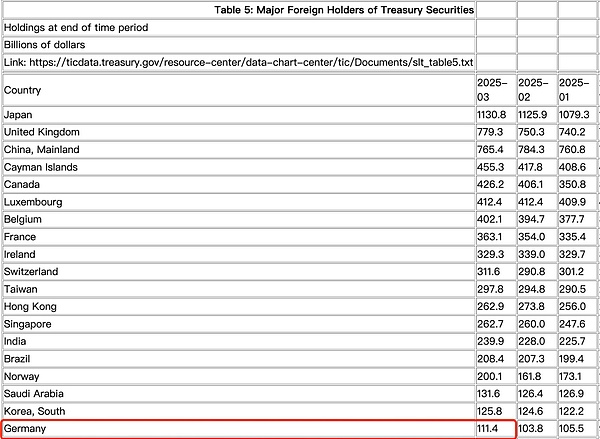

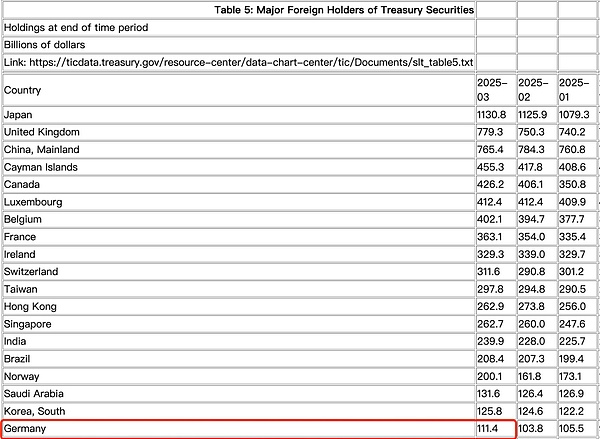

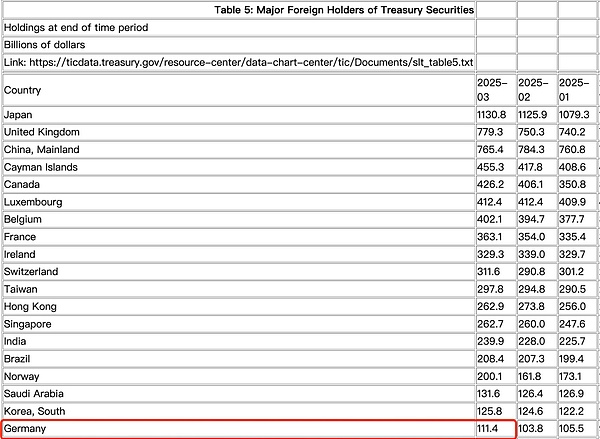

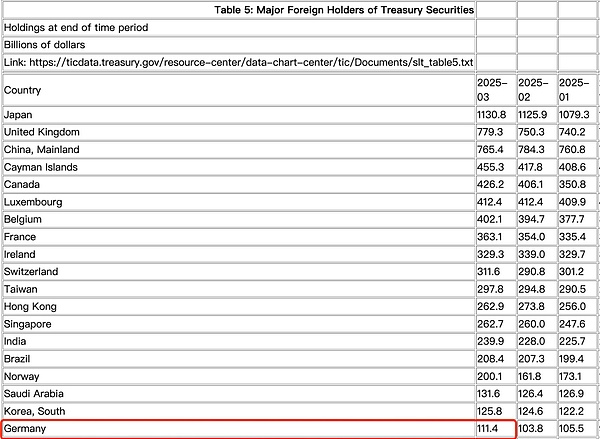

In the traditional financial system, U.S. Treasury bonds have always been the core assets of global central banks and sovereign funds. However, this pattern is being broken by the field of cryptocurrency - the latest data shows that Tether (USDT), the issuer of the U.S. dollar stablecoin, currently holds more U.S. Treasury bonds than Germany, showing the profound impact of the U.S. dollar stablecoin on the traditional financial system.

