There are two huge levers in the Web3 world: exchanges and public chains. Centralized exchanges match the supply and demand of crypto assets, forming a closed loop of transactions, while decentralized public chains are more open and inclusive, and are also the foundation for us to build the so-called "cyber nation".

Centralized exchanges are making plans to move towards decentralized public chains. Public chains also cannot do without the support of exchanges. You are in me, and I am in you.

Dr. Xiao Feng of Hashkey gave the positioning of the public chain based on the essence of finance:"The new generation of financial infrastructure is not only a marginal improvement on the existing system, but also brings disruptive development in terms of transactions, clearing and settlement, forming a new financial paradigm."

Raymond, co-founder of PolyFlow, also vividly compared the public chain with the country from the perspective of payment and clearing:"Each country will have its own market structure and financial payment and clearing system (just like the public chain), and when it comes to countries, the intervention of clearing networks such as SWIFT or Visa/Mastercard will be required (just like cross-chain)."

Just as every country has its own cultural foundation, every public chain has a unique "soul". For the rising Moprh blockchain, "consumer applications" are its soul, and also the key for the Web3 industry to find positive externalities and break through. 1. Morph and its positioning Morph is the first consumer-oriented public chain, dedicated to integrating Web3 into daily life in a deep and seamless way. As a builder of consumer-level application ecosystems, Morph will continue to expand its connections with the traditional world with the help of its partner ecosystem of 45 million+ real users. Its goal is to truly achieve large-scale popularization of blockchain technology through more complete tools, flexible payment scenarios and friendly user experience.

Morph's slogan is also very practical: for Everyday Users, for Everyday Use.

(Exclusive interview with Morph CEO: Crypto leaders need to stay sober, consumer-grade ecological positioning is irreplaceable)

Morph received US$20 million in early seed round financing, led by Dragonfly Capital. Pantera Capital, Foresight Ventures, The Spartan Group, MEXC Ventures, Symbolic Capital, Public Works, MH Ventures, Everyrealm and other institutions followed suit.

In an interview with Catcher: "Morph wants to be a chain that can truly bring practical application value. We have seen the needs of users and no applications can meet their needs, so we build a brand and technology platform as a bridge between users and applications: on the one hand, for applications and developers that focus on consumer scenarios and are committed to improving the Web3 experience, we help them grow; on the other hand, better meet users' needs for the implementation of Web3 in consumer scenarios. I believe that this vision and mission are scarce, and the top VCs have seen our positioning and resources, which is also an important reason why we received a $20 million investment."

Since entering the circle a few years ago, slogans promoting Crypto Mass Adoption have been heard everywhere, but there are not many projects that have actually landed or are truly effective. Although we can see that the transformation of stablecoins based on cross-border scenarios can play a huge role in reducing costs and increasing efficiency, as well as its function as a value storage tool to combat inflation, we are still looking forward to a Web3 application that is truly oriented to C-end consumers.

Second, build a consumer ecosystem with payment as the foundation

After answering the questions of What and Why, Morph needs to answer the question of How, that is, how Morph builds this consumer-grade blockchain.

Last May, Morph launched Morph Zoo, a testnet incentive activity with themes such as zoos, forests, koalas and other small animals, aimed at attracting users to participate and test related technologies and products. Users can earn points by interacting with applications deployed on the Morph testnet. The Morph Zoo event not only provides users with an interesting and attractive testing experience, but also shows more developers Morph's emphasis on consumer applications, thereby motivating them to join the Morph ecosystem and start building.

Ecosystem construction is Morph's core focus and an important difference between Morph and other technology public chains. Therefore, Morph has launched a variety of incentives to encourage innovation and prosperity within the ecosystem.

EudemoniaCC, head of Morph APAC Ecosystem, made a very vivid analogy: "The construction of the ecosystem is like building an online celebrity shopping mall. On the one hand, it requires the support of many merchants to attract high-quality merchants to settle in. On the other hand, it is also necessary to guide the flow of customers to meet the comprehensive needs of users."

(Introducing Morph Pay: The Future of Finance)

In addition, Morph announced the launch of Morph Pay in February this year, aiming to create a platform that integrates Web2 banking infrastructure and Web3 A comprehensive financial ecosystem with decentralized financial profitability, providing consumers with an integrated account and On-chain Bank experience for cryptocurrency and legal tender. This is the key to promoting user interaction in the ecosystem and the key to building a consumer-grade blockchain, which is expected to be released in Q3 this year.

