Author: Michael Nadeau, The DeFi Report; Compiler: Deng Tong, Golden Finance

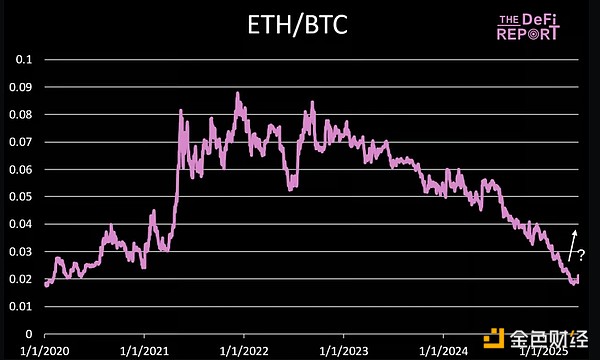

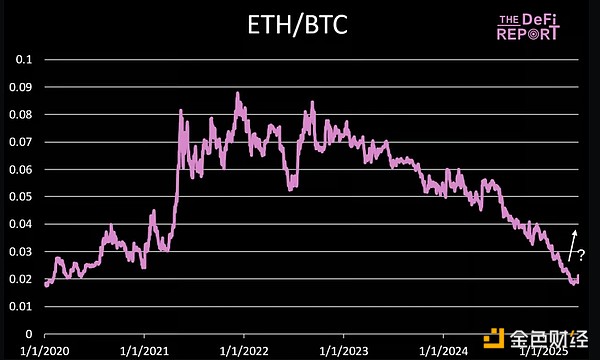

In January 2023, SOL traded at a 97% discount to ETH.

By July of last year, that discount had narrowed to 83%.

Now, nearly a year has passed. The gap continues to narrow as the market questions Ethereum’s scaling roadmap and assesses Solana’s potential to “bring Nasdaq to the chain.”

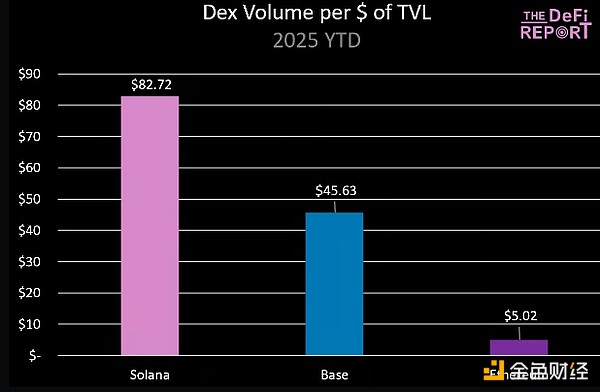

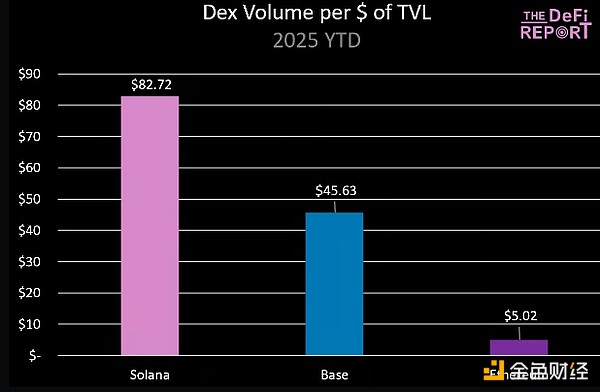

In past analyses, we have focused on high-level KPIs such as fees, decentralized exchange trading volume, stablecoin supply and trading volume, and total locked value (TVL) to compare the two networks.

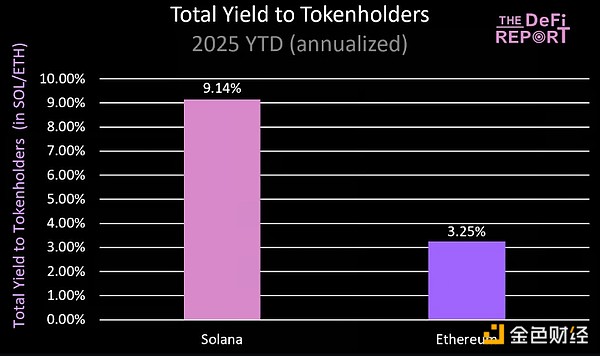

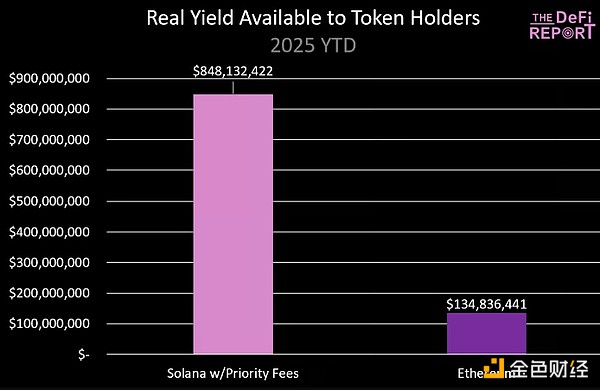

This week’s report turns the focus to the actual value available to token holders.

