Abstract

With the recent passage of the US GENIUS Act and the Hong Kong Stablecoin Ordinance, the market's attention to the topic of stablecoins has increased rapidly. Considering that Circle is about to go public, combined with Tether's financial report, the topic of stablecoins also has a business model that can be compared and studied. As a major change in the field of financial technology, it is worthy of attention.

Stablecoins have, to some extent, served as a "pricing tool" in the cryptocurrency market, which is a supplement or even a substitute for traditional legal currency transactions. Soon after the birth of stablecoins, the most important trading pairs in the cryptocurrency market were stablecoin trading pairs. Therefore, stablecoins play the role of "legal currency" in terms of trading tools and value circulation. In mainstream exchanges (including DEX decentralized exchanges), Bitcoin spot and futures trading pairs are mainly stablecoins such as USDT, especially futures contracts with larger trading volumes. Forward contracts (futures contracts with USD stablecoins as margin) on mainstream exchanges are almost all USDT trading pairs.

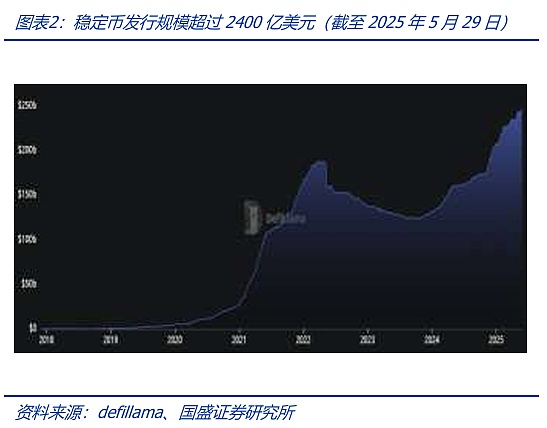

Technically, stablecoins represent a new generation of payment technology.USDT was launched by Tether in 2014. 1 USDT is anchored to 1 US dollar. It is one of the earliest stablecoins in the market. Since then, it has gradually become the most widely used stablecoin product in the market, with a current issuance scale of over 150 billion US dollars. If we regard credit cards as the first generation of payment technology and mobile payments as the second generation of payment technology, and stablecoins become more popular, the competition for the third generation of payment will begin.

Policy-wise, stablecoins will promote the internationalization of currency. Although the issuance of stablecoins is done by centralized institutions and must comply with regulatory requirements, users may be spread all over the world, which is more like cash placed in personal wallets through blockchain technology, and the clearing and settlement of its transactions are also undertaken by the blockchain infrastructure. At the same time, referring to Tether's asset allocation, it can be seen that 80% of its asset size is allocated to US bonds and US bond-like assets. As the scale of issuance increases in the future, the holdings will continue to rise.

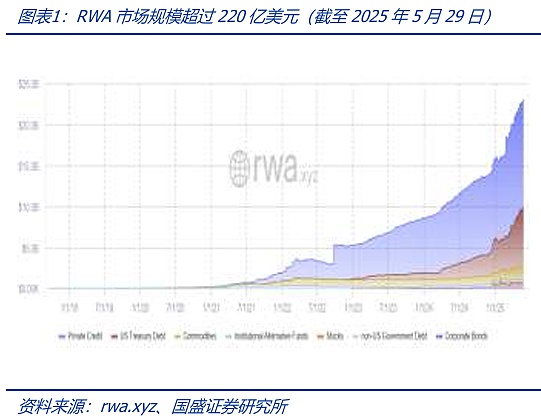

RWA has become an important engine for promoting the listing of real assets on the chain. The market underestimates the universality of RWA. If we compare the issuance of stablecoins to money funds, RWA is equivalent to REITs. In addition to currency, RWA maps more diversified assets to the chain and realizes transactions. At present, there is room for assets such as electricity, computing power, and real estate, and stablecoins are the most basic RWA products.

