In a crazy bull market, it is particularly important to seize the key moments and practice a good mentality. Don't blindly chase the market, continue to study and stay humble.

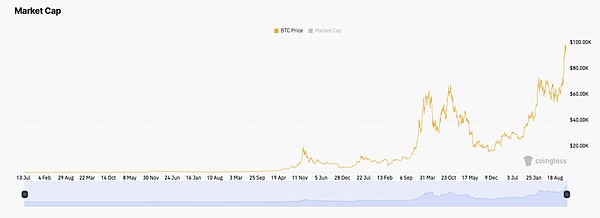

Hello everyone, I am the founder of FMG. Today, Bitcoin broke through the $100,000 mark. I would like to share with you the core bull market principles after several cycles.

1. Emotional value

In the market, the most important asset is the emotional value you give yourself. Make yourself full of energy and strength, sleep well, exercise well, be in a good mood, only compare with yourself, and ride on the back of the bull.

2. Recognize the right and wrong

Since 2023, the market has risen 6 times from the bottom. If you are still entangled in fundamentals, unlocking volume, FDV data, instead of entering the game and embracing risks, you will completely lose this wave of opportunities.

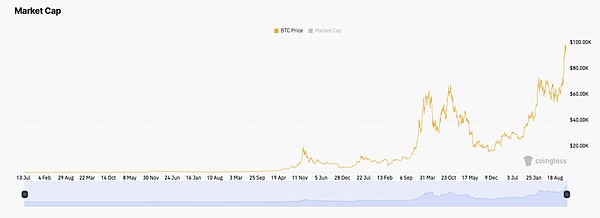

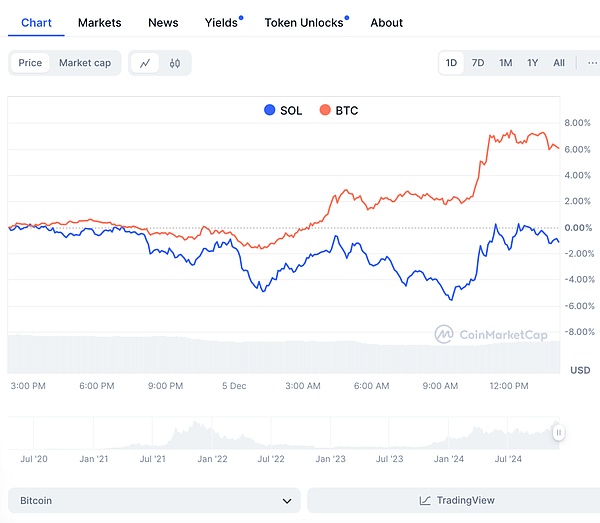

Third, the sad fact: reduced volatility

Due to the entry of robot trading and the crowding of gamma scalping strategies, the wave increase of BTC in this round has been greatly reduced. Everyone knows how to grab chips and how to short. To protect profits, you should withdraw and wait for opportunities. In such a game, it is indeed not as profitable as before.

This is why Meme has risen, and the market needs more volatility. We also believe that the moment of reversal of odds will come, and various sectors will explode. Then the cycle will end and rest.

Fourth, the use of leverage

The time of leverage (contract, margin) should be short, and the over-the-counter leverage can be used for a long time. MSTR is such a trader.

Five, using the plunge and surge in the bull market

We need a combination, strategy and risk control discipline to complete. We build a combination like this: core assets + growth assets + cash warehouse + speculative assets.

The first two must be held, don't move. If you can't help it, move the last small position, speculative assets.

Sixth, recognize the risk-return ratio and reduce anxiety

Core assets are stable returns, growth assets are medium-to-high risk returns, and speculative assets are extremely high risk returns.

If your friend says: "I bought a project and it has increased five times", don't worry, he just bought a low-quality speculative asset. Let me explain why.

Seventh, core assets: limited downside, upside of about 2 times

Core assets are assets recognized by the Ministry of Finance, listed companies, and financial institutions of certain countries. No expert knows that this thing is good, just try it and you can judge it, the only name. Your goal is to hoard more and more core assets in the market.

Don't have too high expectations for core assets, don't be obsessed with 200,000 or 500,000, hold it and wait until the market sentiment is crazy to sell. Just accept the price at that moment.

