Author: 0xJeff Source: X, @Defi0xJeff Translation: Shan Ouba, Golden Finance

The past two and a half months have been brutal for anyone in this crypto industry. We have experienced several events in and outside the cryptocurrency space that have negatively impacted the market in ways we could not have imagined before - market manipulation of Trump family tokens, $LIBRA, strategic reserve announcements, tariff policies, and more.

AI proxy token and meme coin trading activity has cooled, with major players struggling with trading volume, revenue, and price action.

Virtuals

Virtuals Protocol is still the #1 ecosystem with the largest community of builders and investors, but activity has been declining - daily volume has dropped from over $100M to $5-10M, and daily fees have dropped from $500-1M to $50K per day.

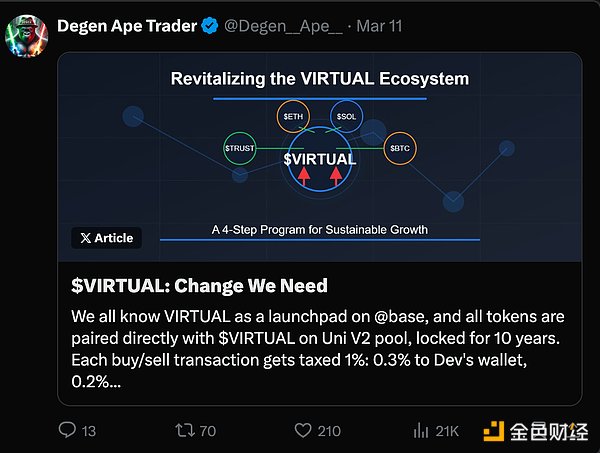

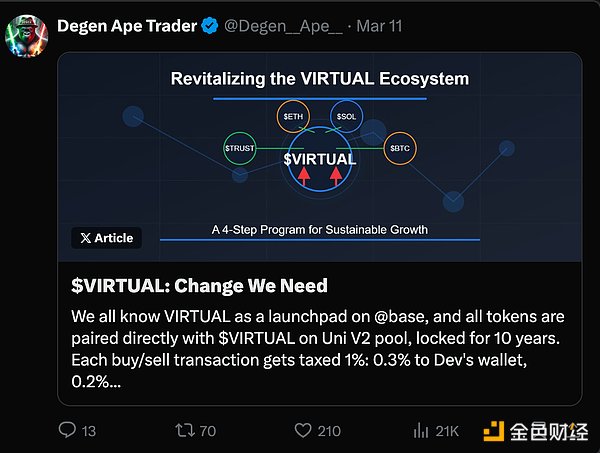

The constant exchange of $VIRTUAL earned from the 1% fee to cbBTC caused $VIRTUAL to fall further, prompting builder community members like Degen Ape Trader to step up and propose a plan for change:

The sentiment on the builder side for Virtuals has been less than favorable on Crypto Twitter (CT), with more and more teams calling for better communication and support for existing builders.

Nevertheless, Virtuals has made progress on its Agent Commerce Protocol (ACP) initiative, with their latest post detailing the three parts of the ACP:

Indexed Registry ➞ A passport for agents detailing name, capabilities, and rates for services.

Commercial Interactions ➞ A negotiation and valuation layer for services.

Monetary Transactions ➞ A smart contract layer for transparent, verifiable, and tamper-proof interactions.

Virtuals is moving towards its vision of "Virtuals Nation" and plans to launch two agency businesses in the next two months:

Autonomous Hedge Fund ➞ Agents assess risk and perform trades/yield farming for users.

Autonomous Media Company ➞ Agents develop compelling narratives, create viral videos, and efficiently promote projects.

I personally believe that the fundamental challenges should be solved first (many of which I share with Degen Ape). Existing builders should be able to continue building without worrying about the liquidity of their tokens or lack of funding.

The hope now for investors and builders is that these challenges can be solved and that ACP case studies can successfully push the boundaries of AI agents.

Clanker

Clankeronbase and Bankr continue to disrupt every launch platform in the space by focusing on simplifying token issuance, a fair issuance environment, and liquidity and fee distribution mechanisms that support creators.

ElizaOS

The complete rebrand from ai16z to ElizaOS marks the beginning of a new chapter - an operating system for AI agents. Shaw has spent the past two months working on building Eliza v2 during the market downturn.

Eliza currently has five major initiatives:

Eliza v2 ➞ Radically improved AI model integration + multi-agent architecture for seamless autonomous collaboration.

Global Trust Marketplace ➞ AI-driven reputation scoring, transaction verification, and decentralized execution.

AI-driven token launch platform.

DegenSpartanAI trading agent.

Eliza Studio ➞ Artistic and creative experiences.

There has been discussion about whether Anthropic’s MCP and OpenAI’s Agents SDK will disrupt frameworks like Eliza. I’m not sure how this will play out, but I think it’s unlikely as Eliza represents a vibrant community of open source AI developers with more products/initiatives coming soon as a catalyst. Arc Arcdotfun released their lightweight whitepaper about a week ago detailing their plans to build an AI agent app store “Ryzome” with MCP at its core. The idea of AI agents working together to plan, coordinate, and execute real-world tasks to generate value seems to be what all market leaders are working towards. Since Arc uses MCP, we’ll likely see more Web2 and Web2 to Web3 use cases emerge, such as searching for flights, comparing routes, checking calendar conflicts, approving itineraries, and completing purchases autonomously.

Arc recently onboarded Fabelis and AgentTank as part of “Arc Handshake,” a registry similar to Virtuals.

The first project to launch on Arc’s launch platform “Forge” was AskJimmy a month ago. However, due to a number of factors including a declining market and a poor launch, the launch fell short of expectations, impacting the price of $ARC. Despite this, Arc continues to grow in terms of GitHub interest and activity.

Competition

Fierce competition among market leaders. The initial phase of trash bots and AI for fun is over. Now, people expect real use cases that will generate value and revenue.

Virtuals has a large database of agents (17,000+) with various expertise and ACP development is a tailwind, but faces builder dissatisfaction.

ElizaOS has yet to launch its major initiatives, but developer metrics show continued growth despite weak price action.

Arc has a clearer vision for MCP-driven use cases and is strategically partnering with projects to realize them.

Clanker remains an underdog competitor, focused on tokenization and providing the best issuance environment for creators and traders.

Whoever launches the most meaningful agent use cases and real-world products will lead the ecosystem's recovery. Strong token economics to capture product value is also key.

Summary

Q1 2025 will be a difficult period for Web3 AI agents in terms of price, but innovation is still accelerating. The focus now is on who can solve real-world problems, build the most value-added products, attract users, and generate revenue. All eyes are on those who can find their niche fastest.

Joy

Joy