Author: Ignas Source: ignasdefi Translation: Shan Ouba, Golden Finance

Cryptocurrency is like a game: trading tokens, making (or losing) money, and increasing followers on social platform X.

Do you feel the same way?

But unlike real games, failure in crypto can have serious consequences.

After the Terra crash, a Korean family of three - including a 10-year-old daughter - was suspected of committing suicide due to financial losses because the father's online search history showed such tendencies.

This is why I feel guilty about admitting that cryptocurrencies are a game. Because too many people have been deceived and lost their life savings.

But the mentality of treating cryptocurrencies as a game keeps me sane and continues to participate. Because the industry is crazy beyond belief.

However, the game’s huge potential makes it worth a try: financial freedom.

As DegenSpartan once posted:

“You have a short period after graduation to gamble and hit elite status, otherwise you will be stuck in an ordinary job for life.” - a now-deleted tweet from @DegenSpartan.

In this blog post, I want to share my “crypto gamebook”, my mindset framework, and some advice on how to choose and win your crypto “game”.

The Rules of the Crypto Game

Once you make the connection between cryptocurrencies and games (especially MMORPGs), you can no longer ignore the similarities.

When the market is down and there is no new capital inflow, we trade in the "PvP-player vs. player" mode. In the bull market, as retail funds enter, we switch to the "PvE-player vs. environment" mode.

If you hate the Internet celebrities cutting leeks, we often comfort ourselves with a sentence: "Don't hate the players, hate the game."

We even design token economic models to prevent people from selling by applying various game theory methods.

Just like every game upgrade, the "game" of cryptocurrency is constantly evolving, with new narratives emerging and old narratives gradually fading.

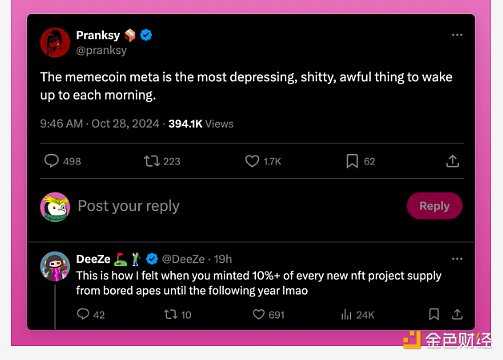

For example, Pranksy, once a top NFT player, is now completely unable to keep up with the pace in the memecoin craze. The gameplay has changed, and he is still playing an old game that almost no one is interested in anymore.

Of course, memecoin may be bad, but a few years ago, some people said that NFT was just as bad because they didn't understand how to play the game of NFT minting and trading.

In this game, you have two choices: either adapt and participate, or quit and wait for the rules of the game to change.

There is also a more difficult choice: change the rules of the game itself.

For example, Cobie launched the Echo platform, which allows ordinary investors to buy tokens together with venture capital institutions like in the ICO era. Step by step, the memecoin narrative will be replaced by players who are determined to change the game.

Nevertheless, memecoin has made some achievements in changing the rules of the game.

For the past year or so, we have been playing the "points" game: you deposit funds into the protocol, accumulate points, and then pray for a generous airdrop. I know you like this game because my "DeFi Geek Bull Market Handbook" is still the most popular post to this day.

However, many people end up being the "game".

Since higher total locked volume (TVL) can support higher valuations, tokens are issued at ridiculous fully diluted valuations (FDV), which benefits venture capital institutions, teams, and airdrop "leeks" who enter at lower valuations.

Disappointed, many turned to memecoin, which made up for what VC-backed tokens lacked.

While Pranksy lost momentum (or chose to exit), memecoin's main characters Ansem, Murad and their followers were reaping the rewards.

In the overall "meta-game", we are constantly introducing new mini-games.

You have to decide whether to participate. If you decide to participate, make sure you understand the rules, because there is always an opponent.

