Friendtech 1: What's With All The FriendTech Hacks?

Two weeks ago, friendtech content creators reported a surge in hacks- what's going on?

Clement

Clement

Authors: AJC, Drexel Bakker, Youssef Haidar; Source: Messari 2026 Crypto Theses

1. BTC has clearly distinguished itself from all other crypto assets and is undoubtedly the dominant form of cryptocurrency.

2. BTC underperformed in the second half of 2025, partly due to increased selling pressure from early large holders. We believe this underperformance will not be a long-term structural problem, and we expect Bitcoin's monetary narrative to remain intact for the foreseeable future.

3. L1 valuations are increasingly detached from their fundamentals. Public chain revenue has declined significantly year-over-year, meaning its valuation is increasingly dependent on expectations of a monetary premium. With a few exceptions, we expect public chains to underperform Bitcoin.

4. ETH remains the most controversial asset. Concerns about value capture have not completely subsided, but its performance in the second half of 2025 demonstrates that the market is willing to view it as a cryptocurrency, just like Bitcoin.

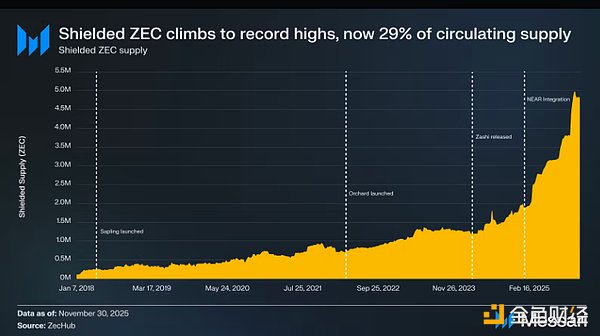

If the cryptocurrency bull market returns in 2026, Ethereum's digital asset treasury (DATs) may experience a "second spring." 5. ZEC is increasingly being priced as a privacy cryptocurrency, rather than a niche privacy coin, making it a complementary hedging tool to Bitcoin in an era of increased surveillance, institutional dominance, and financial repression. 6. Applications may begin to adopt their own proprietary monetary systems, rather than relying on the native assets of their networks. Applications with social attributes and strong network effects are the most likely candidates to achieve this shift. Introduction It is no coincidence that the 2026 Messari Crypto Thesis begins with the most fundamental and important part of the cryptocurrency revolution—money. When we initially planned this report this summer, we never imagined that market sentiment would turn so drastically negative.

