Source: Visa Translation: Conflux

"Currency is not just coins, banknotes or credit cards, which are just forms, not functions. Currency is usually a tool used to measure equal value and medium of exchange. Currency will become data with only letters and numbers, in the form of ordered energy pulses, which flow around the world at the speed of light through countless diverse paths in the electromagnetic spectrum at extremely low cost."

——Dee Hock, founder of Visa

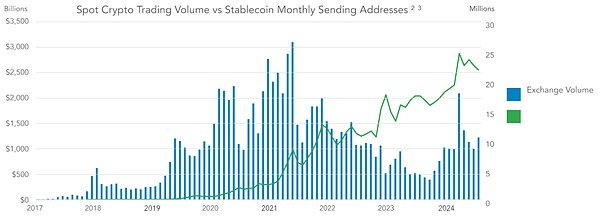

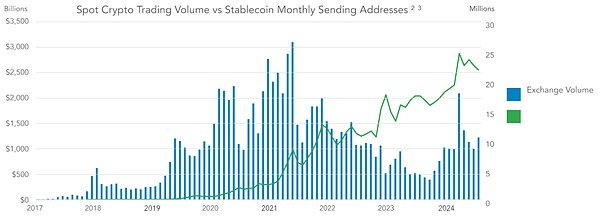

Stablecoins are tokenized representations of legal tender circulating on the blockchain. There is no doubt that it is the "killer application" in the current crypto field. Today, the total value of stablecoins in circulation in the market exceeds $160 billion, while in 2020, this value was only a few billion dollars. More than 20 million addresses conduct stablecoin transactions on public blockchains every month. In the first half of 2024 alone, the settlement amount of stablecoins exceeded $2.6 trillion (according to our adjusted estimates). Stablecoins have significant advantages over existing payment systems: on-chain programmability, strong auditing capabilities, transaction settlement, self-custody of funds, and interoperability.

Based on the difference between the activity of stablecoins and the crypto market cycle, it is clear that the use of stablecoins is no longer just for crypto users and transaction use cases.

In this report, we combine survey results from cryptocurrency users in five key emerging market economies with new on-chain estimates, plus qualitative analysis of companies operating in these markets, to form a comprehensive picture of global stablecoin usage. We pay special attention to the use of stablecoins in non-crypto areas, such as remittances, cross-border payments, salary payments, trade settlements, and business-to-business (B2B) transfers.

Research Methodology

YouGov conducted this survey between May 29, 2024 and June 13, 2024.

The purpose of this user survey was to understand the relevant indicators, behaviors, and attitudes of stablecoin usage in major global markets. We surveyed 500 adult respondents (18 years and above) from each of the five countries: Brazil, Turkey, Nigeria, India, and Indonesia. We chose these countries because they are large and populous countries with anecdotal evidence of stablecoin penetration among their general populations. The surveyed countries ranked an average of sixth in the 2023 Chainalysis Global Crypto Adoption Index, with India and Nigeria occupying the top two positions.

To be eligible for the survey, respondents had to have used a cryptocurrency, blockchain network, or blockchain wallet in the past 12 months. Previous stablecoin use was not a requirement, but the majority of respondents (93%) had experience with stablecoins. Respondents varied in age, gender, education, and country of origin.

The online survey took approximately 15 minutes and was optimized for use on both computers and mobile devices. The survey was conducted in the respondents’ native language, and responses in the text input fields were translated.

On-chain data comes primarily from Artemis, with additional data from Coin Metrics and Allium.

Blockchain Data

On-chain data is usage metrics viewed directly from the blockchain, and it clearly demonstrates the continued growth of stablecoins. However, on-chain data needs to be de-noised and interpreted with caution, and it is often overestimated. Here, we first provide new estimates of the attractiveness of stablecoins, and then turn to survey data to translate the still unclear aggregate data into specific usage patterns.