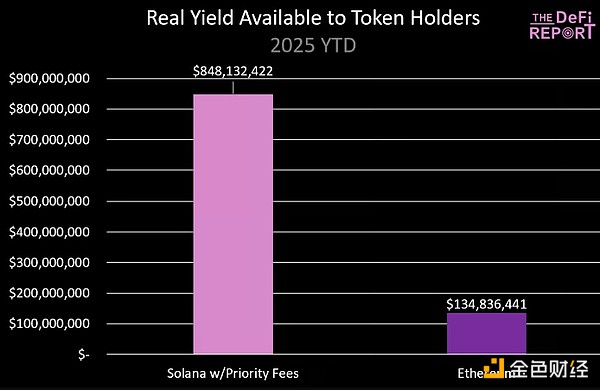

Real Value Available to Token Holders

Solana

Real Value Available to Solana Token Holders/Stakers = Jito Tips (MEV) earned by validators and shared with stakers. This does not include newly issued SOL, base fees, priority fees, or MEV retained by searchers.

Solana’s $475M is net of the 6% fee Jito charges all validators running the Jito Tips router and block engine. If you hold SOL, you can stake to a trusted validator/LST like Helius (hSOL) which charges stakers $0 in commissions. In this case, SOL stakers retain 94% of the MEV running through Jito (95% of Solana’s stake runs on Jito).

Ethereum

The actual value available to Ethereum token holders/stakers = MEV + priority fees earned by validators and shared with stakers. This does not include new ETH issuance, base fees, block fees, and the share of MEV retained by searchers and block builders.

Ethereum’s $134M net value is net of the 10% fee charged by Lido, the most trusted provider of liquidity staking on Ethereum.

Key Takeaways:

Ethereum has 6.6x the TVL of Solana and 10x the stablecoin supply.

Yet, in terms of real value to token holders YTD, Solana has 3.6x the real value of Ethereum.

Why? Execution and speed drive real value. That’s how validators and token holders monetize TVL.

In TradFi, Nasdaq is responsible for execution and circulation speed. DTCC is responsible for custody/settlement. Ethereum is becoming more and more like DTCC (custody + settlement/accounting for L2 trades). Base and other L2 platforms are becoming more and more like Nasdaq (handling execution/circulation speed). Solana is becoming more and more like a combination of the two.

Integrating Nasdaq + DTCC into one solution means SOL holders get 100% of the value of the execution/velocity service, while ETH holders get about 10% (from L2 platforms via burning ETH).

Ethereum has these assets. But it needs to keep them circulating on-chain. This is already starting to work on L2 platforms, and should continue to grow. The question now is whether ETH token holders can eventually get this value - a problem Solana doesn’t have yet.

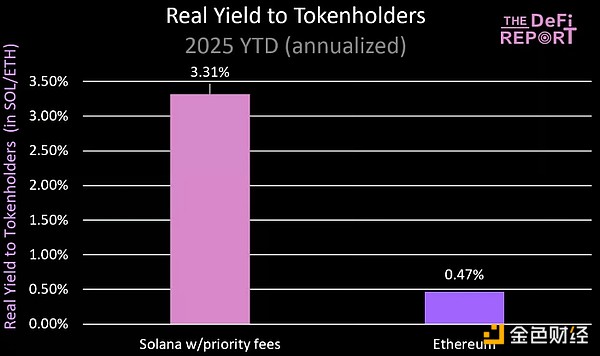

In addition to some innovative LST on Sanctum, Solana validators will keep 100% of the priority fees earned from user transactions (not shared with stakers). Jito hopes to change this. The DAO currently has a governance proposal that would update the tip router to include priority fees in addition to the MEV currently routed and paid to stakers. According to Jito, the proposal is expected to be implemented in the coming months.