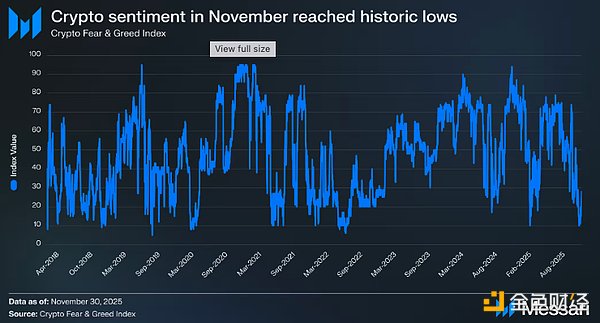

In November 2025, the Cryptocurrency Fear & Greed Index fell to 10 (“Extreme Fear”). Prior to this, the index had only fallen to 10 or lower during the following periods: - May-June 2022, the Luna collapse and the chain reaction triggered by the Three Arrows Capital (3AC) crisis; - May 2021, the massive wave of liquidations; - March 2020, the collapse due to the COVID-19 pandemic; - Several key moments during the 2018-2019 bear market. The cryptocurrency industry has only experienced a few periods of lower sentiment than it is now, and these have only occurred when the industry was truly on the verge of collapse and the future was shrouded in uncertainty. But this is clearly not the case today: no major exchanges have absconded with user funds, no blatant Ponzi schemes have reached valuations of tens of billions of dollars, and the total market capitalization has not fallen below the previous cycle's high. On the contrary, cryptocurrencies are gaining recognition and integration at the highest levels of global institutions. The U.S. Securities and Exchange Commission (SEC) has publicly stated that it expects all U.S. markets to be on-chain within two years; stablecoin circulation has reached an all-time high; and the "someday" application narrative we've repeatedly mentioned for the past decade is finally becoming a reality—yet, industry sentiment has almost never been worse. Almost every week, a trending post appears on social media platform X, with people convinced they've wasted their lives on cryptocurrencies or claiming that everything the industry has built will be forked, misappropriated, and controlled by traditional institutions. This disconnect between collapsing market sentiment and the rise of institutional applications presents an excellent opportunity to re-examine cryptocurrencies from a first-principles perspective. The original principle that gave rise to the chaotic yet wonderful industry we love today is actually quite simple: to build an alternative monetary system superior to the current fiat currency system. This ideal has been deeply embedded in the industry's DNA since the Bitcoin genesis block—a block famously containing the message: "The Times, January 3, 2009: Chancellor on the brink of a second bank bailout." This origin is crucial because, in the course of development, many have forgotten the original purpose of cryptocurrencies. Bitcoin was not created to provide banks with better clearing channels, not to reduce the cost of foreign exchange transactions by a few basis points, and not to drive an endless "slot machine" of speculative tokens. The birth of BTC was a response to a failing monetary system. Therefore, to understand the current situation of cryptocurrencies, we need to return to the core question of the entire industry: Why are cryptocurrencies so important? I. Why Cryptocurrencies? For most of modern history, people had little real choice in the currency they used. Under the current global monetary order based on fiat currencies, people are effectively subject to their national currency and the decisions of its central bank. The state decides the currency you earn, save, and pay taxes in—whether that currency is inflated, devalued, or mismanaged, you can only passively accept it. And in almost all political and economic systems—whether free markets, authoritarian regimes, or developing countries—the same pattern exists: government debt is a one-way street. Over the past 25 years, the debt levels of major global economies have increased dramatically relative to GDP. As the world's two largest economies, the US and China have seen their government debt-to-GDP ratios grow by 127% and 289%, respectively. Regardless of political system or growth model, rising government debt has become a structural feature of the global financial system. When debt grows faster than economic output, the costs are primarily borne by savers—inflation and low real interest rates erode the value of fiat currency savings, shifting wealth from individual savers to the state. Cryptomonney, by separating the state from its currency, offers an alternative to this system. Historically, governments have altered monetary rules through inflation, capital controls, or restrictive regulations when it serves their own interests. Cryptocurrencies, by entrusting monetary governance to decentralized networks rather than central authorities, reclaim the power of monetary choice. Savers can choose monetary assets that align with their priorities, needs, and desires, rather than being trapped in a monetary system that often contradicts their long-term financial well-being. However, choice is only meaningful when the chosen option offers genuine advantages. This is precisely the case with cryptocurrencies, whose value stems from several core attributes that distinguish them from all previous forms of currency: First, the core value of cryptocurrencies lies in their predictable, rules-based monetary policy. These rules are not commitments from institutions, but rather software attributes run by thousands of independent participants. Modifying these rules requires broad consensus, not subjective decisions by a few, making arbitrary changes to monetary rules extremely difficult. Unlike fiat currency systems—where the money supply expands with political and economic pressures—the rules of cryptocurrency are public, predictable, and enforced through consensus, and cannot be quietly altered behind the scenes. Second, cryptocurrencies reshape how personal wealth is safeguarded. In the fiat currency system, true self-custody has become impractical: most people rely on banks or other financial intermediaries to store their savings. Even traditional non-sovereign asset alternatives like gold typically end up in centralized vaults, reintroducing trust-based risks. In practice, this means that if a custodian or state decides to take action, your assets could be delayed, restricted in use, or even frozen entirely. Cryptocurrencies enable direct ownership, allowing individuals to hold and secure their assets without relying on custodians. This capability is increasingly important as financial restrictions such as bank withdrawal limits and capital controls become more prevalent globally. Finally, cryptocurrencies are tailor-made for the globalized digital world. It can be transferred across borders instantly, with no limit on the amount, and without institutional permission. This gives it a significant advantage over gold—gold is difficult to divide, verify, or transport, especially across borders. Cryptocurrencies can be transferred globally in minutes, with no limit on the size, and without relying on centralized intermediaries. This ensures that individuals can freely transfer or allocate their wealth regardless of geographical location or political environment. In short, the value proposition of cryptocurrencies is clear and explicit: it provides individuals with monetary choice, establishes predictable rules, eliminates single points of failure, and enables unlimited global flow of value. In a system where government debt continues to rise and savers bear the consequences, the value of cryptocurrencies will continue to grow. II. BTC: The Dominant Cryptocurrency Bitcoin pioneered the cryptocurrency category, so we naturally begin with it. Nearly 17 years later, Bitcoin remains the largest and most widely recognized asset in the entire industry. Since currency is essentially a product of social consensus rather than a result of technological design choices, the true standard for measuring the status of currency is whether the market assigns a long-term premium to an asset—from this perspective, Bitcoin's status as the dominant cryptocurrency is beyond doubt. This is most evident in Bitcoin's performance over the past three years: from December 1, 2022 to December 2025, Bitcoin rose from $17,200 to $90,400, an increase of 429%, repeatedly setting new all-time highs (most recently $126,200 on October 6, 2025). At the beginning of this period, Bitcoin's market capitalization of approximately $318 billion was insufficient to rank it among the world's largest assets; now, its market capitalization has reached $1.81 trillion, making it the ninth most valuable asset globally. The market not only recognizes Bitcoin's monetary attributes and assigns it a higher valuation, but has also elevated it to the top tier of global asset rankings. However, what is even more telling is Bitcoin's performance relative to other cryptocurrencies. Historically, during cryptocurrency bull markets, Bitcoin's market capitalization share (BTC.D, the percentage of Bitcoin's market capitalization to the total cryptocurrency market capitalization) shrinks as funds shift towards the lower end of the risk curve; but in this Bitcoin bull market, this trend has completely reversed. Over the past three years, Bitcoin's market capitalization share has risen from 36.6% to 57.3%—Bitcoin is diverging from the overall cryptocurrency market.

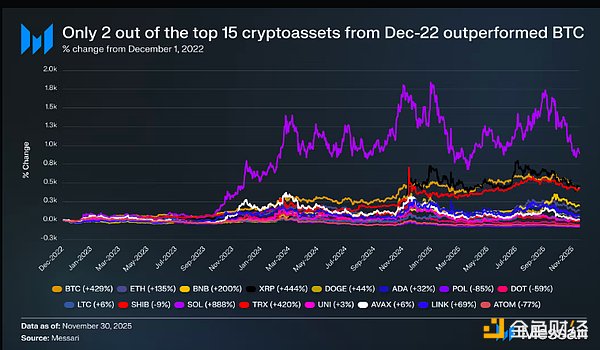

As of December 1, 2022, among the top 15 crypto assets, only two (XRP and SOL) outperformed Bitcoin, and only SOL showed a significant advantage (an increase of 888%, compared to Bitcoin's 429%). Other assets in the market lagged far behind, with many major assets barely rising or even falling during the same period: Ethereum rose 135%, BNB rose 200%, Dogecoin (DOGE) rose 44%, while assets such as POL (-85%), DOT (-59%), and ATOM (-77%) remained mired in losses.