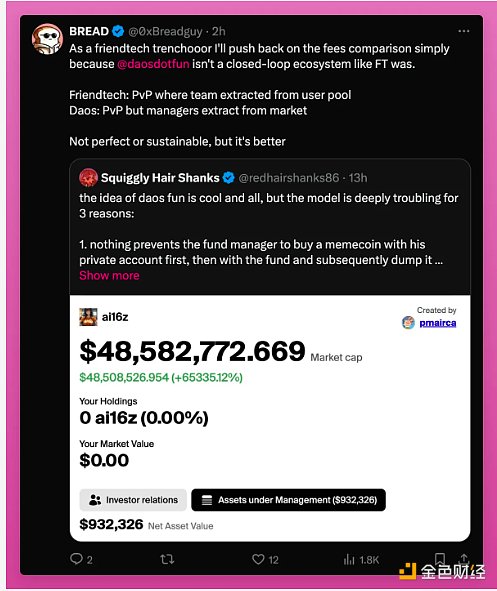

For example, DAOS FUN allows trading of tokenized funds, but confusingly, the top-ranked fund, "ai16z," trades at 52 times its net asset value (NAV), just like memecoin.

Players are trying to make sense of it all. Squiggly compares the fund to the "Grayscale structure" or Friendtech's transaction fee Ponzi scheme, while BREAD disagrees with the FT part.

Who is right?

The same product, different players will have different interpretations. Find your edge in the game and profit from it.

Sometimes, this strategy is very simple. After the team announced that they would whitelist the new "fund" on the website, I expected that geeks holding other "fund tokens" might sell some old tokens to invest in the new fund, causing the price to fall. Sure enough, as soon as the new fund went online, the price of all the old funds fell by about 50%.

Generally speaking, the more complex the game is and the greater the knowledge asymmetry, the more you can profit from it.

The beauty of cryptocurrencies is that there are always some geeks who will rush into new trends without doing due diligence. If you do a little basic research, there is an opportunity to profit.

That being said, I often invest a small amount of money when I first get involved in a hot new project to understand how it actually works. Learn by doing. When you know whether you can win the game, invest more.

Ton’s “click and earn” meta-narrative is a big success because it is completely different from complex DeFi games - you can make profits by just clicking buttons on the screen.

However, due to the simple gameplay, the rewards are also low - unless you use hundreds of mobile phones to cooperate with manual “clicks” to brush rewards.

This is where cryptocurrencies become more interesting and complex: there are multiple layers of gameplay, different roles and strategies to choose from, just like completing “side quests”.

For example.

Recently,

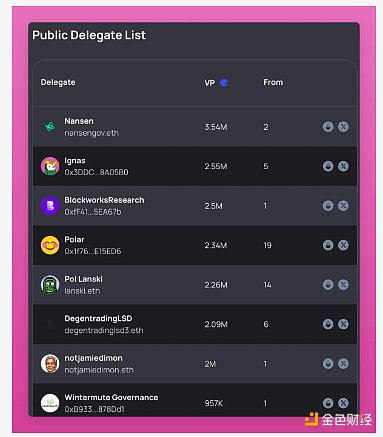

I have been working hard to become an active representative of several DAOs, especially Lido, Arbitrum, and Uniswap.

DAOs promote the vision of decentralized organizations, but it is now an open secret that most DAOs are far from being truly decentralized. For example, in Arbitrum DAO, just 14 addresses controlled more than 50% of the voting power. Other DAOs were similar.

The Uniswap DAO didn’t even know that Unichain would launch support for $UNI staking. This explains why the fee switch for $UNI was turned off for months - insiders knew that once UNI staking was live, the fee switch would no longer be necessary, but the DAO members were kept in the dark.

DAOs realize that the concentration of voting power is a big problem. To solve this problem, they launched delegate incentive programs to attract more new participants. As an active delegate, you can earn between $3,000 and $10,000 from each DAO.

But it’s not easy.