If we add priority fees ($372 million, net of tip router fees), the year-to-date numbers look like this:

It’s unclear how enthusiastic validators are about opting into sharing priority fees, but we wanted to add them here so you have some idea of how the numbers are shaping up.

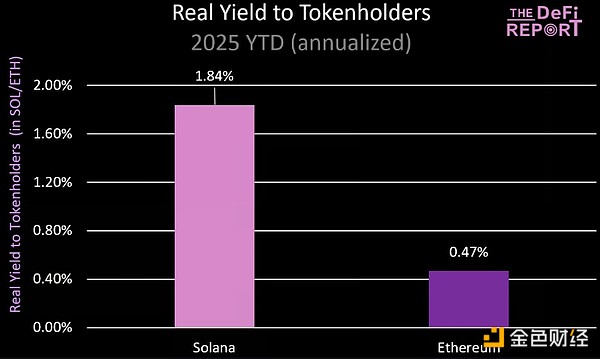

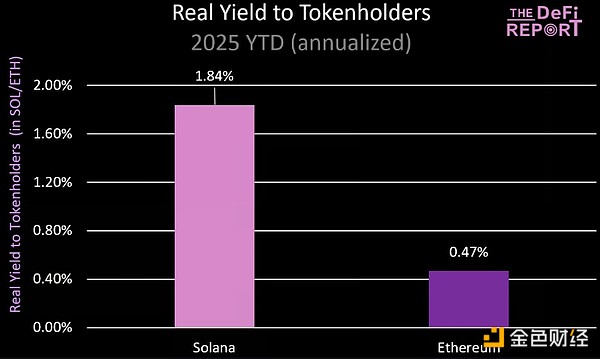

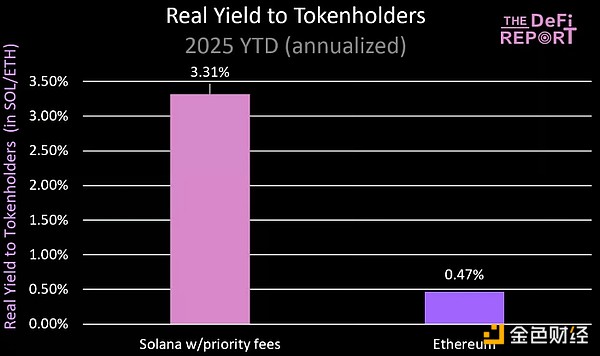

Actual Yield Percentage

The following is the above data converted into annualized actual yield (in SOL and ETH):

Using Solana Priority Fees:

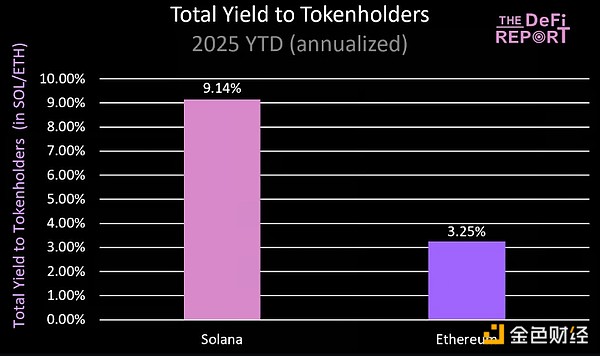

Total returns (including issuance/network inflation):

Key Takeaways:

By staking, token holders gain access to newly issued supply/issuance (used to incentivize validators/stakers to provide services). This is a key difference between crypto networks and companies, as company shareholders cannot avoid equity dilution.

Solana’s “Issuance Yield” = 7.3% based on actual network issuance as of June 5, 2025 (annualized). Ethereum’s “Issuance Yield” = 2.78%.

To date, Solana has issued 9.4 million tokens that will be paid to SOL staked in validators on the network (average stake of 385 million as of June 5, 2025). Ethereum has issued 329,380 ETH to 34.3 million tokens staked in validators on the network.

Due to Ethereum’s extremely low network inflation (0.64% annualized based on actual YTD data), its “Issuance Yield” has normalized. Solana’s “issuance yield” will continue to decline as its network inflation rate is currently 4.5% and declines by 15% per year until it reaches a terminal inflation rate of 1.5%.

