Deng Tong, Jinse Finance

Strategy rose to prominence with its BTC treasury strategy, reaping both fame and fortune as BTC surged. In late September, Strategy founder Michael Saylor boldly declared in an interview that Strategy's ultimate goal was to accumulate a Bitcoin value of one trillion dollars. JPMorgan Chase Managing Director Nikolaos Panigirtzoglou pointed out that Strategy's latest developments are one of the main reasons for the recent continued pressure on Bitcoin prices.

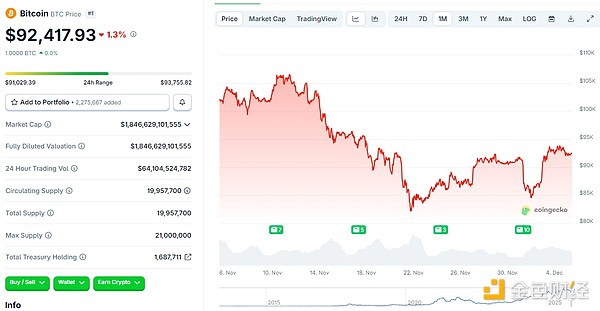

With the recent market downturn, Strategy's stock price has fallen in tandem with BTC prices, and Strategy is increasingly embroiled in controversy.

BTC price trend chart for one month

In addition, Strategy's third-quarter net profit fell to $2.8 billion, far below the record $10 billion in the previous quarter. The decline in Bitcoin prices caused its market capitalization/Bitcoin net worth ratio (mNAV) to fall to about 1.2 times, the lowest since March 2023.

In addition, Strategy's third-quarter net profit fell to $2.8 billion, far below the record $10 billion in the previous quarter.

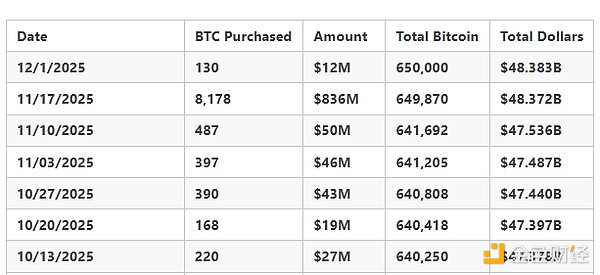

During the quarter, the company added approximately 43,000 Bitcoins, bringing its total holdings to 640,000, valued at nearly $69 billion, marking the slowest growth rate in a first quarter this year. Strategy also raised its variable-rate preferred stock (STRC) dividend to 10.5% to maintain investor demand and continue purchasing Bitcoin. This inevitably raises concerns: if the market continues to decline, can Strategy hold on? Will it sell its previously accumulated BTC? On October 28th, S&P Global Ratings assigned Strategy a "B-" credit rating, classifying it as speculative, non-investment grade (often referred to as "junk debt")—but noted that the outlook for this Bitcoin treasury company remains stable. In its report, S&P stated, "We believe that Strategy's high Bitcoin concentration, single-business structure, weak risk-adjusted capital strength, and insufficient dollar liquidity are weaknesses in its credit profile." S&P pointed out that the stable rating outlook assumes the company will prudently manage the risk of convertible bond maturities and maintain preferred stock dividend payments, which may require further debt issuance. S&P Global also emphasized that Strategy faces an "inherent currency mismatch risk"—all of its debt is denominated in US dollars, while most of its dollar reserves are used to support the company's software business, which is currently roughly breaking even in terms of revenue and cash flow. According to a report released by CryptoQuant, "Strategy's Bitcoin purchases will decline significantly before 2025," noting that Strategy's monthly Bitcoin purchases have decreased significantly since the end of 2024. “Monthly Bitcoin purchases have fallen from a peak of 134,000 in 2024 to 9,100 in November 2025, and only 135 so far this month. This 24-month buffer clearly indicates one thing: they are preparing for a bear market.” Strategy's monthly Bitcoin purchases show a sharp downward trend since its peak in November 2024. Source: CryptoQuant

Despite concerns that the crypto market has entered a bear market, and even more so about Strategy's performance during this period, Strategy itself is not overly worried.

