With the rapid development of the cryptocurrency market, stablecoins have risen rapidly. This article introduces the revenue models of stablecoin participants such as Tether, Circle, PayPal, Walmart, JD.com, JPMorgan Chase, Stripe, etc.

1.Tether

Tether launched USDT in 2014, and USDT is pegged to the US dollar at a 1:1 ratio. Tether invests USDT reserves and the company's own funds to benefit, such as purchasing US Treasury bonds, and obtains interest income from them. Tether's net profit for the whole year of 2024 exceeded US$13 billion, and the group's equity surged to more than US$20 billion, reflecting the company's strategic investments in emerging industries such as renewable energy, Bitcoin mining, artificial intelligence, telecommunications and education.

In the first quarter of 2025, Tether reported an operating profit of more than $1 billion, thanks to the solid performance of its U.S. Treasury portfolio, while the performance of its gold investment almost offset the volatility of the cryptocurrency market. In the first quarter, the company's excess reserves reached $5.6 billion, the circulating supply of USDT increased by about $7 billion, and the number of user wallets increased by 46 million. As of March 31, 2025, Tether held $121.6 billion in cash and cash equivalents and other short-term deposits.

In addition to reserves, Tether continues to make strategic investments through Tether Investments, and has allocated more than $2 billion for long-term investments in areas such as renewable energy, artificial intelligence, peer-to-peer communications and data infrastructure. These forward-looking investments are not included in the reserves that support USDT.

The first quarter of 2025 is also the first quarter that Tether is regulated in El Salvador, and the company has obtained a stablecoin issuer license under the country's digital asset framework. This regulatory milestone enhances Tether's credibility.

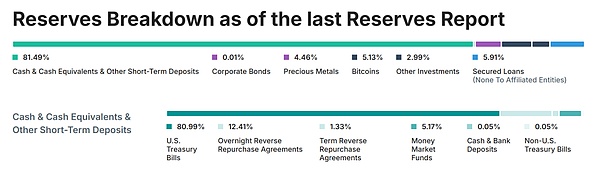

As of March 31, 2025, USDT reserve asset composition

2.Circle

Coinbase's stablecoin business revenue comes from a close cooperation arrangement with Circle. In 2018, Coinbase and Circle jointly established Centre Consortium to provide a legal framework and technical support for the issuance and management of USDC. In 2023, Centre Consortium will be closed, and Circle will become the issuer of stablecoins, fully responsible for the issuance and governance of USDC, including holding all smart contract private keys, complying with reserve governance regulations, and enabling USDC on new blockchains. Coinbase provides a wide range of circulation channels for USDC through its trading platform, enabling USDC to be more widely used in the field of cryptocurrency trading. Coinbase and Circle will share the interest income generated by USDC reserves based on the number of USDC held on their respective platforms. This income-sharing mechanism encourages both parties to jointly promote the circulation and use of USDC and expand its market size. Coinbase began to disclose stablecoin revenue data in 2023: stablecoin revenue in 2023 was nearly US$700 million, accounting for 24% of its total revenue, a year-on-year increase of 183%; revenue in 2024 was as high as US$910 million, a year-on-year increase of 31%. It accounts for 13.86% of the total revenue; in the first quarter of 2025, the stablecoin revenue was US$298 million, a year-on-year increase of 51.27%, which is the fastest growing business category of Coinbase. In 2022-2024, Circle's main business revenue was US$772 million, US$1.45 billion, and US$1.676 billion respectively.

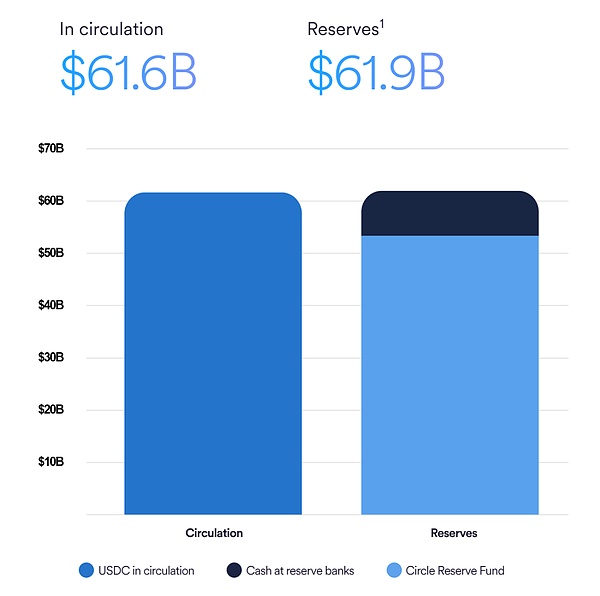

USDC reserve assets

3.PayPal

PYUSD is a stablecoin denominated in US dollars supported by PayPal. Its reserve assets are US dollar deposits, US Treasury bonds and cash equivalents. PYUSD is issued by Paxos, a New York-based trust, not PayPal, on the Ethereum and Solana cryptocurrency networks and is subject to the Paxos USD-Backed Stablecoin Terms and Conditions (hereinafter referred to as the "Paxos Terms").

The Paxos Terms include Paxos' obligation to ensure that PYUSD is fully backed by an equivalent amount of U.S. dollar bank deposits, U.S. Treasury bonds guaranteed by the credit of the U.S. government, and U.S. Treasury reverse repurchase agreements. PYUSD's reserve assets do not include money market funds. Its reserve assets will generate interest and other income, which can be used as Paxos' custody service fees, and Paxos can share this amount with PayPal.