2.1 Payment connects Web2 & Web3

First of all, payment is a tool and channel. Only by solving the seamless connection between cryptocurrency and legal tender can we truly connect Web2 & Web3 and create application scenarios that are widely linked to the real world.

Morph is actively promoting a series of strategic cooperation to realize its vision of a consumer-grade public chain. Currently, Morph is committed to opening up access channels for more than 50 currencies around the world through wallets, which will greatly simplify the flow of funds for users in the Web3 world. In addition, Morph is working with a top five credit card issuer in the world to use Morph as an on-chain settlement layer to further reduce the cost for ordinary consumers to enter or leave Web3. These initiatives are considered key steps in achieving a consumer-grade public chain, aiming to provide users with a more convenient and low-cost Web3 experience.

"Currency is only valuable when it is in circulation", this sentence also applies to Crypto.

2.2 Crypto user migration

As a builder of consumer application ecology, Morph has the support of many powerful partners and has accumulated more than 45 million + real users. These users have already understood Crypto and Web3. They know that the world of Crypto should not only have PVP, but also the "poetry and distance" of the real world.

(https://x.com/Morph_ZH/status/1914530227545428193)

Morph's cooperation with Web3 travel and consumption platform Umy is a model of Web3 consumer-level applications.

Umy is committed to creating a global luxury travel booking platform that integrates "discounts, convenience, and exclusive enjoyment" through Web3 encrypted payments. The cooperation with Morph is not only an upgrade of user rights, but also a new exploration of Web3 lifestyle. Umy can help migrate Morph users to real consumption scenarios, so that Crypto is no longer just an asset on the books, but a currency that can be circulated.

Users can use Morph Pay to book flights, hotels, and shopping on Umy.com, realizing a closed loop of Crypto consumption + ecological Token incentives. Users holding Morph Black & Platinum Card can also enjoy the benefits of the corresponding Umy.com loyalty program, such as 4%-6% booking discounts, vouchers, points, etc.

After booking an overseas trip through Umy.com, the user's communication needs must be met after landing at the destination. At this time, Morph is about to cooperate with Web3 decentralized telecommunications operator Roam to provide Morph users with eSIM global traffic services, truly realizing all scenarios of user travel consumption.

Unlike most projects that need to spend a lot of effort to re-educate and cultivate users, Morph's guidance and migration of mature users on the chain is what distinguishes Morph from other projects, and it is also the most advantageous and most feasible place.

2.3 Composability of on-chain finance

With Morph Pay, users can directly apply on-chain DeFi income to daily consumption, while achieving optimal use of their assets based on full control of their own assets. Morph Pay tailors a one-stop DeFi income aggregation solution for users, supporting double-digit annualized returns on crypto asset deposits. Through the automation of smart contracts, users can seamlessly connect DeFi income to daily payments, thereby achieving a close combination of asset appreciation and payment scenarios.

In addition, Morph Pay will support multi-currency payment functions and be compatible with Google Pay and Apple Pay due to the advanced nature of the platform. Users will also have the opportunity to participate in exclusive airdrops and incentive activities launched by Morph and its ecosystem partners.

Third, connect consumers & ecosystem through Morph Pay

Morph's positioning is different from traditional public chains. It is no longer a simple reinvention of the wheel, but focuses on the expansion of the application layer, taking consumer payment as the entry point to promote the public chain to a wider positive external development and achieve Crypto Mass Adoption.

Currently, there are about 562 million people holding cryptocurrencies worldwide, accounting for about 12% of the total number of Internet users. It can be seen that the popularity of cryptocurrencies has a considerable foundation. However, most Web3 users still enter due to trading attributes or speculative effects, mainly concentrated in centralized exchanges for trading, and active users on the chain only account for 5%-10% of global holders. In other words, the actual penetration rate of cryptocurrency usage is still extremely low.

However, looking to the future, when Web3 truly reaches more than 90% of Internet users, it will not be exchanges or DeFi that drive this change, but payments.

Payment is the key connection point for Web3 to truly enter daily life, and it is also a bridge connecting users to the blockchain world.