More noteworthy is Bitcoin's scale—as a trillion-dollar asset, it should require the most capital to drive its price, yet it has still outperformed almost all major tokens. This indicates genuine, sustained buying pressure on Bitcoin, while most other assets behave more like beta assets, only rising when Bitcoin leads the overall market upward. One of the main drivers of the continued buying pressure on Bitcoin is the increasing institutional adoption. A landmark event in this institutional adoption was the launch of spot Bitcoin ETFs. Market demand for such products is extremely strong. BlackRock's iShares Bitcoin Trust (IBIT) broke multiple ETF records and was hailed as "the most successful ETF launch in history"—IBIT achieved $700 billion in assets under management (AUM) in just 341 days, 1350 days faster than the previous record held by the SPDR Gold Shares (GLD) ETF. The momentum of ETF launches in 2024 continued directly into 2025, with total ETF assets under management increasing by 20% year-on-year, from approximately 1.1 million Bitcoins to 1.32 million Bitcoins. At current prices, these products hold over $120 billion worth of Bitcoin, representing more than 6% of Bitcoin's maximum supply. ETF demand did not subside after the initial launch frenzy but instead became a continuous source of buying pressure, accumulating Bitcoin regardless of market conditions.

Furthermore, institutional participation extends far beyond ETFs. In 2025, Digital Asset Treasurys (DATs) became major buyers, further solidifying Bitcoin's position as a treasury reserve asset. While Michael Saylor's MicroStrategy has long been the most prominent example of corporate Bitcoin accumulation, nearly 200 companies globally now have Bitcoin on their balance sheets. Publicly traded companies alone hold approximately 1.06 million Bitcoins (5% of the total supply), with MicroStrategy holding 650,000, a dominant position. The most significant event in 2025 that will further differentiate BTC from other cryptocurrencies is the establishment of the Strategic Bitcoin Reserve (SBR). The SBR formally recognizes the market's long-standing distinction between Bitcoin and other cryptocurrencies—viewing Bitcoin as a strategic monetary commodity, while placing all other digital assets in a separate reserve category for routine management. The White House, in a statement, described Bitcoin as a "unique store of value in the global financial system" and likened it to "digital gold." Finally, and most importantly, the directive requires the Treasury Department to develop a strategy for future Bitcoin purchases. While no such purchases have yet occurred, this option alone indicates that federal policy is now viewing Bitcoin from a forward-looking reserve asset perspective. If implemented, such a purchase plan will further solidify Bitcoin's monetary status not only among crypto assets but among all assets. III. Is BTC a Premium Currency?

While Bitcoin has solidified its leading position in the cryptocurrency space, 2025 has raised a series of new questions about its monetary attributes. As the largest non-sovereign monetary asset, gold remains Bitcoin's most important benchmark. With escalating geopolitical tensions and rising expectations of future monetary easing, gold has recorded one of its strongest annual performances in decades—but Bitcoin has not followed suit.

Although the Bitcoin/Gold (BTC/XAU) ratio briefly hit an all-time high in December 2024, it has since fallen by about 50%.

This pullback is noteworthy because it occurs against the backdrop of gold's surge to a record high against the dollar—gold prices have risen more than 60% since 2025, reaching $4,150 per ounce. With gold's total market capitalization approaching $30 trillion, while Bitcoin represents only a fraction of that, this divergence raises a valid question: If Bitcoin fails to keep pace with gold during one of its strongest cycles, how solid is its "digital gold" status? If Bitcoin's movements are inconsistent with gold, then its performance relative to traditional risk assets will need to be observed. Historically, Bitcoin has exhibited correlations with benchmark stock indices such as the S&P 500 ETF (SPY) and the Nasdaq 100 ETF (QQQ). For example, from April 2020 to April 2025, the average 90-day rolling correlation between Bitcoin and SPY was 0.52, while its correlation with gold was relatively weaker (0.18). Therefore, if the stock market weakens, Bitcoin's lag relative to gold might be understandable. However, this is not the case. Since 2025, gold (XAU) has risen 60%, SPY has risen 17.6%, QQQ has risen 21.6%, while Bitcoin has fallen 2.9%. Given Bitcoin's smaller size and higher volatility compared to gold and major stock indices, its underperformance relative to these benchmarks in 2025 has raised legitimate questions about its monetary narrative. With gold and stocks hitting all-time highs, one would expect Bitcoin to follow a similar trajectory, especially considering its historical correlations—but this hasn't happened. Why? First, it's important to note that this underperformance is recent, not a year-over-year trend. As of August 14, 2025, Bitcoin's year-to-date absolute return is still higher than gold, SPY, and QQQ; its relative weakness only began to emerge in October. The focus is not on how long this weakness lasted, but on its severity. While multiple factors could contribute to this significant relative weakness, we believe the primary driver of Bitcoin's lackluster performance is the behavior of early large holders. Over the past two years, Bitcoin's liquidity characteristics have undergone significant changes as it has become increasingly institutionalized. Now, through deep, regulated markets such as ETFs, large holders can sell their assets without causing market shocks that were unavoidable in the early stages of the cycle—creating the first genuine profit-taking opportunity for many of these holders. There is ample anecdotal and on-chain evidence that some long-dormant holders have seized this opportunity to reduce their holdings. Earlier this year, Galaxy Digital facilitated the sale of 80,000 Bitcoins by a "Satoshi-era investor"—a single transaction representing 0.38% of the total Bitcoin supply and originating from a single entity.

