0.85At the 500-percentile level, investors are beginning to worry about the possibility of structural weakness in the market. Demand exhaustion has occurred repeatedly, and from a macro perspective, this means the market may need a longer period of consolidation to regain momentum. If measured by selling by long-term holders, the market's fatigue is clearly evident. Since the market peaked in July 2025, long-term holders have been selling Bitcoin continuously, with daily sales increasing from 10,000 Bitcoins per day to at least 300,000 Bitcoins per day. Experienced investors are choosing to cash in on their gains on a large scale at this point, and this selling pressure is one of the core factors that lead to the current market fragility. Figure 3: Daily Bitcoin Selling Volume (30-Day Moving Average) | Open Interest Soars | Bitcoin options open interest has reached a record high and continues to rise, signaling a structural shift in market behavior. Investors are increasingly using options for risk hedging or volatility speculation, rather than selling spot coins outright. Although it has reduced the selling pressure in the spot market to a certain extent, this hedging transaction has significantly increased market volatility in the short term.

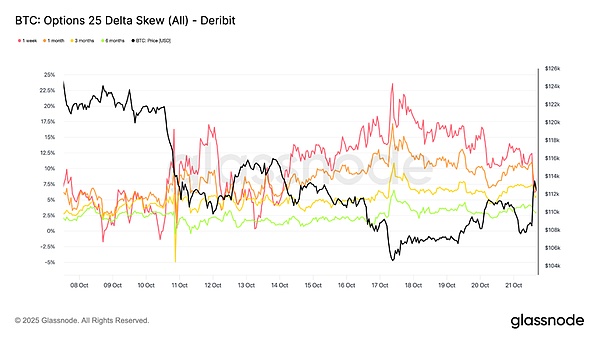

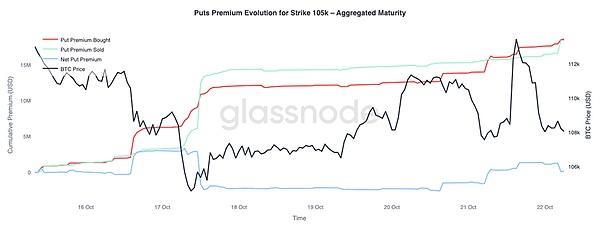

At the same time, the increase in the size of open interest has also led to option positions playing a key role in short-term market fluctuations. In the past two weeks, the skewness of the put option indicator has continued to rise, which means that put options are still more dominant in the market.

Over the past week, the 1-week skewness indicator has fluctuated significantly and remains in a high uncertainty zone, while the skewness of other timeframes has moved further in a bearish direction.

This means that during the current downward price trend, investors tend to spend more money on hedging risks. However, they also maintain limited upside exposure, indicating that although they are fearful in the short term, they still have confidence in Bitcoin in the long term.

Figure 5: 25-Delta Skewness of Options

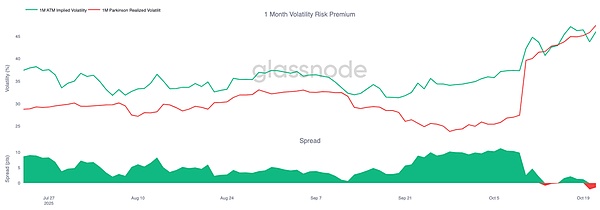

| Risk Premium Reversal

Recently, the monthly volatility risk premium

—— The difference between implied and realized volatility—the difference between implied and realized volatility—has turned negative. Over the past few months, implied volatility has remained elevated while realized volatility has remained subdued, allowing traders who short volatility to profit through a steady “carry margin.” But now, realized volatility has risen sharply and caught up with implied volatility. This marks the end of the “calm period”: Volatility sellers can no longer rely on this “carry” to make money and are forced to take the initiative in a more volatile environment. The market has left its previous period of calm and entered a new period of greater volatility.

Figure 6: Monthly risk premium fluctuations

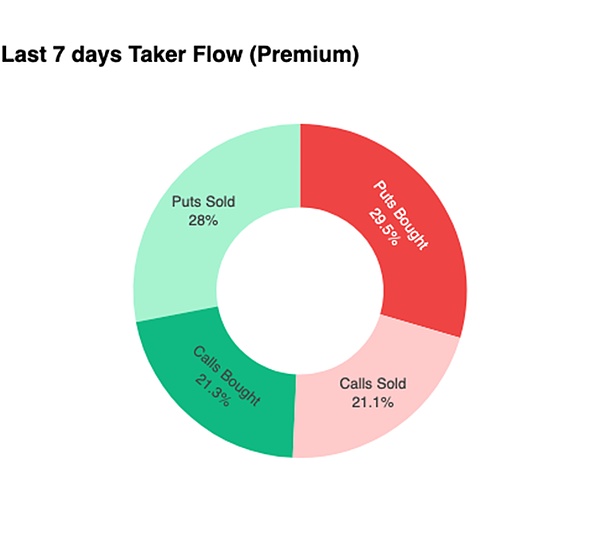

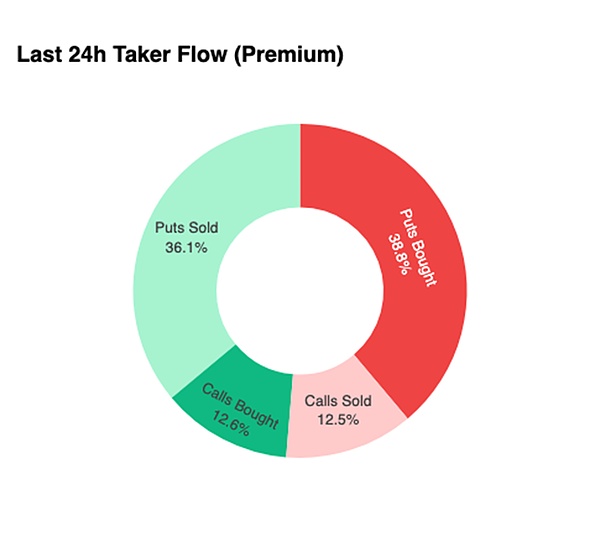

| Funds are still on the defensive

In the past

24 Despite Bitcoin's price rising from $107,500 to $113,900 over the next few hours, call options appeared to remain unsold. Instead, traders increased their put option holdings, effectively hedging against a potential decline. This strategy encourages investors to continue selling regardless of price movements. As long as this pattern persists, the market's unfavorable situation will remain unresolved.

Figure 7: 7-day and 24-hour capital flows

| Looking at the market from the perspective of strategy premium

Figure 9

Summary

Bitcoin prices recently fell below the 0.85 percentile of the cost price of short-term holders ( Bitcoin's recent high of $108,600 (US$108,600) suggests that market demand is drying up. Bitcoin may face a prolonged period of consolidation to rebuild market confidence and absorb the current significant selling pressure. Meanwhile, while open interest has reached a new high, it's largely defensive positioning. This suggests the recent short-term rebound is due to investors hedging against downside risks rather than optimistically chasing gains.

Aaron

Aaron

Aaron

Aaron Jasper

Jasper Kikyo

Kikyo Hui Xin

Hui Xin Jasper

Jasper Aaron

Aaron Clement

Clement Alex

Alex Jixu

Jixu Jixu

Jixu