3.1 Connecting the ecosystem through Morph Pay

(In-depth analysis of consumer-grade blockchain Morph: What exactly is Morph?)

Morph is currently accelerating the construction of the consumer ecosystem with Morph Pay as the core touchpoint. This payment solution based on blockchain technology has higher security, faster response capabilities and lower transaction costs, and is particularly suitable for high-frequency small-amount scenarios, such as daily coffee consumption, online subscription services, etc.

Furthermore, Morph also plans to deeply integrate payment functions into social, gaming, entertainment and other consumer DApps in the ecosystem. In the future, users can not only use Morph Pay to complete on-chain payments, but also realize diversified interactions such as in-app purchases, equity exchange, and event participation, thereby building a closed-loop experience for Web3 consumption.

3.2 Launching the first black card for young people

(x.com/MorphLayer)

In March this year, Morph Pay launched a high-end financial product based on the Morph ecosystem - Morph Black, which was minted in the form of NFT and limited to 3,000 pieces, bringing users exclusive financial and real rights experience.

From the perspective of traditional credit cards, Morph Black is undoubtedly similar to the "King of Cards" - American Express Centurion Black Card. However, unlike the Web2 Black Card that requires off-chain proof and is limited by traditional entry barriers, Morph Black is more like an identity symbol for the new generation of Web3 users.

Low-fee payment

For young people in the Web3 digital world, most current crypto debit cards (VCCs) can complete consumer payments, but they face problems such as high fees and low success rates. Morph Card is a breakthrough product born in this context.

Based on the cooperation with DCS, a first-tier card issuer of Singapore's established bank, Morph Card realizes long-term stable and low-fee channels, avoiding unstable services due to compliance issues or secondary channel problems, and bringing users payment freedom close to OTC level:

No withdrawal restrictions, supporting up to $1M USDT withdrawal

Minimum 0.3% crypto-fiat currency exchange rate

High consumption cashback: 1% Cash back

Lifetime annual fee waiver

High equity status

Of course, if it was just to satisfy the freedom of payment, then American Express would not have achieved the black card it has today.

American Express started as a travel financial service in the mid-19th century and has undergone many transformations to become a global payment and high-end financial service giant. In the early days (1850s-1950s), it accumulated high-net-worth customers by inventing traveler's checks and building a global network. 1950s-1980s, facing the challenge of Diners Club, launched charge cards, bound benefits to business travel scenarios, built a closed loop of payment and travel, and strengthened user stickiness. 1990s-2010s, deeply cultivated the high-end business travel market, launched high-end cards such as Centurion Black Card, created a benefits ecosystem, covered the entire chain of travel services, and achieved globalization and localization. 2010s to date, with the help of technology channel experience upgrades, explored the integration of sustainability and lifestyle, adhered to high-end positioning and opened up cooperation.

Looking back at the development history of American Express, we can sort out the development context in Morph Pay. Morph Card First, it realizes the freedom of user payment to the greatest extent, and then provides a high benefit combination to meet the long-term needs of the new generation of young people in business travel, transportation, social interaction, etc.

Morph Card is expected to redefine the boundaries of payment by focusing on "convenient payment + lifestyle penetration", and upgrade from a transaction tool to a Web3 lifestyle enabler.

3.3 Become a part of the most promising Morph value network

Of course, a valuable consumer ecosystem cannot rely solely on 3,000 high-end Morph Black Cards. Morph Pay has recently launched the Morph Platimun Card, which is more affordable and inclusive than the black card. It is expected to be realized in Q3 this year.

So, payment is just the beginning. Morph Pay is using Card as a starting point to bind consumers to the Morph network and gradually build its own Morph consumer-grade blockchain ecological network.

From a market perspective, previous L2s have focused more on the chain, focusing on the 3 trillion encrypted market, while Morph, as a Consumer Layer, is aimed at the larger off-chain blue ocean market to connect this real-world market with a volume of 400-600 trillion. In addition, 2C applications often have a higher premium than 2B applications.