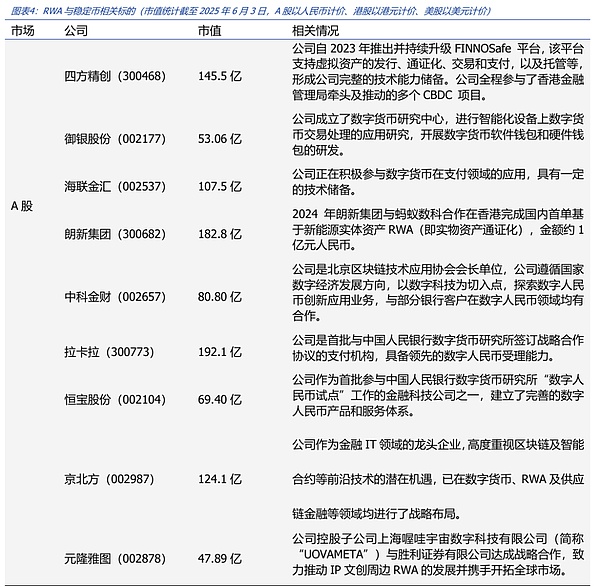

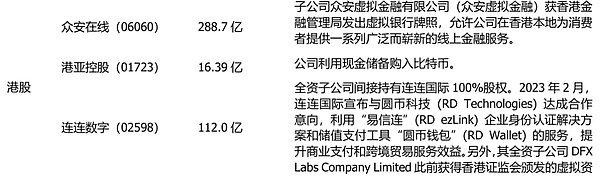

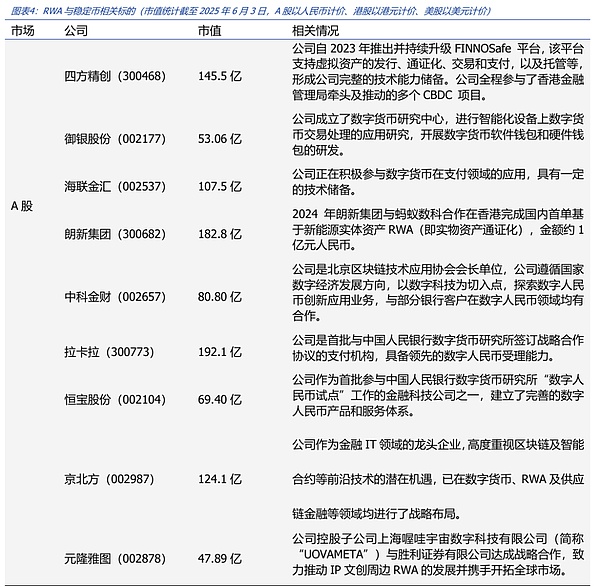

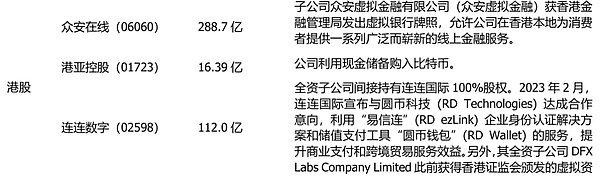

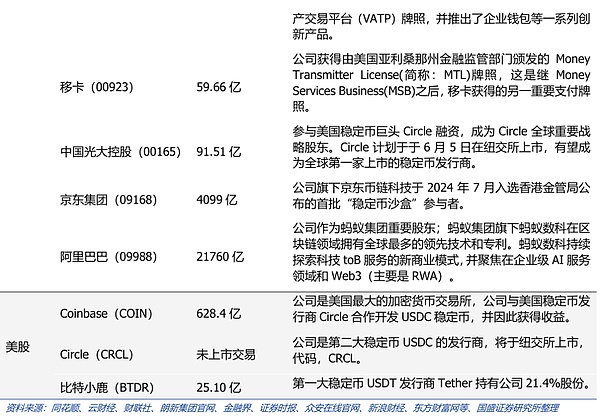

Investment advice: Continuous catalysis, a major change in financial technology. Follow-up attention will be paid to the catalysis such as Circle's listing and the official license issuance in Hong Kong, China. In terms of targets, US stocks focus on Circle, Coinbase, etc.; Hong Kong stocks focus on ZhongAn Online, LianLian Digital, YiKa, etc.; A shares focus on Sifang Jingchuang, Zhongke Jincai, Hengbao Shares, Beijing North, Langxin Group, Yuanlong Yatu, etc.