In response to external doubts, on November 21st, Strategy posted on the X platform stating that, based on recent prices, its current holdings of approximately 650,000 BTC are sufficient to cover dividends for 71 years. It also pointed out that as long as Bitcoin appreciates by approximately 1.41% annually, the resulting returns would be sufficient to cover the annual dividends. However, the community points out that Strategy's data is based on several assumptions, including that the price of Bitcoin remains unchanged, all holdings are available for sale or collateralized financing, there are no external shocks or tax impacts, the convertible debt structure remains manageable, and dividend payments are stable.

On November 25, Strategy announced the launch of a new credit rating dashboard based on the notional value of the company's preferred stock, and claimed that even if the price of Bitcoin remains stable, the company still has a debt repayment buffer equivalent to 70 years of dividend payment capacity. In a post on the X platform, Strategy stated, "If Bitcoin falls to our average cost price of $74,000, our asset coverage ratio for convertible debt will still be 5.9x (what we call the BTC-rated debt); if Bitcoin falls to $25,000, the coverage ratio will still be 2.0x." In its fiscal 2025 earnings projections, Strategy estimates that if the Bitcoin price range at the end of 2025 is $85,000 to $110,000, the company's target range for fiscal 2025 revenue, net income, and diluted earnings per share is as follows: 1. Fiscal 2025 Revenue (Loss): Approximately -$7 billion to $9.5 billion; 2. Fiscal 2025 Net Income (Loss): Approximately -$5.5 billion to $6.3 billion; 3. Fiscal 2025 Diluted Earnings Per Share: $17.00 to $19.00 per ordinary share. On December 3, Strategy CEO Phong Le stated that the company's newly established $1.4 billion reserve will be used to cover short-term dividend and interest expenses, helping the company maintain financial flexibility during periods of market volatility. This reserve, raised through stock sales, aims to alleviate investor concerns that the company might be forced to sell Bitcoin to pay for growing dividends. According to the company's calculations, this reserve can cover approximately 21 months of dividend expenses without having to use its $59 billion Bitcoin holdings. On December 4, on-chain analytics firm CryptoQuant pointed out that Strategy's establishment of a $1.44 billion dollar reserve indicates that the company is preparing for a potential Bitcoin bear market. CryptoQuant believes that establishing a 24-month dollar buffer marks a "tactical shift" for Strategy, moving from aggressively issuing new shares to buy Bitcoin to a more conservative, liquidity-focused strategy. This reduces the risk of being forced to sell Bitcoin during market downturns. CryptoQuant's Head of Research, Julio Moreno, predicts that if the bear market continues, Bitcoin's price could trade between $70,000 and $55,000 next year. [Image of Strategy's financial metrics dashboard] Source: Strategy

Michael Saylor also emphasized Strategy's capital structure: In addition to the steady growth of BTC's intrinsic value, Strategy possesses an incredibly healthy capital structure—an enterprise value of $68 billion, Bitcoin reserves worth $59 billion, and an LTV (Loan to Value) of only 11%. Based on current financial data, the dividend margin is sufficient to cover the next 73 years.

Bitwise Chief Investment Officer Matt Hougan stated that even if MSTR's stock price falls, the company will not be forced to sell Bitcoin to maintain operations, and those who hold the opposite view are "completely wrong."

Strategy's situation isn't dire enough to warrant selling its Bitcoin, as the cryptocurrency is trading at around $92,000, "24% higher than the average price Strategy paid for this batch of Bitcoin ($74,436). If MSTR were forced to dump its $60 billion worth of Bitcoin all at once, it would indeed be very bad for the Bitcoin market—equivalent to two years' worth of Bitcoin ETF inflows. However, given the company has no debt maturing before 2027 and sufficient cash to cover foreseeable future interest payments, I don't think this will happen."

Controversy Two: Will MSCI Remove Strategy?

MSCI announced in October that it was soliciting feedback from the investment community regarding whether companies with digital asset reserves exceeding 50% of their balance sheets should be excluded from its indices. MSCI noted that some feedback suggested such companies "exhibit characteristics similar to investment funds, which currently do not qualify for index inclusion."