You need to pay close attention to forum discussions, write comments, and vote on proposals. The hardest part is getting others to delegate their tokens to you. This is where the political game begins.

After tweeting on X about how to align incentives for token holders and protocols, an anonymous whale delegated 2.5 million LDO to me. To be fair, I was able to get this delegation entirely because of the popularity I accumulated through my posts on X. Being good at running the "popularity game" on X will bring you many opportunities in the cryptocurrency field that many people don't know about.

Now, multiple protocols will actively contact me to thank me for voting for their proposals or ask me to continue to support them in the future. In every DAO, there is an invisible process of relationship building that doesn’t appear in X’s feed or even on the DAO forum.

To be honest, I love this game. I firmly believe in the decentralized future and want to make an impact.

Player mentality

Did you know that one of Vitalik Buterin’s inspirations for creating Ethereum was because “Blizzard removed the damage effect of his favorite warlock skill ‘Life Drain’”?

“I cried myself to sleep because of this. That day I realized the terrible consequences of centralized services and decided to quit.” - Vitalik (his profile was on the about.me page, but has been deleted).

Vitalik chose to quit World of Warcraft because he felt he could not influence the rules of the game.

The charm of cryptocurrency is that each of us has the opportunity to participate and can influence the rules of the game.

Like blockchain, the "gameplay" of cryptocurrency is decentralized. Venture capitalists, retail investors, developers, opinion leaders - we each play different roles, and some have greater influence.

Ansem, Murad, and other memecoin influencers drive the memecoin cycle, but you can choose not to join their game. Just don’t talk about or buy memecoin.

A little off topic, but I was surprised by how little influence VCs actually had in shaping the narrative. VCs in the crypto space are supposed to be championing their investments, yet their presence on social platform X is minimal.

Do they really care? Or are they playing a different game?

A notable example is Kyle from Multicoin, who is promoting his portfolio. More VCs should share their vision for the industry, advocate for the protocols they invest in, and reveal current developments through in-depth research.

Through my interviews with crypto VCs, I came up with a possible explanation: they are essentially just “retail enthusiasts” with more money.

In a strange twist of fate, at the same time that Vitalik was playing World of Warcraft in 2007-2010, I was playing another MMORPG, Lineage 2.

In Lineage 2, you choose a profession (human, elf, orc, etc.) and a class (warrior, mystic).

You level up by completing quests and defeating enemies to gain experience points (XP). Leveling up unlocks new skills, better gear, and gives you access to more challenging content.

I spent two years leveling up like crazy, sleeping only a few hours a day. This memory is deeply rooted in my heart and has influenced my views on cryptocurrency trading.

Just like gaining experience points in a game, in the field of cryptocurrency, you gain experience by learning about blockchain, understanding DeFi, studying token economic models, etc. The more you grind, the better you become.

During this process, you must keep an eye on your HP (health points) and MP (mana points).

HP and MP are like your health, financial stability, and emotional resilience. Cryptocurrency and gaming both require consistent effort, but it can also lead to burnout. In cryptocurrency, the pressure to keep up with the trend, monitor the market at all times, and not want to miss the trend creates a high-pressure environment, like being in an endless game with no option to quit.

I suffered from severe burnout during the last bull cycle, so now I take a sabbatical every three months to manage my “HP”.

Is it weird that I look at crypto this way?

The similarity also applies to demographics: the crypto space is male-dominated, while women make up only about 35% of MMORPG players.

Koreans are as enthusiastic about crypto as they are about esports (like League of Legends), even more so than “real sports”. No wonder the GameFi narrative has so many supporters in crypto.

My point is that a gamer’s mentality can help you excel in crypto. Just pick the right game and understand your role in it.

In his famous short post “How to Get Rich (Without Luck)”, Naval mentions “game” and “play” 15 times! His advice is:

“Ignore those who play the ‘status game.’ They gain status by attacking those who play the ‘wealth creation game.’”

“Choose an industry where you can work with people for a long time and play the long game.”

