Source: Rich Man's Surplus

In the past week, Trump has made two big news.

The first big news, of course, is that he called a pause button on the Sino-US tariff war.

On the 17th, local time in the United States, Trump said:

"I think we will reach an agreement with China, and we will reach an agreement with everyone. If we can't reach an agreement, then we will set a goal and then set it like this, which is also good. Probably in the next three to four weeks, everything should be settled."

That is to say, he believes that the "tariff war" with China may be better handled and resolved in the next few weeks.

Unfortunately, I think this may be his personal wishful thinking. With his changeable policies and the makeshift team in his mansion, no one knows what will happen next.

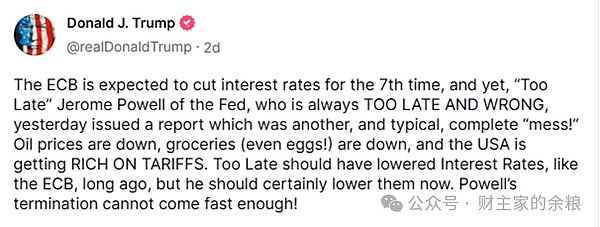

Another event, which is also what I want to talk about today, is that Trump once again intensively attacked the Federal Reserve Chairman Powell.

People who have been reading my articles know that I have always been very sarcastic about all the previous Federal Reserve Chairmen except Volcker, including the current Powell. I always think that they are pretending to be profound and manipulating the market...

But, suddenly a despicable Trump appeared and said that Powell "manipulated politics" and asked him to leave as soon as possible. At this time, I think I can support Powell.

Just last Thursday, Trump criticized Powell three times.

Early in the morning, Trump said:

I don't think Powell is doing his job well. If I ask him to, he has to leave. Powell makes me unhappy. He is always slow.

During the midday trading of US stocks, Trump said again:

I don't think Powell is doing his job well. If I ask him to, he has to leave. Powell makes me unhappy. He is always slow.

After a few minutes, Trump "blasted" Powell again, saying that the Fed should cut interest rates, which the Fed owed to the American people. Powell will face great political pressure.

In short, Trump has been very dissatisfied with Powell recently, constantly saying that interest rate cuts are "always too late and wrong", accusing him of "manipulating politics" and "too bad", and once again pressuring Powell to cut interest rates, believing that Powell "should have cut interest rates like the European Central Bank did long ago", and calling on Powell to "leave office as soon as possible".

This is Trump's usual trick of confusing black and white.

It's really funny. Anyone with eyes and brains can see that no one in the world is doing more political manipulation than Trump himself. What's more shameless is that he has manipulated policies and constantly manipulated the cryptocurrency and US stock markets, making billions or even tens of billions of dollars for his family and people around him.

Trump has repeatedly made statements on his own media, saying that US inflation is falling and that Fed Chairman Powell should take action to lower interest rates, but he is always slow to act and fails to do his job well. He also gave Powell a nickname similar to "Sleepy Joe" "Too Late".

Being a rapist and accusing the victim of being a criminal is Trump's usual style. What's more, when he was running for president in 2024, he kept warning Powell that you can't cut interest rates, you can't cut interest rates, otherwise you are helping the Democratic Party, otherwise you are betraying the people... As a result, he has only been in office for less than 3 months, and he has urged Powell to cut interest rates countless times. If this is not political manipulation, what is political manipulation? Although Trump's criticism of Powell is already very common, this time it made the market feel the danger of "getting serious", not just casually like before. Because this time the news of "studying whether to replace Powell" was provided by Hassett, the current director of the White House National Economic Council, which means that Trump has already communicated with the entire team on the matter of firing Powell, and his team is likely to be working on it.

Just a few days ago, Powell also emphasized that the independence of the Fed chairman is determined by Congress and is a legal issue. He believes that Trump has no power to fire him. He also emphasized that it is because of the soaring inflation expectations and various uncertainties caused by Trump's tariff policy that the Fed decided to wait and see about the interest rate cut.

It is conceivable that Trump was furious when he heard these words, so he attacked Powell three times on Thursday.

The only provision in U.S. law specifically regarding the removal of members of the Federal Reserve Board can be found in Section 10 of the Federal Reserve Act:"Each member of the Federal Reserve Board shall serve for a term of fourteen years, unless earlier removed by the President for cause."