Risk Reminder: Blockchain technology research and development is not as expected; regulatory policy uncertainty; Web3.0 business model implementation is not as expected.

1. Core Views

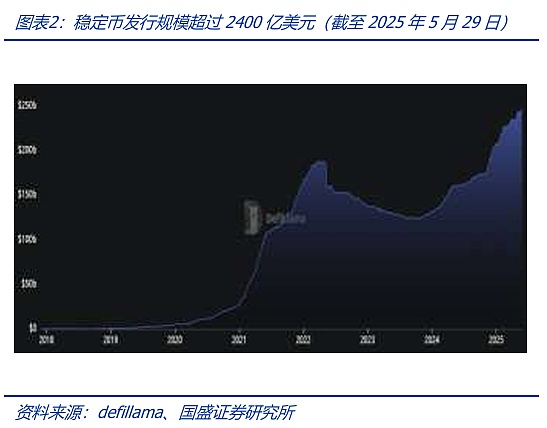

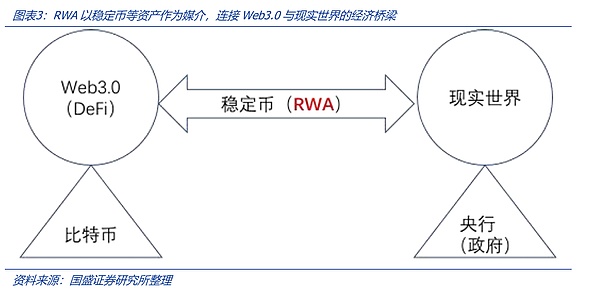

Stablecoins were born in the "grassroots" world of Web3.0. In the early days, they were used as a legal currency pricing tool for trading cryptocurrencies. With the development and growth of the cryptocurrency market, stablecoins have become an indispensable basic tool for exchanges, DeFi and RWA ecology. A key to the success of stablecoins is the ability to gain market trust, which involves the credit transmission mechanism of stablecoins. Stablecoins are not only a rigid demand in the Web3.0 world, but also a bridge between it and the real economic world. They are important infrastructure tools in the RWA process. Today, when stablecoins are popular, traditional financial institutions have also begun to accelerate the adoption of stablecoins and embrace crypto assets. Stablecoins connect two worlds.

This article analyzes the birth, development, mechanism and current status of stablecoins and the current status of the RWA market, and looks forward to the current development opportunities of stablecoins and RWA.

2. RWA+stablecoin dual drive: the next big narrative of Web3

2.1RWA and stablecoins quickly "swallow" the traditional wealth world

RWA (Real World Assets, tokenization of real-world assets) has now become one of the fastest growing tracks in the cryptocurrency market. The market it faces is the vast world of real wealth, and it has become a very bright blue ocean market at present. The so-called stablecoin refers to a cryptocurrency whose value is anchored to various legal currencies. In a broad sense, a stablecoin is a cryptocurrency that maps the value of real-world legal currencies to the blockchain. In this sense, a stablecoin is a typical RWA. As assets on the blockchain, the advantage of RWA and stablecoins is that they can be deeply integrated with cryptocurrency projects (such as DeFi) at the blockchain infrastructure level - such as on-chain exchange with other cryptocurrency assets on the chain or combined staking and other DeFi operations to obtain on-chain scalability and integration.