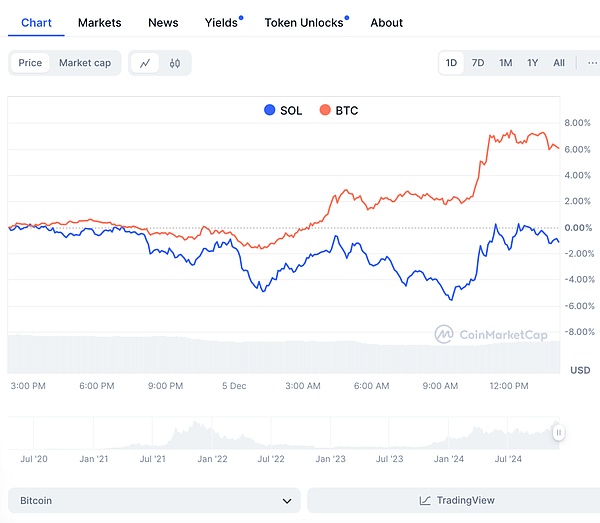

Eight, growth assets: 4-6 times, Yao Ming in the crowd

Growth assets are not recognized by the state, but are recognized and supported by some hedge funds, CEX and Defi, and they have greater liquidity.

Duan Yongping once said a game, how to find Yao Ming in the crowd? Most people see an ordinary person of 1.9 meters from a distance and think he is Yao Ming. In fact, it is very simple. When Yao Ming enters the restaurant, it must be a sensation.

Growth assets often meet the ability range of public cognition and do not need to understand technology. They are the things that outsiders can name the most, except BTC. Ethereum, Solana, Doge, BNB, are all Yao Ming in the crowd. If there is something very novel, but the potential increase is not as good as theirs, or it is only a little higher, but the liquidity is far inferior to theirs, then it is better to hold growth assets, and it is recommended to skip it.

In a crazy market, growth assets are often enough to bring 4-6 times or even higher returns, and they are relatively stable.

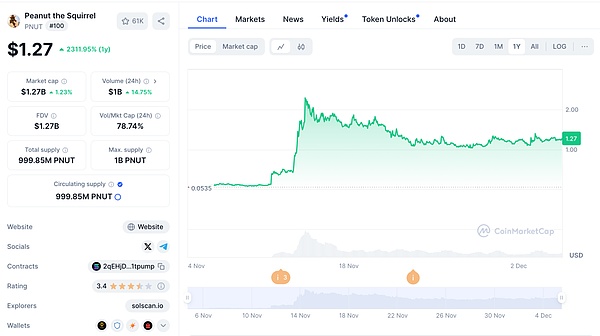

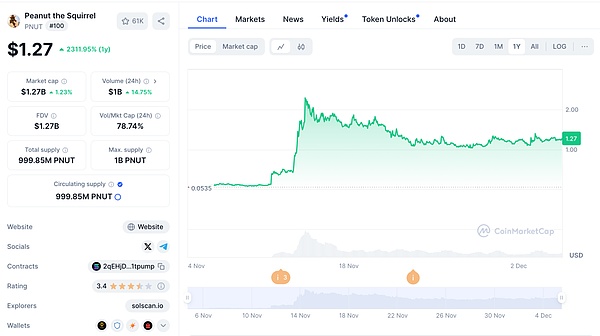

Ninth, speculative assets: Be sure to pursue more than 10 times.

Speculative assets belong to professional players.

YC's entrepreneurial bible said that it is necessary to provide more than 10 times the user experience. Speculative assets must also create a return of more than 10 times to justify the risks you take.

So when your friend brags about how much he has earned, you should check whether this is a low-quality speculation.

PNUT rose more than 10 times in 30 days

10. What is successful speculation?

I will describe the three characteristics of speculative assets, which can make 10 or even 100 times.

The first type is the dark horse that is always strong.

The top 50 in market value have often experienced many cycles of hardship, and it is not easy to recognize that this market value is not easy to achieve. It is impossible for a fast horse to rise so much in a short period of time, but if you can squeeze into the top 50, hold on to it. Network effect, the strong will always be strong.

The second category is new species.

New species are things we have never seen before. For example, AXS in the last cycle actually allowed Filipinos to make money by playing games? For example, this time AI Meme, a conversation robot can actually become a digital asset? We need to have funds like scouts to layout and learn from them. Get on the bus first and then learn.

The third category is side doors and low valuations.

Because it is unpopular and undervalued, the lower you squat, the higher you jump.

Therefore, unpopular and undervalued are often as scarce as pearls.

When everyone is busy hyping up hot topics, they forget about them. One by one, good news will pull the entire side track, and small market capitalization will easily take off. For example, POL, CRV, HNT, etc.

Summary

In general, speculative assets are very difficult. We use the money for profit protection to invest and hold them, and leave the rest to fate and time. Those who stare at the absolute rate of return every month will definitely not do well in this area.

I think an investor who can make a profit from investing in BTC and growth assets and persist in doing this is a responsible, disciplined investor who has a systematic pursuit of Alpha and knows how to manage money. FMG is such an investor.

Joy

Joy