A very reliable understanding of this sentence is"The President has the power to remove any director of the Federal Reserve,"but Powell understood it as"You can't remove me without cause."

The term "for cause" will be interpreted as "serious misconduct, dereliction of duty, malfeasance or abuse of power" in US legal rulings, so Trump must find evidence that Powell neglected his duties or malfeased.

But the problem is that since 2023, Powell has done an excellent job. On the one hand, he has brought the ultra-high inflation that has not been seen in 40 years back to a level of just over 2%. There has been no large-scale unemployment and economic recession, and the stock market has not fallen sharply. In 2025, when the economy is slowing down, the Federal Reserve still holds the good card of a federal interest rate of 4.25%. Slowly lowering interest rates can smooth the economic cycle. What reason do you have to say that he has malfeasance?

Hey, you know what, with the ability of the Trump team to confuse right and wrong and find faults, they actually found a "reasonable reason" to remove Powell:

1) During Trump's first term, the Fed's actions were aimed at helping the Democrats (return to power);

2) During Biden's term, the Fed (failed to do its job) did not warn Biden that his out-of-control spending would bring serious inflation.

Because this matter has reached the team's execution, the market really feels the risk.

No matter what the next result is, after this incident, the credibility of the Federal Reserve has been damaged and the credit foundation of the US dollar has been shaken.

If Trump's "dismissal" fails and the Fed resists the pressure and does not cut interest rates, the financial market will have to continue to endure high interest rates, which is extremely unfavorable to the capital market.

If the Fed cannot withstand the pressure and cuts interest rates, the market will think that it is under pressure from Trump and will no longer trust the Fed. The crisis caused by this will be more serious than not cutting interest rates, because the Fed may really be "politically manipulated". From then on, the Fed's god-like position in the financial market will be shaken, and the market will no longer believe in the Fed's so-called "dollar value" promise.

If Powell is really dismissed by Trump through legal procedures, then - it will be a mess, because this will prove that the "central bank independence" that the Fed has been claiming for the past 40 years is a joke, which means that the US dollar may be issued at any time at the request of a president like Trump, and the US dollar, which is originally a credit note, will degenerate to the same level as the Zimbabwean dollar and the Venezuelan dollar.

In short, this incident has caused a huge blow to the credit system of the US dollar.

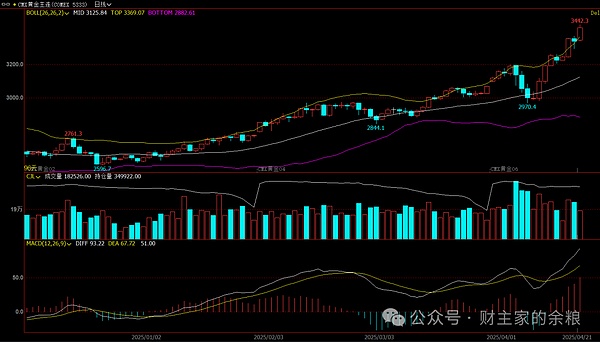

Perhaps because of the danger of this incident, gold soared as soon as it opened today, up 3%.

Further considering that in the past 10 days, gold has soared by 6%, and in just two weeks, gold has soared by 14%, which is a reflection of the extreme distrust of the US dollar currency in the financial market.

You know, even when the Federal Reserve announced QE after the global financial crisis in 2008, gold did not soar so much, even when the epidemic crisis came and the Federal Reserve announced unlimited QE (unlimited money printing), gold did not soar so much!

The extent of Trump's damage to the foundation of the credit of the US dollar can be seen from this.

However, just five days ago (April 16), Powell issued another statement, emphasizing that Trump had no right to dismiss him - "The independence of the Federal Reserve is a legal issue."

The President of the United States and the Federal Reserve can be said to be the two most powerful people in the world. Now, the gods have started fighting, and all assets have suffered except gold, which serves as the mirror of the US dollar.

If you want to learn more about the relationship between the independence of the Federal Reserve and the evolution of the power of the US President, please click on an article I wrote 5 years ago:

Chuan Duidui, can he fire Bao Boss?

Clement

Clement

Clement

Clement Davin

Davin Kikyo

Kikyo Hui Xin

Hui Xin Catherine

Catherine Hui Xin

Hui Xin Catherine

Catherine Davin

Davin Kikyo

Kikyo Clement

Clement