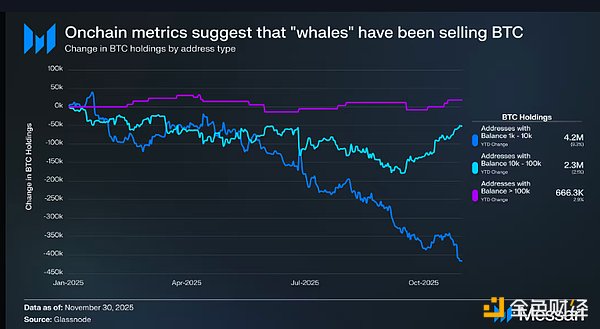

Bitcoin on-chain metrics also reflect a similar situation. Some of the largest and longest-held holders (addresses holding 1,000-100,000 Bitcoins) were net sellers throughout 2025. These addresses held 6.9 million Bitcoins at the beginning of the year (nearly one-third of the total supply) and continued to sell throughout the year: the group holding 1,000-100,000 Bitcoins saw a net outflow of 417,300 Bitcoins (down 9% year-over-year), and the group holding 100,000-1,000,000 Bitcoins saw an additional net outflow of 51,700 Bitcoins (down 2% year-over-year).

Bitcoin on-chain metrics also reflect a similar situation. Some of the largest and longest-held holders (addresses holding 1,000-100,000 Bitcoins) were net sellers throughout 2025.

The third structural challenge facing Bitcoin is the security budget. This issue has been discussed for over a decade, and although opinions on its severity differ, it remains one of the most controversial long-standing issues concerning the integrity of Bitcoin as a currency. At its core, the security budget is the total revenue that miners can obtain by maintaining network security, currently consisting of block rewards and transaction fees. With block rewards halving every four years, Bitcoin will eventually rely primarily, or even entirely, on transaction fees to incentivize miners to maintain network security.

Once upon a time, with the explosive popularity of Ordinals and Runes, the market believed that transaction fees alone were enough to support miners' profits and ensure network security. In April 2024, Bitcoin's on-chain transaction fee revenue reached $281.4 million, setting the second-highest monthly record in history. However, a year and a half later, transaction fee revenue has plummeted—in November 2025, Bitcoin's on-chain transaction fees were only $4.87 million, setting the lowest monthly record since December 2019. While the plunge in transaction fee revenue is shocking, there may be no need for excessive concern in the short term. Block rewards currently provide substantial incentives for miners, and this will continue for decades. Even by 2050, the Bitcoin network will still produce approximately 50 bitcoins per week—a considerable mining reward for miners. As long as block rewards dominate miner revenue, the security of the Bitcoin network will not face a substantial threat. However, it is undeniable that the possibility of transaction fees completely replacing current block rewards is becoming increasingly smaller. The discussion about security budgets is far more complex than whether transaction fees can completely replace block rewards. Transaction fees do not need to reach the size of current block rewards; they only need to exceed the cost of launching a trusted attack—a cost that is itself unknown and fluctuates significantly with changes in mining technology and the energy market. In the future, if mining costs decrease significantly, the minimum transaction fee threshold required to maintain network security will also decrease accordingly. This could be achieved through various scenarios: in mild scenarios, iterative upgrades to mining chips and the efficient utilization of idle renewable energy will reduce miners' marginal costs; in extreme scenarios, breakthroughs in energy production technologies (such as commercial nuclear fusion and ultra-low-cost nuclear energy) could reduce electricity prices by several orders of magnitude, fundamentally changing the economic model of mining. While we acknowledge that there are too many unknown variables to precisely calculate the "reasonable threshold" for Bitcoin's security budget, it is still necessary to assume an extreme scenario: what would happen if future miners' profits were insufficient to cover the economic costs of maintaining network security? In this case, the economic incentive mechanisms supporting Bitcoin's "trustworthy neutrality" would begin to fail, and network security would increasingly rely on social consensus rather than enforceable economic constraints. One possible outcome is that certain entities (such as exchanges, custodians, sovereign states, and large holders) might "mine at a loss" to protect their Bitcoin assets, on which they depend for survival. However, while this "defensive mining" can maintain network operation, it may weaken the market's consensus on Bitcoin's monetary attributes—if users realize that Bitcoin's security relies on the collaborative support of large entities, its "monetary neutrality" and even its monetary premium will face severe challenges. Another possibility is that no entity is willing to bear the losses to defend Bitcoin. In that case, Bitcoin will face the risk of a 51% attack. Although a 51% attack will not completely destroy Bitcoin (Ethereum Classic, Monero, and other proof-of-work cryptocurrencies have survived 51% attacks), it will undoubtedly cause the market to fundamentally question Bitcoin's security. Because many unknown variables influence Bitcoin's long-term security budget, no one can accurately predict how the system will evolve decades from now. Although this uncertainty does not currently pose a threat, it is indeed a "long-tail risk" that needs to be priced in by the market. From this perspective, the residual monetary premium of some public chains can be seen as a hedging tool—used to hedge against the extreme risk of potential problems with Bitcoin's future economic security. VI. The Ethereum Debate: Is it a Cryptocurrency? Of all mainstream crypto assets, none has sparked such prolonged and intense controversy as Ethereum. While Bitcoin's status as the dominant cryptocurrency is widely recognized, Ethereum's position has remained ambiguous. Some see Ethereum as the only non-sovereign currency asset besides Bitcoin with credibility; others view it merely as a "company" facing declining revenue, shrinking profit margins, and fierce competition from faster, cheaper public chains. This debate seemed to reach its peak in the first half of this year. In March, Ripple's fully diluted valuation (FDV) briefly surpassed Ethereum's (it's important to note that Ethereum's supply has been fully released, while Ripple only has about 60% of its supply in circulation). On March 16th, Ethereum's fully diluted valuation was $227.65 billion, while Ripple reached $239.23 billion—a result almost no one could have predicted a year earlier. Then, on April 8th, 2025, the ETH/BTC exchange rate fell below 0.02, hitting a new low since February 2020. In other words, all the excess gains Ethereum accumulated relative to Bitcoin in the previous bull market had been completely wiped out. At that time, market sentiment towards Ethereum plummeted to its lowest point in years. To make matters worse, the price slump is just the tip of the iceberg. With the rise of competing ecosystems, Ethereum's share of the public blockchain transaction fee market continues to shrink. In 2024, the Solana ecosystem made a strong comeback; in 2025, Hyperliquid emerged as a dark horse. Caught between these two, Ethereum's transaction fee market share fell to 17%, ranking fourth among public blockchains—a stark contrast to its dominant position a year earlier. While transaction fees don't tell the whole story, they are a direct signal of economic activity—and Ethereum is now facing its most intense competitive environment ever.

