The recent plunge of Bitcoin and a number of copycats has put the entire market sentiment into a state of extreme panic. In just one month, from the expectation of a violent bull market to having to accept "Maybe the bear market is really coming", investors' emotions have fluctuated like a roller coaster, and their confidence has been ruthlessly crushed in the violent price fluctuations.

Is there still a reason to be bullish on cryptocurrencies in 2025? Is this bull market cycle really over? Michael Nadeau, founder of The DeFi Report, gave his analysis and views. The following is the full text:

Review of this cycle

Before entering the on-chain data, I would like to share some qualitative analysis of how we think about the cryptocurrency cycle.

1. Early Bull Phase

This is the period from approximately January 2023 to October 2023.

This is the period when the market bottomed out after the FTX incident. The crypto market became very quiet (low trading volume, crypto Twitter was silent). Then we started to rise again.

Bitcoin (BTC) went from approximately $16,500 to $33,000 during this time.

However, no one calls this a bull market. During the “early bull market”, most market participants remain on the sidelines.

2. Wealth Creation Phase

This is the period from approximately November 2023 to March 2024.

This is the period where we see some big moves and significant wealth creation. Solana (SOL) went from $20 to $200. Jito’s airdrop (Dec 2023) created additional wealth effects within Solana and re-priced Solana’s decentralized finance (DeFi) projects (Pyth, Marinade, Raydium, Orca, etc.). The venture capital market reached a mania peak during this period (which is typical).

Bitcoin went from $33k to $72k. Ethereum (ETH) went from $1500 to $3600.

Bonk went from a $90m market cap to $2.4bn (26x). WIF went from a $60m market cap to $4.5bn (75x). The seeds for a larger “memecoin season” were sown during this period.

But this period is still pretty “quiet.” Your “regular friends” may not have started asking you questions about crypto yet.

3. Wealth Distribution Phase

This is the period from approximately March 2024 to January 2025.

The “peak attention” period. We tend to see “WAGMI” (We’re All Going to Make It) type sentiments, rapid rotation, new trends (which quickly fade), and blind risk-taking that pays off. Celebrities and other “crypto short-termers” often enter the market during this phase.Crazy headlines like “Tesla Buys Bitcoin” or “Bitcoin Strategic Reserve” tend to appear during the wealth distribution phase.

Why?

New investors enter the market because of these headlines. They don’t know they’re late to the party.

This was the second wave of “memecoin season” which subsequently morphed into “AI agent season”. During this period, the market ignored a lot of clearly problematic behavior. No one wanted to point out anything. People were making money.

Now, that brings us to today.

4. Wealth Destruction Phase

We believe we entered this phase shortly after Trump took office.

This is the period immediately following a market top. The bullish catalyst is now a thing of the past. Seemingly positive news is accompanied by bearish price action.

In the current environment, the executive action regarding the “Strategic Bitcoin Reserve” failed to move the market – an important sign. During this period, rallies tend to run into key resistance periods and fade (we saw this last week after Trump’s tweet about crypto reserves).

Some additional signals we look for during the Wealth Destruction phase include:

Liquidations and “panics”, events that shake the market but still don’t fully sober it up.We saw this with the DeepSeek AI panic and tariff uncertainty.

Investor “hopefulness”.We saw a lot of talk today about a falling dollar and rising global M2 (more on that later in this report).

“Scammer” types enter the market. More people PMing us to “check out their project”. Increased advertising capital flowing through the market. Thoughtless spending at conferences by well-funded projects. More player-vs-player (PvP) competition/infighting. The industry as a whole gives off a more “dirty” vibe. Bad actors start to get called out during “Wealth Destruction”.

During this period, failed projects will also start to surface - usually after liquidation. The last cycle started with Terra Luna. This led to the collapse of Three Arrows Capital. This was followed by the bankruptcy of BlockFi, Celsius, FTX, etc. This ultimately led to the collapse of Genesis and the sale of CoinDesk.

We haven't seen any explosive events yet. We note that there should be fewer explosions this cycle - simply because there are fewer centralized finance (CeFi) companies. Time will tell. Fewer explosions may lead to higher lows when we officially bottom.

Where might these explosions come from?

No one knows, but my guess is to focus on the usual suspects.

Exchanges:Watch out for hidden leverage and/or potential fraud on some of the “B and C grade” exchanges abroad.

Stablecoins:We are watching Ethena/USDe — the stablecoin in circulation is close to $5.5 billion. It maintains its peg and earns yield through cash and carry trades (holding spot assets, shorting futures) — the main source of leverage in the last cycle (via Greyscale). Ethena’s reliance on centralized exchanges adds additional counterparty risk. In addition, MakerDAO also invests part of its reserves in USDe, creating additional cascading risk in DeFi.

Protocols:Watch out for an increase in hacks and potential liquidation cascades due to crypto collateral on platforms like Aave — Aave currently still has over $11 billion in active loans (down from a peak of $15 billion).

Microstrategy:We think they have done a good job managing their debt as most of it is long-term unsecured debt or convertible bonds (BTC holdings have no margin calls). In addition, they were able to withstand a 75% drop in Bitcoin in the last cycle. Nonetheless, a sharp drop in Bitcoin prices could put pressure on Saylor, forcing him to sell a lot of Bitcoin at the worst time.