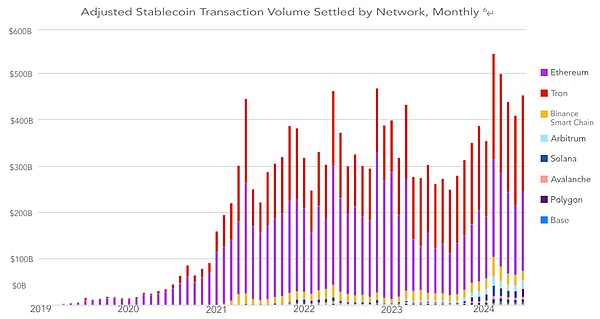

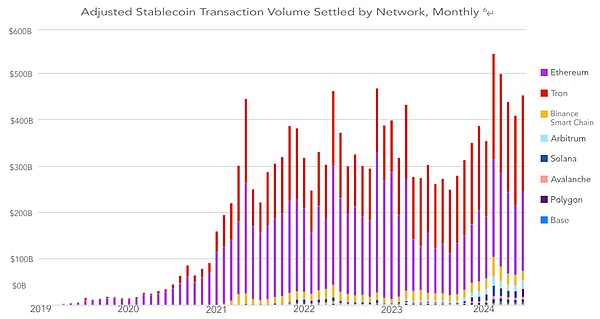

According to our adjustments, the total settlement volume of stablecoins in 2023 is conservatively estimated to be $3.7 trillion, while in the first half of 2024 it will be $2.62 trillion, and the full-year settlement volume in 2024 is expected to be $5.28 trillion. It is worth noting that despite the sell-off of crypto assets and the decline in trading volume in 2022 and 2023, the settlement volume of stablecoins has continued to grow steadily over the market cycle. This once again shows that stablecoins have attracted a group of new users who are not only interested in using them for exchange settlement.

After denoising, as of June 2024, the most popular blockchains by settlement value are: Ethereum, Tron, Arbitrum, Base, BSC and Solana.

The growth trend of monthly transfer addresses is similar, if not more stable. We prefer this metric to the number of transactions because it is generally less susceptible to manipulation (but not completely impervious to manipulation).

The most popular blockchains for stablecoin transfers are: Tron, BSC, Polygon, Solana, and Ethereum. Ethereum generally has a higher fee burden, which means it generally has fewer transaction addresses and transactions than Tron or BSC, but Ethereum still leads in terms of value settled.

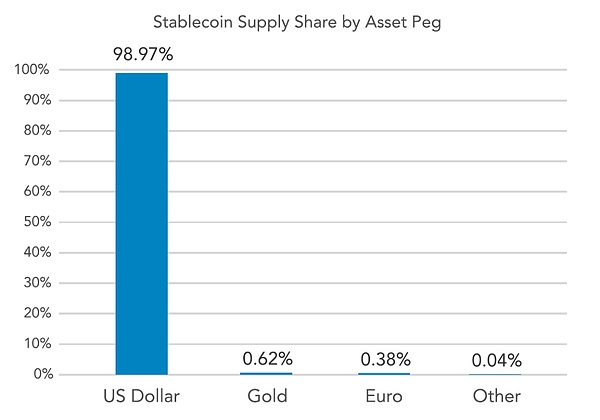

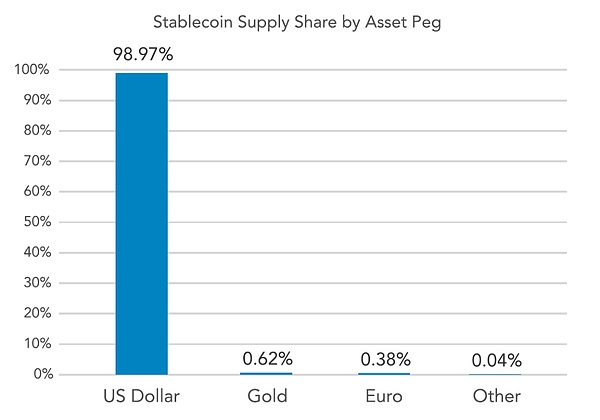

When stablecoin settlement volume is compared to native crypto assets, the phenomenon of "blockchain dollarization" emerges. While Bitcoin and Ethereum have historically been the dominant medium of exchange on public blockchains, stablecoins—and almost exclusively those pegged to the U.S. dollar—have gradually captured an increasing share of the market.

Finally, stablecoins remain closely tied to the U.S. dollar. The second most popular currency used in stablecoins is the euro, which has a supply of $617 million as of June 2024, accounting for 0.38% of the entire stablecoin market. While there are stablecoins using the lira, Singapore dollar, yen, and some other fiat currencies, no stablecoin other than the U.S. dollar and the euro has a peg of more than $100 million.