However, historical experience tells us that the most significant reversals in the cryptocurrency field often begin at the moment when market sentiment is at its most pessimistic. When Ethereum was labeled a "failed asset," most of its so-called "negative factors" had already been priced in by the market.

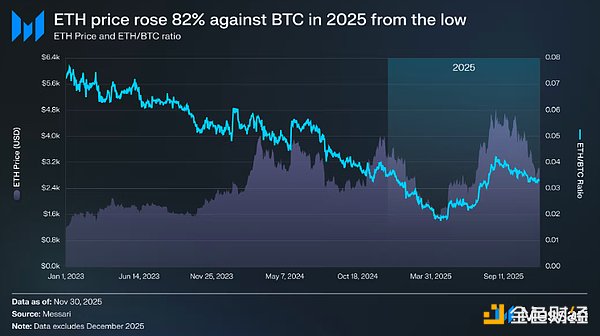

In May 2025, signs of excessive pessimism in the market began to appear. The Ethereum-to-Bitcoin exchange rate and the price of the US dollar both bottomed out and rebounded during this period. The ETH/BTC exchange rate surged from a low of 0.017 in April to 0.042 in August, an increase of 139%; during the same period, the Ethereum-to-USD price rose from $1646 to $4793, an increase of 191%.

This surge finally peaked on August 24th—Ethereum hit an all-time high of $4,946. Following this valuation correction, Ethereum's long-term trend has clearly returned to an upward trajectory. Leadership changes at the Ethereum Foundation and the emergence of Ethereum-focused Digital Asset Treasuries (DATs) have injected confidence into the market that had been lacking for the previous year. Prior to this rally, the divergence between Bitcoin and Ethereum was vividly reflected in their respective ETF markets. When the Ethereum spot ETF was launched in July 2024, inflows were extremely weak. In its first six months after listing, total inflows amounted to only $2.41 billion—a paltry sum compared to the record-breaking performance of the Bitcoin ETF. However, with Ethereum's strong rebound, market concerns about its ETF dissipated. For the full year, the Ethereum spot ETF saw inflows of $9.72 billion, while the Bitcoin ETF saw $21.78 billion. Considering that Bitcoin's market capitalization is nearly five times that of Ethereum, the difference in inflows between the two ETFs was only 2.2 times, a result far exceeding market expectations. In other words, when adjusted for market capitalization, the Ethereum ETF was even more attractive than Bitcoin—a stark contrast to the mainstream narrative of "institutional lack of interest in Ethereum." At certain times, Ethereum's advantage was even more pronounced: from May 26 to August 25, the Ethereum ETF saw inflows of $10.2 billion, exceeding the $9.79 billion inflows into the Bitcoin ETF during the same period, marking the first time institutional demand clearly shifted towards Ethereum. From the perspective of ETF issuers, BlackRock maintained its dominant position in the Ethereum ETF market. At the end of 2025, BlackRock held 3.7 million Ethereum, representing 60% of the Ethereum spot ETF market. This figure represents a 241% increase from 1.1 million at the end of 2024, far exceeding the growth rate of other issuers. As of the end of the year, total holdings of Ethereum spot ETFs reached 6.2 million, approximately 5% of the total Ethereum supply. Behind Ethereum's strong rebound, the most crucial structural change is the rise of Ethereum Digital Asset Treasuries (DATs). These treasuries have created a stable and continuous source of demand for Ethereum—something unprecedented in Ethereum's history—and their supporting role for Ethereum far surpasses that of narrative hype or speculative funds. If price movements are the "symptom" of Ethereum's reversal, then the continuous accumulation of treasuries is the "deep driving force" behind this reversal. In 2025, the cumulative increase in Ethereum Digital Asset Treasuries reached 4.8 million, accounting for 4% of Ethereum's total supply, significantly impacting its price. The most representative example is Bitmine (stock code BMNR), owned by Tom Lee. This company, originally focused on Bitcoin mining, began shifting its treasury funds and capital to Ethereum in July 2025. Between July and November, BitMine purchased a total of 3.63 million Ethereum, becoming the absolute leader in the Ethereum digital asset treasury with a 75% holding. Despite Ethereum's strong rebound, the rally eventually subsided. As of November 30, the price of Ethereum had fallen from its August high to $2,991, significantly lower than the all-time high of $4,878 in the previous bull market. Compared to the lows of April, Ethereum's situation has improved significantly, but the structural concerns that previously fueled the bear market narrative have not been completely eliminated. On the contrary, the debate about Ethereum's positioning is becoming more intense than ever. On one hand, Ethereum is exhibiting many characteristics of Bitcoin's rise to monetary status: ETF inflows are no longer weak, and digital asset treasuries are becoming a continuous pillar of demand. More importantly, a growing number of market participants are beginning to distinguish Ethereum from other public chain tokens, viewing it as an asset belonging to the same monetary framework as Bitcoin. On the other hand, the core issues that dragged down Ethereum in the first half of this year have not yet been fully resolved: Ethereum's fundamentals have not fully recovered, and its public chain transaction fee share still faces pressure from strong competitors such as Solana and Hyperliquid; main chain activity is far below the peak of the previous bull market; despite Ethereum's significant rebound, Bitcoin has firmly reached a new all-time high, while Ethereum has not yet broken through its previous high. Even during Ethereum's strongest months, many holders still viewed the rebound as a good opportunity to exit, rather than an endorsement of its long-term monetary narrative. The core issue in this debate is not "whether Ethereum has value," but rather "how Ethereum tokens capture value from the Ethereum ecosystem." In the last bull market, the prevailing assumption was that Ethereum tokens would directly benefit from the success of the ecosystem. This is precisely the core logic of the "Ultrasound Money" narrative: Ethereum's utility will generate massive transaction fee burning, ultimately making the Ethereum token a deflationary value asset. Now, we have sufficient confidence to assert that this direct value capture logic will not materialize. Ethereum's transaction fee revenue has declined significantly, with no signs of recovery; meanwhile, the fastest-growing areas of the Ethereum ecosystem (real-world asset tokenization, institutional business) primarily use the US dollar as the base currency, not the Ethereum token. In the future, Ethereum's value will depend on how it indirectly captures value from the ecosystem's success. However, the certainty