Compliance-friendly, can be used as a regulatory compliance reserve asset. From this perspective, stablecoins are "new Breton tokens with T-Bills as gold", with the credit system of the US Treasury embedded behind them. Fourth, stablecoins = extension of US dollar sovereignty, not weakening it Although on the surface, stablecoins are issued by private institutions, it seems to weaken the central bank's control over the US dollar. But in essence:

Every USDC issued must correspond to 1 US dollar of US Treasury bond/cash;

Every on-chain transaction is priced in "US dollar units";

Every global circulation of stablecoin is an expansion of the radius of use of the US dollar.

This makesthe United States no longer need SWIFT or military projection to "airdrop" dollars to global wallets, which is a new paradigm for outsourcing monetary sovereignty.

Therefore we say:

stablecoins are "unofficial contractors" of US monetary hegemony

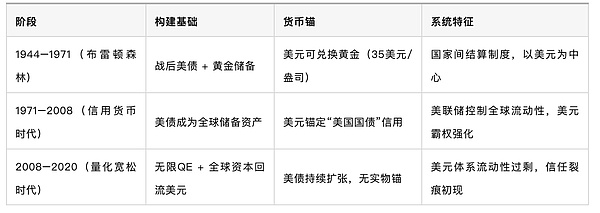

- it does not replace the dollar, but pushes the dollar to the chain, to the world, and to the "bankless zone". V. The prototype of the Bretton Woods 3.0 system has emerged: digital dollar + U.S. debt on the chain + programmable finance

In this architecture, the global financial system will evolve into the following model:

text="">This means:The future Bretton Woods system will no longer take place at the Bretton Woods conference table, but will be negotiated and agreed upon between smart contract codes, on-chain asset pools, and API interfaces.

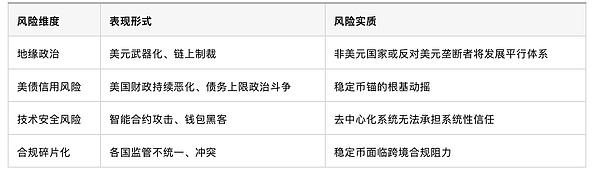

Six. Risks and uncertainties: How far can this system go?

VII. Conclusion: Stablecoin is not the end, but the "midfield supply station" of the global governance of the US dollar

Stablecoin seems to be a private innovation, but in fact it is becoming a "disguised bridge" of the US government's digital currency strategy :

It connects old finance (U.S. debt) and new finance (DeFi);

It extends U.S. financial sovereignty to the smart contract layer;

It allows the U.S. dollar to maintain its dominant position in digital transformation.

Just as the Bretton Woods system established the credit of the U.S. dollar through gold anchoring, today's stablecoins are trying to rewrite the monetary governance structure with "on-chain T-Bills + U.S. dollar clearing consensus".

Stablecoin is not a revolution, but a reconstruction of US debt, a reshaping of the US dollar, and an extension of sovereignty.

Brian

Brian