In practice, this means that when individuals in emerging markets use stablecoins pegged to the U.S. dollar, they are indirectly purchasing U.S. debt, such as short-term Treasury bills. Regulators in some countries with high cryptocurrency penetration, including Nigeria (one of the countries covered in this survey), are concerned that if cryptocurrency dollarization continues unchecked, it could pose a risk to their currencies.

Survey Results

We surveyed approximately 500 individuals from Nigeria, Indonesia, Turkey, Brazil, and India, for a total sample of 2,541 adults. Since we did not sample the entire population, but restricted our sample to existing cryptocurrency users, we cannot infer the overall penetration of stablecoins. Instead, our goal was to better understand the ways in which these individuals interact with stablecoins.

The survey data shows that the use of stablecoins is growing, the frequency of transactions is increasing, the penetration rate of investment portfolios has increased significantly, and their use is becoming more diverse in addition to cryptocurrency trading scenarios.

Key Results:

• While the top motivation for using stablecoins is to acquire cryptocurrencies (50%), non-crypto uses such as acquiring USD (47%), generating yield (39%), and transactional purposes are also popular.

• Users prefer stablecoins over USD banks due to yield, efficiency, and lower likelihood of government intervention.

• 57% of users reported an increase in their use of stablecoins in the past year, and 72% believe they will increase their use of stablecoins in the future.

• In some scenarios, Tether was preferred mainly due to its network effect, followed by user trust, liquidity and track record relative to other stablecoins.

• In non-transactional use cases, currency conversion (for USD) was the most reported activity, followed by paying for goods, cross-border payments, and salary payments/receipts.

• Ethereum was the most popular blockchain among respondents, followed by BSC, Solana and Tron.

• The most popular wallet among respondents is Binance (exchange wallet), followed by Trust Wallet, MetaMask, Coinbase Wallet, Crypto.com, and Phantom Wallet. Users use a wide variety of wallets.

Types of Stablecoin Activity:

The most common purpose for using stablecoins in our sample is still trading cryptocurrencies or NFTs, but other non-crypto uses are not far behind. Overall, 47% of respondents said one of their main purposes was to store funds in USD, 43% mentioned getting better currency exchange rates, and 39% said they wanted to earn a yield. The results are clear: non-crypto uses account for a large portion of stablecoin usage in the countries we surveyed.

Penetration of stablecoins in user portfolios:

At the country level, Nigerians have a significantly higher percentage than other countries, followed by Turkey and India. In the sample of Indian users, the wealthiest respondents said that stablecoins account for a larger proportion of their financial portfolios.

Findings by country:

The most active stablecoin users in the sample are Nigeria, India, Indonesia, Turkey and Brazil. In terms of the proportion of stablecoins in portfolios, Nigeria is still far ahead, followed by India, Turkey, Brazil and Indonesia.

Tether preference for USDT:

Tether is widely considered to be the most popular stablecoin among users in emerging markets. We want to understand its lasting advantage. The most commonly cited reasons for preferring Tether were its network effects, followed by greater trust in Tether and Tether’s best liquidity.

Conclusion

In this study, we first demonstrate that stablecoin usage is growing from an on-chain perspective, whether measured by monthly active addresses, total supply, or settlement value. In particular, our new transaction value estimates show that stablecoins have become an important settlement tool, comparable to existing transfer networks, while avoiding the overestimation problem that is common in on-chain data in the past.

Our findings overturn the common perception that stablecoins are only used for speculative crypto asset trading. 47% of the crypto users surveyed said they use stablecoins for USD savings, 43% cited efficient currency exchange, and 39% mentioned earning yield. While visiting cryptocurrency exchanges remains the most common use case for respondents, a range of ordinary (non-crypto) economic activities are also reflected.

When asked about non-crypto stablecoin activity, the most common use case was currency substitution (69%), followed by payment for goods and services (39%) and cross-border payments (39%). It is clear that in the countries surveyed, stablecoins have evolved from being simply transaction collateral to being a commonly used digital dollar instrument.

More importantly, almost all stablecoins (about 99%) are pegged to the U.S. dollar. The discussion of stablecoin regulation in the United States cannot ignore the fact that a large number of individuals and businesses in emerging markets rely on these networks for savings, cross-border payments, remittances, and corporate cash management. In almost all of the countries surveyed, stablecoins are increasingly becoming a substitute for scarce U.S. dollar banking services. When discussing the merits of stablecoins, the potential benefits of efficient access to alternative hard currency for billions of users in emerging markets must have a place.

Catherine

Catherine