Author: JE labs

1. Introduction: The Market Paradigm is Shifting

Key Signals

The South Korean digital asset market is undergoing one of the most significant structural reconfigurations in its history. Upbit's daily trading volume plummeted from $9 billion in December 2024 to $1.78 billion in November 2025, a drop of approximately 80%. This occurred against the backdrop of a 141% year-on-year increase in the overall number of new coin listings on South Korean exchanges in 2025. Simultaneously, retail investor funds rotated dramatically, flowing into the soaring stock market. Driven by the AI chip sector, spearheaded by Samsung Electronics and SK Hynix, the KOSPI index rose by approximately 70%.

3.1 Key Actions

In October 2025, Binance made a major foray into the South Korean market by acquiring Gopax, ending a four-year absence. This was partly due to South Korea's relaxation of restrictions on foreign ownership, and also signaled South Korea's willingness to further open up to global crypto companies.

This acquisition laid the foundation for more intense market competition, smoother liquidity channels, and a more complex and mature product offering, significantly upgrading the products and services available to local users.

This acquisition laid the foundation for more intense market competition, smoother liquidity channels, and a more complex and mature product offering, significantly upgrading the products and services available to local users.

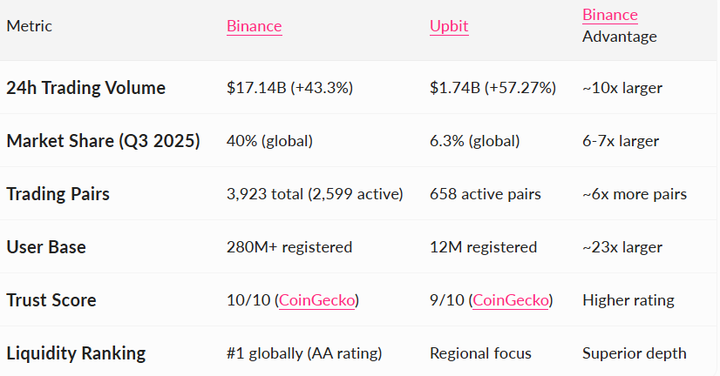

Core Performance Indicator Matrix

Source: Surf AI, 2025

3.2 Why now?

Institutional Demand Continues to Rise

South Korean institutional investors are showing increasing interest in custody, asset tokenization, and legally compliant digital asset allocation, laying the foundation for continued long-term capital inflows in the future.

4. Outlook

The current downturn is not the end, but rather a structural reset that is pushing the South Korean market away from purely speculative behavior and towards a more use-value-oriented approach that aligns better with institutional demand. Stablecoin legislation, institutional custody infrastructure, and potential Bitcoin ETFs are likely to become key pillars for the next phase of growth. South Korea is entering a new phase driven by real product value, user education, and compliant innovation.

4.1 Market Forecast

The South Korean crypto market is expected to grow slowly at a CAGR of 2.94%, but the real turning point is likely to come from the Bitcoin ETF, which is expected to be approved in 2026. This topic has been frequently discussed and circulated among South Korean policymakers. ... Once approved, potential changes include: Formal participation of South Korean pension funds and asset management institutions; Large-scale entry of overseas market makers; Higher quality price discovery and tighter bid-ask spreads. This could also re-establish South Korea's position as a regional "net capital inflow hub." 4.2 Web2 and Web3 Convergence in South Korea Large South Korean conglomerates are further deepening their involvement in the practical application of blockchain: Banks, fintech companies, and large technology enterprises are testing stablecoin pilots and exploring payment and settlement pathways related to the digital won. Upbit and Bithumb have launched or expanded institutional custody services, enabling local institutions and overseas capital to re-enter the market in a compliant manner. This signifies a shift in the market from primarily speculative uses to an application model centered on infrastructure and practical use. 4.3 Global Benchmarking South Korea's regulatory trajectory is increasingly resembling Japan's: strict yet relatively predictable. If South Korea can achieve similar regulatory clarity on key issues such as stablecoins, asset tokenization, and digital asset ETFs, it has a real chance to become one of Asia's most balanced crypto hubs, attracting both institutional builders and global liquidity.

4.4 From a Web3 Marketing Perspective: Why South Korea Places Special Importance on Product Usability

South Korea is one of the few markets where exchanges and users actively test, verify, and deeply understand a project before truly accepting it. This trend is becoming increasingly apparent as the market transitions to a use value-driven stage.

South Korea is a crucial market where exchanges and users actively test, verify, and deeply understand a project before truly accepting it. This trend is becoming increasingly evident as the market transitions to a use value-driven stage.

4.4 From a Web3 Marketing Perspective: Why South Korea Places Special Importance on Product Usability

South Korea is one of the few markets where exchanges and users actively test, verify, and deeply understand a project before truly accepting it. This trend is becoming increasingly apparent as the market transitions to a use value-driven stage.

4.4 From a Web3 Marketing Perspective: Why South Korea Places Special Importance on Product Usability

South Korea is one of the few markets where exchanges and users actively test, verify, and deeply understand a project before accepting it. This trend is becoming increasingly apparent as the market transitions to a use value-driven stage.

Alex

Alex

Alex

Alex Alex

Alex Miyuki

Miyuki Weiliang

Weiliang Alex

Alex Miyuki

Miyuki Alex

Alex Miyuki

Miyuki Weiliang

Weiliang Alex

Alex