Source: Blockchain Knight

Last year, Crypto asset-related product inflows reached a staggering $44.2 billion, almost four times the all-time high of $10.5 billion in 2021< /strong>.

According to the latest report from CoinShares, this record-breaking performance is attributed to the launch of US spot exchange-traded funds (ETFs), which has greatly affected global investment.

Among them, BTC occupies a dominant position, attracting US$38 billion in capital inflows, accounting for 29% of total assets under management (AuM)

BTC The massive inflow has also led to a significant increase in BTC ETF holdings, with holdings exceeding one million in less than a year after its launch.

Leading products such as BlackRock’s IBIT and Fidelity’s FBTC attracted the most attention.

It is worth noting that IBIT surpassed nearly 3,000 other ETFs to become the most successful ETF product in the past decade.

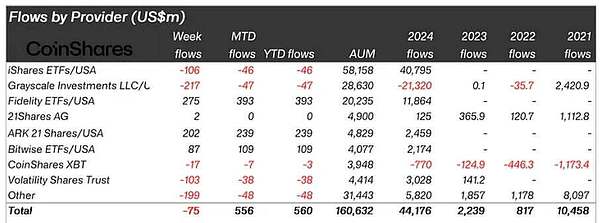

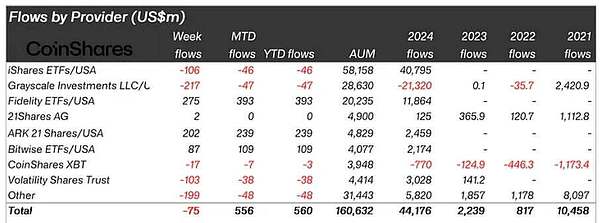

Grayscale's GBTC, on the other hand, saw the largest outflows last year as investors withdrew more than $21 billion from the fund in favor of cheaper alternatives.

Nonetheless, positive flows in ETF products led to the United States becoming the global leader in inflows as it attracted almost all of the $44.4 billion, followed by Switzerland $630 million.

However, these gains were partially offset by significant outflows from Canada and Sweden, totaling US$707 million and US$682 million respectively.

James Butterfill, director of research at CoinShares, pointed out that the outflow of funds shows that investment is shifting from these regions to US products, highlighting the growing attractiveness of the US Crypto asset market.

Butterfill also pointed out that BTC climbed to an all-time high of over $100,000 last year, resulting in an inflow of $116 million in BTC short products.

Ethereum has also performed well, especially with its resurgence in the second half of this year.

As Ethereum spot ETFs performed strongly at the end of the year, the digital asset received $4.8 billion in inflows.

This inflow accounts for 26% of its total asset management, which is 2.4 times the total inflow in 2021, greatly exceeding the performance in 2023.

Meanwhile, Ethereum outpaced its rival Solana, which managed $69 million in inflows, accounting for just 4% of its assets under management. .

Other large-cap tokens, such as Polkadot, Cardano, XRP, etc., attracted a total of $813 million, accounting for 18% of their net asset value.

At the same time, BTC investment products in the United States have started well this year, with inflows reaching US$666 million in the first two trading days.

According to Farside data, there was a single-day inflow of US$908 million on January 3, of which Fidelity led the way with US$357 million, second only to BlackRock and ArkInvest. to $253 million and $222 million.

Catherine

Catherine