The best time to re-enter the market would be at the end of the wealth destruction phase. We don’t think that’s here yet. Of course, we’ll notify you when we think it’s back in the “buy zone.”

Bearish Reasons

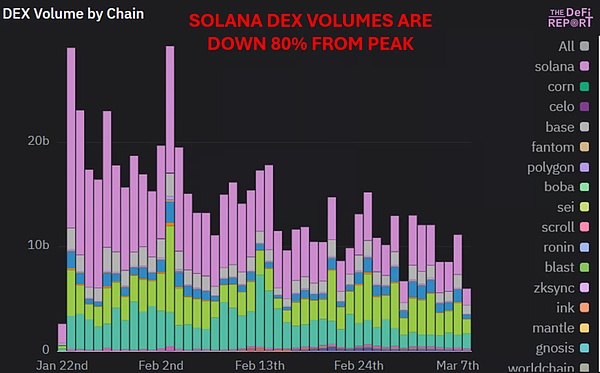

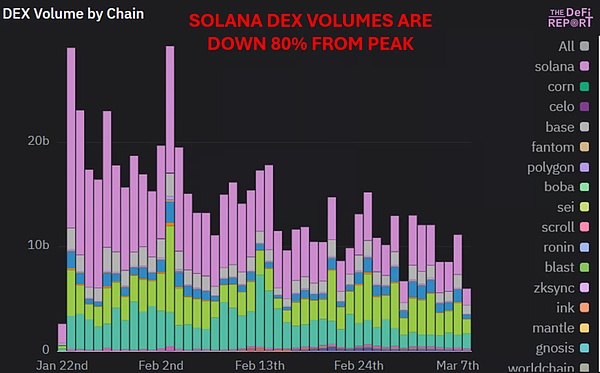

DEX Volume

Decentralized exchange (DEX) volume on Solana is down 80% from its peak after Trump launched the memecoin. Meanwhile, the number of unique traders has dropped by more than 50%. This suggests to us that animal spirits are waning.

Data source: The DeFi Report, Dune

Token issuance

Token issuance on Solana has fallen 72% from its peak. Despite this, the chain still sees more than 20,000 tokens created every day.

Data source: The DeFi Report, Dune

Bitcoin long-term holder MVRV ratio

Data source: Glassnode

The MVRV of long-term holders (Bitcoin's "smart money") peaked at 4.4 in December. This is 35% of the 2021 cycle peak of 12.5, which in turn was 35% of the 2017 cycle peak.

Bitcoin rose about 80x from trough to peak in the 2017 cycle. It rose about 20x in the 2021 cycle. It rose about 6.6x in the current cycle.

Bitcoin’s realized price (a proxy for the average cost basis of all circulating Bitcoin) peaked at $5,403 in the 2017 cycle, 15.1x higher than the 2013 cycle peak. It reached $24,530 in the 2021 cycle, 4.5x higher than the 2017 cycle peak. Today, the realized price is $43,240, 1.7x higher than the 2021 cycle peak.

Key Takeaways:

With each of the above data points, we can observe that the peaks decrease from one cycle to the next with symmetry. We think this data clearly tells us that the law of diminishing returns is very real.

Bitcoin is a $1.7 trillion asset today. No matter how bullish the headlines are, investors should not expect to see sustainable parabolic moves like they have in the past. It takes too much capital to move this asset right now. When Bitcoin loses momentum, the rest of the market loses big.

Animal spirits on Solana are waning. We are keeping an eye on this because we are concerned that Solana’s “recovery story” appears to be built on a “house of cards” – considering that 61% of DEX volume so far this year involves meme coins. Furthermore, less than 1% of Solana users have contributed more than 95% of gas fees in the last 30 days. This is concerning because it highlights that a small group of Solana users (the “big fish”) are preying on everyone else (the “small fish” trading meme coins). Therefore, if the “small fish” get tired of losing money and take a break (which we think they are doing), we could see Solana’s fundamentals deteriorate rapidly.

Data source: The DeFi Report, Dune (base fee + priority fee + Jito tip on Solana)

Long-term Bitcoin holders have taken profits twice in the past year. Their realized price (a proxy for cost basis) is currently around $25,000. Meanwhile, short-term holders who bought at the top are currently losing money (average cost basis is $92,000). We think this group may continue to sell at lower highs as they realize the reality of Bitcoin's top at $109,000 has arrived.

Data source: Glassnode

When you lay it all out, we think it is undeniable that the "typical" cycle has ended. To deny this is to deny reality.

Of course, there is no "law" at work here.

In our opinion, the best way to process this information is to accept the reality + set a probability for the cycle top. We think this probability is clearly higher than 50%.

Once the basic work is done, we will try to question our thesis and stress test our views.

Bullish Cases

I still see a lot of people pushing back against the bearish case. The bulls are not going to lay down their arms easily.

This begs the question: Are the bullish cases more evidence that we have entered the "wealth destruction" phase, the "denial" phase? Or are we perhaps too bearish at the local lows and the market will rise again later?