The consultation period will last until December 31, with a final decision announced on January 15 next year. Any resulting changes will take effect in February. MSCI's initial list of affected companies includes 38 companies, such as Michael Saylor's Strategy Inc., Sharplink Gaming, and cryptocurrency mining companies Riot Platforms and Marathon Digital Holdings. On November 20, JPMorgan Chase stated that if Michael Saylor's Strategy is removed from major MSCI indices, it could face approximately $2.8 billion in capital outflows; if other index providers follow suit, the total could reach $8.8 billion. Analysts say this will depress company valuations, weaken liquidity, and increase financing difficulties. MSCI will make its decision on January 15, 2026, a date considered a key turning point for company share prices. Charlie Sherry, head of finance at Australian cryptocurrency exchange BTC Markets, said he believes the likelihood of MSCI excluding digital asset reserve companies is "very high," as the index "only consults when it's inclined to make such a change." If MSCI decides to remove these companies, funds tracking the index will be required to sell, which in itself will put enormous pressure on the affected companies. JPMorgan analysts previously warned that Strategy Inc. could face a $2.8 billion outflow if MSCI proceeds with the removal. Of Strategy Inc.'s estimated $56 billion market capitalization, approximately $9 billion is linked to its passive funds tracking the index. Sherry believes MSCI's action marks a shift in tone. Over the past year, corporate strategies for heavy crypto assets have been seen as innovation in capital markets, but now major index providers are tightening their definitions, indicating a market is moving from an "anything goes" phase back to more conservative filtering mechanisms. Michael Saylor responded to the MSCI index removal risk issue in a social media post, stating that Strategy, as a publicly traded and operating company, is fundamentally different from funds, trusts, and holding companies. Strategy not only has a $500 million software business but also uniquely uses Bitcoin as productive capital in its fund management. Index classification cannot define Strategy. The company has a clear long-term strategy, a firm belief in Bitcoin, and its mission has always been to become the world's first digital currency institution based on sound money and financial innovation. On December 4th, JPMorgan Chase stated that Strategy's stock has fully absorbed the potential risk of being removed from major stock indices, and that even if MSCI's upcoming decision results in the company's removal (which would still trigger passive capital outflows), it could still be a catalyst for a rise in the stock price. Controversy Three: Do Institutions Still Favor Strategy? Meanwhile, several institutions also proactively reduced their exposure to Strategy (MSTR) in the third quarter of 2025, reducing their holdings by approximately $5.4 billion. It's worth noting that Bitcoin remained around $95,000 during the same period, and MSTR's stock price also remained largely flat. This suggests that it wasn't a passive liquidation, but rather an active reduction in institutional holdings. Major funds such as Capital International, Vanguard, BlackRock, and Fidelity all significantly reduced their positions. Reports indicate that this signifies Wall Street is gradually shifting from the old path of "MSTR as a Bitcoin proxy" to more direct and compliant Bitcoin exposure (such as spot ETFs and custody solutions). [Image of Strategy selling] In the future, a pullback or sideways movement in Bitcoin could test the remaining supporters of Strategy. If Bitcoin prices rise again, large institutions may change their strategies and increase their exposure to MSTR. Conversely, if Bitcoin prices reach $80,000, it will likely prompt these institutions to further reduce their exposure to Strategy. This shift in institutional preferences also represents, to some extent, the maturity of the industry. Spot Bitcoin ETFs and other regulated custody solutions mean that large portfolios can now hold Bitcoin without the negative impact of equities. As institutional strategies evolve, assets like Strategy are no longer necessities but are gradually becoming options. Conclusion From an ordinary software company to a BTC treasury giant; from meteoric rise to constant skepticism, whether Strategy can survive the bear market is not only answering market doubts about Strategy itself, but also verifying whether the DAT craze that has emerged this year can be sustainable. Hopefully, Strategy will not repeat the tragedy of LUNA.

Miyuki

Miyuki

Miyuki

Miyuki Weiliang

Weiliang Alex

Alex Catherine

Catherine Joy

Joy Kikyo

Kikyo Weatherly

Weatherly Catherine

Catherine Anais

Anais Weatherly

Weatherly