“Play the game of iteration. Whether it’s wealth, relationships, or knowledge, the rewards in life come from compounding.”

And my favorite is:

“Building specific knowledge will look like a game to you, but look like work to others.”

So, what game are you playing in crypto?

What is your role in crypto?

The cryptocurrency space has become increasingly complex in recent years. Before 2020, success was often as simple as investing in an ICO and trading on a centralized exchange (CEX). Since then, the cryptocurrency space has expanded rapidly: DeFi, L2, NFT, RWA, Runes, Memecoins, and more.

How do you keep up with this rapid pace of change?

Will you specialize in a certain field, or do you want to try to "catch all opportunities"?

In massively multiplayer online role-playing games (MMORPGs), players usually choose a race first and then a profession. In Lineage 2, I chose the least popular option because I wanted to stand out and increase my chances of becoming a "hero". I chose the human mystic, and as I accumulated experience points (XP), I further specialized in the warlock and then turned to the mystic lord. This is an unpopular profession because its specialty is defeating enemies through pets.

Similarly, in cryptocurrencies, you can start by learning basic skills and then gradually specialize in areas such as active trading, DeFi yield farming, memecoins, DAO representatives, etc.

Many people lack the perseverance to focus and often jump between different narratives without really understanding the principles. As a result, they miss the opportunity to master the complex mechanisms behind the game theory of a certain field and eventually become "taker".

However, jumping between different narratives and making profits can also be a skill in itself. In this case, you need to understand the rotation of funds and successfully sell before the funds move to another narrative. Are you good at this?

That said, I think that in the current market stage, focusing on a certain area can bring superior returns.

Focus can take many forms:

Crypto Koryo is good at creating and profiting with Dune data dashboards.

USD Denominated is deep in the stablecoin market and exploits market nuances to maximize returns.

Andy is all in on the modular narrative, even though it is the most questioned area in crypto.

wale.moca is a great account to follow NFTs (he has strong convictions!).

Bold Leonidas posts daily crypto-themed comics.

But always be mindful of what opinion leaders are saying, as their incentives are often different than yours. The game a lot of people present publicly is not aligned with the game they play privately. You don’t want to be part of a game that’s stacked against you. For example, Ansem attracts celebrities to participate and profit from it.

Do you know why I post on X?

I post on X to: 1) stay up to date on the market, 2) attract customers to my DeFi creative studio Pink Brains, and most recently 3) build influence and get token delegate votes.

This strategy allowed me to explore multiple topics, even though I wasn’t an expert in some of them.

When you start growing followers on X, first pick a niche you’re passionate about. As your followers grow, gradually expand the range of topics. Posting can increase your influence, so everyone should try.

Becoming an influencer is like becoming a hero in Lineage 2. Your character gains a special aura that not only increases your abilities, but also allows you to broadcast messages to the entire server. In fact, I chose the least popular character because it reduces the competition to become a hero.

Many people work for crypto companies, which forces them to specialize in areas such as marketing, market making, or private placement. This gives you more advantages than those who just do it as a hobby - use industry resources, gain insights, and even influence the rules of the game.

Nowadays, focus is the key to getting real excess returns.

While holding BTC or ETH may be a safe bet, getting a 100x return now requires deeper exploration, like digging for gold in an already mined gold mine. As Naval said, find work that makes you feel like "playing."

Whether it's DeFi, on-chain wallet tracking, or cutting-edge information mining on the DAO forum, let your curiosity guide you. In the process of building specific knowledge, you will find opportunities that others have missed.

This niche market - small enough not to be noticed by big players, but large enough for you to win - may be your "gold mine" in the crypto game.

Aaron

Aaron

Aaron

Aaron Catherine

Catherine Snake

Snake Clement

Clement Davin

Davin Kikyo

Kikyo Clement

Clement Hui Xin

Hui Xin Jasper

Jasper Catherine

Catherine