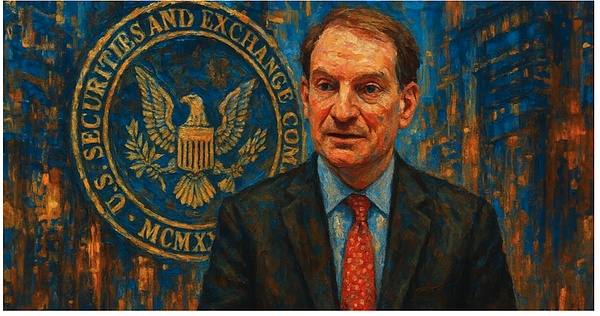

With the implementation of the Trump administration, Paul Atkins was nominated to serve as Chairman of the U.S. Securities and Exchange Commission (SEC), succeeding Gary Gensler. Paul Atkins is the founder of risk consulting firm Patomak Global Partners. He served as a Republican commissioner of the SEC from 2002 to 2008 and is known for advocating reducing regulatory intervention and promoting market efficiency.

Paul S. Atkins' keynote speech at the Tokenized Crypto Working Group Roundtable on May 12, 2025. As he said: "It is a new day at the SEC." This is a brand new beginning. The SEC will no longer adopt the form of regulation by enforcement as it did during the Gary Gensler era. Instead, it will pave the way for crypto assets in the U.S. market: 1. Develop a reasonable regulatory framework for the crypto asset market; 2. Issuance: adopt a more flexible way of issuing crypto assets instead of strictly applying the traditional securities issuance method; 3. Custody: support providing registered institutions with more independent choices in custody of crypto assets; 4. Trading: support the launch of more types of trading products based on market demand, breaking the previous SEC restrictions on such trading behaviors.

5. Create more flexible conditional exemption measures to promote the return of blockchain innovation to the United States, MAGA.

This new start for the SEC will greatly promote the innovative development of crypto assets in the United States. The obvious trend can be seen: 1. Capitalization path of U.S. crypto asset companies: Coinbase will be included in the S&P 500 index, Circle and other Fintechs will go public; 2. Due to the relaxation of regulations, Fintech M&A wave will be staged: Coinbase 2.9 billion US dollars to acquire options trading platform Deribit, Anchorage Digital acquired stablecoin issuer Mountain Protocol; 3. The tokenization of real assets will be accelerated: the issuance standards of security tokens will become friendly, and the tokenization wave led by Blackrock will begin. The current on-chain US stocks have already shown signs of this; 4. The opening of the US market: In the past, the crypto market was divided into the US market and the non-US market. Now with the changes in the SEC, more companies may turn their attention to the United States; 5. The strong progress of the US dollar stablecoin: whether it is the friendly supervision of the SEC or the gradual introduction of the stablecoin bill, US payment and Internet giants have already entered the market or are preparing, including Stripe, Meta, Visa, Mastercard, Circle, etc.

6. Existing securities brokers will quickly integrate crypto assets and launch one-stop trading services: Crypto assets are familiar to securities brokers such as Robinhood, Futu, and Tiger, and they can use their existing network effects to quickly establish barriers.

The following is Paul S. Atkins' keynote speech on "Assets on the Chain - The Intersection of Traditional Finance and Decentralized Finance" at the Tokenized Crypto Working Group Roundtable:

https://www.sec.gov/newsroom/speeches-statements/atkins-remarks-crypto-roundtable-tokenization-051225

The migration of securities from off-chain to on-chain systems is similar to the transition of audio recordings from analog vinyl records to tapes and then to digital software decades ago. Once audio could be easily encoded into a digital file format that could be easily transferred, modified, and stored, this unlocked enormous potential for innovation in the music industry. [2] Audio is no longer constrained by static, fixed-format creation, but becomes interoperable across a wide range of devices and applications. It can be combined, disassembled and programmed to form entirely new products. This has also driven the development of new hardware devices and streaming content business models, greatly benefiting consumers and the U.S. economy. [3]

Just as digital audio revolutionized the music industry, the migration of securities to the blockchain has the potential to reshape every aspect of the securities market, giving rise to entirely new ways of issuing, trading, holding, and using securities. For example, on-chain securities can utilize smart contracts to distribute dividends to shareholders periodically and transparently. Tokenization can also facilitate capital formation by transforming relatively illiquid assets into liquid investment opportunities. Blockchain technology is expected to enable a wide range of new use cases for securities, giving rise to many new types of market activities that the SEC's traditional rules and regulations do not currently contemplate.

To realize President Trump’s vision of “making the United States the world’s crypto capital,”[4] the Commission must keep pace with innovation and reassess whether existing regulations need to be updated to accommodate on-chain securities and other crypto assets. If rules and regulations designed for off-chain securities are directly applied to on-chain assets, they may create incompatible or unnecessary regulatory burdens and inhibit the development of blockchain technology.

An important task during my tenure as chairman is to develop a reasonable regulatory framework for the crypto-asset market and establish clear rules for the issuance, custody, and trading of crypto-assets, while continuing to deter illegal activities by bad actors. Clear rules are essential to protecting investors from fraud, especially helping them identify scams that do not comply with the law.

SEC has entered a new era. Policy making will no longer rely on ad hoc enforcement actions. Instead, the SEC will use its existing rulemaking, interpretation, and exemption powers to develop practical standards for market participants. The SEC’s enforcement approach will return to Congress’s original intent to police violations of these established obligations, particularly with respect to fraud and manipulation.

