Article author:Prathik Desai

Article compilation:Block unicorn

Foreword

There is an irony in modern finance. You may hold $400,000 worth of Bitcoin, but have difficulty getting approved for a $300,000 mortgage. Your digital wealth may make you look rich on paper, but when you actually want to buy a large commodity like a house, it seems invisible. This is even more true if you don't have a good credit history.

This absurdity makes me wonder: wealth is real, why is it not recognized?

On Monday, this absurdity was one step closer to being solved.

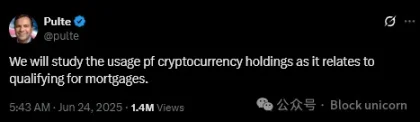

Bill Pulte, the newly appointed director of the Federal Housing Finance Agency, sent a tweet.

Within hours, the elites in the cryptocurrency field responded.

Michael Saylor proposed his Bitcoin credit model. Strike's Jack Mallers volunteers to make Bitcoin-backed mortgages "a reality in the U.S."

The signs are clear: the credit system as we know it is changing fast and embracing cryptocurrencies in new ways every day.

28 million "financial ghosts"

There are about 28 million adults in the U.S. that regulators classify as "credit invisibles." They exist in the economy: they work, they earn, they spend, but they don't exist in the eyes of banks. They have no credit cards, no student loans, and no mortgage history. They are just financial ghosts, with intact funds but no Fair Isaac credit scores (FICO) to prove it.

The extent of this exclusion is even clearer when, according to Tom O『Neill, a senior adviser at Equifax, lenders are missing out on about 20% of the growth in credit demand in the U.S. by not choosing to add alternative data to traditional scoring models.

Meanwhile, about 55 million Americans hold cryptocurrencies. This segment of the population may include a large number of people who are asset-rich in crypto but credit-poor in the traditional system.

Think of immigrants who avoid debt, young professionals who never need a credit card, or global entrepreneurs who get paid through digital assets. Someone may hold enough Bitcoin but be unable to get a mortgage because their wealth does not register in the traditional FICO scoring system.

Ironically, traditional banks are beginning to recognize this problem.

In 2023, JPMorgan Chase, Wells Fargo, and Bank of America launched a pilot program that challenged the decades-old credit card approval process. Instead of requiring a traditional credit score, these lenders began approving credit cards by analyzing consumers’ account activity — including checking and savings balances, overdraft history, and spending patterns.

Early results showed that many of the excluded consumers were actually creditworthy, but had issues with their financial history information.

The logical next step? Cryptocurrency holdings as another alternative data. After all, if your bank balances, stock and bond portfolios can be used to assess creditworthiness, why can’t your Bitcoin balance?

The scale of this disconnect is even clearer in the numbers. In 2023, the global loan market is one of the world’s largest financial industries, worth $10.4 trillion, and is expected to reach $21 trillion by 2033.

On-chain lending accounts for only a small portion of this (0.56%).

Focusing solely on housing, the Federal Housing Finance Agency (FHFA) provides over $8.5 trillion in funding to the U.S. mortgage market and financial institutions.

If crypto assets can be properly integrated into this mainstream market, you will see a large influx of recognized collateral and participants.

Rather than forcing cryptocurrency holders to sell assets to qualify for a mortgage, lenders can consider digital assets as legitimate collateral or proof of wealth.

Under today's rules, buying a $400,000 house means liquidating your crypto, triggering capital gains taxes, and giving up any future appreciation in the assets you would have held. It's like being punished for holding the "wrong currency."

Under a crypto-inclusive framework, you could use your Bitcoin holdings as collateral without having to sell them, avoid a tax event, and keep your digital assets while pledging against real estate.

Some companies are already doing this in the private sector.

Milo Credit, a Florida-based fintech, has issued more than $65 million in crypto-backed mortgages.

There are a few other companies offering Bitcoin-backed mortgages, but they are all operating on their own. Some of them also operate outside the Fannie Mae/Freddie Mac system, which means higher rates and limited scale. Pulte’s announcement could push this trend into the mainstream.

Modernization is imperative

Traditional credit scoring is outdated. Banks look back at payment history and ignore forward-looking wealth indicators.

Some decentralized finance (DeFi) protocols are already experimenting with on-chain credit scores.

Cred Protocol and Blockchain Bureau analyze wallet transaction history, decentralized finance (DeFi) protocol interactions, and asset management patterns to generate credit scores based on demonstrated financial behavior.

A person with a stable on-chain transaction history and a healthy cryptocurrency portfolio may be more creditworthy than someone with a credit card overdraft, but current systems simply cannot recognize this. Some progressive lenders are already experimenting with alternative data: rent payments, bank balance trends, utility bills.

So what’s holding back the rise of home loans backed by cryptocurrency holdings? Therein lies a problem.

The notorious volatility of cryptocurrencies could turn mortgages into a margin call-like situation.

Bitcoin lost about two-thirds of its value between November 2021 and June 2022. What happens if your mortgage eligibility depends on one bitcoin worth $105,000 today, and it becomes $95,000 tomorrow? Borrowers who were once creditworthy suddenly become default risks through no fault of their own.

If this spreads to millions of loans, you have the makings of a real crisis.

It all feels familiar.

In 2022, European Central Bank official Fabio Panetta noted that the cryptocurrency market was larger than the $1.3 trillion subprime market that triggered the 2008 crisis. He observed "similar dynamics" between traditional and crypto markets: rapid growth, speculative frenzy, and opaque risks.

During a bull run, crypto fortunes can appear and disappear at alarming speed. Aggressive lending based on inflated portfolio values could recreate the boom-bust cycle that devastated the housing market seventeen years ago.

Our Take

Even if the FHFA moves forward, and Pulte has yet to offer a timeline or specifics, the practical hurdles remain daunting. How to value volatile assets for lending purposes? Which cryptocurrencies qualify? Just Bitcoin and Ethereum? What about stablecoins? How to verify ownership without facilitating fraud?

Then there’s the foreclosure scenario: Can a bank really seize crypto collateral if a borrower defaults? What if a borrower claims their private keys “were lost in a boating accident”? Traditional repossession involves sending out enforcement officers to collect the physical asset. Repossession of crypto assets involves… well, just some alphanumeric keys.

Some of these challenges are being addressed by developing protocols for low-mortgage lending. Platforms like 3Jane have developed “credit-cutting” mechanisms that bridge the gap between anonymous lending and real-world accountability. Their approach allows borrowers to maintain privacy initially, but default triggers a process whereby collection agencies can access real-world identities and pursue them through traditional debt collection methods, including credit reports and legal action. Borrow anonymously, but default at your own risk.

For cryptocurrency holders, Pulte’s announcement represents a long-awaited endorsement. Your digital assets may finally be considered “real” wealth in the eyes of mainstream finance. For the housing market, this could unlock a wave of buyers that have been excluded by outdated qualification methods.

But how it’s implemented will determine whether this becomes a bridge to financial inclusion or a path to the next crisis. Integrating cryptocurrencies into the mortgage space requires the kind of careful risk management that the financial industry has not always excelled at.

The barriers between cryptocurrency and traditional credit are beginning to crumble. Whether a stronger, more inclusive financial system emerges or a more fragile house of cards will depend on how carefully we build the bridge between these two worlds.

Weatherly

Weatherly