1. The U.S. dollar stablecoin is devouring the status of traditional finance

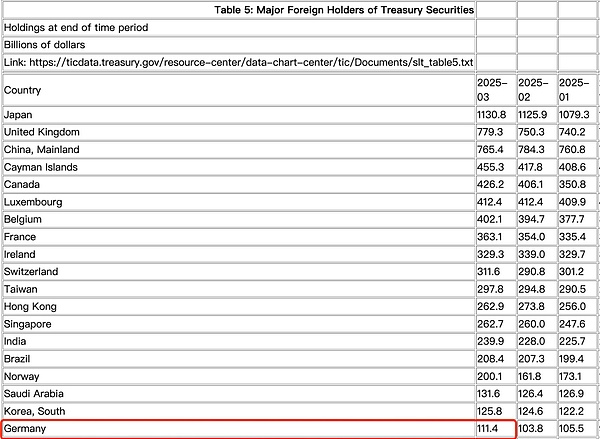

According to Tether's first quarter report for 2025, the scale of its holdings of U.S. Treasury bonds has exceeded US$120 billion, surpassing the latest disclosed scale of US$111.4 billion held by Germany. Tether is currently the 19th largest holder of U.S. Treasury bonds in the world.

As the largest economy in Europe, Germany's core position in the global financial system has always been solid, but this traditional cognition is facing new challenges - Tether, as a leading stablecoin issuer with a market value of over 100 billion, has a substantial impact on the US Treasury market structure through its underlying asset allocation strategy. In order to maintain the 1:1 rigid redemption commitment between USDT and the US dollar, the institution has allocated more than 90% of its reserves to liquid assets such as short-term US Treasury bonds. This large-scale operation has not only consolidated its own market position, but has also objectively become an important force in supporting the international demand for US Treasury bonds.

It is worth thinking about that, as a stable pillar of a "decentralized world", Tether's reserve system is deeply bound to the US debt system. This structure not only provides it with credit endorsement, but also exposes its systemic risks: once there is a major fluctuation in the US debt market, will Tether become the first "domino"?

2. The regulatory framework is accelerating: The GENIUS Act reshapes the industry landscape

Faced with the rapid expansion of stablecoins, the GENIUS Act proposed by US Senator Bill Hagerty in February 2025 has entered the legislative fast lane. On May 20, 2025, the bill completed a procedural vote in the Senate and passed with a vote of 66:32.

This landmark bill includes three major regulatory dimensions:

1. Market access and operation regulations

Implement a tiered licensing system (US$10 billion is the federal/state regulatory boundary)

Limit the types of reserve assets (only cash, short-term bonds within 93 days, money funds and repurchase agreements)

Prohibit technology giants from issuing stablecoins independently

2. Risk prevention and control system

Mandatory monthly audits and information disclosure

Establish a bankruptcy isolation mechanism for user funds

Give FinCEN (Financial Crimes Enforcement Network) new regulatory authority over DeFi tools

3. Avoidance of conflicts of interest

Prohibition of current senior officials from participating in stablecoin projects

Prohibition of interest-bearing stablecoins

3. A new monetary order is brewing

With the GENIUS With the formal passage of the bill, the US government's strategic positioning of stablecoins has shifted from "risk prevention" to "regulatory acceptance". Stablecoins are no longer a technical experiment outside the system, but are becoming part of the US dollar system.

This change is reshaping the global structure of holding US dollar assets. From sovereign countries such as Japan and China, to offshore financial centers such as Cayman and Luxembourg, to global technology institutions such as Tether and Circle, the buyer group of US debt has undergone profound changes. Stablecoin issuers support the currency value through US debt, which objectively becomes a new channel for "exporting US dollars abroad".

It can be said that a "US dollar 2.0" system is taking shape. It is both compliant and cross-border; it is both decentralized and dependent on core assets; it is a decentralized network architecture on the surface, but in fact it has formed a new concentrated force in the market. This new order driven by private institutions, accommodated by policies, and centered on asset binding is becoming the prototype of the next round of global financial system.

Joy

Joy