of indirect value capture is much lower—it relies on the premise that as Ethereum's systemic importance increases, more and more users and capital will choose to view Ethereum tokens as both cryptocurrency and a store of value. Unlike direct, institutionalized value capture, this indirect path offers no guarantees. It depends entirely on social preferences and collective consensus—this in itself is not a flaw (as explained in detail earlier, Bitcoin's value capture is based on this logic), but it means that Ethereum's appreciation is no longer definitively linked to the economic activities within the Ethereum ecosystem. All of this brings the Ethereum debate back to its core contradiction: Ethereum may indeed be accumulating a monetary premium, but this premium consistently lags behind Bitcoin. The market is once again viewing Ethereum as a "leveraged expression" of the Bitcoin monetary narrative, rather than an independent monetary asset. Throughout 2025, Ethereum's 90-day rolling correlation with Bitcoin fluctuated between 0.7 and 0.9, while its rolling beta surged to multi-year highs, even exceeding 1.8 at times. This means that Ethereum's price volatility is greater than Bitcoin's, but its price movement remains highly dependent on Bitcoin. This is a subtle but crucial distinction. Ethereum's current monetary value is entirely built upon the foundation of the Bitcoin monetary narrative. As long as the market believes Bitcoin is a non-sovereign store of value, some investors will be willing to extend this trust to Ethereum. Therefore, if the Bitcoin bull market continues in 2026, Ethereum will also have a clear upward trajectory. Currently, Ethereum digital asset treasuries are still in their early stages of development, and their funds for increasing Ethereum holdings mainly come from common stock issuance. However, against the backdrop of a renewed cryptocurrency bull market, these treasuries are expected to learn from the financing strategies used by companies like MicroStrategy to accumulate Bitcoin and explore more capital operation methods, such as issuing convertible bonds and preferred stock. For example, a digital asset treasury like BitMine can raise funds by issuing a combination of low-interest convertible bonds and high-yield preferred stock, directly using the raised funds to purchase Ethereum, while simultaneously staking these Ethereum to obtain stable staking returns. Under reasonable assumptions, staking returns can partially cover bond interest and preferred stock dividend expenses, allowing the treasury to continuously increase its Ethereum holdings through leverage when market conditions are favorable. Assuming a Bitcoin bull market recurs in 2026, this "second growth curve" of the Ethereum digital asset treasury will become a significant force supporting Ethereum's high beta relative to Bitcoin. Ultimately, the market still views Ethereum's monetary premium as a derivative of Bitcoin. Ethereum has not yet become an independent monetary asset with its own macroeconomic logic, but rather a "secondary beneficiary" of Bitcoin's monetary consensus. Its recent strong rebound reflects that some investors are willing to view Ethereum more as Bitcoin than as a typical L1 public chain token. However, even in its relatively strong phase, market confidence in Ethereum is inextricably linked to the continued strength of the Bitcoin narrative. In short, while Ethereum's monetary narrative has not broken down, it is far from settled. Under the current market structure, considering Ethereum's high beta relative to Bitcoin, as long as Bitcoin's bull market logic continues, Ethereum is expected to achieve considerable gains—the structural demand from digital asset treasuries and corporate treasuries will provide real upward momentum. However, in the foreseeable future, Ethereum's monetary trajectory will still be dependent on Bitcoin. Unless Ethereum can achieve low correlation and a low beta coefficient with Bitcoin over a longer period, its monetary premium will forever be overshadowed by Bitcoin's halo. VI. Zcash: A Hedging Tool for Bitcoin? Among all crypto assets outside of Bitcoin and Ethereum, ZEC's perception of its monetary attributes underwent the most significant shift in 2025. For years, ZEC remained on the periphery of the cryptocurrency system, regarded as a niche privacy coin rather than a true monetary asset. However, with increased global surveillance and the institutionalization of Bitcoin, privacy has once again become a core attribute of cryptocurrencies—rather than a marginalized ideological preference. Bitcoin proved that non-sovereign digital currencies can circulate globally, yet it failed to retain the privacy enjoyed when using physical cash. Every Bitcoin transaction is broadcast to a transparent public ledger, traceable by anyone with a block explorer. Ironically, this tool, intended to subvert centralized power, has inadvertently created a "panopticon" of finance. ZEC, through zero-knowledge proof cryptography, perfectly combines Bitcoin's monetary policy with the privacy of physical cash. Currently, no other digital asset offers the proven and deterministic privacy guarantees of ZEC's latest Shielded Pool. This makes ZEC a unique private currency whose value is difficult to replicate. In our view, the market is reassessing ZEC's value relative to Bitcoin, positioning it as a "potential privacy cryptocurrency"—an ideal hedge against the rise of surveillance states and the institutionalization of Bitcoin in an era where ZEC represents two major trends. Since 2025, ZEC has seen a 666% increase relative to Bitcoin, with its market capitalization climbing to $7 billion, briefly surpassing Monero (XMR) to become the highest-valued privacy coin. This relative strength indicates that ZEC, along with Monero, is considered by the market as a viable privacy cryptocurrency. Regarding Bitcoin's privacy, it is almost impossible for Bitcoin to adopt a privacy pool architecture, therefore the view that "Bitcoin will eventually swallow up ZEC's value proposition" is untenable. The Bitcoin community has always been known for its conservatism, and its core culture is "hardening the protocol"—reducing protocol changes, lowering the attack surface, and maintaining the integrity of the currency. Embedding privacy features at the protocol layer requires significant modifications to Bitcoin's core architecture, potentially introducing inflationary vulnerabilities and undermining its monetary