By: ECOINOMETRICS

If you pull away from the day-to-day volatility of the major asset classes, you’ll find a big trend.

This trend ties together Bitcoin, Gold, and the leading companies that have a significant presence in the stock market, and it’s affecting everything downstream.

This is the big picture we should be focusing on.

I.Key Points

This week we’re not looking at short-term correlations, but at the long term. What we learned when we looked at the big picture:

Bitcoin’s price trend is closely correlated with Gold and Nasdaq in the long term, driven primarily by global liquidity conditions.

Bitcoin’s price trend is closely correlated with Gold and Nasdaq in the long term, driven primarily by global liquidity conditions.

This is the big picture we should be focusing on.

I.Key Points

This week we’re not looking at short-term correlations, but at the long term.

When we looked at the big picture, what we learned:

Bitcoin’s price trend is closely correlated with Gold and Nasdaq in the long term, driven primarily by global liquidity conditions. ...

Many crypto assets, miners, and related stocks follow the movement of Bitcoin. Investing in these assets is effectively betting on the direction of Bitcoin.

Financial conditions in the United States are easing, creating a favorable environment for Bitcoin and related assets.

Current liquidity supports Bitcoin, but a potential US recession remains a key risk to watch.

Understanding these long-term trends and macro correlations is essential to effectively navigate the crypto market.

Second,Looking at Macro Correlations

Since we started this correlation report, I have generally focused on shorter time frames. For us, "short" means the monthly scale, so we generally look at changes in correlations within a 1-month rolling window.

This approach helps identify potential turning points, but also comes with relatively large noise (so some guesswork is required in the analysis).

Sometimes it pays to take a longer-term view to better understand longer-term trends.

When I first got into the quant business about 15 years ago, it was still possible to find information advantages on short time frames. But as time has gone on, those advantages have become harder to capture, and I believe that having a deep understanding of the bigger picture for long-term trading is where the real advantage lies.

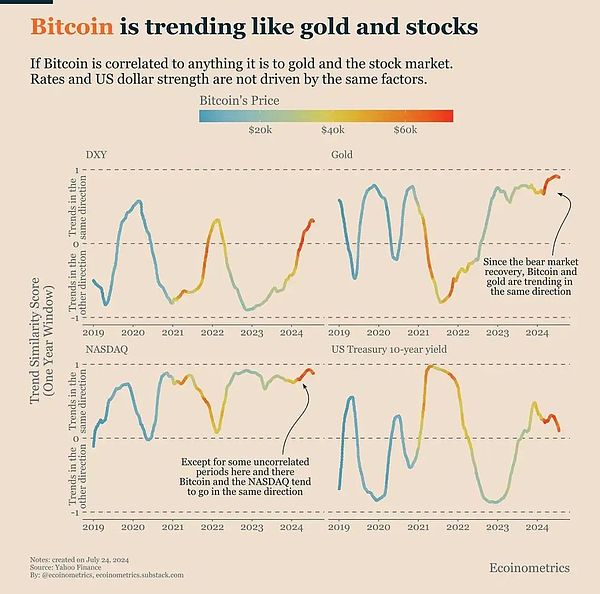

So today, I decided to tweak some parameters and look at the evolution of the trend similarity score for Bitcoin versus several “macro” assets over a 1-year rolling window.

This approach helps ensure that we don’t miss the forest for the trees and gives us a clearer overall picture.

Here are the results.

As a reminder, a trend similarity score close to 1 means that two assets are trending in the same direction, while a score close to -1 suggests that they are trending in opposite directions.

Is Bitcoin greatly affected by the strength and weakness of the US dollar (DXY)? No. The trend similarity score fluctuates only between positive and negative values.

Is Bitcoin correlated with interest rate movements? Again, not much of an impact. The trend correlation we see is similar to the pattern seen with the DXY.

However, when you look at gold and the Nasdaq, you see a more consistent relationship. Especially since we’ve been through the recent bear market, the correlation between Bitcoin, gold, and the Nasdaq has been very strong.

This is no coincidence. There is a common factor that ties all three together: global liquidity.

Global liquidity drives these assets by influencing risk appetite and investment flows. Easy monetary policy not only boosts risk assets such as Bitcoin and tech-focused Nasdaq stocks, but also gold as a hedge against potential inflation. As liquidity fluctuates, these assets tend to move in sync, reflecting broader economic conditions and investor sentiment.

This has downstream effects.