This work requires coordination among multiple offices and departments within the SEC. I am therefore pleased that Commissioners Uyeda and Peirce have established the Crypto Task Force. The SEC has long been plagued by fragmented policymaking. The Encryption Task Force exemplifies how our policy communities are working together to rapidly provide much-needed clarity and certainty to the American public.

Next, I will share the three key areas of crypto asset policy: issuance, custody and trading.

1. Issuance

First, I hope the SEC will develop clear and reasonable guidelines for the issuance of crypto assets that are securities or subject to investment contracts. To date, only four crypto-asset issuers have registered for issuance under Regulation A. [5] Most issuers have chosen to avoid such offerings, in part because of the difficulty in meeting the related disclosure requirements. It is also difficult for issuers to determine whether crypto assets constitute “securities” or are subject to investment contracts if they are not ordinary securities, such as stocks, bonds or notes. [6]

Over the past few years, the SEC initially took what I call a “head-in-the-sand” approach—perhaps hoping that the crypto industry would gradually die out on its own. Later, the SEC changed direction and adopted a "shoot-first-and-ask-questions-later" regulatory strategy through law enforcement. Its claims of willingness to “knock on doors” with potential registrants proved to be short-lived at best and often misleading, as the SEC did not make the necessary adjustments to registration forms to account for the new technology.

For example, the S-1 form still requires detailed information about executive compensation and use of proceeds, which may not be relevant or material to an investment decision in crypto assets. While the SEC has previously adjusted its forms for asset-backed securities offerings and real estate investment trust offerings, it has yet to do so for crypto assets despite growing investor interest in the asset class over the past few years. We cannot encourage innovation by fitting a square peg into a round hole.

Currently, SEC staff has issued a statement on registration and issuance disclosure obligations for crypto assets (Offerings and Registrations of Securities in the Crypto Asset Markets, Division of Corporation Finance). [7] The staff also clarified that certain offerings and crypto-assets are not subject to the federal securities laws, and I expect the staff to continue to provide clarifications with respect to other types of offerings and assets as I direct (Staff Statement on Meme Coins, Division of Corporation Finance). [8]

However, existing registration exemptions and safe harbor rules may not be fully applicable to certain types of crypto-asset offerings. I view these statements from the staff as interim steps—formal action from the SEC is critical. In the meantime, I have asked Commission staff to consider whether additional guidance, registration exemptions, and safe harbors are needed to facilitate the issuance of crypto-assets in the United States. I believe the SEC has broad discretion under the securities laws to support the crypto industry, and I will drive this work to fruition.

2. Custody

Secondly, I support providing registration institutions with more autonomy in the custody of crypto assets. The SEC staff recently revoked Staff Accounting Bulletin No. 121 (SAB 121), removing a significant hurdle for firms seeking to provide crypto asset custody services. [9] The announcement itself was a serious mistake. The staff does not have the authority to so broadly supersede Commission action or to establish notice-and-comment rules. This action has created unnecessary confusion with consequences far beyond the SEC’s jurisdiction. However, the SEC can do much more than repeal SAB 121 to enhance competition in the market for legal and compliant custodial services.

The SEC must clarify which custodians qualify as “qualified custodians” under the Advisers Act and the Investment Company Act, as well as reasonable exemptions from the qualified custody requirements to accommodate certain common practices in the crypto asset market. Many advisors and funds could use more advanced self-custody technology solutions to safeguard crypto assets. As a result, the SEC may need to update its custody rules to allow advisors and funds to engage in self-custody in certain circumstances.

In addition, it may be necessary for the SEC to abolish the “special purpose broker-dealer” framework[10] and replace it with a more reasonable system. There are currently only two special purpose broker-dealers in operation, apparently due to the significant restrictions placed on these entities. Broker-dealers have never been restricted from acting as custodians of non-security crypto-assets or crypto-asset securities, but the Commission may need to take action to clarify the application of the “customer protection” and “net capital rules” to such activities.

3. Trading

Third, I support registrants to launch more types of trading products on their platforms based on market demand and break the previous SEC restrictions on such trading activities. For example, some broker-dealers are attempting to enter the market by offering integrated trading of securities, non-securities and other financial services, creating “super applications”.

The federal securities laws do not prohibit a registered broker-dealer with an alternative trading system from facilitating non-security transactions, including through “pairs trading” between securities and non-security. I have asked staff to help us design ways to modernize the ATS regulatory regime to better accommodate crypto-assets. Additionally, I have asked staff to explore whether further guidance or rulemaking is needed to facilitate the listing and trading of crypto-assets on national securities exchanges.

While the SEC and its staff work to develop a comprehensive regulatory framework for crypto-assets, securities market participants should not be forced to go overseas to innovate with blockchain technology. I am exploring a set of exemption mechanisms to allow new products and services that are difficult to implement due to current rules to have the opportunity to innovate while complying with regulations.

I am eager to coordinate with my colleagues in President Trump’s administration and Congress to make the United States the best place for global participation in the crypto-asset markets.

Kikyo

Kikyo

Kikyo

Kikyo Alex

Alex Brian

Brian Kikyo

Kikyo Alex

Alex Kikyo

Kikyo Alex

Alex Kikyo

Kikyo Brian

Brian Alex

Alex