Fourth, Morph's vision is not just payment

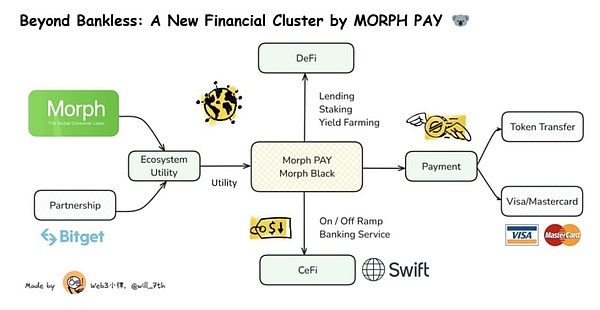

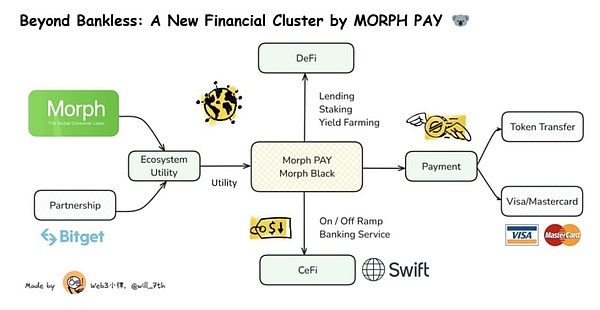

If Morph Black makes people think of the first black card of young people in the Web3 world, but through the layer of consumer payment, Morph's vision is to create a brand new PayFi financial cluster and the next generation of financial infrastructure through Morph Pay.

Innovative application model. The core is to use blockchain as the settlement layer, combining the advantages of Web3 payment and decentralized finance (DeFi) to promote the efficient and free flow of value. PayFi's goal is to realize the vision of the Bitcoin white paper, build a peer-to-peer electronic cash payment network that does not require a trusted third party, and take full advantage of DeFi to create a new financial market, including providing a new financial experience and building more complex financial products and application scenarios.

(Morph Pay can also provide consumers with convenient conversion from cryptocurrency to fiat currency, as well as flexible, crypto-friendly banking services through its partner licensed financial institutions.

C. Consumer payment. Whether the backend is connected to VISA/Mastercard Card or the payment scenario of a digital wallet (such as Bitget Wallet), it can provide consumers with a better solution to replace the original old payment methods.

The above three points are actually what the blockchain-based Web3 payment solution must achieve, but the crypto-native Morph can provide much more than that:

D. DeFi compatibility. Morph Pay, as a payment product launched by the consumer-grade public chain Morph, can not only create a one-stop DeFi income aggregation solution for consumers, support an annualized yield of up to 30% on crypto asset deposits, but also support innovative operations of smart contracts, thereby building scenarios that are difficult to achieve with traditional financial payments. For example, DeFi income can be directly used for daily payments, achieving a seamless connection between asset appreciation and payment scenarios, and evolving the previous Buy Now Pay Later to Buy Now Pay Never.

E. Ecological governance empowerment. On-chain: Users will be able to participate in exclusive ecosystem airdrops and incentive activities provided by Morph and its ecosystem partners; Off-chain: Provide consumer cashback, Aspire travel concierge services, industry summits and other rights and interests, and further provide users with real-world utility.

What Morph is building is no longer limited to a single product and a single scenario. This on-chain composability based on blockchain and cryptocurrency is fully capable of building a new PayFi financial service complex, covering financial services such as payment, savings and wealth management, lending, remittance transfer, and ecological governance. More importantly, this PayFi financial cluster is not only limited to cryptocurrencies, but also smoothly compatible with legal currencies.

We used to say: "It's time to go bankless." But now it seems that Morph has broken through the boundaries of bankless in its early days.

In the future, everyone can seamlessly manage funds in the PayFi financial cluster created by Morph to achieve wealth growth and financial freedom. This is not only a technological innovation, but also a new financial lifestyle that will drive the global financial system towards a more open and equal era.

V. Written in the end

Morph has chosen a difficult but clear path from the beginning: starting from the daily life of users, taking payment as the starting point, and embedding financial capabilities into every consumption.

In this era from "Ten Thousand Chains Launched Together" to "Narrative Differentiation", different public chains are clarifying their unique positioning. BSC is heading towards the meme craze, Base is strengthening the collection of data assets, and Solana is reconstructing the ecological order. Morph, on the other hand, is fulfilling the imagination of consumer-grade blockchain through actual consumer scenarios.

Its path is clear, its pace is steady, and its vision is far-reaching. The story of Morph has just begun.

Kikyo

Kikyo