In this section, we will discuss some of the main "bullish cases" that I see.

Global M2/Liquidity

Data Source: Bitcoin Counter Flow

The green box on the right shows that Bitcoin is falling as global M2 begins to rise. Some people point this out, mentioning Bitcoin's correlation with M2 and how Bitcoin usually has a 2-3 month lag reaction.

However, the green box on the left shows that the same dynamics occurred at the end of the previous cycle: M2 was rising, while Bitcoin was falling. In fact, M2 did not peak until early April 2022 - 5 months after Bitcoin peaked.

Since mid-January, global M2 has risen by 1.87% as central banks have switched from tightening to easing.

This is positive for liquidity conditions.

However, we should also ask the following questions:

What is driving the increase in M2? We think this is mainly from the falling USD (down 4% since 28th Feb!) – when denominated in USD, foreign currencies have increased. This is a driver of global M2. In addition, the reverse repo facility was recently exhausted + China is easing to stimulate its economy.

Will it last? We think the USD will continue to fall as investors move money overseas, but not at the pace of the past few weeks. We think China will continue to ease in response to a lower USD. However, we do not expect the Fed to ease anytime soon as they have indicated that reserves remain “ample”. We believe they remain concerned about inflation.

How does this compare to liquidity conditions last year? We believe current liquidity conditions should be viewed as a headwind compared to last year. Remember, this is more about the rate of change than nominal increases. We strongly believe that the Fed and Treasury injected liquidity into the market last year through “shadow liquidity” – or, as Michael Howell of Cross Border Capital puts it, “QE that is not QE” and “yield curve control that is not yield curve control”. The chart below shows the rate of change impact of removing these policies under the new Trump administration.

Data source: Cross Border Capital

The "secret stimulus" in the above chart is estimated to have injected $5.7 trillion into the US market at the beginning of 24 years. This was done by exhausting reverse repo + issuing new debt notes in advance.

Finally, we think investors should pay close attention to what Treasury Secretary Bessant said in a CNBC interview last week:

"The market and the economy have become addicted. We have become addicted to this government spending. There will be a detoxification period. There will be a detoxification period."

Business Cycle/ISM

We previously pointed out that the ISM data indicates the beginning of a new business cycle. We also recorded strong data on capex purchases and small business confidence. We think this is real, but clearly growth is slowing. The data we saw last month may have been skewed by some manufacturers “front-loading” in anticipation of tariffs. We have seen some softening in the services and new orders data. The February manufacturing PMI reading was 50.3, down from 50.9 in January.

Strategic Bitcoin Reserve

Until last Friday, crypto natives were still holding out hope for talk of a strategic cryptocurrency/bitcoin reserve – despite the market repeatedly dismissing the news over the past 6 weeks.

I think we can all agree by now that this has been a “buy the rumor, sell the news” event. Is “cycle thinking” flawed?

We should also acknowledge that this “cycle” is different than in the past.

For example:

For the first time, Bitcoin reached a new all-time high before the halving.

This cycle was much shorter, with only a two-year bull run.

The “altcoin season” behaved quite differently, as Bitcoin’s dominance has been gradually rising since the beginning of 2023.

Bitcoin is now fully integrated into the financial system and backed by the US government.

If “cyclical thinking” is flawed, is it possible that we haven’t reached the top yet? Instead, we may be experiencing a pause/correction/consolidation phase followed by the next leg up, rather than a year-long bear market with a 75-80% price drop as in the past? Our view is that the cycle is indeed evolving. Despite this, we still expect a bear market that could last 9-12 months. Summary To summarize our view: We believe we are currently in the "Complacency" phase in the above chart. All the bullish catalysts that could be identified a few years ago have played out. The economy may be heading for a recession. We think the Trump administration's messaging has been very clear. They are actually telling us that the economy needs to be detoxified. We should take their word for it. This is very similar to when Powell came out and said “pain is coming” before a rate hike in early 2022. We currently believe that crypto is the canary in the coal mine. Traditional financial markets will follow with a slow bleed/shock.

Given the extremely bearish sentiment, we could see the market rally to as low as $90k for Bitcoin in the short term. However, we think this will be sold aggressively – which could kill any hopes of restoring the bull market structure.

As always, we remain open to mistakes. Our analysis is based on the information available today. We update our view as new information comes in.

What would it take for us to be bullish again?

We would be looking for the following:

Fiscal constraints/reversal of DOGE efforts.

Big Fed rate cuts/QE.

Major inflows of global liquidity, driven by the Fed (not just China).

Big corrections/capitulations in the S&P 500/Nasdaq.

One thing we are concerned about is that the bearish scenario is starting to become consensus. This gives us some pause. But we still need to stick with all other factors for now - because the probability suggests that the cycle top is in and the bear market is coming.

Of course, there is a lot to be bullish about in the long run.

Crypto has truly entered its "turning point" period. Now is finally the time to rebuild the financial system on public blockchains.

Not to mention, we love bear markets. As the tide recedes, it becomes easier to separate the noise from the signal of past cycles – which will prepare us for the next bull run.

Alex

Alex