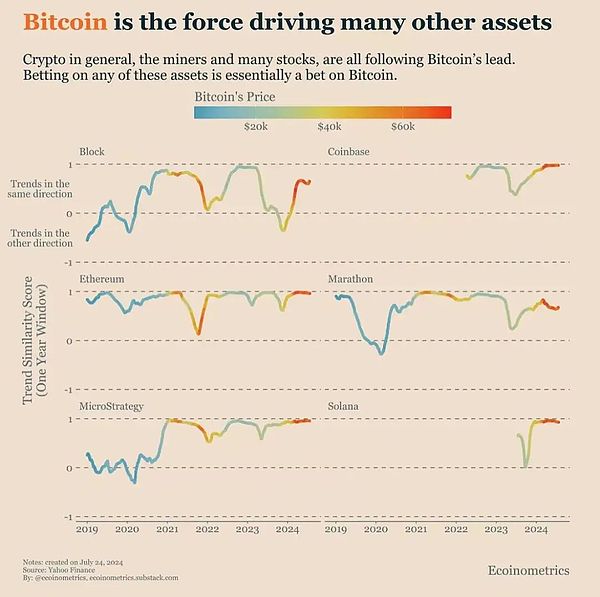

Third, Downstream Effects of Bitcoin

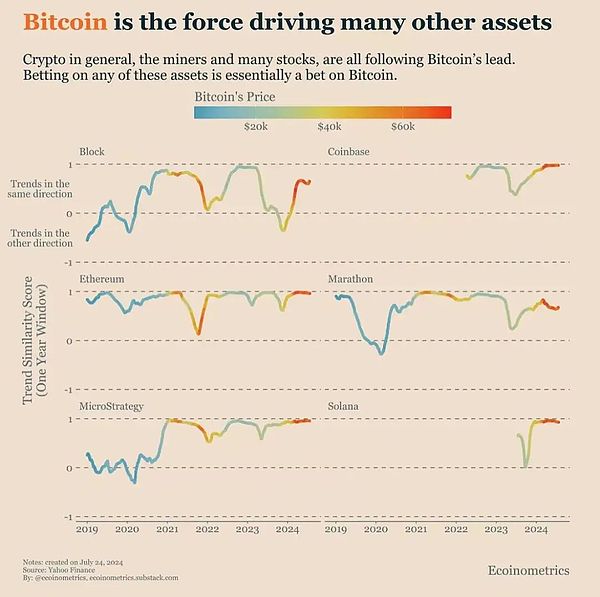

Here we are talking about correlation, not potential causation.

However, it is fair to say that we can divide the world into leaders and followers.

For example, global liquidity is the leader and Bitcoin is the follower. Or Bitcoin is the leader and MicroStrategy is the follower.

When it comes to Bitcoin followers, we can identify several natural categories:

Crypto assets (like Ethereum)

Assets that derive their value from Bitcoin (like miners, MicroStrategy)

Assets that profit indirectly from the growth of Bitcoin's value (like Coinbase)

By looking at the trend similarity scores of these assets over a 1-year period, we can see some typical patterns of behavior. Let's look at a few examples:

The rule basically goes something like this: Over a long enough timeframe (like a year), the trend correlation between Bitcoin and all directly or indirectly related assets is very high.

Actually, the word "very high" isn't quite accurate enough. I should say these trends are very strongly correlated.

Betting on any of these assets is essentially the same as making a directional bet on Bitcoin. Yes, some of them will grow faster than others. But they will all boom or bust together.

The good news is that conditions currently appear to be favorable for these assets to thrive.

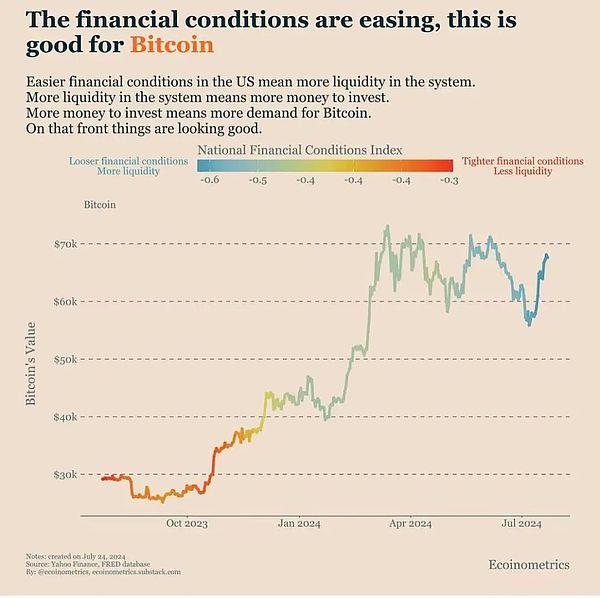

Fourth,Liquidity Tailwind

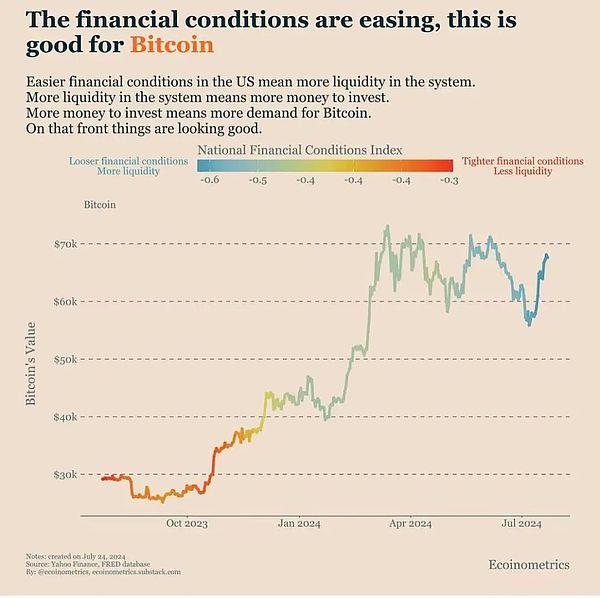

A few months ago, we discussed that the financial situation in the United States is at a critical juncture.

There are two possible scenarios:

If the inflation situation worsens, we will face the risk of "higher interest rates for longer" and more rate hikes. Even just the threat of this will lead to tighter financial conditions and less liquidity in financial assets.

If the inflation situation improves, the Fed may start to cut interest rates. This will likely lead to an easier financial environment than at the time. In the end, the accommodative scenario prevailed. This is already evident from the trend of the National Financial Conditions Index.

Going against liquidity is very dangerous. After the 2008 financial crisis, liquidity became the driving force of everything.

As financial conditions become easier in anticipation of rate cuts, Bitcoin (and its related assets) will have a tailwind.

The only factor that could break this situation is the US falling into a recession. Therefore, I am closely watching the speed of change in the job market.

JinseFinance

JinseFinance