PYUSD is different from other crypto assets. Regardless of the price of PYUSD in the market, when PayPal purchases PYUSD tokens on the Crypto Center, the price is $1.00 per token. When a user buys or sells PYUSD on the cryptocurrency center, PayPal will fulfill the order by buying PYUSD from Paxos or selling PYUSD to Paxos. Paxos is obligated to buy and sell PYUSD to PayPal at a stable price of $1.00 per PYUSD token. There are no fees for buying, selling, holding or sending PYUSD, but there are fees for exchanging PYUSD for other cryptocurrencies, which will vary depending on the value of the cryptocurrency purchased or sold.

4.Walmart

Recently, Walmart and Amazon are discussing the issuance of stablecoins in the United States, hoping to bypass the traditional payment systems of Visa and Mastercard. It has not yet been officially issued. Walmart and Amazon's stablecoin plans are mainly focused on internal use; they are closed-loop tokens used in their respective closed ecosystems and their supplier networks. The benefit is that retailers can avoid relying on credit card networks that charge 2-3% per transaction, or bank transfers that take days. A stablecoin-based system allows retailers to settle transactions instantly, with significantly lower costs, and may open up new revenue streams for its issuers. Under the GENIUS Act, stablecoin issuers must back tokens with cash or equivalents at a 1:1 ratio. Issuers typically choose short-term government bonds (Treasury bills) as their cash equivalents, which means that issuers can receive the proceeds of these Treasuries.

5. JD.com

JD.com CoinChain Technology (Hong Kong) Co., Ltd. ("JD.com CoinChain"), a subsidiary of JD.com Group, is actively promoting the issuance of a pilot Hong Kong dollar stablecoin, aiming to enhance cross-border payment capabilities and serve the real economy. At the end of 2023, Hong Kong will formulate a regulatory framework for stablecoins. In July 2024, JD.com entered the sandbox pilot. In May 2025, the Hong Kong Legislative Council passed the Stablecoin Ordinance. Currently, JD.com's stablecoin is in the late stage of sandbox testing and is expected to be launched on the market after Hong Kong officially issues a license. Liu Peng, CEO of JD.com Coin Chain, revealed that JD.com Coin Chain expects to obtain a stablecoin license in the early fourth quarter. At present, the scenario testing of JD.com Coin Chain in the "Sandbox" is progressing smoothly, and plans to launch stablecoins anchored to Hong Kong dollars and other currencies. He believes that one of the first-mover advantages of JD.com Coin Chain is that it has a "cold start" scenario from zero to one, that is, the JD.com e-commerce ecosystem. The second phase of the sandbox self-test focuses on the use test in three actual scenarios: cross-border payment, investment transaction, and retail payment. In terms of cross-border payment, it plans to expand users through two paths: "direct customer acquisition + cooperative wholesale"; in terms of investment and trading, it is negotiating cooperation with global compliant exchanges and plans to launch JD Stablecoin in different regions; in terms of retail, it will be launched first on the "JD Global Sales Hong Kong and Macau Station", and users can use stablecoins to shop in JD's self-operated e-commerce scenarios.

It is reported that the goal of JD Stablecoin is not to be involved in Crypto native or investment trading scenarios, but to open up a new "battlefield" - connecting the traditional cross-border trade settlement market.

6. JPMorgan Chase

JPMorgan Chase is further entering the cryptocurrency field through its self-issued JPMD, a stablecoin-like token. JPMorgan Chase has revealed plans to launch deposit tokens on Coinbase’s public blockchain Base, which is built on the Ethereum network. Each deposit token is designed to serve as a digital mapping of commercial bank deposits. JPMD will provide clients with 24/7 settlement services as well as interest payments to holders. It is a so-called “permissioned token,” meaning the token is only available to JPMorgan’s institutional clients — unlike many public-facing stablecoins, it is designed to enable on-chain settlement and cross-border B2B transfers. JPMorgan’s blockchain division Kinexys promotes it as a “deposit token” — a fully insured, interest-earning digital representation of a bank deposit, making it easy to reconcile with existing banking operations. Unlike stablecoins backed by Treasury bonds, JPMD is a tokenized certificate of JPMorgan’s deposits, integrating deposit insurance and liquidity. The product was launched just as the GENIUS Act passed the Senate, highlighting JPMorgan’s positioning under the new stablecoin framework: 1) 100% reserve backing; 2) monthly disclosure; 3) regulated issuance.

7.Stripe

In May 2025, Stripe launched a stablecoin financial account called "Stablecoin Financial Accounts", a new fund management function driven by stablecoins, which will be open to businesses in 101 countries. This is only three months after Stripe completed its acquisition of the stablecoin platform Bridge.

Through these new accounts, businesses can hold stablecoin balances, receive funds through cryptocurrency and fiat channels, and send stablecoins almost anywhere in the world. These accounts will enable entrepreneurs in countries with large currency fluctuations to hedge against inflation risks and enter the global economy more easily. Stripe will first support two dollar-denominated stablecoins-USDC and Bridge's USDB, and plans to add other stablecoins over time.

Stablecoin transaction volumes have surged more than 50% over the past year. Because stablecoins can significantly speed up and reduce the cost of international remittances, many of the world's largest companies are turning to Stripe to help develop their stablecoin strategies. But one challenge remains: making stablecoins usable in businesses that only accept fiat currencies.

To address this, Bridge has partnered with Visa to launch the first global card issuance product, making stablecoin balances as easy to spend as fiat. Fintech companies such as Ramp, Squads, and Airtm will be able to issue Visa cards linked to stablecoin wallets in dozens of countries. When cardholders make a purchase, Bridge deducts the funds from their stablecoin balance and converts them into fiat, allowing merchants to get paid in local currency. These stablecoin cards can be used at 150 million merchants around the world that accept Visa.

Clement

Clement

Clement

Clement Clement

Clement Davin

Davin Clement

Clement YouQuan

YouQuan Catherine

Catherine Joy

Joy Jasper

Jasper Jixu

Jixu Hui Xin

Hui Xin