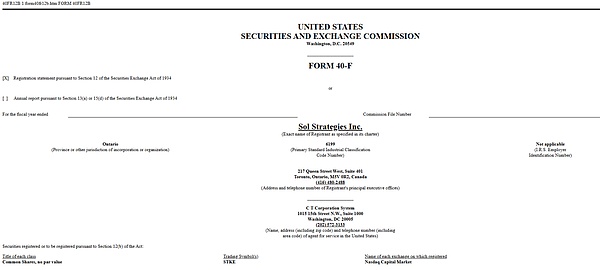

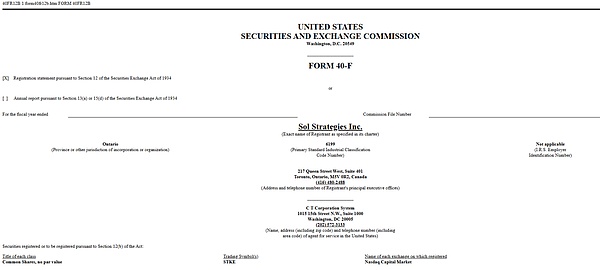

SOL Strategies filed a Form 40-F with the SEC, allowing it to trade on the Nasdaq under the ticker symbol STKE.

The company holds 420,355 SOL, of which 268,671 SOL are actively staked to its validators as of May 2025.

SOL Strategies receives $500 million in funding from ATW Partners to expand Solana holdings.

SOL Strategy Submits Nasdaq Listing Application to the U.S. SEC

On June 19, SOL Strategy submitted a Form 40-F registration to the U.S. Securities and Exchange Commission (SEC), planning to trade on the Nasdaq Capital Market under the stock code "STKE". This is a necessary step for Canadian companies to list securities in the United States, marking the company's first direct entry into the U.S. financial market.

Previously, SOL Strategy was traded on the Canadian Stock Exchange under the symbol "HODL" and on the U.S. OTCQB under the symbol "CYFRF". If the Nasdaq listing is approved, it will provide the company with wider visibility and participation opportunities from U.S. institutional investors.

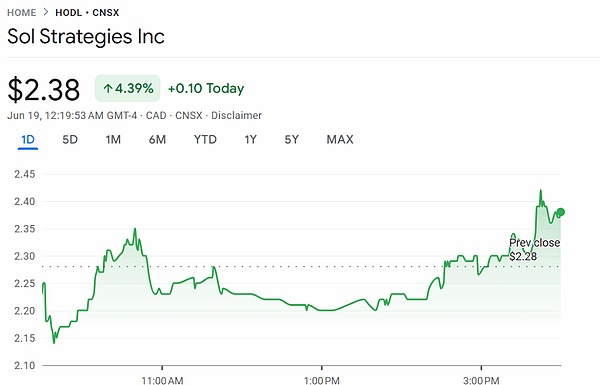

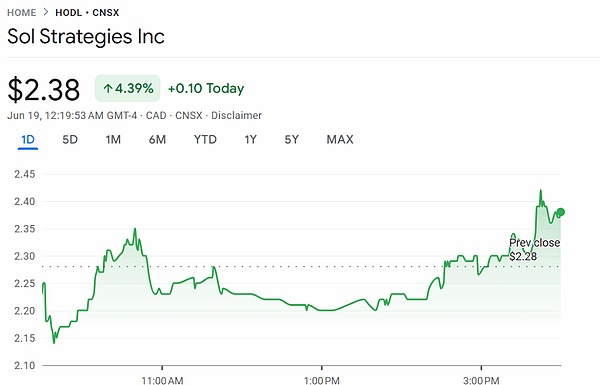

Source: Google Finance

The Ontario-based company is positioned as one of the few asset management companies focused on Solana. SOL Strategy shares rose 4.4% on June 19 following the announcement. According to Google Finance data, its Canadian listed stock price rose from 2.28 to 2.38, up 10 points on the day.

Current Solana holdings and pledge business

As of May 29, SOL Strategy holds a total of 420,355 Solana (SOL) tokens, including 269,258 directly held SOL and 268,671 SOL pledged through the company's verification nodes. The combined value of these assets is subject to market fluctuations, but the latest disclosed purchase value is US$4.7 million.

Staking is an important part of the company's long-term strategy, which aims not only to accumulate Solana, but also to strengthen its position by participating in network security and verification. Staking tokens generates interest income for the company while supporting Solana's Proof of Stake (PoS) system. This makes SOL Strategy one of the larger institutional SOL holders in addition to the Foundation and Ecosystem Fund.

In addition, the company began to exit its Bitcoin investment at the end of 2024 and fully switched to Solana in early 2025. This strategic shift was officially announced in the shareholder letter on January 29, confirming Solana as the company's future asset management model.

A $500 million financing agreement with ATW Partners

In April 2025, SOL Strategy announced a convertible bond agreement with New York investment firm ATW Partners for up to $500 million. The funds will be used to further accumulate Solana tokens and strengthen the company's verification node infrastructure.

Through the capital injection, the company is able to expand its exposure to Solana without immediately diluting its equity. The convertible bond structure is flexible and allows future debt to be converted into equity based on market conditions and performance milestones. According to the agreement, the funds will also be used to expand the company's technology stack and verification node operations, which are at the core of its staking income model.

This financing move reflects the growing institutional attention to blockchain-native asset management strategies, and is consistent with the market trend of digital asset companies seeking traditional capital to expand the influence of decentralized networks.

Solana price performance during the application period

Despite the company's submission of a Nasdaq listing application and the expansion of its asset reserves, Solana's native token SOL has had little short-term price volatility. After the announcement, Solana's price rose slightly by 0.3% during the day, but it was still on a downward trend overall.

As of June 19, the price of Solana was $146.38, a daily decline of 1.62%. In the past week, SOL fell by about 9%, and in the past month, it fell by 13.6%. The current market value of Solana is about 77.2 billion US dollars, ranking among the top ten cryptocurrencies by market value.

Anais

Anais