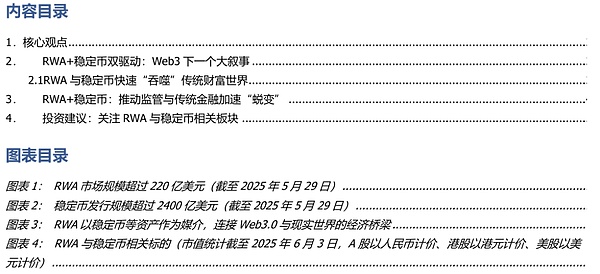

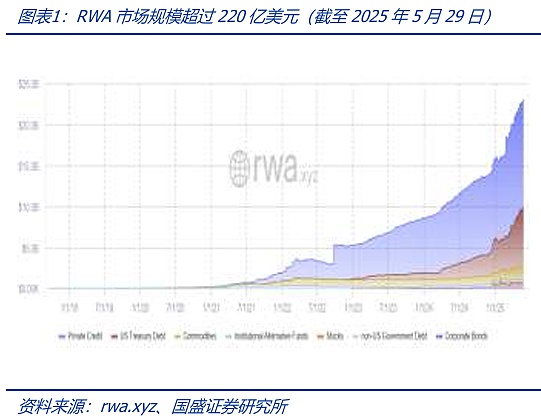

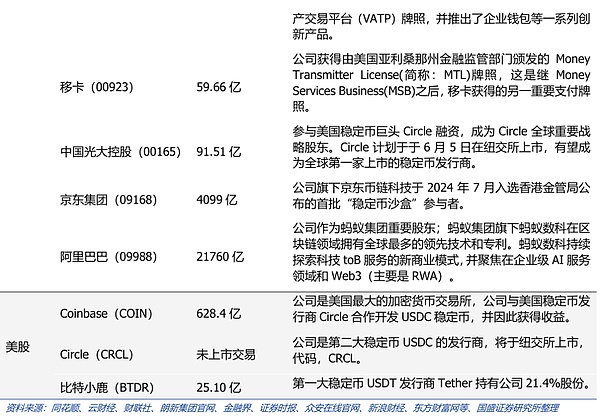

As of May 29, 2025, the RWA market continues to maintain a rapid growth rate, and its scale has exceeded US$22 billion; the scale of stablecoins exceeds US$247 billion. As dual engines, RWA and stablecoins have become the main driving force of the cryptocurrency market.

We believe that the integration of the Web3.0 world represented by cryptocurrency and the real economic world is an inevitable trend, and RWA is an important driving force in this integration process - because RWA more directly maps real-world assets to the blockchain. For users in the traditional financial market, stablecoins are the bridge for them to enter the cryptocurrency market and realize the RWA process. For traditional financial institutions that want to enter the Web3.0 world, stablecoins are an important position. With stablecoins, they can freely travel in the Web3.0 world to convert asset allocation. In turn, investors holding cryptocurrency assets can convert stablecoins into traditional financial assets or purchase goods and return to the traditional financial market. In recent years, there have been many cases of traditional financial institutions getting involved in stablecoins. For example, on April 28, 2025, payment giant Mastercard announced that Mastercard would allow customers to consume in stablecoins and allow merchants to settle in stablecoins. This is not an isolated case, as the use of stablecoins has begun to spread in reverse to the traditional economic society.