The Source of Real Value

Solana

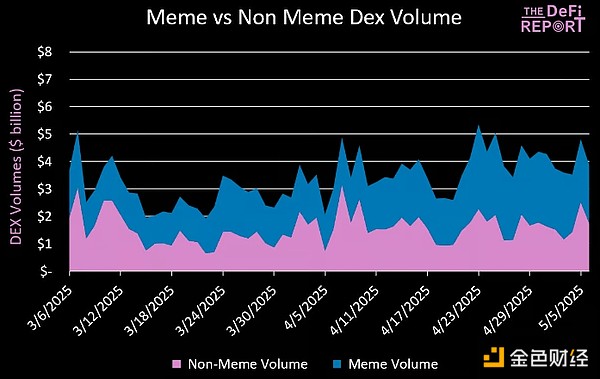

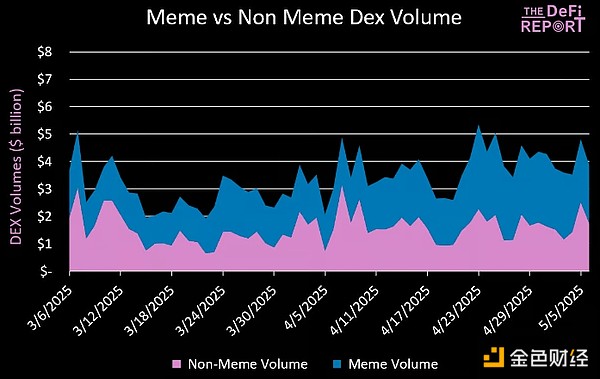

Memecoins account for more than half of Solana DEX trading volume (up 51% in the past few months). SOL/USD accounts for about 35% of DEX volume, with the remaining 14% made up of stablecoins, LST, and other assets.

Is this a problem?

Yes and no.

Clearly, speculation/gambling is one of the strongest use cases in crypto. Solana has found product/market fit by providing a better user experience.

We don’t see this going away anytime soon.

Additionally, memecoin trading is stress testing the system and providing valuable feedback to infrastructure providers.

Memecoins today. Stocks, bonds, currencies, and private assets tomorrow?

That’s ultimately Solana’s goal.

In case you’re curious, 1-2% of DEX volume on Ethereum Layer-1 is currently memecoins. Stablecoin swaps account for about half of the volume, while ETH/stablecoin swaps and other project tokens account for about 20% of the volume each.

Currently, about 50% of DEX volume on Base comes from memes, with the vast majority coming from new meme coins.

MEV

Some cryptocurrency analysts believe that MEV (the value users pay for time-sensitive transactions) is the only sustainable long-term value in Layer 1 as base fees compress/commoditize over time.

We disagree with this view, but we do believe that MEV will drive most of the economic benefits. Therefore, it is necessary to clarify the differences in how MEV works on Solana and Ethereum, and the impact that Layer 2 may have.

Ethereum

Ethereum has a memory pool that all transactions pass through before being sorted and submitted to validators.

The MEV market is here. The main players are as follows:

Searchers: These bots use machine learning algorithms to identify profitable opportunities in the memory pool.

Block builders: Block builders are responsible for building blocks. In other words, they sort transactions into blocks and accept "bribes" from searchers in the process.

Validators: Validators approve blocks after block builders submit them (with tips).

Workflow:

User submits transaction —> Ethereum memory pool —> "Searchers" (bots) identify value (arbitrage, sandwich trades, liquidations) —> Submit additional transactions to block builders (with tips) —> Block builders package transactions —> Submit to validators (with tips) —> Validators approve transactions, keeping most of the tips (block builders and searchers keep a portion).

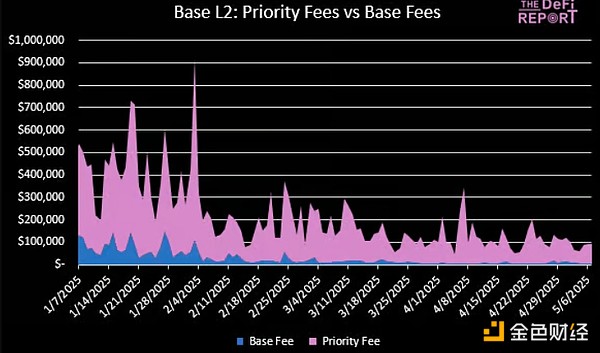

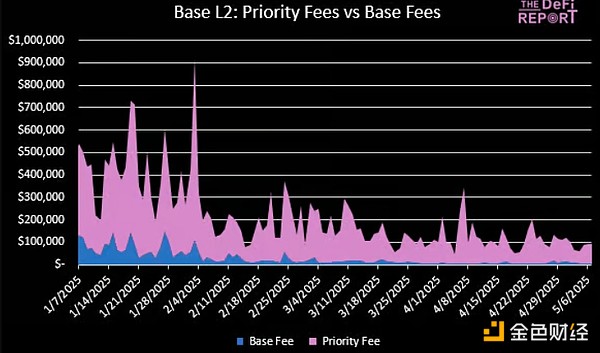

Ethereum’s Biggest Unknown: What happens to MEV if the majority of volume moves to Layer-2 as expected?