foundation. ZEC, however, prioritizes privacy as a core value proposition and is therefore willing to bear this technological risk. Furthermore, deploying zero-knowledge proofs at the main chain layer reduces the blockchain's scalability. Zero-knowledge proofs require the use of nullifiers and hashed notes to prevent double-spending, which can lead to the long-term problem of "state bloat": nullifiers generate a permanent, append-only list that expands infinitely over time, significantly increasing the hardware resource requirements for running a full node. If nodes are forced to store massive and continuously growing sets of nullifiers, Bitcoin's decentralization will be severely compromised. As mentioned earlier, without introducing opcodes like OP_CAT that support zero-knowledge proof verification through a soft fork, Bitcoin's second-layer network cannot achieve ZEC-level privacy protection while inheriting Bitcoin's security. Current solutions either require the introduction of trusted intermediaries (such as consortium blockchains), or involve long and highly interactive withdrawal waiting periods (such as the BitVM model), or completely transfer the execution and security layers to independent systems (such as sovereign rolling records). Unless this situation changes, there is currently no path to achieving a combination of "Bitcoin-level security + ZEC-level privacy"—which is precisely what establishes ZEC's unique value as a privacy cryptocurrency. The urgency of privacy needs has been further exacerbated by the rise of Central Bank Digital Currencies (CBDCs). Currently, half of the countries globally are researching or have already launched CBDCs. CBDCs are programmable, meaning that issuers can not only track every transaction but also control how, when, and where funds are used. For example, funds can be programmed to be used only at designated merchants or only within specific geographical areas. This might sound like something out of a dystopian novel, but cases of the politicization and weaponization of the financial system have already occurred in reality: - Nigeria (2020): During the "#EndSARS" protests against police violence, the Central Bank of Nigeria froze the bank accounts of several protest organizers and women's rights organizations, forcing the protests to rely on cryptocurrency to continue operating. - United States (2020-2025): Regulators and large banks have deprived certain legitimate but politically unfavorable sectors of banking services, citing "reputational risk" and ideology, rather than considerations of security and robustness. This phenomenon has become so severe that it has attracted the attention of the White House—a 2025 study by the Office of the Comptroller of the Currency (OCC) shows that many legitimate industries, including oil and gas, guns, adult content, and cryptocurrencies, face systemic restrictions on financial services. - Canada (2022): During the "Freedom Cars" protests, the Canadian government invoked the Emergency Act to freeze the bank and cryptocurrency accounts of protesters and even small donors without court approval. The Royal Canadian Mounted Police also blacklisted 34 decentralized cryptocurrency wallet addresses and ordered all regulated exchanges to cease transactions with these addresses. This incident demonstrates that Western democracies are also willing to use the financial system as a weapon to suppress political dissent. In an era where currency can be programmed, Zcash offers a clear "exit option." But ZEC's value goes beyond circumventing central bank digital currencies—it is becoming increasingly important, even a necessary tool for protecting Bitcoin itself. Hedging Bitcoin Capture As influential industry advocates such as Naval Ravikant and Balaji Srinivasan have stated, ZEC is insurance for maintaining Bitcoin's vision of "financial freedom." Currently, Bitcoin is rapidly concentrating in centralized entities. Statistics show that centralized exchanges hold 3 million Bitcoins, ETFs hold 1.3 million, and listed companies hold 829,192—a total of approximately 5.1 million Bitcoins, representing 24% of the total supply. This concentration means that these 24% of Bitcoin are at risk of being seized by regulators—a situation strikingly similar to the historical context of the US government's confiscation of gold in 1933. Back then, US Executive Order 6102 mandated that US citizens surrender all gold exceeding $100 to the Federal Reserve, with compensation consisting only of fiat currency exchanged at the official fixed exchange rate. This order was not enforced through physical force, but rather through the banking system, a crucial "choke point." A similar mechanism can be replicated for Bitcoin. Regulatory agencies can seize these 24% of Bitcoin without obtaining users' private keys—they only need to exert legal pressure on the custodian institutions. In this scenario, governments could issue enforcement orders to institutions like BlackRock and Binance. These legally bound institutions would be forced to freeze and transfer the Bitcoin they hold in custody. Overnight, the equivalent of 24% of the total Bitcoin supply could be "nationalized"—all without altering a single line of code. While this is an extreme case, we cannot completely rule out this possibility. The transparency of the Bitcoin blockchain also means that "self-custody" is no longer a foolproof solution. Any Bitcoin withdrawn from a compliant exchange or brokerage can be traced—because the flow of funds leaves a clear "paper trail," ultimately pointing to the final storage address of these Bitcoins. Bitcoin holders can sever this custody chain by exchanging ZEC, physically isolating their wealth from surveillance systems. Once funds enter a ZEC privacy pool, their destination address becomes a cryptographic "black hole" to external observers. Regulatory agencies may be able to track the funds leaving the Bitcoin network, but they cannot know the final destination of the funds—making these assets completely invisible to governments. While converting ZEC back to fiat currency and transferring it to a domestic bank account still faces certain regulatory hurdles, ZEC assets themselves are censorship-resistant and difficult to actively trace. Of course, the strength of this anonymity depends entirely on the security of the user's actions—if a user reuses an address or acquires ZEC through a compliant exchange, a permanent traceable record is left before the funds enter the privacy pool.