It can be seen that RWA and stablecoins have formed a mutually reinforcing flywheel model, and the "chaining" of traditional financial institutions has become an important new demand. Recently, according to Standard Chartered Bank's forecast, if the US GENIUS Act (Stablecoin Act) can be successfully passed, the supply of stablecoins will reach 2 trillion US dollars by 2028. As an important infrastructure tool in the RWA process, stablecoins will be driven by the demand of traditional financial markets. RWA and stablecoins drive Web3.0 to "swallow" the traditional wealth world. 3. RWA+Stablecoin: Promote supervision and accelerate the "transformation" of traditional finance The rapid development of RWA and stablecoins has promoted the follow-up of supervision. On May 20, the "Guiding and Establishing a United States Stablecoin National Innovation Act" (GENIUS Act) passed the procedural vote of the U.S. Senate, marking an important progress in the Senate; subsequently, the bill will enter the Senate plenary vote stage. On May 21, the Legislative Council of Hong Kong, China passed the "Stablecoin Bill", which established a licensing system for issuers of legal currency stablecoins in Hong Kong, China, and improved the regulatory framework for virtual asset activities. Whether in the U.S. market or the Hong Kong market, the force behind the active promotion of the stablecoin bill by regulators is inseparable from the rapid development of the stablecoin and RWA markets. Previously, the Hong Kong Monetary Authority of China has publicly disclosed the first batch of stablecoin issuers' sandbox list, including JD.com's JD CoinChain Technology (Hong Kong), Yuancoin Innovation Technology, and joint applications from Standard Chartered Bank (Hong Kong), Animoca Brands Limited, and Hong Kong Telecom (HKT).

It is no longer new that traditional payment institutions such as Mastercard support the use of stablecoins., RWA has also become a new option for corporate financing. This is an active bid by traditional financial institutions for Web3.0 financial traffic.For example, as early as August 2024, Longxin Group (300682.SZ) cooperated with Ant Digital Technology to complete the first domestic RWA based on new energy physical assets in Hong Kong, with an amount of approximately 100 million yuan. On May 7, 2025, Futu Securities International announced that it would officially launch BTC (Bitcoin), ETH (Ethereum), USDT (Tether) and other encrypted asset recharge services to provide users with Crypto+TradFi (traditional finance) asset allocation services.

In the US capital market, stablecoins will help connect traditional finance and the cryptocurrency market. The IPO of Circle, the issuer of USDC stablecoins, may become the first landmark event after the passage of the US stablecoin bill "GENIUS Act". As of June 2, Circle disclosed the latest progress of its IPO application on the New York Stock Exchange, with a latest valuation ceiling of US$7.2 billion; BlackRock plans to subscribe to 10% of Circle's IPO shares. This is a typical case, that is, under the momentum of stablecoins, the traditional capital market and the cryptocurrency market will be deeply integrated - stablecoins will absorb more financial flows from the traditional capital market, and stablecoin issuers will also obtain more financing capabilities from the traditional capital market.

We believe that RWAand stablecoins entering the traditional financial market, one of the most concerned areas is stablecoin payment and international payment. In the past, RWA and stablecoins, as the most basic infrastructure and tools in the cryptocurrency market, have established a large-scale business ecosystem; in the real world, stablecoin payments and international payments are a possible potential market. Previously, payment giant Stripe acquired the stablecoin trading company Bridge for US$1.1 billion. Recently, the company announced that stablecoin financial accounts using Bridge technology now cover 101 countries and regions. These institutions can receive payments through cryptocurrencies or bank transfers, and use stablecoins for global payments. In other words, Stripe is trying to connect stablecoin payments with the traditional bank payment system, which brings new development potential for stablecoins in the payment field.

4. Investment advice: Pay attention to RWA and stablecoin related sectors

We believe that the United States and Hong Kong, China, driven by the stablecoin-related regulatory bills, will usher in the rapid development of the RWA and stablecoin markets. It is recommended to pay attention to targets related to the RWA and stablecoin industry chain.

5. Risk Warning

Blockchain technology research and development is not as expected: The blockchain-related technologies and projects underlying Bitcoin are in the early stages of development, and there is a risk that technology research and development will not meet expectations.

Uncertainty of regulatory policies: The actual operation of blockchain and Web3.0 projects involves a number of financial, network and other regulatory policies. At present, the regulatory policies of various countries are still in the research and exploration stage, and there is no mature regulatory model, so the industry faces the risk of regulatory policy uncertainty.

Web3.0 business model is not implemented as expected: Web3.0 related infrastructure and projects are in the early stages of development, and there is a risk that the business model will not be implemented as expected.

Edmund

Edmund