We believe MEV will move to Layer-2 via priority fees. The chart below shows that 85% of Base’s fees come from priority fees.

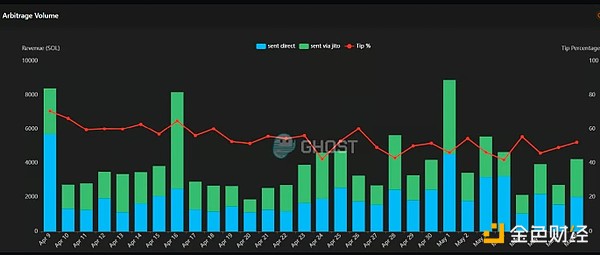

Solana

Solana does not have a memory pool. Instead, it has dedicated validator clients like Jito that implement some form of rolling private memory pool.

How it works:

Jito’s block engine creates a very short (~200ms) window in which a Seeker can submit a transaction package to be included in the next block. This rolling memory pool is not public, but is accessible to Seekers connected to Jito’s infrastructure, allowing them to discover and exploit potential arbitrage opportunities during this short window.

Seekers monitor on-chain state (e.g., order books, liquidity pools) directly, typically by running their own full nodes or RPC endpoints. They detect arbitrage opportunities by observing state changes caused by confirmed transactions, rather than by looking at pending transactions in the memory pool.

When a profitable opportunity arises (e.g., a price imbalance between DEXs), bots quickly build and submit their own transactions or packages to the next block leader (usually through Jito or a similar relay), hoping to seize the opportunity before others.

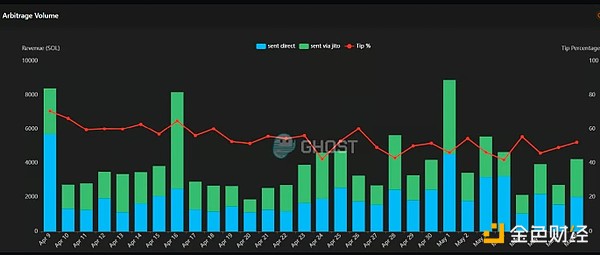

Currently, about 50% of arbitrage MEV is done through Jito (the value is shared with stakers via the tip router):

If you are investing in these networks, you need to understand how MEV accumulates for you as a token holder through staking.

We believe that SOL holders currently have a better chance of earning MEV (and potentially priority fees) than ETH holders.

Summary

Should SOL be trading at a 65% discount to ETH (63.5% fully diluted)?

From a fundamental perspective, absolutely not. Even considering ETH's superior network effects, decentralization, Lindy Protocol, asset collateralization, etc., this discount is too high.

Our conclusion is that the market currently values ETH at a higher price than SOL based on ETH's network effects and total value locked (TVL).

One of the great things about ETH is that it will be home to trillions of tokenized assets, ranging from stocks, bonds, currencies/stablecoins, private assets, and more.

That may be the case in the future.

But ultimately, investors need to focus on how ETH can extract real value from these assets.

Why?

Because investors have a choice. If another chain can consistently deliver more value to token holders, we should expect more capital to flow into that asset in the long run.

As Benjamin Graham once said:

“In the short run, the market is a voting machine. In the long run, it’s a weighing machine.”

One way ETH could potentially catch up is through re-staking and blob fee adjustments. As exciting new L2 layers like MegaETH (which uses EigenLayer for data access) come to market, ETH holders can extract additional real value from these networks by re-staking ETH.

We’ll have more analysis in these areas.

But let’s be clear:

Crypto assets rarely trade on fundamentals today.

While we believe this will happen, this is not currently the case.

Narrative, momentum, storytelling, social impact, and liquidity conditions continue to be what drives the market.

Certainly, ETH has been at a disadvantage in the narrative game over the past few years.

But it feels like things are getting better.

A 20% daily move is nothing for an asset valued at over $220 billion.

Remember: Crypto markets are extremely reflective. Price —> Narrative —> Fundamentals.

We’ll have to wait and see if the recent volatility is just the beginning of something bigger.

Catherine

Catherine