the driving forces behind it are complex

and directly:

1. leaf="">Naked economic interests: This is the most direct and undisguised motive. Trump and his family members have been deeply involved in the investment and operation of cryptocurrencies. Whether it is the $TRUMP meme coin that has made him and his partners a lot of money, or the Bitcoin mining company invested by his two sons, and World Liberty Financial, in which they hold a majority stake, they all clearly point to the growth of personal wealth. The president and his family are directly profiting from this emerging industry.

2.Realistic political considerations: The crypto community was described by Trump as"full of the spirit of the founding of the country, which is exciting". Behind this is the covetousness of the political energy of this group. Supporters of cryptocurrency are usually young, passionate, and have certain economic strength. It is very tempting for any politician to win their votes and campaign donations. Trump's promise to introduce favorable legislation for cryptocurrencies and portraying the Biden administration as an "executioner" who stifles the emerging industry is precisely to cater to the demands of this group.

3.Consistent anti-regulatory stanceOne of the core policies of the Trump administration is deregulation. The challenge of the cryptocurrency industry to the existing financial regulatory system and its desire for a more relaxed environment coincide with Trump's governance philosophy. Freeing cryptocurrencies from the "shackles" of institutions such as the SEC is in line with his overall strategy to weaken the power of regulators. 4. Self-reinforcement of the “disruptor” image: Cryptocurrency itself is anti-establishment and challenges tradition, which, to some extent, fits the image of “outsider” and “disruptor” that Trump has been trying to create. Embracing this field that is regarded as “heterogeneous” by the mainstream financial community may further consolidate its appeal among specific voter groups.

(II) “Cannonballs” and “Pandora’s Box”: Potential Huge Risks

However, beneath the sugar coating of Trump’s

“cannonballs” that are enough to blow up the entire financial system, or a “Pandora’s box” that will release countless disasters. The risks are multi-dimensional and deep-seated: 1. Systemic risks of the financial system: 2. Volatility contagion: 3. Extreme volatility, 4. High volatility, and 5. High volatility of the financial system: 5. High volatility, 6. High volatility of the financial system: 7. High volatility of the financial system: 8. High volatility of the financial system: 9. High volatility of the financial system: 10. High volatility of the financial system: 11. High volatility of the financial system: 12. High volatility of the financial system: 13. High volatility of the financial system: 14. High volatility of the financial system: 15. High volatility of the financial system: 16. High volatility of the financial system: 17. The essence of the narrative supporting the financial system has not changed. In the absence of supervision, if it is allowed to be deeply integrated into the mainstream financial system, its inherent instability may be transmitted to the traditional financial market through various channels, triggering a systemic crisis. Insiders have warned that Bitcoin could become today’s credit default swaps (CDS) or subprime mortgage-backed securities (MBS) — the complex and under-regulated financial instruments that triggered the 2008 financial crisis. Regulatory arbitrage is rampant: Financial institutions have an innate urge to circumvent regulation. If the crypto sector becomes the new “lawless place”, Wall Street firms are likely to take advantage of this wave of “crypto-friendly policies” to “reshape” their businesses into crypto businesses, thereby bypassing the existing regulatory framework designed to protect financial stability. The Absurdity and Danger of “Strategic Bitcoin Reserve”: The Trump administration proposed the establishment of the so-called“Strategic Bitcoin Reserve”, planning to use up to $100 billion in public funds to purchase cryptocurrencies such as Bitcoin and Ethereum, which was denounced by experts as a “meaningless and even stupid idea”.

Unlike oil or drug reserves, which have actual strategic value, Bitcoin reserves have almost no strategic significance other than delivering huge profits to the crypto industry.

This is actually putting taxpayers' money into highly speculative assets, and the risks are completely socialized. A repeat of the 2008 crisis: Once these risks erupt, their impact will go far beyond"cryptocurrency traders" and will affect all ordinary Americans who have mortgages, retirement accounts, or want to start a business through loans. Because the entire financial system is built on "trust", when opaque risks are quietly implanted and supervision is deliberately weakened, the collapse of trust is only a matter of time. Even more frightening is that the "firewalls" such as the Dodd-Frank Act, which were introduced to respond to the crisis, are now being gradually dismantled by the Trump administration.

2. Risks for ordinary investors: Just out of the fire pit, into the swamp

Fraud is rampant, and all the money is lost The cryptocurrency space is rife with scams and Ponzi schemes. Many companies pop up overnight, targeting those who don't know much about finance and technology with exaggerated promises. Once you're scammed, the loss is almost irreversible due to the anonymity and difficulty of tracking cryptocurrencies.

Compared with the risk warnings and anti-fraud mechanisms in the traditional banking system, the world of cryptocurrency is like a

“ dark jungle ” . Seniors, veterans, start-up business owners, and even people who are just looking for a partner on dating apps can become victims of fraud, with losses amounting to tens of billions of dollars. The illusion of "democratization" and the tragedy of retail investors: Events like$TRUMP dinners, while seemingly providing ordinary people with access to top power, often result in the sudden wealth of a few insiders and the loss of a large number of retail investors. This is especially true of the craze for Meme coins, whose rapid rise and fall have reduced most latecomers to "take over".

3. CountryGradeCorruptionWithCrisis:

Trump once made "Drain the Swamp" one of his core campaign promises, meaning to clear out political corruption and special interest groups in Washington. However, when it comes to cryptocurrency, he seems to be digging a new, more hidden, and possibly more dangerous "digital swamp" with his own hands.

This "unicorn" that once carried the ideals of liberalism is being alienated into a "swamp beast" entrenched in the center of power.

Unprecedented conflict of interest: The President and his family have directly reaped huge financial benefits from an industry for which they are actively pushing for deregulation. This blatant conflict of interest is extremely rare in its degree and scope in modern American political history.

This is no longer just a matter of "opening a Trump Hotel next to the White House", but a "large-scale version of corruption" of privatizing state public facilities, which even reminds people of the governance dysfunction of the "banana republic".

“BriberyChannel" Institutionalization:

Hotbed for terrorist financing and cyber theftEncryption systems have become an ideal tool for state-level hacker groups (such as North Korea's"Lazarus Group") and terrorist organizations to steal funds and finance terrorism due to their anonymity and ease of cross-border flow.

Conclusion: Reflections in the “Me, Me, Meme” Era

“Me, me, meme” - this pun imitating “Me, me, me” accurately captures the selfish nature of the current combination of cryptocurrency and political power.

A technology that once claimed to empower the masses now seems more keen to serve a few powerful people. Cryptocurrency has gained an unprecedented role at the policy-making table, but its reputation and fate have become closely tied to the rise and fall of its political benefactors.

Trump's

"preference" for cryptocurrency may bring huge economic benefits to him and his family in the short term, and also win a relaxed regulatory environment for the encryption industry. But as The Economist warns, the benefits of this deal may ultimately flow only one way. When the political wind changes, or when risks accumulate to a critical point and finally explode, the "honeymoon" may turn into a "nightmare" in an instant. The technology of cryptocurrency itself is not an original sin, and it still shows positive innovation potential in the fields of payment and asset tokenization. But when this potential is hijacked by political speculation and the pursuit of unscrupulous interests, when

"innovation" becomes a cover for "rent-seeking", the consequences may be disastrous. What people

need is financial innovation that can truly benefit the general public and promote social progress, rather than a "swamp carnival" that will ultimately be paid for by ordinary people.  Catherine

Catherine