The market demand for privacy currencies has always existed. ZEC's previous problem lay in its failure to lower the barrier to entry for users. For years, the Zcash protocol has been plagued by high memory consumption, long proof times, and cumbersome desktop client operations, making privacy transactions slow and difficult for most users. However, in recent years, a series of breakthroughs in infrastructure have systematically solved these pain points, paving the way for ZEC user adoption.

The Sapling upgrade reduces ZEC's memory usage by 97% (to approximately 40MB) and proof time by 81% (to approximately 7 seconds), laying the foundation for privacy transactions on mobile devices.

The Sapling upgrade solved the speed issue, but Trusted Setup is still considered a potential problem by the privacy community. ZEC, by integrating Halo 2 technology, completely eliminates its reliance on Trusted Setup, achieving complete trustlessness. Meanwhile, the Orchard upgrade introduced "Unified Addresses," integrating transparent and privacy addresses into a single address, eliminating the need for users to manually select address types.

These architectural improvements ultimately led to the creation of the Zashi wallet. This mobile wallet, developed by the Electric Coin Company, was officially released in March 2024.

Zashi leverages the unified address feature to simplify privacy transactions to just a few clicks on a mobile phone, making privacy the default user experience. Having solved the user experience barrier, the next challenge for ZEC was "liquidity." Previously, users still needed to go through centralized exchanges to deposit or withdraw funds into their ZEC wallets. The integration of the NEAR Intents protocol completely resolves this pain point: Zashi users can directly exchange mainstream assets like Bitcoin and Ethereum for the privacy coin ZEC without going through centralized exchanges. Furthermore, the NEAR Intents protocol allows users to use ZEC to pay any asset to any address across 20 blockchains. These measures combined help ZEC overcome historical usage barriers, connect to a global liquidity network, and precisely meet market demands.

Since 2019, the rolling correlation between ZEC and Bitcoin has shown a clear downward trend—from a high of 0.90 to a recent low of 0.24. At the same time, ZEC's rolling beta relative to Bitcoin has risen to an all-time high. This means that while ZEC amplifies Bitcoin's price volatility, its correlation with Bitcoin is weakening. This divergence indicates that the market is beginning to assign a "unique premium" to ZEC's privacy protections. Looking ahead, we expect ZEC's performance to be dominated by this "privacy premium"—the value the market assigns to financial anonymity in an era of increased global surveillance and the weaponization of the financial system.

We believe it's virtually impossible for ZEC to surpass Bitcoin. Bitcoin's transparent supply and unparalleled auditability make it the most robust form of cryptocurrency. In contrast, ZEC, as a privacy coin, always faces inherent trade-offs: achieving privacy through a cryptographic ledger sacrifices auditability and introduces the theoretical risk of an "inflation loophole"—the potential for undetected supply inflation within the privacy pool, something Bitcoin's transparent ledger aims to completely eliminate. Despite this, ZEC can still carve out its own unique niche outside of Bitcoin. These two assets are not competing in the same market, but rather fulfilling different use cases within the cryptocurrency space: Bitcoin is a robust cryptocurrency that optimizes transparency and security, while ZEC is a private cryptocurrency that optimizes confidentiality and financial privacy. In this sense, ZEC's success doesn't require replacing Bitcoin, but rather complementing it by providing attributes that Bitcoin deliberately forgoes.We anticipate that another trend that will accelerate in 2026 is the feasibility of application-layer currencies. Application-layer currencies are monetary assets designed specifically for a particular application scenario, with highly focused functions, distinguishing them from general-purpose monetary assets like Bitcoin and public chain tokens. To understand why application-layer currencies can take root in the cryptocurrency environment, we first need to revisit two core principles of money:

1. The value of money derives from the goods and services it can be exchanged for;

2. When the cost of switching between different monetary systems is high, market participants will gradually converge to a single mainstream monetary standard.

Historically, money was created to store the value created by economic activity. Because most goods and services are perishable or time-sensitive, money allows people to store purchasing power for future use. It needs to be emphasized that…

Two weeks ago, friendtech content creators reported a surge in hacks- what's going on?

Clement

ClementSIM Swap attacks are apparently really easy- and Friendtech was the perfect target.

Clement

ClementFriendtech is flawed- but these flaws are far from unique

Clement

ClementSpoiler alert- Web3 isn't at fault, bad Web2 security is.

Clement

ClementWeb2 Security is laughably bad when compared to Web3- but it still has something to offer for us.

Clement

ClementFor those customers who were able to access PayLah! and qualify for the DBS 5 Million Hawker Meals cashback, the bank assured that rebates would be issued by Friday.

Davin

DavinIf everything sucks, what's the way forward?

Clement

ClementArticle exploring the potential rug-pull and tokenomic risks associated with KuCoin's latest product. Urges readers to conduct their own due diligence before investing.

YouQuan

YouQuanCrypto Aid Israel raises $185,000 in a mere ten days. This achievement highlights the dedication of both Israeli Web3 community members and international companies.

Catherine

CatherineElon Musk made an announcement regarding the plans of X, formerly known as Twitter. Musk confirmed the impending launch of two distinct premium tiers, affirming prior reports and code discoveries.

Joy

Joy